Wall Street analysts have downgraded Apple for the second time this week, citing a deteriorating outlook for iPhone sales and macro weakness.

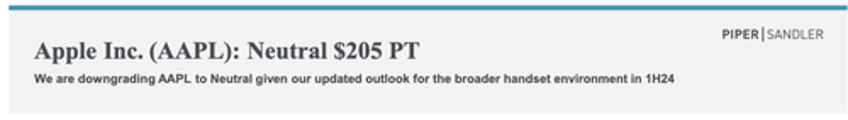

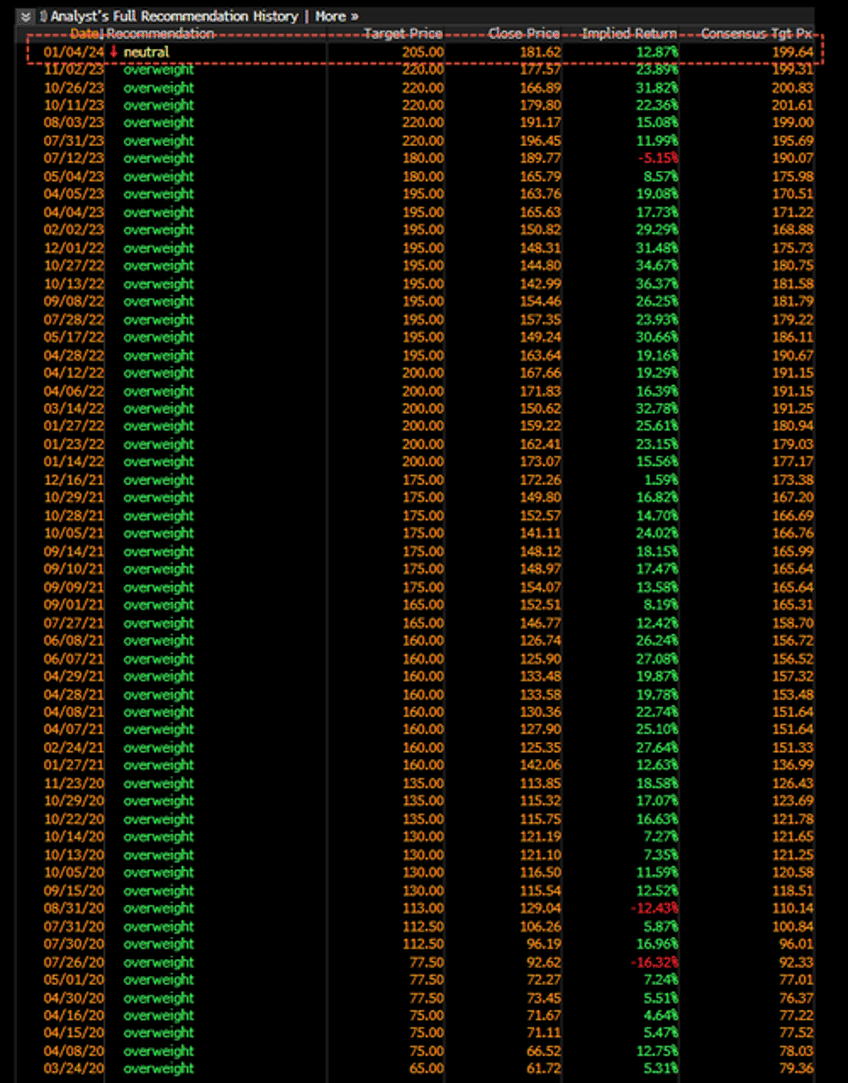

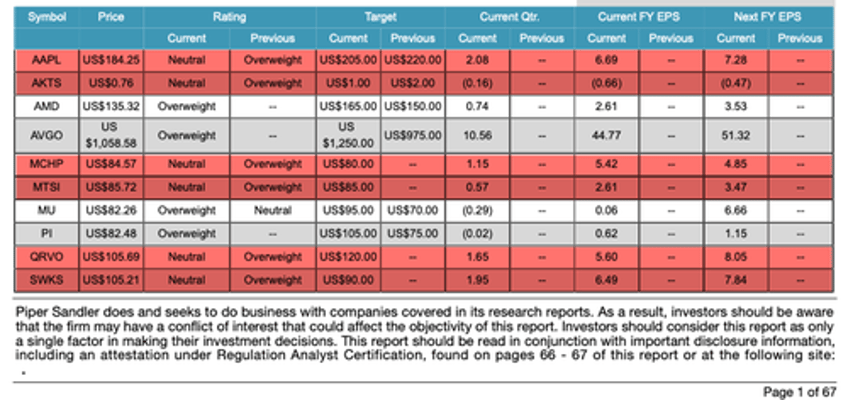

Piper Sandler analysts led by Harsh Kumar are the latest to downgrade Apple from "Overweight" to "Neutral" with a price target of $205, down from $220.

"We are concerned about handset inventories entering into 1H24 and also feel that growth rates have peaked for unit sales. Handsets are ~51% of total revs," Kumar wrote in a note to clients. He lowered his recommendation on Apple after being bullish since March 2020.

