By Russell Clark, author of the Capital Flows and Asset Markets substack

America Created The Trade Imbalance

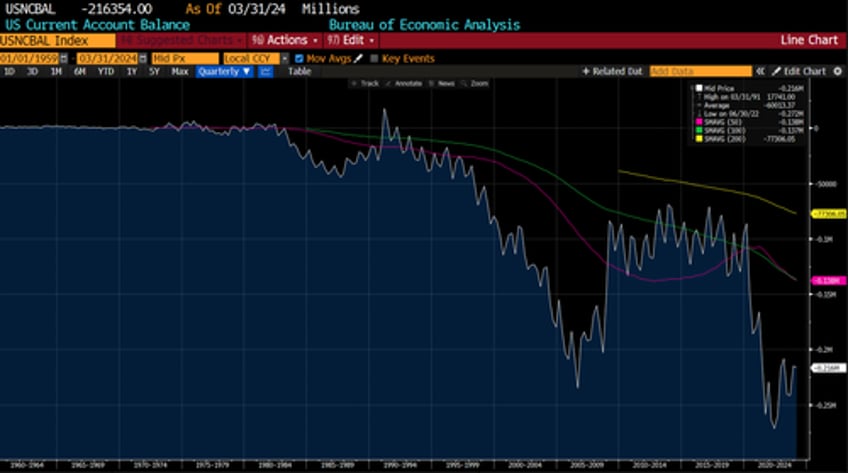

Donald Trump has rallied against nations that run trade surpluses with the US, accusing them of stealing American jobs. Prior to the 1980s, the US ran a flat current account (of which the trade balance is the largest component). Moving from the gold standard was a key driver in the ability for trade deficits to open up. But why does only the US run such large trade deficits?

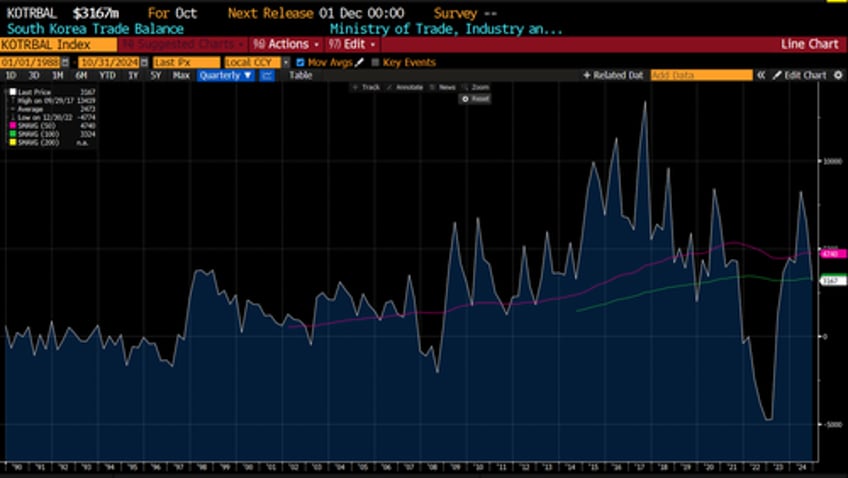

Korea offers a good explanation of how America created the trade deficit. The Korean example pretty much generalizes across east Asia, and unlike Japan in 1980s, or China now is not seen as a threat, so it allows for more rational analysis. During the boom years of Korea in the early 1990s, it was running a close to flat trade balance. It was importing as much as it was exporting.

