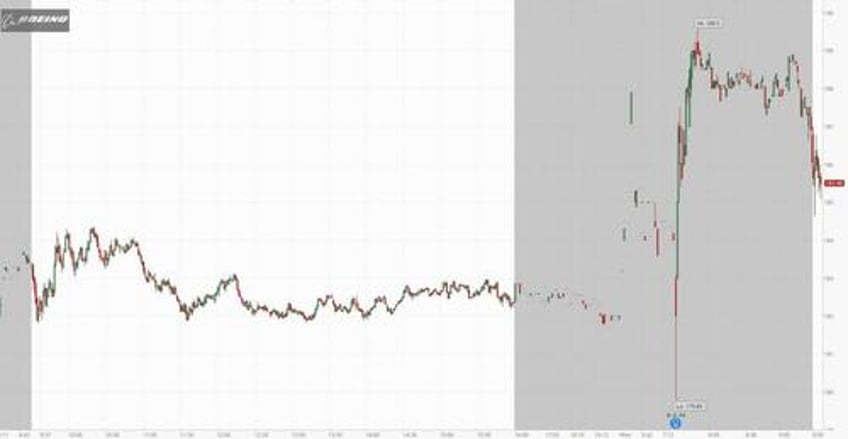

Update: (9:45am ET). And it's red

* * *

Shares of Boeing jumped 3% in premarket trading Wednesday on what we can only assume is a batch of idiot AI algos delivered by WokeGPT, after the company that sells airplanes that were "designed by clowns who are supervised by monkeys", reported revenues and earnings that missed already reduced estimates, including the company's ninth consecutive money-losing quarter, free cash flow which came in worse than expectations (it burned through $310 million, worse than the $252 million expected) and cut its annual delivery target for 737 deliveries (again), but reaffirmed the full-year outlook for free cash flow which apparently was enough for the market to push its stock higher, if only for a few hours minutes.

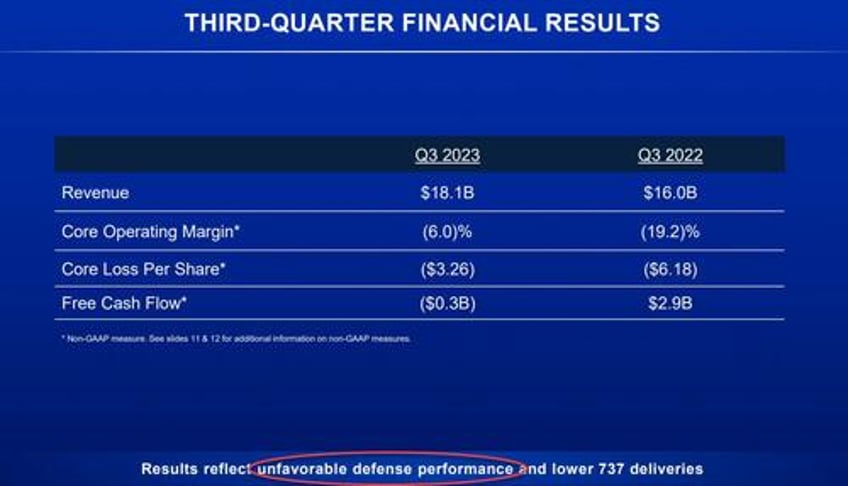

Here is a snapshot of what BA reported for Q3.

- EPS loss per share of $3.26, missing the -2.96 estimate.

- Revenue $18.10 billion, missing estimates of $18.16 billion

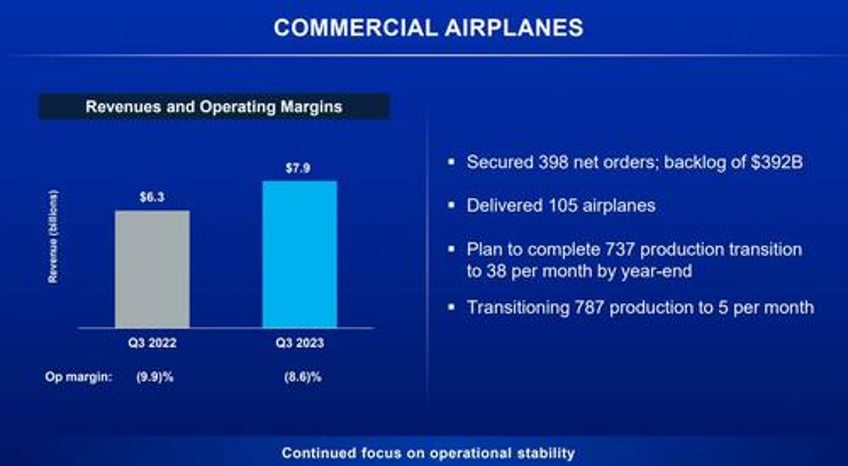

- Commercial Airplanes revenue $7.88 billion, beating estimates of $7.47 billion

- Defense, Space & Security revenue $5.48 billion, missing estimates of $6.05 billion, which is remarkable with not one but two wars taking place

- Global Services revenue $4.81 billion, beating estimates of $4.74 billion

- Operating cash flow $22 million, missing the estimate of $448.2 million

- Negative adjusted free cash flow $310 million, estimate negative $252.6 million

The top line summarized:

The company’s income was dented by the supplier snarls that caused 737 deliveries to plunge by a third from the previous quarter. Losses at the defense subsidiary included a charge of $482 million to kit out the next Air Force One presidential aircraft (because Biden's handlers must travel in style).

