- APAC stocks were somewhat mixed following the key developments stateside where the S&P 500 and Nasdaq extended to fresh record levels following the softer-than-expected US CPI but despite the hawkish Fed dot plots.

- Fed kept rates unchanged at 5.25-5.50%, as expected with the vote unanimous, while the statement noted there has been modest (prev. a lack of) further progress towards the 2% inflation objective.

- Fed’s updated dot plots now signal only one rate cut in 2024 vs. three in the March projections; four policymakers saw no rate cuts this year, while seven pencilled in just one cut and eight expect two rate cuts this year.

- BoJ will reportedly consider gradually reducing its Japanese government bond holdings at this week's two-day policy meeting, according to Nikkei.

- European equity futures indicate a mildly softer open with Euro Stoxx 50 futures down 0.1% after the cash market closed up 1.4% on Wednesday.

- Highlights include German Wholesale Price, Swedish Inflation, EZ Industrial Production, US IJC, PPI (F), NZ Manufacturing PMI, Comments from ECB’s de Guindos, BoC’s Kozicki & Fed’s Williams, Supply from Italy & US, Earnings from Adobe.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks finished higher in which the S&P 500 and Nasdaq extended on record levels after softer-than-expected US CPI data provided an early boost and saw money markets briefly revert to fully pricing in two 25bp rate cuts this year, although some of the gains were later pared and money markets are back to fully pricing in just one cut after the FOMC announcement.

- The Fed kept rates unchanged as expected and lifted its dot plot projections in which the median view was for one cut this year vs prev. median view of three cuts. Furthermore, Fed Chair Powell's press conference largely stuck to the script and noted they do not have the confidence right now that would warrant loosening policy.

- SPX +0.85% at 5,421, NDX +1.33% at 19,465, DJI -0.09% at 38,712, RUT +1.62% at 2,057.

- Click here for a detailed summary for a detailed summary.

FOMC

- Fed kept rates unchanged at 5.25-5.50%, as expected with the vote unanimous, while the statement noted there has been modest (prev. a lack of) further progress towards the 2% inflation objective and it repeated that it does not expect it will be appropriate to reduce policy target range until gaining greater confidence inflation is moving sustainably towards 2%.

- Fed’s updated dot plots now signal only one rate cut in 2024 vs. three in the March projections and four policymakers even saw no rate cuts this year, while seven pencilled in just one cut and eight expect two rate cuts this year. Looking ahead, the 2025 median dot plot increased to 4.1% from 3.9% and the 2026 dot was unchanged at 3.1%, but the longer run rate ticked up again to 2.8% from 2.6%.

- Fed Chair Powell said during the press conference that the economy has made considerable progress and continued strong job gains in the economy, as well as noted that inflation has eased substantially but is still too high. Powell said the Fed is maintaining a restrictive stance of policy and recent indicators suggest economic growth is still expanding at a solid pace. Furthermore, he said they remain highly attentive to inflation risks and so far have not greater confidence on inflation in order to cut, while he noted that SEPs are not a plan or any kind of decision and that the assessment of policy will adjust.

- Fed Chair Powell said during the Q&A that all agree the Fed is data dependent and he'd look at all Fed forecasts for the rate path as plausible, while he wants to gain further confidence on rates, but not going to say how many more months of good data is needed and noted that policymakers are not trying to send a strong signal with forecasts. Powell said they will be monitoring the labour market for signs of weakness, but not seeing that right now and they do not have the confidence right now that would warrant loosening policy. Furthermore, he said FOMC participants were allowed to update SEPs to incorporate the latest CPI data if they wanted, but most policymakers do not update their forecasts mid-meeting and some do, as well as noted that no one has rate hikes as a base case and he ultimately thinks rates will need to come down to continue to support goals.

