Comments by Governor Waller in a speech and discussion today raised the risk that the first cut could come slightly later than the market's expectation of March and that the pace of cuts could be quarterly from the outset, rather than the market's more aggressive forecast of three initial consecutive cuts followed by a switch to a quarterly pace.

On the timing of the first cut, Waller said he believes that the FOMC will be able to lower the funds rate “this year.”

On the speed of cuts, Waller said the funds rate “can and should be lowered methodically and carefully” and that he sees “no reason to move as quickly or cut as rapidly as in the past,” when the FOMC was combating recessions.

Waller also noted that next month's scheduled revisions to CPI inflation (the seasonal factors will be revised on February 9) could influence his thinking on rates cuts, especially if the revised data show a less clear deceleration recently.

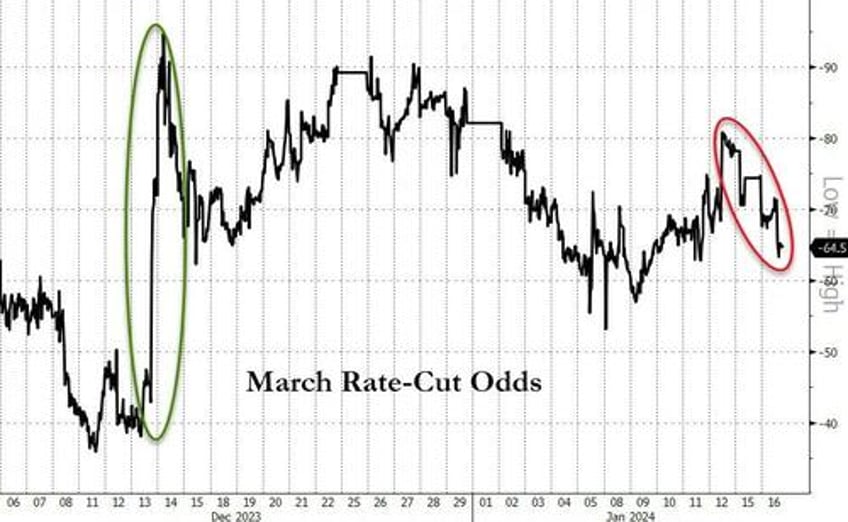

The result was most evident in the drop in the market's expectations for a rate-cut in March...

Source: Bloomberg

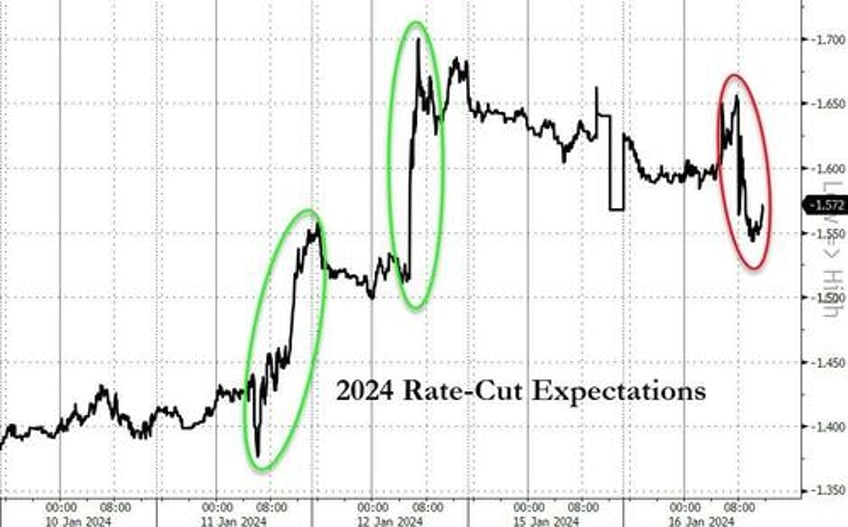

...and expectations for 2024 rate-cuts declined also...