Commercial airplanes had a Q3 operating loss of $678 million, missing the estimated loss of $624.4 million

Defense, Space & Security had an even bigger operating loss at $924 million, twice as bad as the estimated loss of $461.9 million, and a -16.9% margin, which is remarkable with not one but two wars going on.

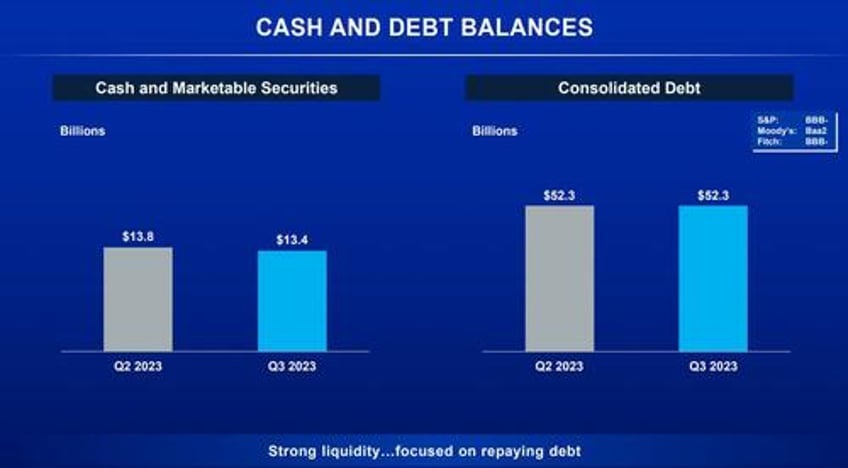

On the balance sheet, there were almost no changes, with cash dropping about half a billion as debt remained unchanged from Q2.

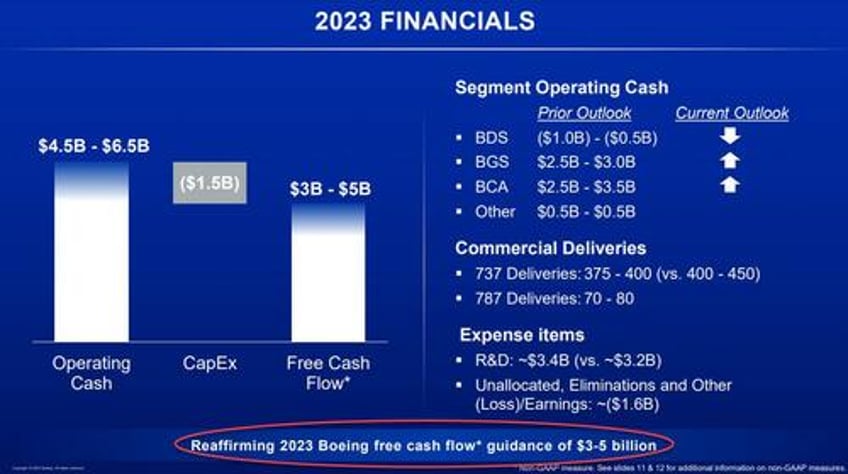

But despite the mixed results, the reason why the stock is higher for now is that in its 2023 projections, the company affirmed its guidance for free cash flow of $3.0 billion to $5.0 billion and for 70 to 80 787 deliveries, even as it cut its outlook for 737 deliveries to 375 to 400 from 400 to 450 due to another round of quality issues (of course) which have led to delivery delays.

Boeing’s start-stop comeback from the pandemic has frustrated investors and customers at a time when demand for new jets is booming. In a message to employees, Chief Executive Officer Dave Calhoun said “it’s on us to perform,” highlighting how the company has struggled to increase production as it struggles with quality lapses at it’s largest suppliers.

“When we set our recovery plans, we knew issues would come up along the way,” Calhoun said in the memo. “This is a complex long-cycle business and enduring change takes time.”

Investors will be looking for more details around inspections and repairs needed for the aft pressure bulkhead in some 737 Max jets, the latest production glitch uncovered at Spirit AeroSystems Holdings Inc., when Boeing hosts an earnings call later this morning.

Boeing's stock has dropped 14.8% over the past three months through Tuesday while the Dow Jones Industrial Average has shed 6.5%. It rose as much as 3% premarket before fading gains after the open; we expect it to close red.

Full earnings presentation below (pdf link).