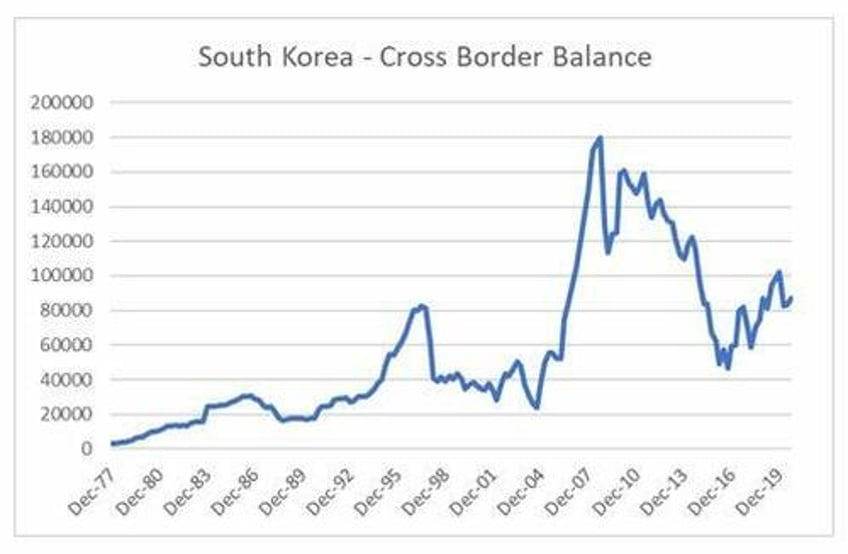

Korea’s problem was that it had come to rely on global (read American) financing. We can most clearly see this using BIS data. This looks at claims of foreign banks by Koreans versus claims by Koreans on foreign banks. When the number rises, it means foreign banks are more heavily participating in the Korean financial system.

Surges in lending in 1997 and 2007, preceded the Asian Financial Crisis and Global Financial Crisis. When the flow of capital turned, the Korean Won suffered, and economic activity in Korea weakened dramatically.

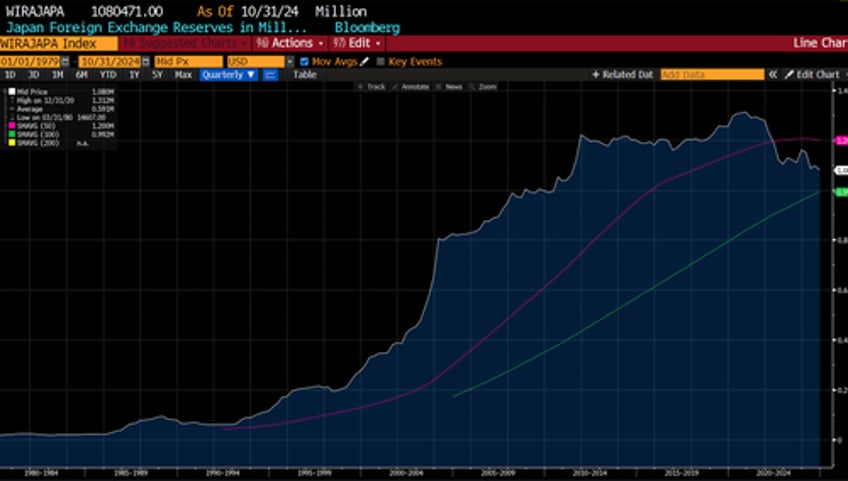

Koreans (and in fact Asian, Latin American, Russians and most emerging markets) learned that foreign (mainly American) financing could not be relied on, so nations needed to have strong exports, and to build up foreign reserves. In this respect they were following in the steps of Japan. Prior to Japan, almost all foreign reserves were held as gold, but Japan started to build US treasury reserves, in part to try and slow the strengthening of the Yen.

