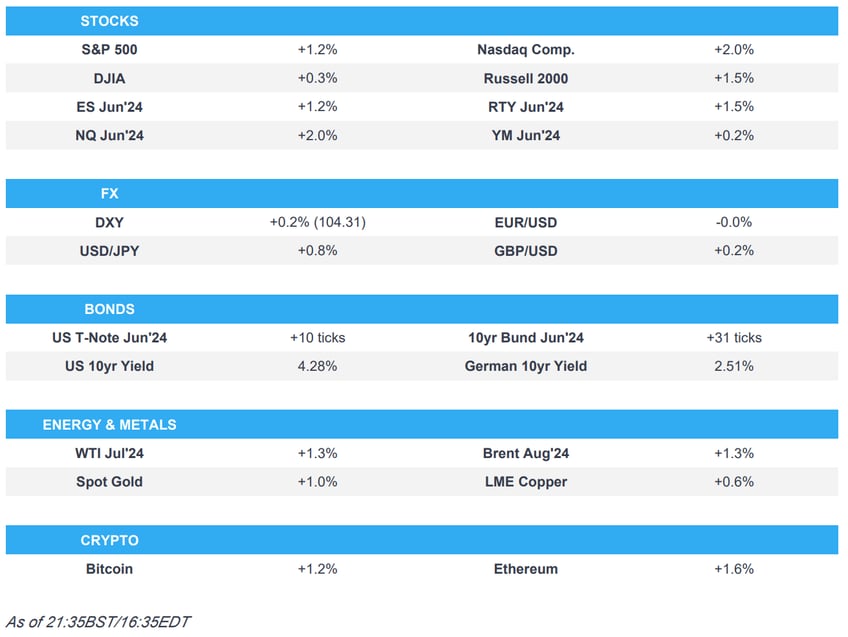

- US stocks were bid on Wednesday as markets digested a soft ADP, a BoC rate cut and hot US ISM Services PMI.

- The Dollar climbed higher ahead of the ISM Services PMI release, although gains had pared slightly before with the weak ADP unemployment release supporting the downside move.

- T-notes were bid after a soft ADP report and BoC rate cut, but knocked on hot services PMI before grinding higher into settlement.

- Crude prices were choppy throughout the session in response to US data, inventories and Fed rate cut bets.

- Looking ahead, highlights include Japanese Foreign Stock and Bond Investments, Australian Goods/Services, Japanese 30yr Auction.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

6th June 2024

SNAPSHOT

- Click here for the Newsquawk Week Ahead.

US TRADE

- US stocks were bid on Wednesday as markets digested a soft ADP, a BoC rate cut and hot US ISM Services PMI.

- SPX +1.18% at 5,354, NDX +2.04% at 19,035, DJI +0.25% AT 38,807, RUT +1.47% at 2,064.

- Click here for a detailed summary.

FX

- The Dollar climbed higher ahead of the ISM Services PMI release, although gains had pared slightly before with the weak ADP unemployment release supporting the downside move

- The Euro was ultimately flat ahead of the ECB rate decision on Thursday reaching lows of 1.0855. Money markets are pricing in approx. 95% of the ECB cutting rates by 25bps on Thursday and two full 25bps cuts by October later this year.

- Cyclical currencies (ex-CAD) outperform their G10 FX peers, but moves remain muted.

- Haven currencies (Franc and Yen) gave back some of their recent outperformance with both currencies lagging their G10 FX peers on Wednesday with the downside move supported by strong ISM data, despite the weakness in UST yields.

FIXED INCOME

- T-notes were bid after a soft ADP report and BoC rate cut, but knocked on hot services PMI before grinding higher into settlement.

COMMODITIES

- Crude prices were choppy throughout the session in response to US data, inventories and Fed rate cut bets.

- Saudi Aramco confirmed it sets July Arab Light crude oil OSP to Asia at plus USD 2.40 vs Oman/Dubai average (prev. USD 2.90 M/M).

- Canada Energy Regulator said it is updating an order that will allow Nova Gas to temporarily increase operating pressure by 5% in a section of the Grande Prairie mainline.

