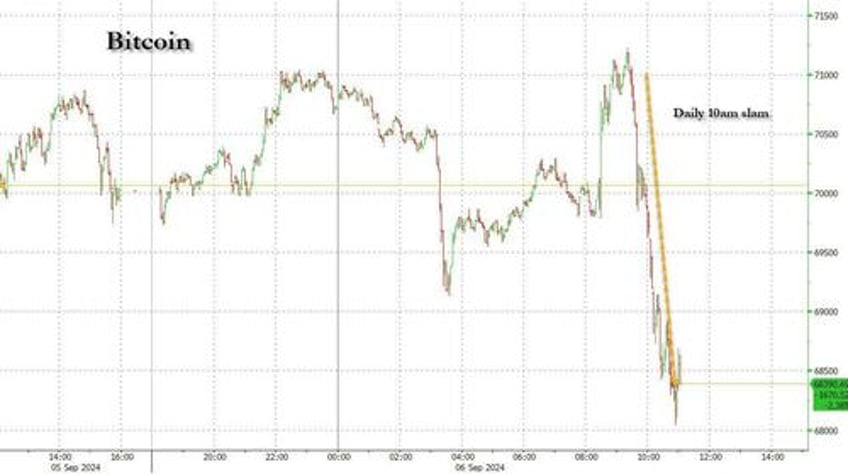

There was a bizarre reaction in risk assets this morning after the jobs report: after first surging, everything started selling off just after the cash open, led by a huge hammer in bitcoin as usual just around the 10am slam...

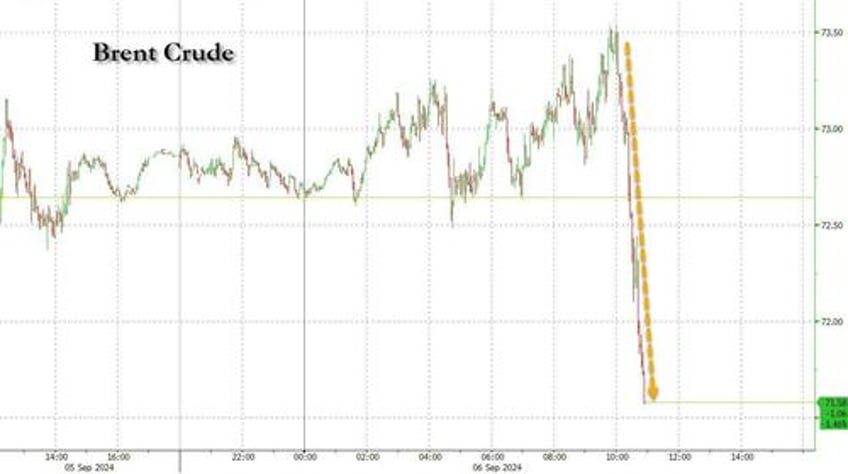

... which spilled over into oil, which has been selling off all morning..

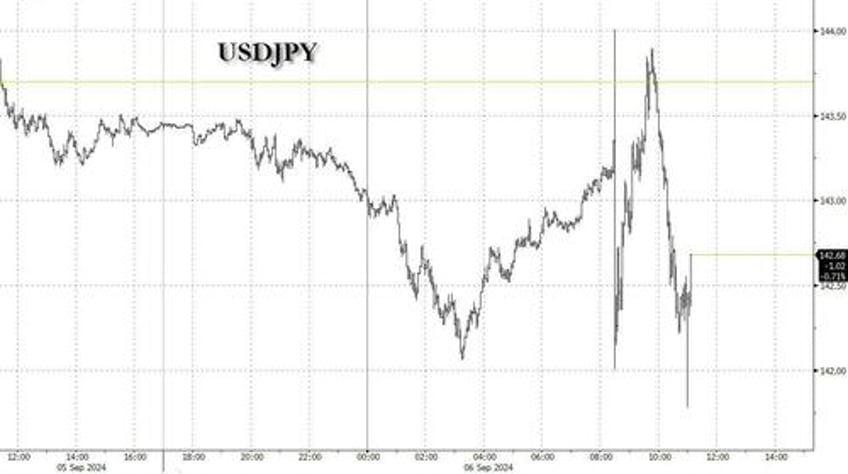

... and also the USDJPY which reversed a brief rebound on the kneejerk move higher...

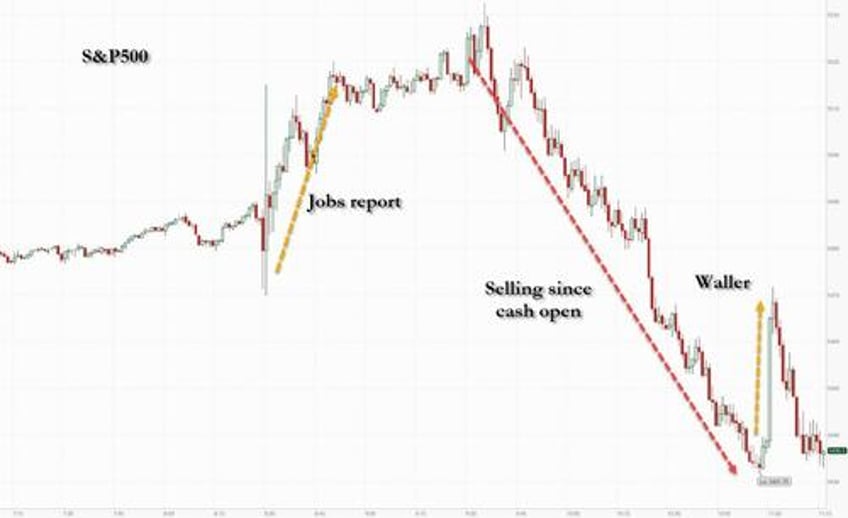

... with some speculating that while the market got a green light for a 25bps rate cut - as many had wanted as an even uglier jobs report would have prompted a 50bps cut on fears of imminent recession - traders decided to push for a 50bps rate cut anyway.