Source: Bloomberg

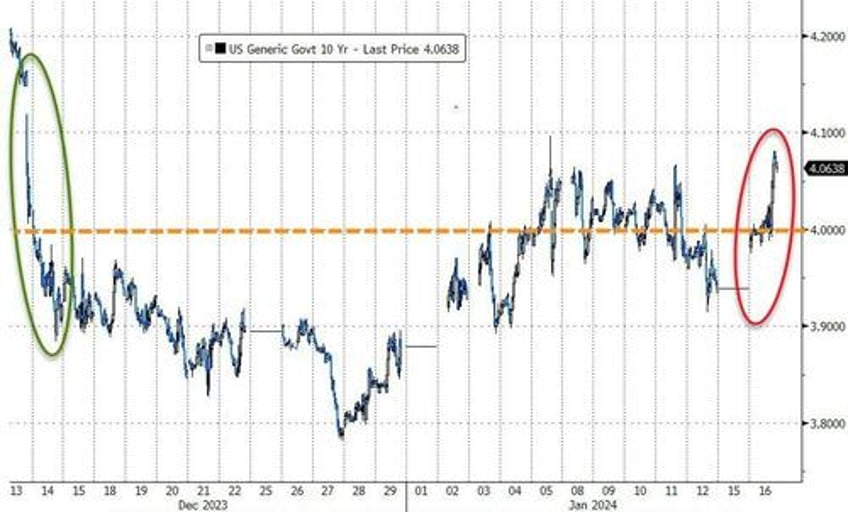

Treasury yields were higher across the curve with the long-end underperforming (from Friday's close)...

Source: Bloomberg

This was the 10Y yield's highest close since the Dec FOMC meeting (back above 4.00%)...

Source: Bloomberg

Financial conditions have eased back again from their tightening bias to start the year and remain near their loosest since August 2022...

Source: Bloomberg

Stocks did not like Waller's comments at all but while yields were higher, the growthy/long-duration tech stocks actually outperformed (ending red despite a late-day panic-bid algo ramp try to get green) while Small Caps were the most punished...

With bank earnings now mostly, all the majors are in the red since last Thursday's close with MS pummeled today...

Source: Bloomberg

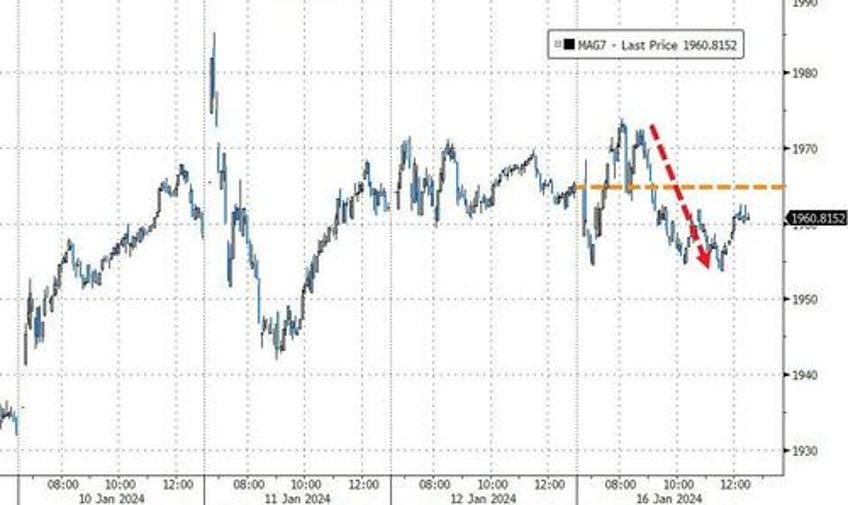

MAG7 stocks drifted modestly lower on the day...

