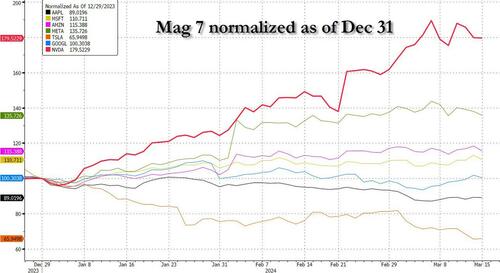

Earlier today, we quoted Goldman trader John Flood who noted that the bank's trading desk "continued to see institutional clients sell pockets of crowded tech" such as Mag 7 underperformers including TSLA, AAPL and GOOGL.

And while there was another powerful rotation below the surface, with HFs aggressively buying cyclicals and financials, where "last week’s notional long buying in the sector was the largest in a year and ranks in the 87th percentile vs the past five years", with the resultant improvement in market breadth should, according to Flood, continue which has the Goldman trader watching "for another breakout higher with S&P touching 5500 in Q2", last week the selling outweighed the buying and US stocks ended the week lower (NDX -1.2%, R2K -2.1%) as markets digested mid-month data and rising concerns about the stickiness of inflation ahead of next week’s FOMC.