DATA

- US ISM N-Mfg PMI (May) 53.8 vs. Exp. 50.8 (Prev. 49.4)

- US ISM N-Mfg Bus Act (May) 61.2 vs. Exp. 53.0 (Prev. 50.9)

- US ISM N-Mfg Employment Idx (May) 47.1 (Prev. 45.9)

- US ISM N-Mfg Price Paid Idx (May) 58.1 (Prev. 59.2)

- US ISM N-Mfg New Orders Idx (May) 54.1 (Prev. 52.2)

- US ADP National Employment (May) 152.0k vs. Exp. 175.0k (Prev. 192.0k, Rev. 188k)

- US MBA Mortgage Applications -5.2% (Prev. -5.7%)

- US MBA 30-Yr Mortgage Rate 7.07% (Prev. 7.05%)

- US EIA Weekly Crude Production Change, 0.0% (Prev. 0.0%)

- US EIA Weekly Crude Production Change, bbl 0k (Prev. 0k)

- US EIA Weekly Crude Production 13.1M (Prev. 13.1M)

- US EIA Weekly Refining Util w/e 1.1% vs. Exp. 0.4% (Prev. 2.6%)

- US EIA Weekly Gasoline Stk w/e 2.102M vs. Exp. 1.95M (Prev. 2.022M)

- US EIA Weekly Crude Stocks w/e 1.233M vs. Exp. -2.3M (Prev. -4.156M)

- US EIA Weekly Dist. Stocks w/e 3.197M vs. Exp. 3.014M (Prev. 2.544M)

- US EIA Wkly Crude Cushing w/e 0.854M (Prev. -1.766M)

CENTRAL BANKS

- ECB's Kazimir says inflation is on a good trajectory and the ECB is approaching its first interest rate cut. Note, that these comments are being made in the ECB's quiet period.

- ECB is reviewing banks' lending to the private equity industry; and carries out in-depth assessment of leveraged loans, via Bloomberg.

- "ECB Insight: Insiders See Likelihood of July Cut as Low, but Don’t Expect It to Be Excluded", via Econostream Media.

- Polish NBP Base Rate (Jun) 5.75% vs. Exp. 5.75% (Prev. 5.75%)

- BoC cuts rates by 25bps to 4.75%, as expected; says monetary policy no longer needs to be as restrictive. BoC Governor Macklem says "We are taking our rate decisions one meeting at a time; reasonable to expect more rate cuts if inflation continues to ease".

- BoC's Macklem, when asked about the odds of a July cut, says they will be taking decisions meeting-by-meeting; the timing of future cuts is data dependent.

GEOPOLITICS

MIDDLE-EAST

- Yemen's Houthis said they have conducted three military operations in the Red Sea and Arabian Sea, according to Reuters.

- Israeli War Council to meet Thursday to discuss the hostage exchange deal and the Lebanon front, Al Arabiya reports.

RUSSIA-UKRAINE

- US expected to sign a new USD 225mln weapons package for Ukraine this week, according to sources cited by Reuters.

- Russia's President Putin said it has to defend gas pipelines on the bed of the Black Sea from Ukraine's attacks. Ukraine attacked gas facilities meant for Turkey on the Black Sea. Ships that protect these gas pipelines are being constantly attacked by drones, which are supplied to Ukraine by Europe.

OTHERS

- IAEA passed a resolution calling on Iran to improve cooperation with IAEA, and reverse its barring of inspectors, diplomats said.

ASIA-PAC

NOTABLE HEADLINES

- Japan to raise the cap on state backing for copper mine stakes to 75%, according to Reuters.

EU/UK

NOTABLE HEADLINES

- FTSE Reshuffle: Darktrace (DARK LN, LondonMetric Property (LMP LN) and Vistry Group (VTY LN) are set to replace Ocado (OCDO LN), RS Group (RS1 LN) and St James's Place (STJ LN)

DATA

- EU HCOB Services Final PMI (May) 53.2 vs. Exp. 53.3 (Prev. 53.3); Composite Final PMI (May) 52.2 vs. Exp. 52.3 (Prev. 52.3)

- German HCOB Services PMI (May) 54.2 vs. Exp. 53.9 (Prev. 53.9); Composite Final PMI (May) 52.4 vs. Exp. 52.2 (Prev. 52.2)

- French HCOB Composite PMI (May) 48.9 vs. Exp. 49.1 (Prev. 49.1); Services PMI (May) 49.3 vs. Exp. 49.4 (Prev. 49.4)

- Italian HCOB Services PMI (May) 54.2 vs. Exp. 54.5 (Prev. 54.3); Composite PMI (May) 52.3 (Prev. 52.6)

- UK S&P Global PMI Composite Output (May) 53 vs. Exp. 52.8 (Prev. 52.8); Services PMI (May) 52.9 vs. Exp. 52.9 (Prev. 52.9)

- EU Producer Prices YY (Apr) -5.7% vs. Exp. -5.3% (Prev. -7.8%); MM (Apr) -1.0% vs. Exp. -0.4% (Prev. -0.4%, Rev. -0.5%)

- Swedish PMI Services (May) 49.5 (Prev. 48.1, Rev. 48.0)