Well, that escalated quickly...

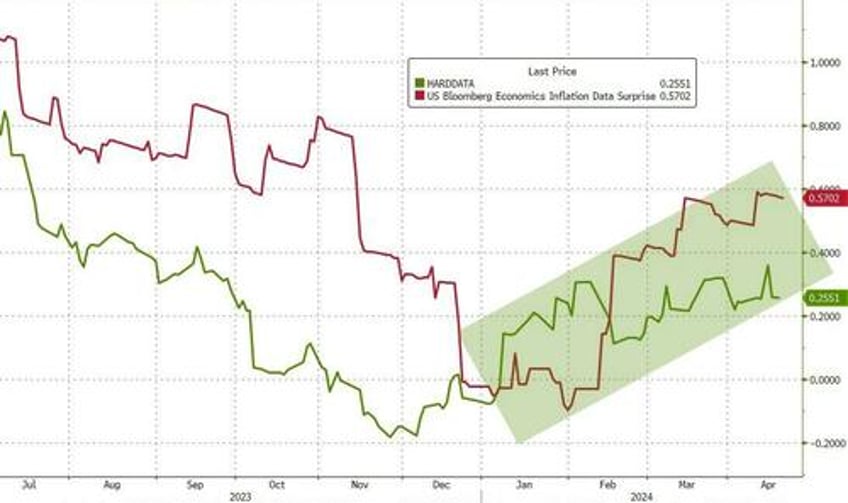

In a week characterized by data supporting 'no landing' from a growth perspective and disappointment from a disinflation perspective...

Source: Bloomberg

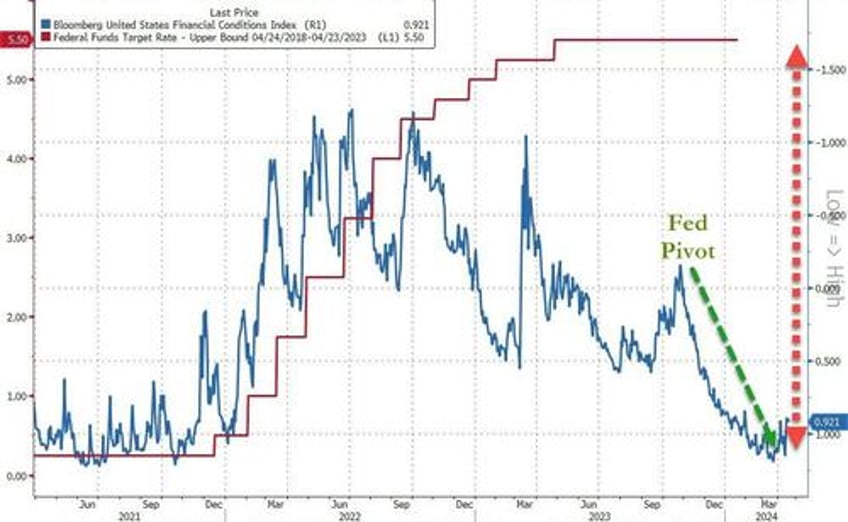

This was reinforced by FedSpeak that was without exception - hawkish!

As they suddenly realized that all that 'pivot' optimism did nothing but dramatically ease financial conditions and fuck their 'best laid plans' for a rate-cut and soft landing...

Source: Bloomberg

Even the dove-est of the doves - Austan Goolsbee - bent the knee today:

“So far in 2024, that progress on inflation has stalled,” Goolsbee said Friday in remarks prepared for an event in Chicago.

“You never want to make too much of any one month’s data, especially inflation, which is a noisy series, but after three months of this, it can’t be dismissed.”

“Right now, it makes sense to wait and get more clarity before moving,” Goolsbee said.

