With Powell giving off strongly dovish hints today and Thursday's CPI expected to come in soft for the 3rd month in a row, moments ago the Treasury had no problem finding buyers for $58 billion in 3 year paper in a very strong auction to start the week's coupon issuance which sees 10Y and 30Y sales in the next two days.

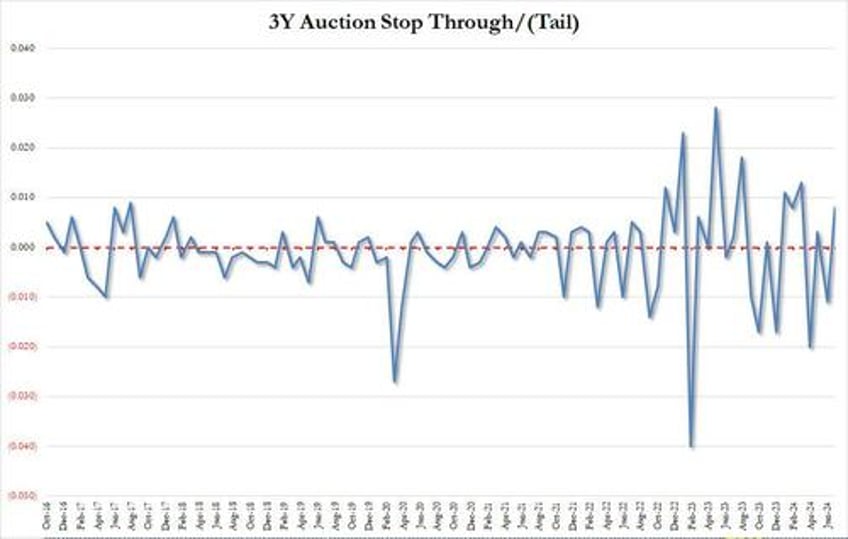

The high yield on today's sale was 4.399%, which was down from last month's 4.659% and was the lowest since March, with the auction stopping through the When Issued 4.407% by 0.8bps, the biggest stop through also since March.

The bid to cover was 2.667, up from 2.433 in June and the highest since January; naturally it was well above the six-auction average of 2.570.

The internals were also solid, with Indirects taking 64.0%, just below last month's 64.1 and under the recent average of 65.2%. And with Directs awarded 21.2% - the most since December - Dealers were left holding just 14.8%, the lowest since March.

Overall, this was a very strong auction and one which helped push 10Y yields lower to 4.31% after they touched session highs of 4.33% moments earlier.