While politics and geopolitics dominate the headlines—whether it's Joe Bien's mumbling and stumbling or the risks of World War III in Eastern Europe, the Middle East, or the South China Sea—many seem to overlook the ongoing commercial real estate crash in the US. This CRE downturn is set to worsen as remote and hybrid work models drastically reduce demand for traditional office towers.

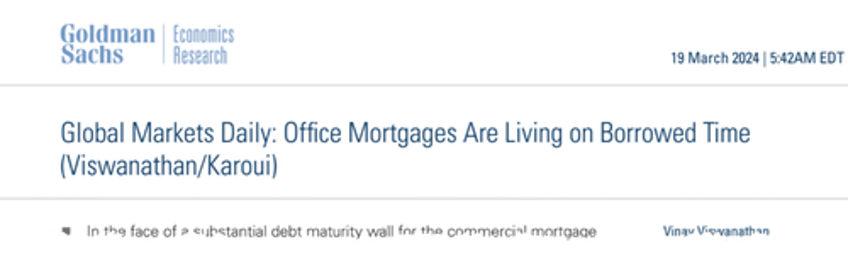

Bloomberg cited data from the Mortgage Bankers Association, reminding us that banks will face a $1 trillion maturity wall of CRE loans at the end of this year. This only means more bank failures are ahead because of the bad property debt held on balance sheets.

"Compared with the Savings & Loans crisis and 2008, we're still in the first or second innings" when it comes to distressed CRE assets, said Rebel Cole, a finance professor at Florida Atlantic University who advises Oaktree Capital Management, adding, "There's a tsunami coming and the waters are pulling out from the beach."

In a recent note, John Brady, global head of real estate at Oaktree, explained, "We could be on the precipice of one of the most significant real estate distressed investment cycles of the last 40 years."

Brady said that "unloved" CRE space will present opportunities for bottom fishing: "Few asset classes are as unloved as commercial real estate and thus we believe there are few better places to find exceptional bargains."

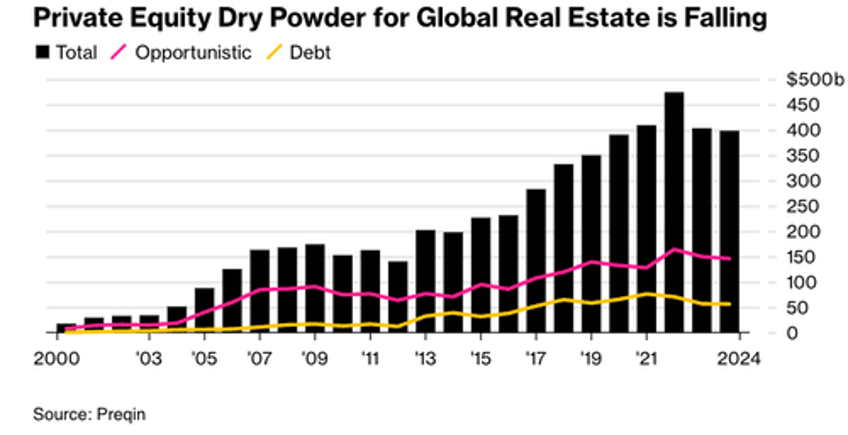

Data from Preqin show private equity firms are building war chests as the CRE storm is expected to worsen, allowing them to bargain hunt. About 64% of the $400 billion of dry powder on the sidelines is intended for CRE investments across North America, the highest share in two decades.