That's why the S&P, after hitting a session high of 5,530 then went straight down 100 points to 5,431, on what seemed like a familiar game of chicken with the Fed, where stocks dump unless the Fed relents to more easing (especially since the jobs market doesn't actually require it).

But then S&P futures suddenly rebounded at 11am ET when Fed's Waller (a voter this year) delivered remarks, in which he said that the current batch of data no longer requires patience, it "requires action" (the data he was referring to is clearly not the drop in the unemployment rate nor the rebound in the average hourly wages, but more likely the continued drop in Kamala Harris betting odds on Polymarket), and that he would advocate to "front-load" rate cuts if appropriate.

He also said some other things, to wit:

- He believes maintaining the economy's forward momentum means time has come to begin reducing policy rate at upcoming meeting

- Data in past three days indicates labor market is softening but not deteriorating; this judgment important to upcoming policy decision.

- It is likely a series of reductions in policy rate will be appropriate, but determining appropriate pace of cuts will be challenging.

- Is open minded on size and pace of cuts and will depend on data.

- If future data shows significant deterioration in labor market, Fed can act quickly and forcefully.

- He would also cut at consecutive meetings if data calls for it as I would be for larger cuts if needed.

- That said, he does not believe economy is in a recession or necessarily headed for one soon

- He stand ready to act promptly to support the economy as needed, and there is sufficient room to cut policy' rate and still remain somewhat restrictive to ensure inflation returns to 2%.

- August jobs report and other recent data reinforces view there has been continued moderation in the labor market.

- In light of 'considerable and ongoing progress’ toward FOMC’s 2% inflation goal, balance of risks has shifted toward employment.

- Monetary policy has to adjust accordingly as balance of risks has shifted to employment side of mandate.

- Softening of labor market pattern consistent with moderate growth in economic activity.

- Labor market and economy performing in a solid manner and future prospects are good.

- See some downside risks to employment, will be watching closely.

But while the kneejerk reaction to the Waller speech was that he is endorsing a 50bps rate cut, a comment by the WSJ's Nick Timiraos promptly intercepted that, writing that "Fed governor Chris Waller’s speech doesn’t explicitly say “25” or “50” but it leans into endorsing a 25 bps cut to start, explicitly reserving the option to go faster “as appropriate” if “new data” show more deterioration."

Timiraos then goes on that "Waller pats the Fed on the back for not overreacting to the banking crisis, the lower inflation prints of 2H 23, the higher prints of Q1 24. Then he says, “Based on the evidence I see, I do not believe the economy is in a recession or necessarily headed for one."

Fed governor Chris Waller’s speech doesn’t explicitly say “25” or “50” but it leans into endorsing a 25 bps cut to start, explicitly reserving the option to go faster “as appropriate” if “new data” show more deterioration

— Nick Timiraos (@NickTimiraos) September 6, 2024

Waller pats the Fed on the back for not overreacting to…

The sharp, violent reversals in rate cut expectations this morning are shown below:

The result of this sequence was just as bizarre as the market reaction to the jobs report: while stocks initially jumped, they then immediately reversed all gains and have since sunk, dropping not just to session lows, but rapidly approaching the lowest level since the early August freakout...

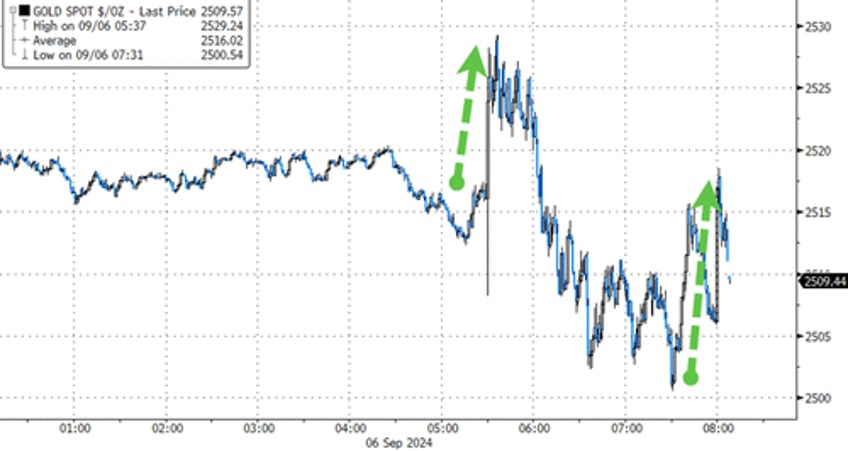

... as the schizophrenic market tries to decide if it wants a 25bps cut, a 50bps cut, and whether it prefers a soft or a hard landing. The on asset that seems to like any outcome, is gold, as it once again trades near all time highs.

In any case, thanks to the surging negative dealer gamma, this morning the selling algos are clearly in control with the dollar plunging, yields sliding to fresh session lows...

... and risk assets a sea of red.