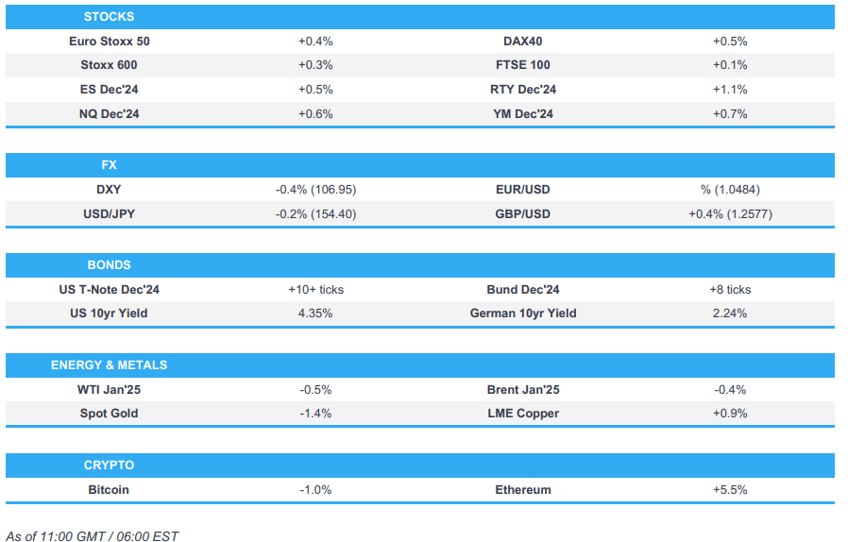

- European bourses & US futures begin the week on the front-foot, as markets welcome the nomination of Scott Bessent as Trump's Treasury Secretary.

- USD pressured and USTs bid following this, with the DXY sub-107.00 and the US yield curve bull-flattening

- FX peers generally benefit from the USD pressure, JPY outperformed overnight on favourable yield action and approval of Japanese stimulus

- Crude in the red on Bessent, Israel-Lebanon and Iranian updates, Gas outperforms. XAU slipped below USD 2700/oz before recovering while base metals follow the tone though China performance capped

- Looking ahead, highlights include ECB’s Lane & Makhlouf, Supply from the US. Earnings from Bath & Body Works, AutoZone & Zoom

- Click for the Newsquawk Week Ahead.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses have kicked the week off on the front foot with reports suggesting that the better mood is partly a function of Scott Bessent's nomination as US Treasury Secretary; Euro Stoxx 50 +0.4%.

- Within Europe, sectors are now mixed. Opened with a strong positive bias but this has dissipated somewhat throughout the morning. Basic Resources outperform, with Real Estate cheering lower yields though Banks in turn are pressured.

- Stateside, futures in the green, ES +0.5%, following the Bessent nomination; Bessent is expected to prioritise delivering Trump tax cuts and maintaining the dollar's position as the global reserve currency, while he said enacting tariffs and cutting spending will also be a focus. On tariffs, Bessent is seen as more of a gradualist.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD has been pressured and the index below 107.00 in reaction to the nomination of Bessent to the Treasury. Lifted off a 106.79 overnight base but remains in the red.

- Peers benefitting as a function of this, EUR made a brief foray onto a 1.05 handle, topping out at 1.0501. If the pair is able to gain a footing above this level, the 21st November peak sits @ 1.0555.

- USD/JPY down to a 153.56 base overnight (19th November low sits at 153.28). JPY supported overnight by the retreat in UST yields and the Japanese Cabinet's stimulus package approval.

- GBP firmer with specifics focussed on BoE speak as Lombardelli reiterated the MPC consensus while Dhingra has been her usual dovish self thus far. Cable briefly surpassed 1.26, currently holding some 30 pips shy of the mark.

- Barclays month-end rebalancing model shows strong USD selling against all majors.

- PBoC set USD/CNY mid-point at 7.1918 vs exp. 7.2257 (prev. 7.1942).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs outperform following US President-elect Trump selecting Scott Bessent as the next Treasury Secretary, an update which has sparked pronounced bull-flattening.

- USTs towards the top-end of a 109-28+ to 110-05 parameter, surpassing last week’s best by half a tick.

- Bunds and Gilts are both firmer in tandem with the above, though they have been gradually pulling off best as the tone remains constructive and as the latest German Ifo has some possible glimmers of optimism for the future.

- Bunds remain in the green, but at the lower-end of a 133.15-57 band. Gilts firmer but in a relatively thin range, have been pulling back but remain comfortably clear of Friday's 94.48 close.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks are in the red by around USD 0.40/bbl despite the relatively robust risk tone and pressure in the USD. Downside which emerged on reports that Israel and Lebanon are close to an agreement.

