By Ven Ram, Bloomberg markets live reporter and strategist

Wall Street’s worst-kept secret is that stocks are overvalued, but there is a cautionary tale from history.

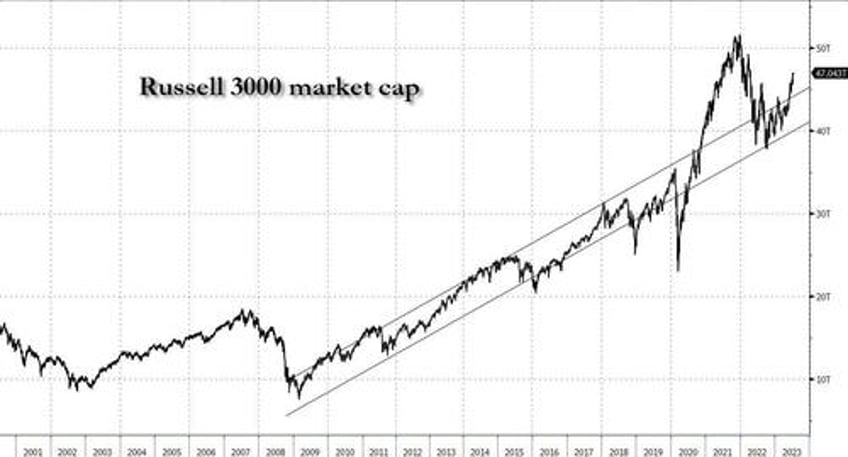

The combined market capitalization of the Russell 3000 eclipsed $47 trillion on Monday.

By way of perspective, consider the value of US gross domestic product, which at last count was some $26.5 trillion. So investors were essentially saying that Corporate America is worth 1.77 times the combined output of everything that the US produces, corporate or otherwise.

The nation’s GDP has grown at a compounded annual rate of some 4.3% since the turn of the century, meaning if the economy does have as good a run, America Inc. will get to levels ascribed by the markets around 2037.

This “duration” is likely to act as a drag on prospective returns, so those buying into the optimism may have to ride out the rather long payback period with oodles of patience. If anything, this measure was even loftier in 2020, and it is telling that even after a 17% rally this year, we are still below that peak.

Over in technology, valuations are even more frothy — and that seems like an understatement. So much so that the equity risk premium — the excess that investors demand to hold stocks rather than the safest assets — is deeply negative. That hasn’t happened in years, and is obviously a reflection of the AI mania that has taken the markets by storm. Despite the punitive valuations, you could argue that it’s all just beginning, and you would still be right.

Which is why it is hard to say when it will end. What is a lot easier to say is that it is unlikely to end well. And the longer it goes, the more abruptly will the music stop. You just don’t want to be the one looking for a chair then.