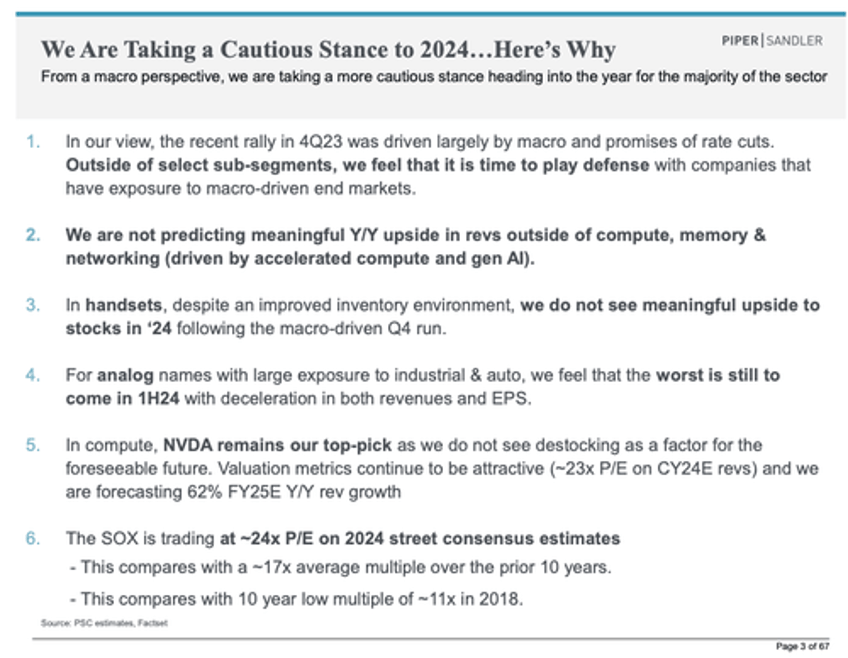

He outlined several other reasons for his downgrade decision:

Deteriorating macro environment in China could also weigh on handset business.

Headwinds due to negative news around both the Watch and other ongoing legal battles could be a distraction.

Difficult comps from 2023 paired with constant currency headwinds are expected to continue in 1H24 with interest rates remaining elevated.

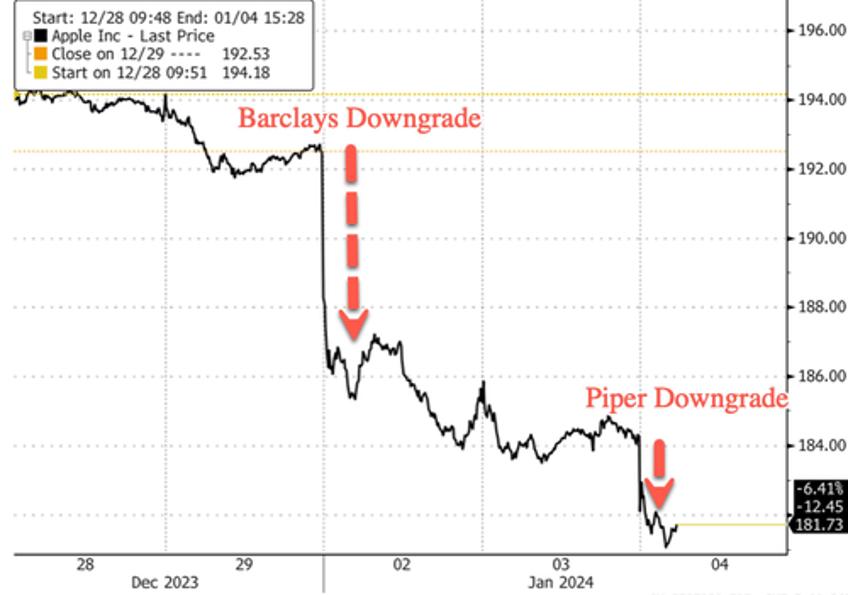

Kumar's downgrade was similar to that of Barclays analyst Tim Long, who slashed Apple from "Equal-Weight" to "Underweight" with a slight downshift in price target, from $161 to $160. The price target indicates Long expects a 17% share decline this year. However, Kumar's $205 price target is more optimistic than Long's $160 price target.

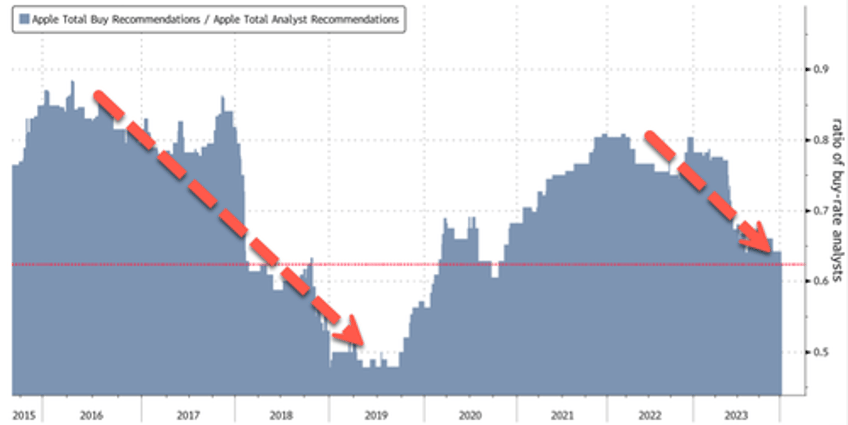

Bloomberg data shows that the percentage of bullish analysts covering Apple has hit a three-year low.

Apple shares have dropped about 6% since Long's downgrade on Tuesday.

Kumar's Apple downgrade was part of a much larger note to clients, warning about a challenging first half of the year for the analog market, handset, and consumer end markets.

"We are starting 2024 with a cautious stance and as such are downgrading 6 names in our coverage to Neutral from Overweight previously," the analyst said.

Here are the six downgrades the analyst made:

Meanwhile, the "Magnificent 7" (Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms, and Tesla) index has been priced for perfection (the thinking is that the Fed slashing rates so fast it would imply the US is in a brutal recession in 2024 is somehow good for tech companies).

It's not a great start to the new year when the world's largest company, in terms of market capitalization, is hit with two downgrades in a matter of days.