- Pressure also a function of Bessent's aim to lift US oil production by 3mln BPD. More recently, another bout of downside came on the Iranian Oil Minster's remarks. Benchmarks at the low-end of c. USD 1/bbl parameters.

- XAU in the red, downside which comes as markets welcome the nomination of Bessent; XAU fell from a USD 2720/oz peak early-doors to just below the 2.7k mark before briefly recovering. Thereafter, as the risk tone continued to improve, the yellow metal slipped back below the figure to a USD 2658/oz low.

- Base metals bolstered by the risk tone, gains somewhat tempered by the relatively poor performance of China overnight though. 3M LME Copper above USD 9k, but only modestly so.

- Gas outperforms on the below updates and the overall risk tone.

- Nominations for gas flows from Slovenia into Czech Republic on Monday -5% W/W, according to EuroStream data

- Iraq said a 15-day halt in Iranian gas due to maintenance is cutting 5.5GW from the national grid.

- Iran's Oil Minister says Iran will strive not to accept limits on oil production quota.

- Kazakhstan Energy Minister says "due to expectations of a shortage of light oil products in 2036, it will be necessary to start designing a new oil refinery with capacity of 10 million tonnes per year no later than in 2030".

- Click for a detailed summary

NOTABLE DATA RECAP

- German Ifo Business Climate New (Nov) 85.7 vs. Exp. 86.0 (Prev. 86.5); Current Conditions New (Nov) 84.3 vs. Exp. 85.4 (Prev. 85.7); Expectations New (Nov) 87.2 vs. Exp. 87.0 (Prev. 87.3)

NOTABLE EUROPEAN HEADLINES

- UK PM Starmer said in an op-ed in the Mail on Sunday that the government will set out “radical reforms” in the coming week to tackle the rising outlays on benefits and will get to grips with the bulging benefits bill.

- Economists revised their forecasts for German economic growth in 2025 to 0.6% from 1.2% which is the largest growth forecast downgrade for the period in any major industrial economy as the Trump tariff threat rattles exporters, according to FT citing a Consensus Economics survey.

- ECB's Lane says monetary policy should not remain restrictive for too long, via Les Echos; rapid rises in rates have further slowed the housing sector and investment. Also, encouraged saving over consumption. A large part of getting inflation back to 2% will be completed next year. Restrictive policy is probably no longer needed in 2025.

- French Budget Minister says the aim for next year's budget deficit is to come as close as possible to 5%; "aiming for savings of EUR 60bln in the budget next year, may be a little below".

- National Rally's Le Pen repeats her red lines to French PM Barnier, says "nothing has changed so far". With the budget bill in it's current form, "we would not support Barnier"

- BoE's Lombardelli says the economy has made good progress on disinflation. There are some signs that the wage disinflation may be slowing. Views the probabilities of downside and upside risks to inflation as broadly balanced. Too early to declare victory on inflation. PMIs may suggest some slowing in the UK but "I don't take a strong signal from one event".

- BoE's Dhingra says recent CPI outturns show no asymmetry in inflation unwinding. Fall in services PPI appears to be slowing but probably due to erratic components. UK no longer looks like an outlier for inflation among advanced economies

NOTABLE US HEADLINES

- Fed’s Bowman voter said must avoid the temptation to limit the use of AI in finance which could chill innovation in the banking system, while she added AI has the potential to improve the reliability of economic data and can be a strong anti-fraud tool in the finance sector.

- US President-elect Trump named several new senior officials and cabinet nominees including hedge fund CEO Scott Bessent as Treasury Secretary, while he was also reported to pick Brooke Rollins to be Agriculture Secretary and nominated Rep. Lori Chavez-DeRemer for Labour Secretary.

- US Treasury Secretary nominee Scott Bessent prioritises policy of delivering Trump tax cuts and maintaining the dollar's position as the global reserve currency, while he said enacting tariffs and cutting spending will also be a focus. Bessent's policy priorities include making first-term cuts permanent, as well as eliminating taxes on tips, Social Security benefits, and overtime pay. Furthermore, he suggested pursuing 3% US GDP growth, aims to reduce US budget deficit to 3% of GDP by 2028 and seeks an additional 3mln bpd of US oil production, according to WSJ.

- US President Elect Trump to confront IEA over focus on green energy; plans to lift pause on new LNG export permits and move swiftly to approve pending permits. Plans to seek money from congress to replenish strategic petroleum reserve.

GEOPOLITICS

MIDDLE EAST

- Senior adviser to Iran’s Supreme Leader said Iran is preparing to respond to Israel, according to Tasnim.

- Iran will hold nuclear talks with the UK, France and Germany on Friday regarding nuclear and regional issues, according to an Iranian Foreign Ministry spokesperson cited by Reuters.

