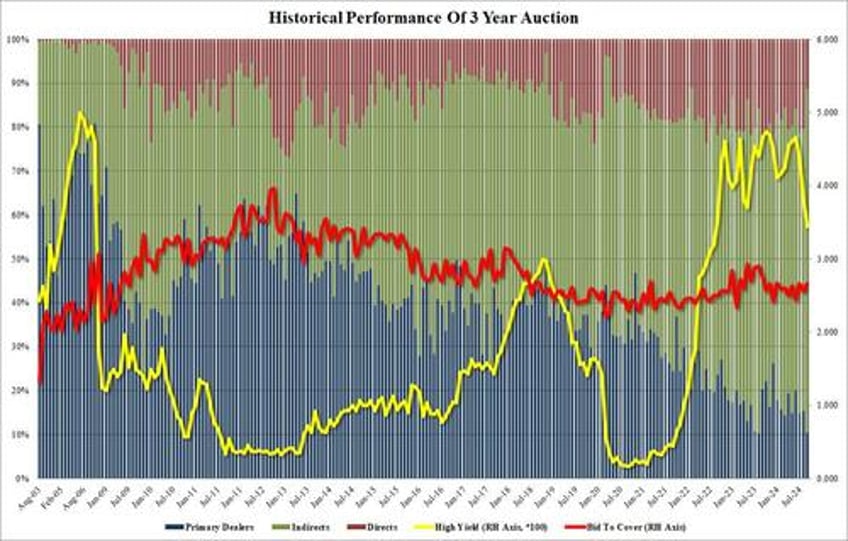

With the stock market rollercoaster stuck in "down" mode today, it is probably not a surprise that the flight to safety would be strong to quite strong, and sure enough moments ago when the US sold $58BN in 3Y paper, the demand was the strongest since at least last summer.

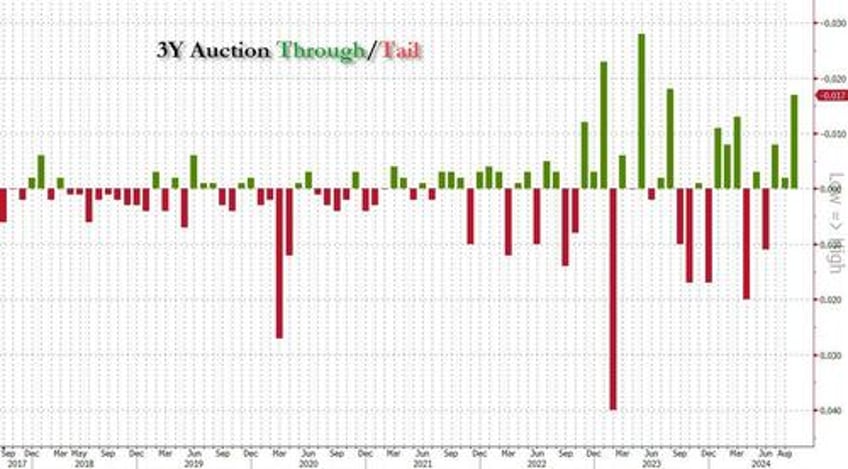

Pricing at a high yield of 3.440%, the 3Y auction was not only 37bps below last month's 3.81% and the lowest since August 2022, but also stopped through the 3.457% When Issued by 1.7bps, the biggest Through since August 2023 and the 4th biggest on record.

As one would expect for a auction with big demand, the bid to cover jumped to 2.662 from 2.551, above the recent average of 2.564.

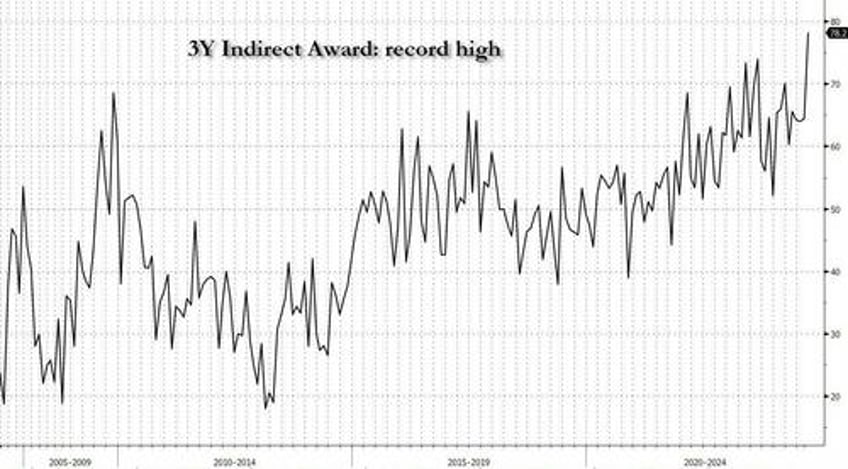

The internals, however, were the most impressive feature of today's auction, with Indirects awarded 78.24%, up from 64.4% last month, and the highest on record!

With little room left for the other two groups, the breakdown was almost equal: Directs took down 11.3% and Dealers were left ith just 10.4%, the second lowest on record.

Overall, this was a stellar 3Y auction, and it indicates that the market is certain that the Fed will cut by at least 25bps next week, with some still expecting a 50bps cut.