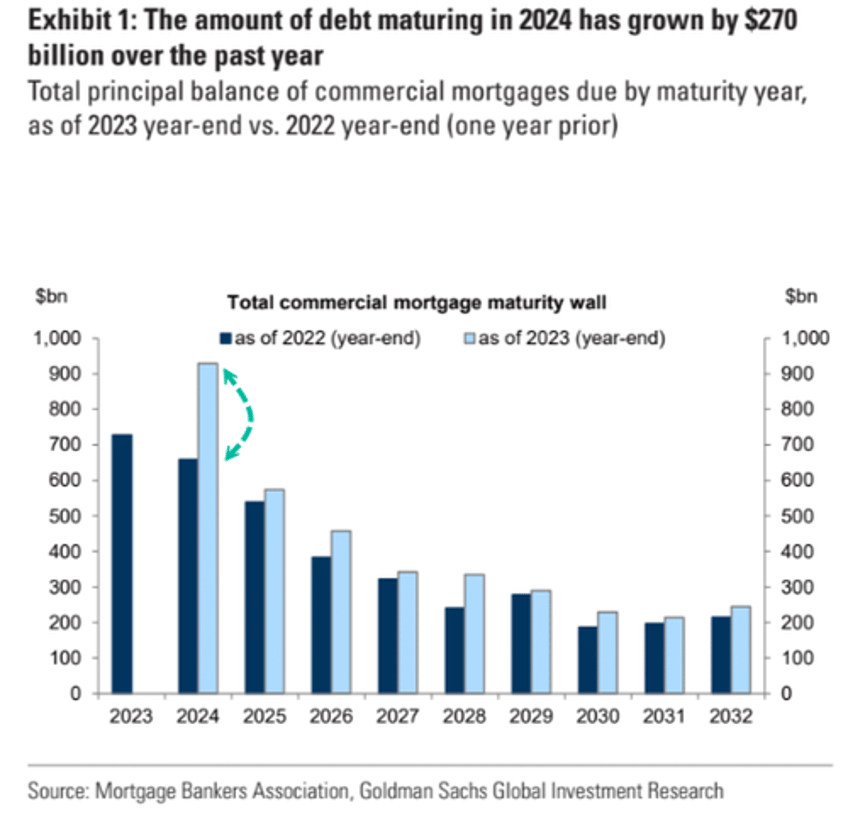

The percentage of office CMBS loans that are 30+ days delinquent just hit a decade high.

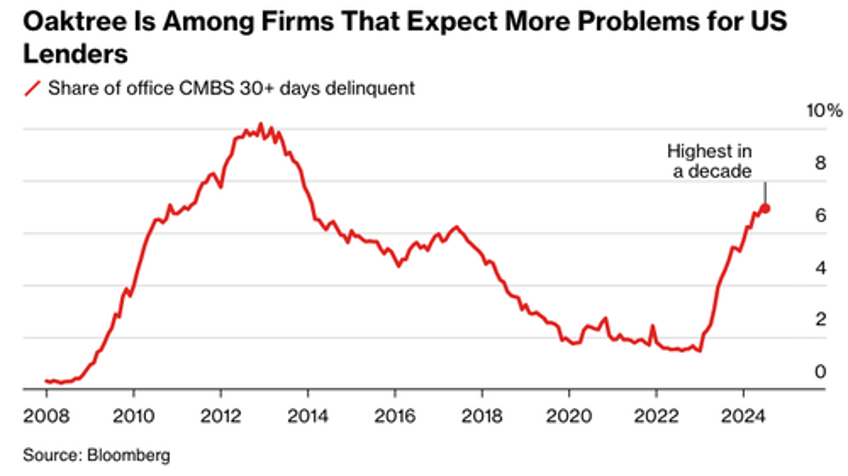

Geographically, distressed office loans are piling up in the eastern half of the US.

Meanwhile, Pimco expects more regional bank failures due to bad property debt. Adding to this, a recent Oaktree report indicates the number of banks that could fail if CRE prices fell just 20% from peaks would exceed 2008.

Charles McGrath, an associate vice president at Preqin, pointed out that higher borrowing costs for longer indicate a decline in dry powder on the sidelines. He said there are signs of a "sharp decline in fundraising and transactions."

The day of reckoning for banks nears as strategies like "extend and pretend" to delay recognizing losses on balance sheets are ending.

Goldman's Vinay Viswanathan noted earlier this year...

Here's a visualization of the upcoming maturity wall.

What's clear is the CRE storm is far from over.