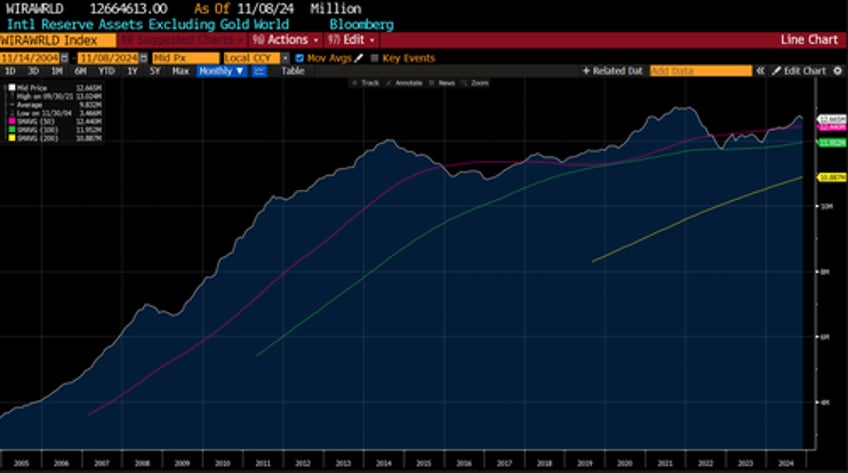

The rest of the world followed suit, and by 2013, we can count 12 trillion in foreign reserves.

Talk of foreign reserves, and currency movements tend to obscure the simplicity of what is really happening. Governments learned that financial markets can be volatile, and so made a choice to reduce their consumption, and build up savings. Someone had to lend to them, and that was the US. Unlike a bank, this lending happened via trade balance, where the US consumed more that it made. The problem, as we see above with Korea, is when lending nations, like Korea also start to become borrowers. When there are only borrowers, someone is going to not get a loan, and the cycle breaks down. So far, China has been happy to be a lender, in so far it has a record trade surplus.

Trump’s trade policies seem to be focused on getting the trade surplus in balance. I can also safely assume, that he does not plan to achieve this through austerity and recession. For Asian nations they are faced with a tricky choice. Relying on exports, and building foreign reserves leaves them exposed politically, and at risk of tariffs and trade wars. The better option is to stimulate. Japan is probably ahead of the curve in this respect. They have embarked on very stimulatory policy, although relied too heavily on Yen weakness.

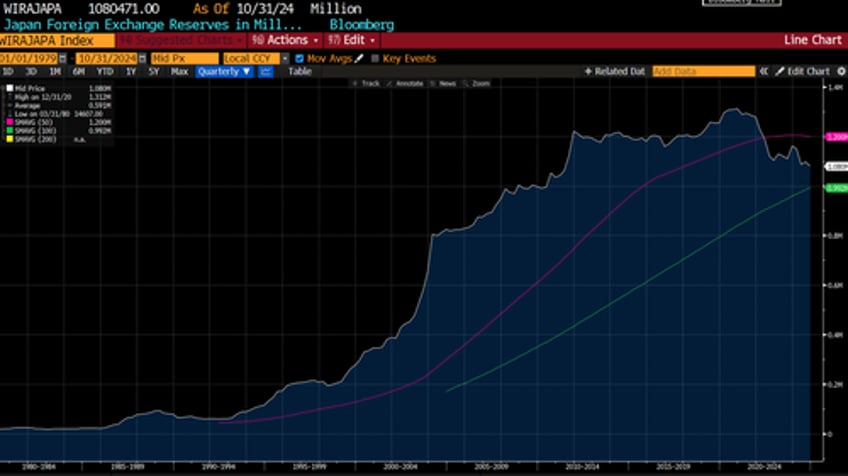

But despite Yen weakness Japanese foreign reserves are declining. When I was there in May, it was booming.

We have already seen an inflection in the long term trend of Treasuries versus gold. What happens when China realizes it has no option but to stimulate?

In a strange way, perhaps China’s refusal to stimulate is perhaps the most bullish thing in the market. Collapsing Chinese yields have coincided with great strength in US assets.

In contrast to China, US 30 year treasury yields are looking to test 5% again in my view.

If China chooses to stimulate to reduce its trade surplus, then even higher yields look likely to me. I think Asians have been slow to realize that the game has changed, although Shinzo Abe and Japan seemed to understand it early on.

Stimulus is the only game in town now. When China stimulates, who will be left to lend to the US?