The Swiss National Bank (SNB) announced a surprise cut to interest rates on Thursday in a sign of policymakers’ confidence over falling inflation.

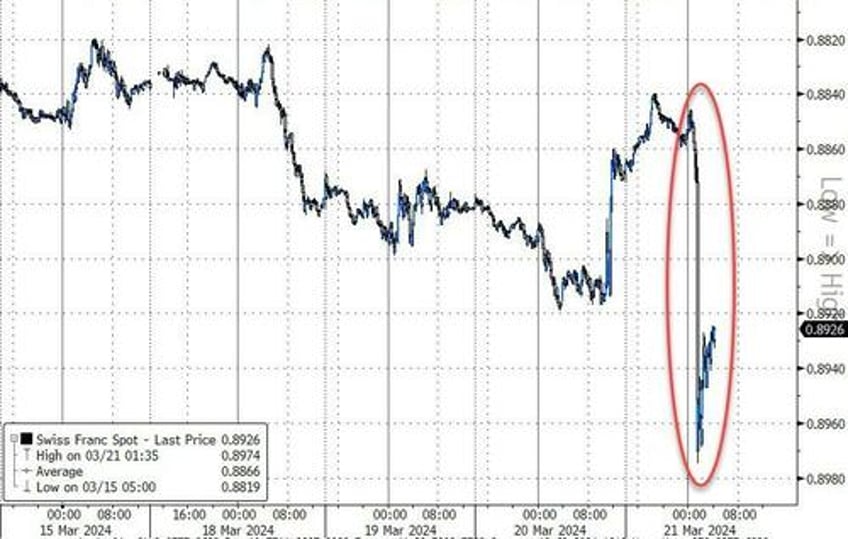

The SNB cut its key interest rate by 25bps to 1.50%, acting months before global peers may follow suit as policymakers try to prevent gains in the franc... and sure enough the franc tumbled...

While the move was a surprise, banks including Barclays and Citigroup had been preparing for a cut.

Meanwhile, CFTC positioning data show leveraged funds, which include hedge funds, boosted their bets for a weaker franc to their biggest in a year last week.