- Hezbollah said it launched a drone attack on Israel’s Ashdod Naval Base for the first time. It was also reported that Hezbollah announced 50 attacks on Sunday against bases, towns and gatherings of soldiers in Israel, according to Sky News Arabia.

- EU Foreign Policy Chief Borrell said they are ready to devote EUR 200mln to the Lebanese armed forces, while he added that they must pressure Israel and Hezbollah to accept the US proposal for a ceasefire.

- Israel's ambassador to the US said Israel and Hezbollah are nearing a truce agreement, according to Bloomberg.

- Israeli senior official said Israel's direction is to move towards a ceasefire agreement in Lebanon, while Israeli and US officials stated that Israel and Lebanon are on the cusp of a ceasefire agreement, according to Axios. It was separately reported by Asharq News that Israeli media stated Israel agreed in principle to the proposal for a ceasefire in Lebanon.

- Israel Broadcasting Corporation initially stated the green light has not yet been given on the Lebanon agreement and there are still issues that need to be resolved but it later cited an Israeli source stating the green light was given to complete a ceasefire agreement with Lebanon and they hope to announce it within two days.

- Israel recommended avoiding non-essential travel to the UAE after the body of Israeli rabbi Zvi Kogan was found. Israeli PM Netanyahu’s office said the murder was a heinous anti-Semitic terrorist act and PM Netanyahu said Israel will take all measures to hold accountable the murderers and those who sent them.

- Iran’s Embassy in the UAE said it categorically rejects allegations of Iran’s involvement in the murder of Israeli rabbi Kogan in the UAE, according to a statement cited by Reuters.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said on Saturday that Russian drones and missiles have damaged 321 Ukrainian port infrastructure facilities since July 2023 and 20 civilian ships from other countries were damaged by Russian strikes.

- Ukraine launched a mass attack on Russia's Kursk region with foreign-made missiles, according to a military analyst via Reuters.

- A fire broke out at an industrial enterprise after Ukraine's drone attack on Russia's Kaluga, according to the regional governor.

- Ukraine’s air force said air defences downed 50 out of 73 Russian drones, while Russian air defence reportedly destroyed 34 Ukrainian drones, according to a report on Sunday via Reuters.

- Russian President Putin and Turkish President Erdogan discussed trade and economic cooperation during a phone call.

- Russia is likely to name Alexander Darchiev as ambassador to Washington, according to Kommersant citing unidentified sources.

OTHER

- North Korea condemned US military drills as provocative and strongly warned the US to stop hostile activity in the region, while North Korea’s military will keep all options open and if necessary, take pre-emptive actions to defend the state, according to KCNA.

CRYPTO

- Bitcoin is in the red with the 100k mark proving elusive thus far. Printed a 98.9k peak before fading to a 95.8k low, currently holding closer to the high but remains off best and ultimately lower.

APAC TRADE

- APAC stocks began the week mostly higher following last Friday's gains stateside and as markets reacted to news over the weekend that President-elect Trump picked hedge-fund manager Scott Bessent as Treasury Secretary which is seen as a nod to Wall Street and could potentially reduce the chances of severe tariffs with Bessent seen to have a gradual approach on tariffs.

- ASX 200 was led by outperformance in real estate and consumer-related sectors amid lower yields which saw financials lag.

- Nikkei 225 surged and briefly reclaimed the 39,000 level following the Japanese Cabinet's stimulus package approval and as equity markets saw a relief rally on the US Treasury Secretary nomination, although the Japanese benchmark moved off today's highs owing to yen strength.

- Hang Seng and Shanghai Comp were indecisive in a tight range with headwinds following the PBoC's CNY 550bln drain through its Medium-term Lending Facility operations and amid expectations of further US export restrictions on China, while automakers were supported by reports that the EU is said to be close to an agreement with China to abolish EV import tariffs.

NOTABLE ASIA-PAC HEADLINES

- PBoC conducted a CNY 900bln 1-year MLF operation (vs CNY 1.45tln maturing) with the rate maintained at 2.00%.

- White House said the National Security Adviser Sullivan and other senior officials met with telecom executives to share intelligence and discuss China’s cyber espionage campaign targeting the sector.

- China Premier Li says China's economic operation has been generally stable with progress amid stability; adds China will continue to strengthen counter-cyclical adjustments.

DATA RECAP

- New Zealand Trade Balance (Oct) -1.5B (Prev. -2.1B, Rev. -2.2B)

- New Zealand Exports (Oct) 5.8B (Prev. 5.0B, Rev. 4.9B); Imports 7.3B (Prev. 7.1B, Rev. 7.1B)

- New Zealand Retail Sales Volumes QQ (Q3) -0.1% (Prev. -1.2%)

- New Zealand Retail Sales YY (Q3) -2.5% (Prev. -3.6%)