Source: Bloomberg

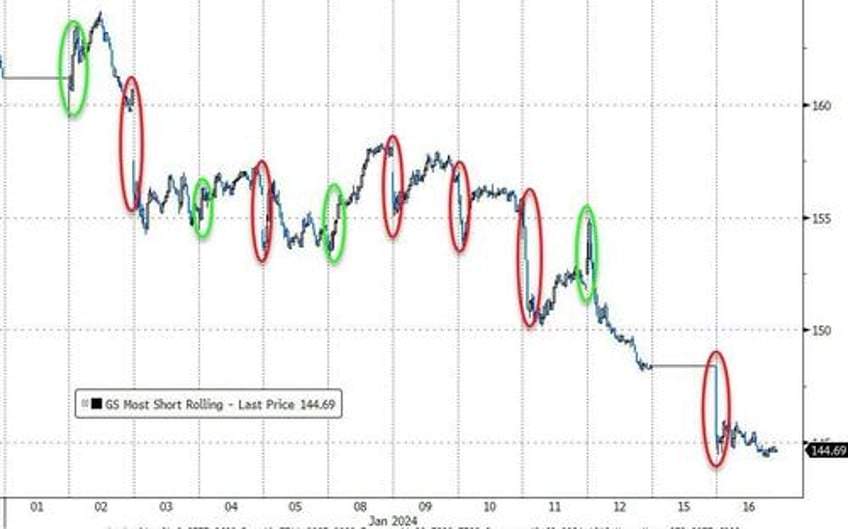

'Most Shorted' stocks continued the trend lower in 2024...

Source: Bloomberg

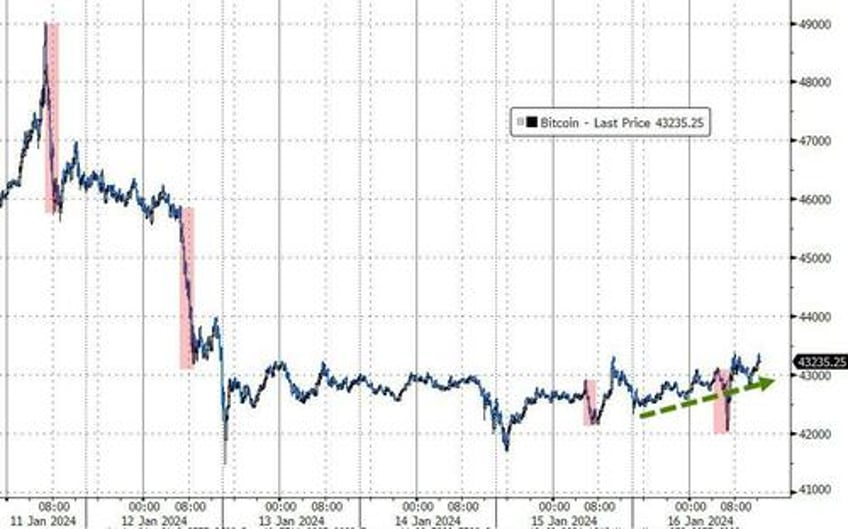

Bitcoin rallied back above $43,000 today, but well off the pre-ETF highs...

Source: Bloomberg

With ETF aggregate volumes still concentrated in IBIT and FBTC...

Source: Bloomberg

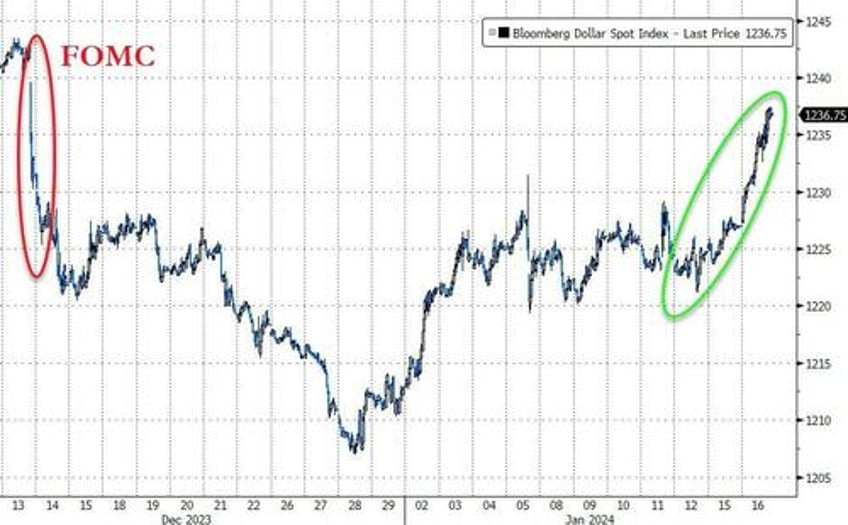

The dollar ripped higher today, almost entirely erasing the post-FOMC drop......