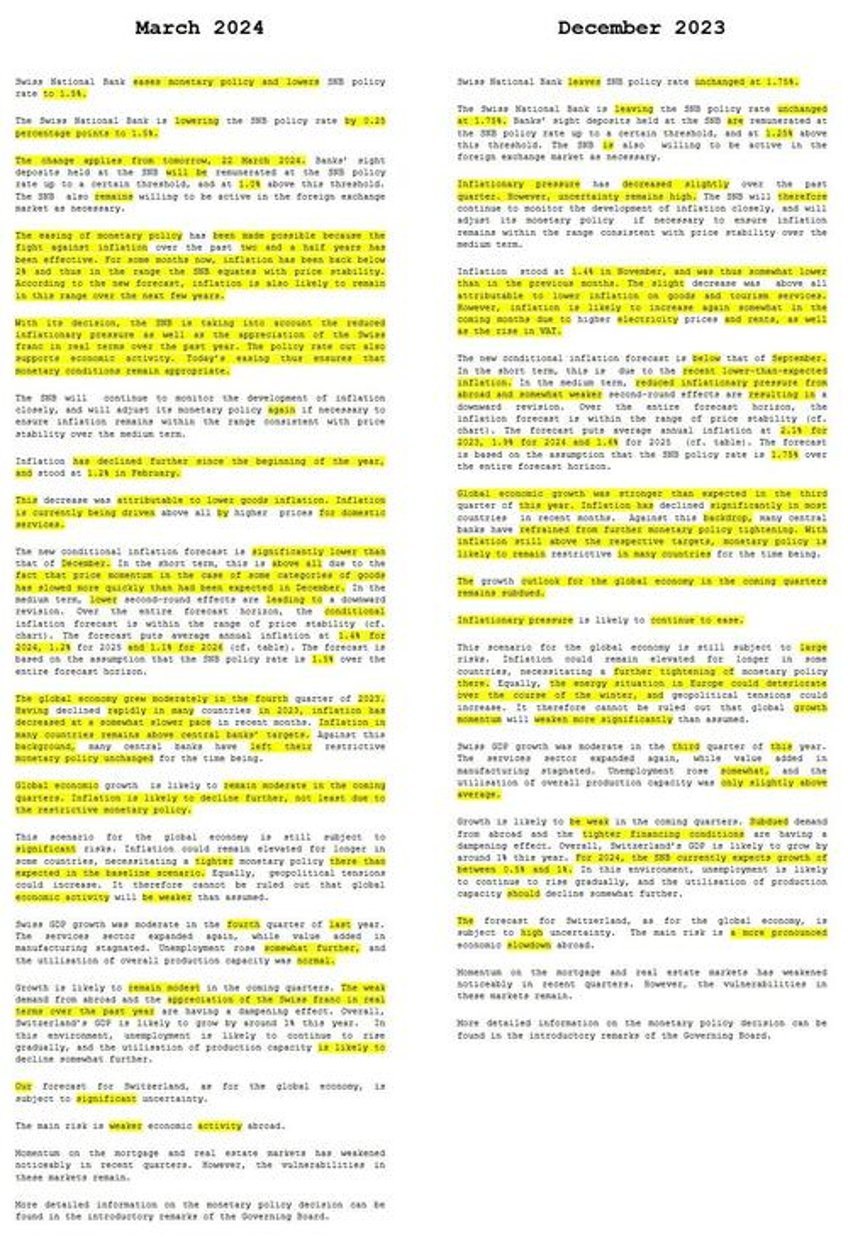

The SNB summed the decision up thus:

“The easing of monetary policy has been made possible because the fight against inflation over the past two and a half years has been effective.

For some months now, inflation has been back below 2 per cent and thus in the range the SNB equates with price stability.

According to our new forecast, inflation is also likely to remain in this range over the next few years. With our decision, we are taking into account the reduced inflationary pressure as well as the appreciation of the Swiss franc in real terms over the past year.”

And indeed it has...

As Bloomberg notes, the SNB has long been unafraid to jolt investors with abrupt action, and this cut adds another chapter to that history.

Previous instances include its 2015 abandonment of the cap on the franc, and its surprise 50 basis-point hike in borrowing costs in 2022.

Some significant changes to the SNB statement:

The SNB “has used its leeway to support economic development by cutting interest rates early on,” said Raiffeisen Switzerland economist Alexander Koch.

“However, the comparatively moderate level of interest rates, together with the robust economy, means that no overly aggressive easing should be expected in the further course of the year.”

To which Bloomberg's Ven Ram adds, the markets shouldn’t assume that the Swiss National Bank’s surprise interest rate cut means:

a) that it can afford to keep delivering successive cuts and,

b) that other central banks will follow quickly in tow.

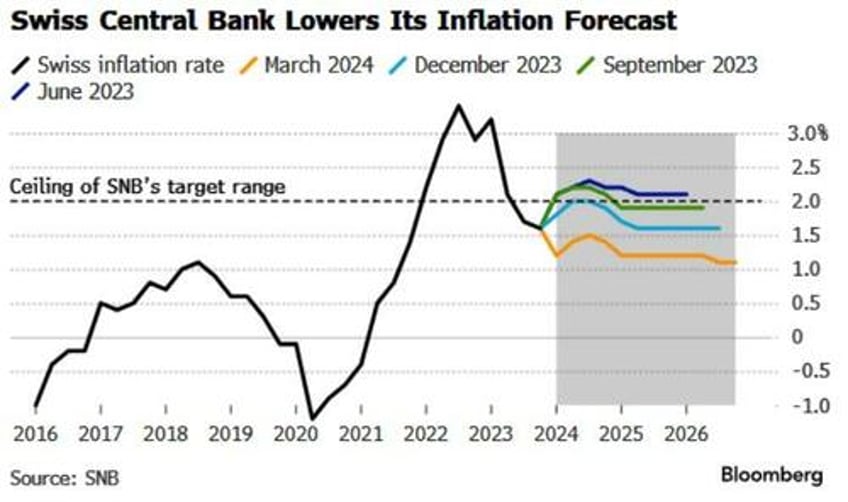

In a statement accompanying its rate-cut decision, the SNB lowered its inflation forecast to 1.4% by the end of the year from 1.9%. With its policy rate already cut to 1.50%, that means that the scope for additional easing isn’t that great unless the SNB doesn’t mind putting up with a negative real policy rate. Of course, inflation in February was already just 1.2% and if successive prints prove even mellower, more cuts could follow — but that outlook wouldn’t be compatible going purely by the SNB’s inflation forecast.

