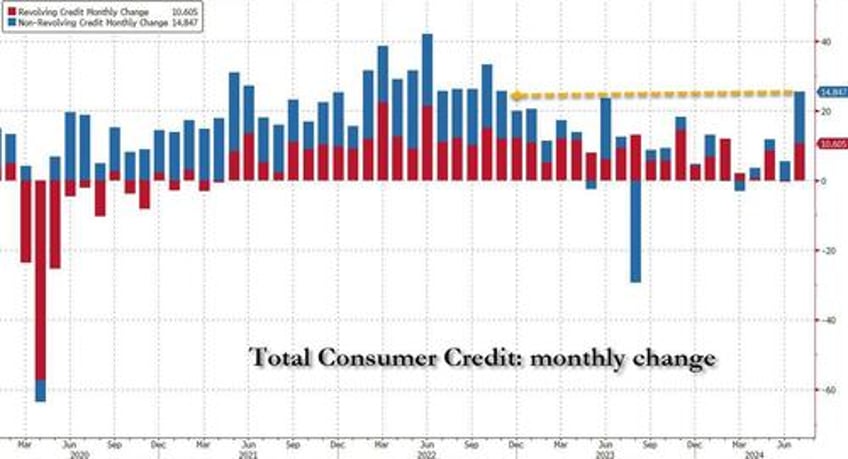

Yesterday we said that the latest consumer credit numbers, which saw a bizarre surge in credit card debt as consumers - their savings now depleted and at record low levels - now have to charge their credit card for every day staples, were the "last hurrah" for consumption in the US.

It didn't take long to get confirmation, when first JPMorgan shocked the market when its president Daniel Pinto warned that the bank will not hit its (or the Wall Street consensus) previous Net Interest Income target, sending the stock plunging the most since June 2020...

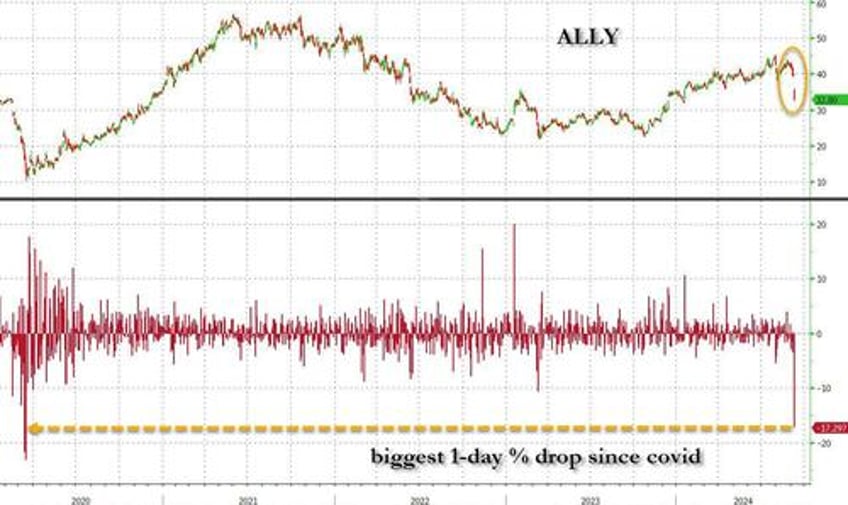

... which however was followed by a far more dramatic crash in the shares of Ally Financial, which plunged as much as 18%, their biggest one-day drop since March 2020, after the auto lender’s management presented at the Barclays 22nd Annual Global Financial Services Conference.

What sent the stock crashing is CFO Russ Hutchinson warning about weaker credit and net interest income trends quarter-to-date relative to expectations; specifically Hutchingson said that in July and August, they saw auto delinquencies soar a whopping 20 basis points compared to their expectation, while net charge offs (NCOs) were up ~10 bps compared to their expectations.

Confirming that the pain is mostly linked to the firm’s retail auto loan book, Hutchinson said that borrowers have shown signs of vulnerability throughout the year and August US jobs data underscored those stresses.

“Over the course of the quarter, our credit challenges have intensified,” Hutchinson said on Tuesday. “Our borrower is struggling with high inflation and cost of living and now, more recently, a weakening employment picture.”

He also said that the firm may experience some underperformance, he said, adding that Ally will evaluate reserves to cover bad loans and increase them if needed. Needless to say, the sudden confirmation that the bottom is falling out of auto loans is something the market was apparently unaware of, and confirms that US consumer are once again picking and choosing on which accounts to default first.

Hutchinson said the firm will focus more on capital and expenses moving forward, though is not updating its guidance at this time.

Commenting on the announcement, KBW analyst Sanjay Sakhrani said that management pointed to weaker credit trends quarter-to-date compared to expectations

“Clearly the guide was disappointing and begs the question if this is ALLY-specific or a canary in the coal mine,” he writes. “We still think the stock remains a compelling longer-term opportunity with rates on the decline, but concede this revision is not a good look,” he noted, sidestepping commentary on how those who bought the stock per his reco ahead of today's 18% plunge must feel.

RBC analyst Jon Arfstrom, who also has an "outperform" rating on the crashing company, wrote that “while these are manageable increases relative to the prior guidance, we believe the relatively quick increase in the NCO and delinquency direction is something that investors will question”

Ally's announcement sparked a stock liquidation frenzy among all consumer-facing card issuers, including Bread Financial -9.7%, Synchrony Financial -8.6%, Capital One Financial -6.9% and Discover Financial Services -6.9%.