Source: Bloomberg

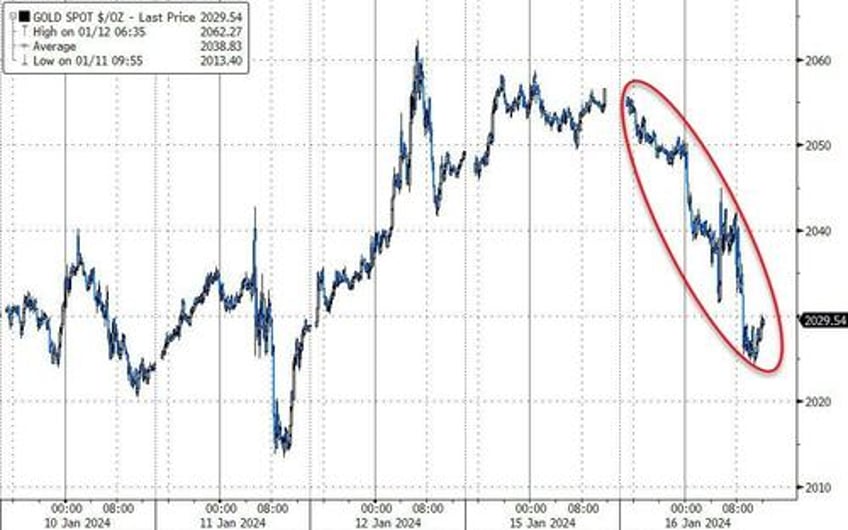

And as the dollar rallied, gold tumbled...

Source: Bloomberg

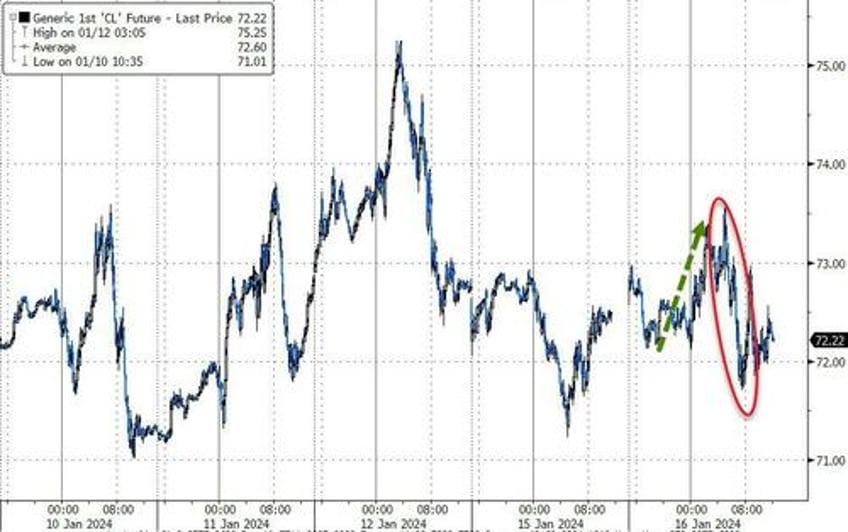

Oil edged lower on a choppy day - despite the shitshow in the Red Sea getting considerably worse...