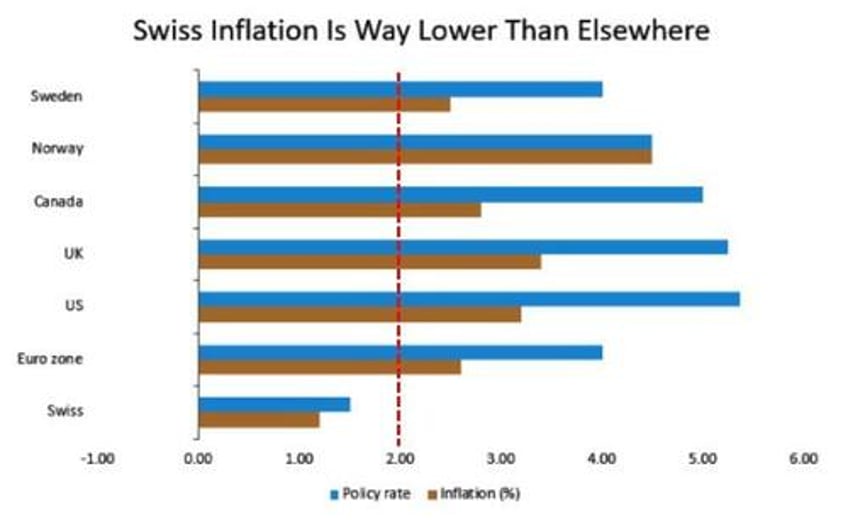

A key point to remember is that inflation in Switzerland has averaged just above 1% in the first two months of the year — and there is hardly any other major economy where price pressures are as docile.

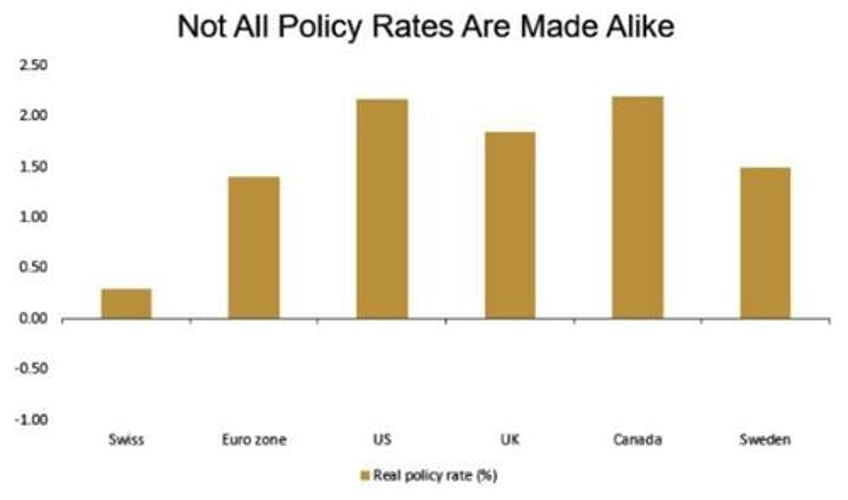

As the chart shows, inflation is running neck and neck with the policy rate in Norway, which is why the central bank there held rates today - and won’t be in a position to cut for a long time yet. Central bank policy rates adjusted for inflation are the highest in the US and Canada among the major economies, suggesting that policymakers there have the biggest scope to deliver successive rate cuts.

In the euro zone, the European Central Bank is sitting on a real policy rate of some 140 basis points. While that suggests it has room to start being less restrictive, it’s not a given that it can deliver a series of rate cuts without imperiling that real-rate cushion. This is the reason why President Christine Lagarde sounded a note of caution on pre-committing to successive rate cuts on Wednesday.

Perhaps the central bank that faces the biggest challenge is the Bank of England. While headline inflation has slowed considerably, services inflation — which tends to have a ripple-through into the wider economy — has remained above 6%, making policymakers wary.

Clearly, when it comes to embarking on rate cuts, not all central bankers are in the same position as the SNB, and that will mean that rates traders will have to calibrate their enthusiasm of what is to follow from Switzerland.