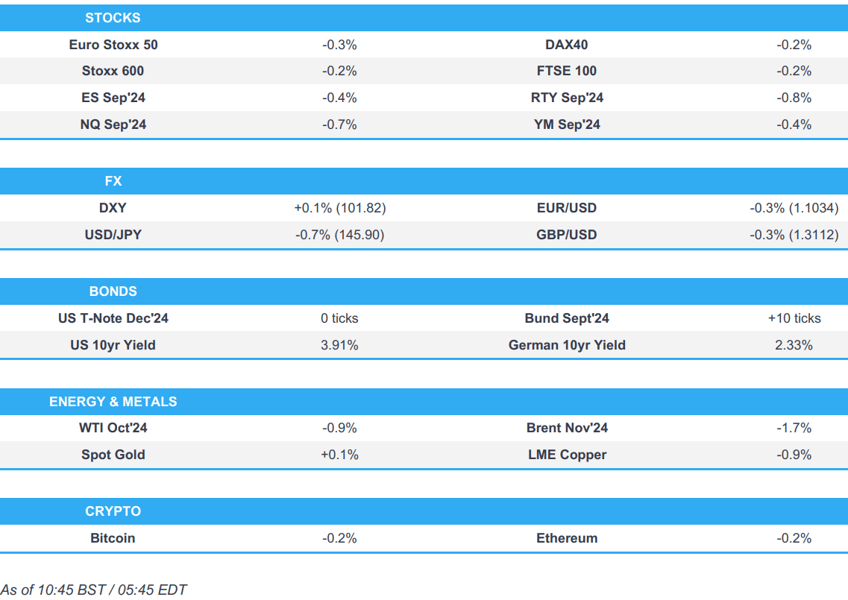

- Equities are entirely in the red, continuing the subdued risk tone seen in APAC trade overnight

- Dollar is slightly firmer, JPY bid given the risk tone & Ueda documents, Antipodeans lag

- USTs flat ahead of key US ISM Manufacturing PMI, Bunds slightly firmer

- Crude is significantly lower but with specifics light, XAU climbs back above USD 2.5k, base metals slip

- Looking ahead, US PMI (F), ISM Manufacturing, BoE’s Breeden, ECB's Nagel

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.1%) are mixed, having opened with a generally positive bias. Indices initially traded sideways, but have slowly deteriorated as the morning progressed, currently near session lows.

- European sectors are mixed. Consumer Product & Services top the pile, whilst Basic Resources is the clear laggard, hampered by losses in metals prices.

- US Equity Futures (ES -0.4%, NQ -0.6%, RTY -0.8%) are lower across the board, as US participants return from US Labour Day holiday. The docket for today includes US PMIs (Finals) and more importantly the ISM Manufacturing data.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY was flat for most of the European morning, but has edged higher in recent trade. Currently in a 101.62-83 range. The key inflection point will be on US ISM Manufacturing data, with a particular focus on the employment components, ahead of the NFP report on Friday.

- EUR is softer and trading towards the lower end of a 1.1035-72 range, and dipping below its 20 DMA. European docket is thin, with only ECB's Nagel scheduled.

- GBP is on the backfoot, in what has been yet another session free from any UK-specific catalysts. Cable currently sits in a 1.3108-85 range, a trough which marks the lowest in 7 days. BoE’s Breeden is due to speak today at 13:45BST.

- The JPY is by far the best performer among G10 peers, with USD/JPY slipping below 146.00. Pressure in the pair could be attributed to Bloomberg reports which stated that BoJ's Ueda submitted documents to the gov't, which noted that the BoJ would continue to hike if the economy/prices perform as expected.

- Antipodeans are amongst the worst performers across the G10s, given the subdued risk tone in APAC trade which led a sharp sell-off in metals prices.

- CHF began the European session on the front-foot, largely attributed to its safe-haven status; however, it saw modest weakness on the back of a slightly softer inflation report.

- PBoC set USD/CNY mid-point at 7.1112 vs exp. 7.1120 (prev. 7.1127)

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are flat as we await the return of US participants from Monday's holiday, but as focus remains on US ISM Manufacturing data later. No real follow-through from JGB pressure overnight after a relatively subdued short-dated tap. In a narrow sub-10 tick range which is at the mid-point of Monday's 113-14 to 113-30+ band.

- Bunds are essentially unchanged in a much narrower c. 20 tick range vs. the 40+ tick range seen on Monday in the wake of weekend political developments. Bunds are in a 133.27-133.48 band which is entirely within Monday's 133.16-133.62 range.

- Gilts are trading similar to the above, with the benchmark also within a slim 15-tick range which has just eclipsed yesterday's peak to a 98.39 high.

- Japan sold JPY 2.6tln 10-year JGB; b/c 3.17x (prev. 2.98x), average yield 0.915% (prev. 0.926%).

- Books close on sale of a 2040 Gilt via syndication, orders topped GBP 107bln, via Reuters citing bookrunner.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks are both significantly lower, but with differing performances given the lack of settlement in WTI, attributed to the the US Labour Day holiday. Nothing specific driving the pressure in the complex, but comes alongside incremental strength in the Dollar index. Brent'Nov as low as USD 76.05/bbl.

- Spot gold is slightly firmer and has climbed back above USD 2.5k/oz after losing that figure on Monday. Strength which comes as the general risk tone remains tepid and as focus turns to US ISM Manufacturing later. Currently trading in a USD 2490-2506/oz range.

