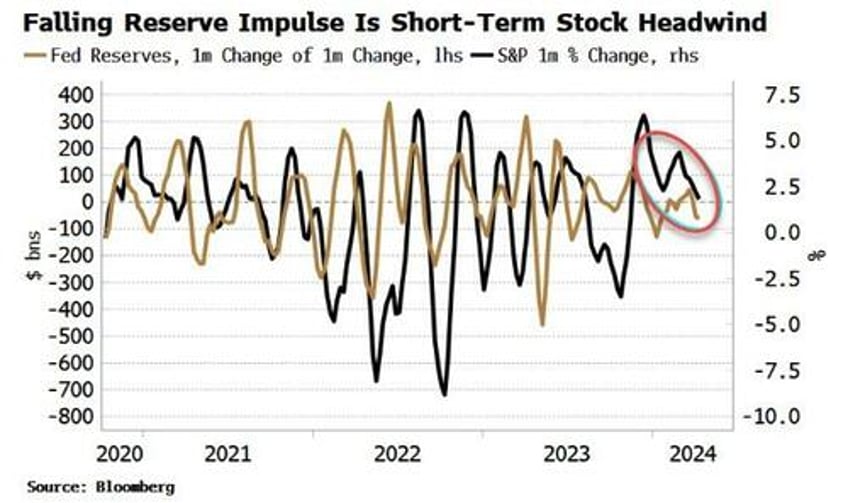

The impulse from central-bank reserves in the US, or the change in their change on a monthly basis, points to further short-term resistance for stocks.

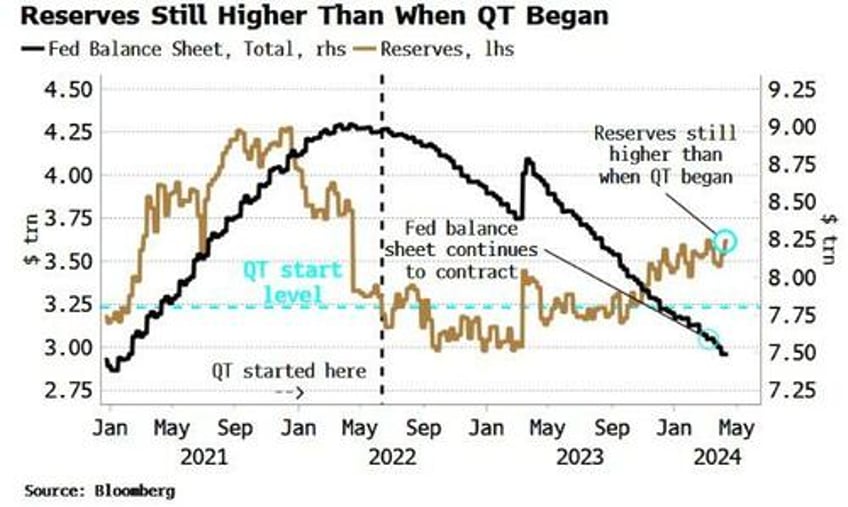

The Federal Reserve’s quantitative tightening program is ongoing, but bank reserves still remain almost $400 billion higher than when the Fed began QT in June 2022, even as the total size of the Fed’s balance sheet steadily contracts.

The “Treasury pivot,” its decision to pivot issuance towards bills, was instrumental in allowing risk assets to rally in the face of tight monetary policy, by allowing money market funds to finance the government using reserves it had parked at the Fed’s reverse repo facility.

But for risk assets such as stocks, their shorter-term performance is not just related to by how much reserves are rising, it’s by how much they are accelerating. The chart below shows the impulse in reserves - the one-month change of their one-month change - tracks the one-month change of the S&P. The impulse has been weakening, consistent with the headwinds stocks have been encountering.

The headwinds are likely to continue. In the short term, reserves have fallen due to tax payments. The Treasury’s account at the Fed has risen over $240 billion to $906 billion since last week as taxes came in, with increases in the account removing reserves from the system. The Treasury aims to keep the account around $750 billion, so it should fall again as the Treasury spends the money, re-injecting reserves back into the system.

Nonetheless, reserves are likely to be increasingly challenged as the RRP falls. The facility this week hit its lowest levels in almost two years, to a low of $327 billion. Some of that is tax related, but key is that bill yields, e.g. six and 12-month maturities, are rising again as the amount of interest rate cuts expected from the Fed diminishes. This makes bills more attractive for MMFs, who then pull money out of the RRP to buy them.

Not only will that incrementally make the liquidity backdrop for stocks less friendly this year, it also means funding risks are rising again. In this changing environment, it is prudent for investors to heighten their vigilance.