APAC TRADE

EQUITIES

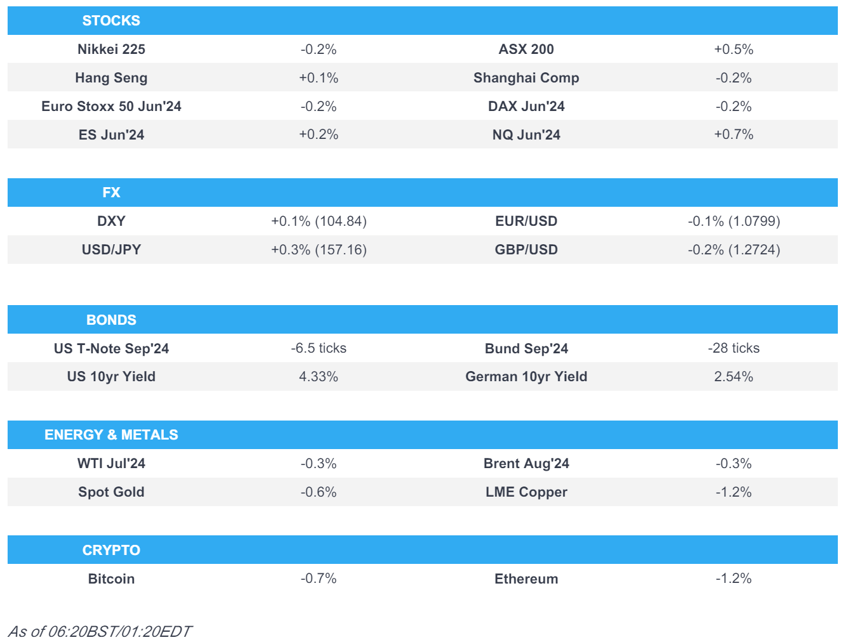

- APAC stocks were somewhat mixed following the key developments stateside where the S&P 500 and Nasdaq extended to fresh record levels after softer-than-expected CPI data, although participants also digested the latest FOMC meeting and hawkish dot plots which suggested just one rate cut this year vs. prev. view of three cuts.

- ASX 200 was led higher by outperformance in tech amid a softer yield environment and with stronger-than-expected jobs data.

- Nikkei 225 failed to sustain early gains and dipped back below the 39,000 level as the BoJ kick-started its two-day policy meeting, while Nikkei reported the BoJ will consider gradually reducing its JGB holdings at this meeting.

- Hang Seng and Shanghai Comp. diverged in rangebound trade with the mood in Hong Kong positive as several automakers weathered the EU announcement of tariffs on Chinese EVs and HKMA maintained its base rate at 5.75% in lockstep with the Fed, while the mainland was lacklustre despite the PBoC's latest efforts to support the property industry.

- US equity futures traded mostly sideways although Nasdaq 100 futures outperformed owing to the recent softening of yields.

- European equity futures indicate a mildly softer open with Euro Stoxx 50 futures down 0.1% after the cash market closed up 1.4% on Wednesday.

FX

- DXY was slightly firmer although remained at a sub-105.00 level after it tumbled yesterday and briefly dipped below its 200 DMA (104.46) following the cooler-than-expected CPI data, before recovering some of its losses after the FOMC announcement whereby the Fed kept rates unchanged but the 2024 dot plot signalled only one rate cut this year (prev. 3 in March).

- EUR/USD pulled back from its post-US CPI highs and looks to retest the 1.0800 level to the downside.

- GBP/USD failed to sustain its recent brief foray above 1.2800 which has since provided a level of resistance.

- USD/JPY recovered some of its lost ground and returned to the 157.00 territory as participants await the BoJ.

- Antipodeans continued to partially unwind the US data-induced advances, while better-than-expected Australian jobs data only provided a brief tailwind for AUD/USD.

- PBoC set USD/CNY mid-point at 7.1122 vs exp. 7.2384 (prev. 7.1133).

FIXED INCOME

- 10-year UST futures traded slightly lower after yesterday's fluctuations which were spurred by the softer US CPI report and more hawkish Fed dot plots, while attention turns to incoming Fed rhetoric and PPI data.

- Bund futures trickled lower from the prior day's peak and dipped back beneath the 131.00 level.

- 10-year JGB futures pared some of their opening gains but remained afloat amid firmer demand at the enhanced liquidity auction and as the BoJ kick-started its two-day policy meeting.

