By Jessica Menton, Bloomberg markets live reporter and strategist

The pain in long-duration growth stocks, fueled in recent weeks by a relentless surge in Treasury yields, is finally on the verge of subsiding. That is, at least, if the so-called Taylor Rule is anything to go by.

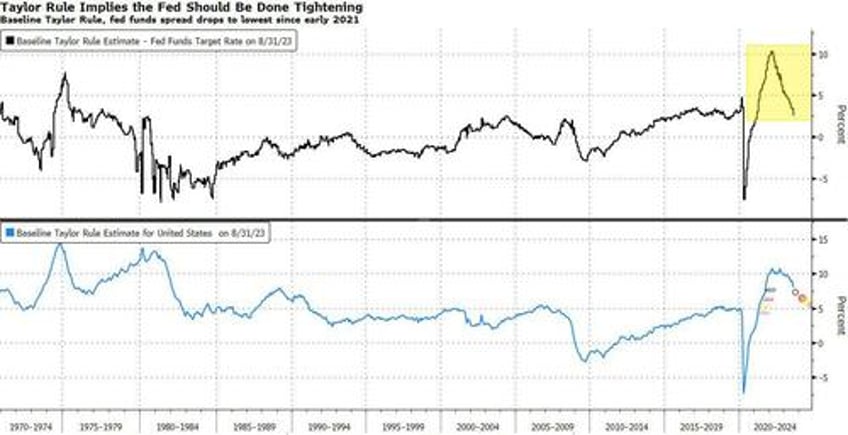

The equation, posited by Stanford economist John Taylor in 1993, has become a way to measure how the Federal Reserve can use its overnight bank lending rate to tame inflation or stimulate the US economy. Now, it’s approaching a critical inflection point for the US equity market by signaling that the central bank has finally normalized rates.

The calculation calls for a higher terminal rate when price pressures are anticipated to be higher than usual, and — all else being equal — a lower one when economic growth is expected to be lower than usual.

The spread between the fed funds target rate and the rate implied by the Taylor Rule peaked above 10 percentage points in early 2022, suggesting the Fed was well behind the curve at the start of the current cycle, according to Gina Martin Adams, chief equity strategist at Bloomberg Intelligence.

But now, that spread has dropped to its lowest level since early 2021. So, if the consensus is correct that core inflation will continue to ease, the fed funds rate may be finally hitting its cycle peak. Naturally, the next question for investors is just how long will the central bank keep rates high?

“The Fed is pretty close to being done, particularly because the bond market is doing the work for them by also tightening financial conditions,” said Julie Biel, portfolio manager at Kayne Anderson Rudnick. “While investors can’t ignore how strong the economy is, the Fed is scared of repeating the 1970s where they misjudged the staying power of inflation, so they will likely hold rates higher for longer than needed.”

In the run-up to the Fed’s Nov. 1 policy decision, investors are looking to figures later this week on economic growth, inflation and consumer spending that will help determine the trajectory of central bank policy for the remainder of the year.

Economists expect Thursday’s GDP data to show US economic output accelerated to 4.5% on an annualized basis in the third quarter, up from 2.1% in the three-month period ended in June.

Policymakers have taken comfort from a slowdown taking hold in the US in key underlying measures of inflation, including the Fed’s preferred inflation measure. The annual core personal consumption expenditures metric, which strips out food and energy, fell below 4% in August for the first time in nearly two years.

The consensus is for core PCE to slow to 2.6% by the end of 2024, as the unemployment rate rises modestly to 4.4% by that time. These two forecast inputs to the Baseline Taylor Rule model suggest the current fed funds target rate is “spot on the level implied by the equation,” according to Gillian Wolff, senior associate analyst at Bloomberg Intelligence.

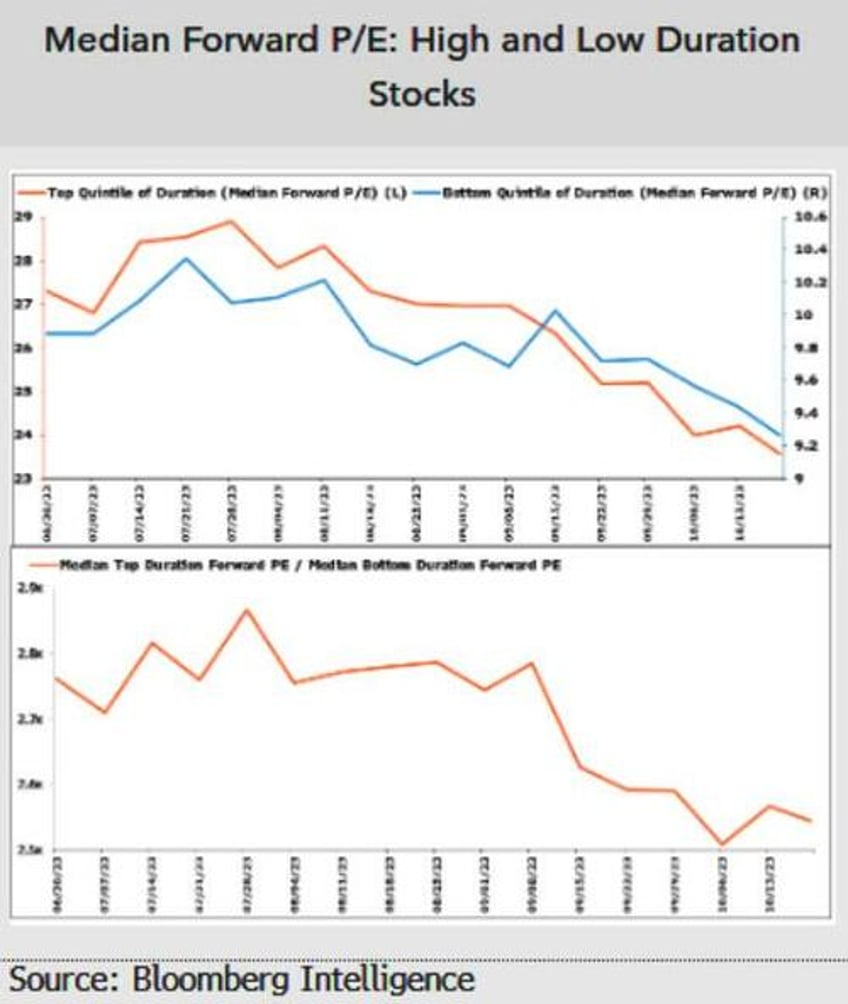

What’s more, a steep climb in bond yields since late June has coincided with an 8% reduction in the valuation premium that high-duration stocks have over their low-duration counterparts, data compiled by Bloomberg Intelligence show.

Generally speaking, Big Tech companies are particularly susceptible to fears of higher-for-longer rates because many of them are valued on projected profits delivered years in the future. The present value of those future profits are worth less as yields rise. The highest duration sector in the S&P 500 Index on average is communications services, including shares like Take-Two Interactive Software Inc., AT&T Inc. and News Corp.

In fact, the median top quintile of BI duration stocks within the benchmark equities gauge saw forward price-to-earnings multiples contract more than 13.6% as of Friday, from 3.84% on June 30. Bottom quintile stocks, meanwhile, have experienced valuation compression of just 6.3%. High-duration shares still trade at a hefty premium compared with their lower-duration peers.

“High-duration growth stocks that aren’t profitable will continue to be pressured with rates elevated, so it will be hard for investors to stomach,” Kayne Anderson Rudnick’s Biel said. “But I’m more concerned about a divergence in the companies that can continue to maintain their pricing power versus those who face further margin degradation.”