Source: Bloomberg

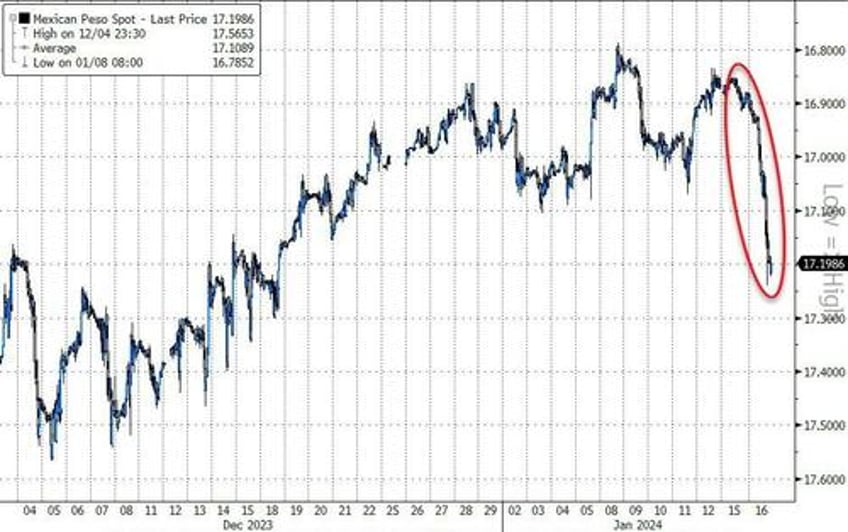

And finally, EMFX was pummeled, with MXN puking over 2% (after Trump's big win last night?)...

Source: Bloomberg

...and given that move, it is worth considering how the election could impact markets.

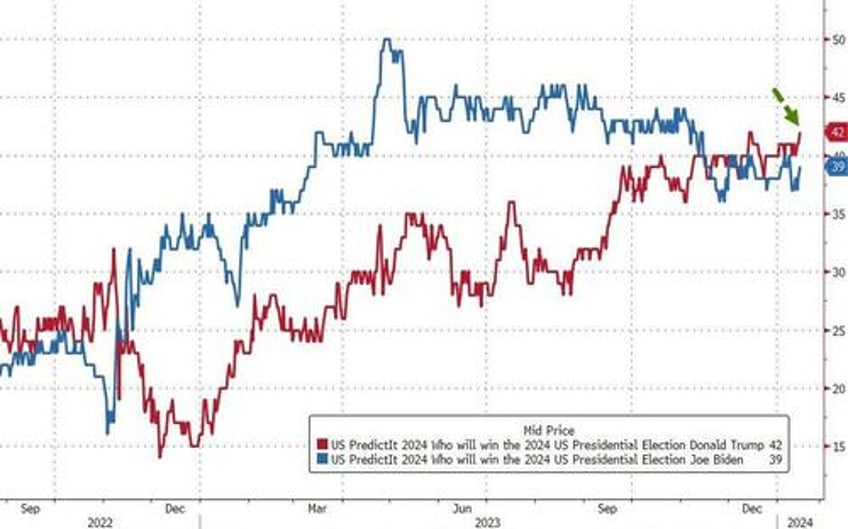

Trump's odds of winning the election are now at the highest, and 3 ppts above Biden...

Source: Bloomberg

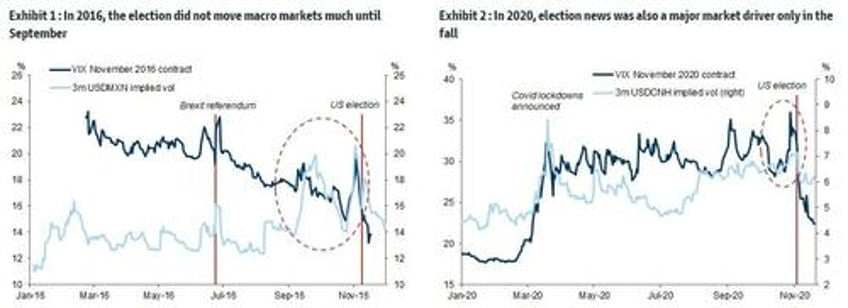

As Goldman notes, on balance, a Republican 'sweep' looks likely to increase the chances of a stronger USD, higher breakeven inflation rates, higher yields, and a steeper yield curve. It may also increase the tails in both directions for energy prices.

But, as the charts above show, there was little direct impact on macro markets until the Fall.