COMMODITIES

- Crude futures were subdued after yesterday's choppy performance amid bearish inventory data and heightened Middle East tensions.

- Spot gold was mildly pressured and unwound CPI-related gains in the aftermath of the hawkish dot plots.

- Copper futures reversed the prior day's initial advances as the SEPs pointed to a 'one and done' Fed rate cut this year.

CRYPTO

- Bitcoin was pressured and slipped beneath the USD 68,000 level to test USD 67,000 to the downside where support held.

NOTABLE ASIA-PAC HEADLINES

- Hong Kong Monetary Authority maintained its base rate at 5.75%, in lockstep with the Fed.

- China hopes the EU will make some serious reconsideration on tariffs for China EVs and stop going further in the wrong direction, according to state media.

- BoJ will reportedly consider gradually reducing its Japanese government bond holdings at this week's two-day policy meeting, according to Nikkei.

- South Korea's government and ruling party are to increase fines and punishment for illegal short-selling, while the stock short-selling ban will be extended until March, according to Yonhap.

DATA RECAP

- Australian Employment (May) 39.7k vs. Exp. 30.0k (Prev. 38.5k)

- Australian Full Time Employment (May) 41.7k (Prev. -6.1k)

- Australian Unemployment Rate (May) 4.0% vs. Exp. 4.0% (Prev. 4.1%)

- Australian Participation Rate (May) 66.8% vs. Exp. 66.7% (Prev. 66.7%)

GEOPOLITICAL

MIDDLE EAST

- Israel's top general met earlier this week in Bahrain with his counterparts from several Arab militaries to discuss regional security cooperation, according to Axios citing sources.

- Hamas's request in advance for a guarantee of a permanent ceasefire complicates Gaza truce negotiations and the main sticking point in the hostage negotiation is the demand for an explicit pledge by Israel to end the war, according to The Times of Israel. it was also reported that Hamas hardened some of its positions on the truce proposal and demanded the inclusion of China, Russia and Turkey as guarantors of the agreement, according to the Israel Broadcasting Corporation.

- Hamas statement said it showed positivity in all stages of negotiations to stop the aggression, while it urged the US administration to direct its pressure on Israel which it said wants to pursue the Gaza war.

- US military said it does not want the situation between Israel and Lebanon to escalate into a regional conflict, while Defense Secretary Austin urged a de-escalation of tensions in the region during a call with his Israeli counterpart.

- Lebanese army chief is visiting Washington this week to discuss the situation at the border, according to Al-Monitor.

- US military said its forces successfully destroyed three anti-ship cruise missile launchers in a Houthi-controlled area of Yemen and one uncrewed aerial system launched from a Houthi-controlled area of Yemen. However, it stated that one Iranian-backed Houthi unmanned surface vessel struck M/V Tutor which is a Liberian-flagged, Greek-owned and operated vessel in the Red Sea, while the impact caused severe flooding and damage to the engine room.

- Iran is responding to last week's IAEA resolution against it by expanding uranium-enrichment capacity at two underground sites although the escalations are not as large as many feared, according to diplomats cited by Reuters.

OTHER

- US Deputy Secretary of State Campbell said the US believes China is currently determined to work to stabilise US-China relations and not create frictions that can escalate in unpredictable and dangerous ways, while Campbell said it is difficult to envision how the US is going to get back on any kind of engagement with North Korea given current circumstances.

- Russian nuclear-powered submarine and other naval vessels arrived in Cuba for a five-day visit to the communist island in a show of force amid spiralling US-Russian tensions, according to AFP News Agency.

EU/UK

NOTABLE HEADLINES

- UK opposition Labour Party leader Starmer said they are not looking at bringing in wealth taxes.

- Sky News/YouGov poll found that 64% of respondents thought Labour Party leader Starmer did better in the Sky News Leaders TV interviews, while 36% thought UK PM Sunak did better.

- ECB's Nagel said core inflation is still very sticky and inflation is going down.

DATA RECAP

- UK RICS Housing Survey (May) -17 vs. Exp. -6 (Prev. -5, Rev. -7)