- Base metals are pressured, with 3M LME Copper extending further below the USD 9.2k mark and now beginning to approach USD 9k.

- Libya's NOC declared force majeure on the El Feel oil field from 2nd September, according to Reuters.

- UN hosts talks in Tripoli aimed at resolving Libya's central bank crisis, key understandings reached, according to a statement cited by Reuters.

- Goldman Sachs has cut its 2024 copper forecast to USD 10,100/ton (prev. saw 12,000/ton), due to China's weak economic recovery. It also reduced its 2025 aluminium price estimate to USD 2,540, and remains bearish on iron ore and nickel, Bloomberg reports. The bank favours gold as a hedge, and maintained its USD 2,700 price target.

- Click for a detailed summary

NOTABLE DATA RECAP

- Swiss CPI YY (Aug) 1.1% vs. Exp. 1.2% (Prev. 1.3%); MM (Aug) 0.0% vs. Exp. 0.1% (Prev. -0.2%)

- UK Barclaycard Consumer Spending YY (Aug) +1.0% (Prev. -0.3%)

- UK BRC Total Sales YY (Aug) 1.0% (Prev. +0.5%); LFL Sales +0.8% (Prev. +0.3%)

- UK BRC Retail Sales YY (Aug) 0.8% (Prev. 0.3%)

NOTABLE EUROPEAN HEADLINES

- ECB decisions look get more contentious once interest rates fall to about 3%, according to Bloomberg sources.

NOTABLE US HEADLINES

- Intel (INTC) and Japan will establish a research and development hub for advanced semiconductor manufacturing equipment in Japan, according to Nikkei.

- Japanese firms will not be supplying Apple (AAPL) iPhone displays as the Co. is ending LCD usage, via Nikkei citing sources; excluding Japan Display (6740 JT) and Sharp (6753 JT) from the iPhone supply chain

GEOPOLITICS

MIDDLE EAST

- "Israel Today: The security establishment is considering declaring the West Bank a zone of military security operations", according to Sky News Arabia.

- On the Israel-Hamas talks, "Sources: The US administration is not particularly optimistic about the chances of success of the new outline, even in light of the declarations made by both sides", according to Kann News

- US President Biden said they are still in the middle of ceasefire and hostage-deal negotiations, according to Reuters.

- Two oil tankers, one Saudi-flagged and the other Panama-flagged, were attacked on Monday in the Red Sea off Yemen, according to Reuters sources.

OTHER

- China Commerce Ministry, in response to Canada's tariffs on Chinese products, said China to initiate an anti-dumping investigation into canola imports from Canada, according to Reuters.

CRYPTO

- Bitcoin is very slightly softer and holds just shy of the USD 59k mark.

APAC TRADE

- APAC stocks eventually faltered and traded in the red across the board, albeit with losses somewhat limited amid cautious trade ahead of the US return and accompanying risk events, such as ISM Manufacturing today and NFP on Friday.

- ASX 200 saw mild pressure from its Consumer Staples and Mining stocks, but losses are cushioned by Tech, Telecoms, and Energy.

- Nikkei 225 was initially firmer amid the weaker JPY with the upside is led by the Industrial sector, however, gains later trimmed as the JPY gained ground.

- Hang Seng and Shanghai Comp were subdued and in-fitting with a broader risk tone with pressure in Real Estate continuing to be a grey cloud over the nation, whilst PBoC liquidity injections get more and more tepid.

NOTABLE ASIA-PAC HEADLINES

- South Korean Vice Finance Minister said inflation is expected to stabilize in the lower 2% range going forward, according to Reuters.

- BoK sees inflation maintaining the current stable trend for the time being, according to Reuters.

- Japan says it will spend about JPY 989bln from the reserve fund to cover energy subsidies, according to Reuters

- PBoC injected CNY 1.2bln via 7-day Reverse Repo at a maintained rate of 1.70%

- Japanese Chief Cabinet Secretary Hayashi wishes to declare the end of inflation as soon as is possible, adds that they should not hesitate to deploy fiscal spending if required to bolster the economy.

- BoJ's Ueda submitted documents to a government panel explaining the recent policy announcement, via Bloomberg; article writes the document suggests the central bank will continue to hike if the economy/prices perform as expected.

DATA RECAP

- New Zealand Terms of Trade QQ (Q2) 2.1% vs. Exp. 2.2% (Prev. 5.1%)

- New Zealand Import Prices SA (Q2) 3.1% vs. Exp. 0.5% (Prev. -5.1%)

- New Zealand Export Prices SA (Q2) 5.2% vs. Exp. 2.8% (Prev. -0.3%)

- New Zealand Export Volumes SA (Q2) -4.3% vs. Exp. -2.7% (Prev. 6.3%)

- Australian Current Account Balance SA (Q2) -10.7B AU vs. Exp. -5.9B AU (Prev. -4.9B AU)

- Australian Net Exports Contribution (Q2) 0.2% vs. Exp. 0.6% (Prev. -0.9%)

- South Korean CPI Growth YY (Aug) 2.0% vs. Exp. 2.0% (Prev. 2.6%)

- South Korean CPI Growth MM (Aug) 0.4% vs. Exp. 0.3% (Prev. 0.3%)

- Japanese Monetary Base YY (Aug) 0.6% (Prev. 1.0%)