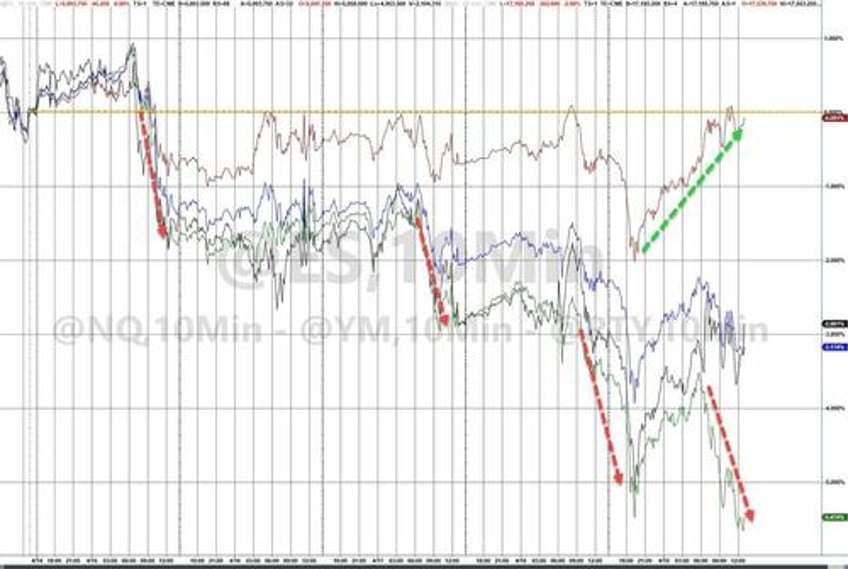

And sure enough, rate-cut expectations for 2024 and 2025 have both plunged this week...

Source: Bloomberg

...and that has finally started to weigh on investors' risk appetites (that's a long way to catch down to reality)...

Source: Bloomberg

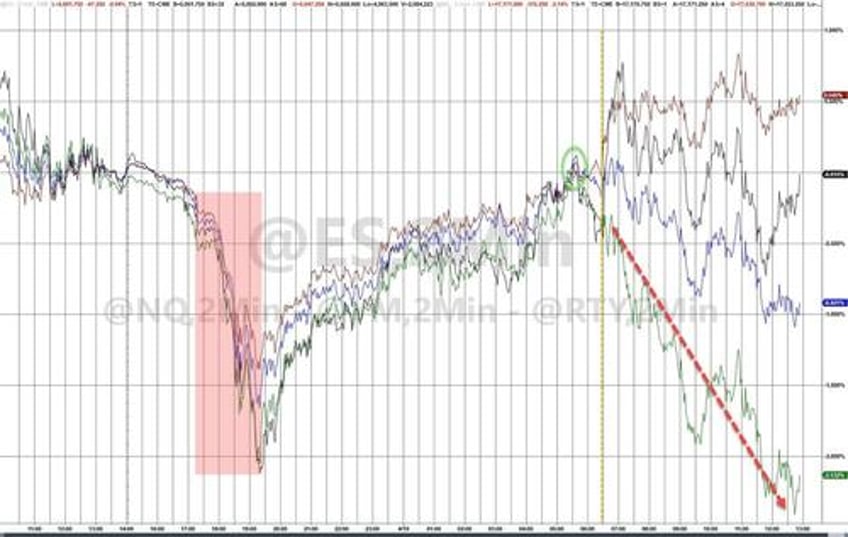

Most traders thought the worst was over last night as the panic-puke in futures was BTFD'd back to unchanged ahead of the cash open, but then the selling started (on Nasdaq) and never really stopped. On the day, Nasdaq was down over 2% while The Dow managed to gain 0.5%. Small Caps were almost unchanged by the end of the day with the S&P lagging...

But, all the majors ended the week red (with The Dow desperately trying to get back to even). Nasdaq was down over 5.5% on the week! S&P and Small Caps down around 3%...

Nasdaq is down for six straight days for its biggest weekly drop since Nov 2022, breaking below its 100DMA as CTA 'sell threshold's were crosed. Goldman's trading desk noted:

"The NDX now pacing for its worst week in over a year (down 6 of 7 weeks) as a complicated technical backdrop (CTAs, lower retail participation, NDX now testing 100-dma, seasonality), sideways earnings revisions thus far (ASML, TSM and even Sheridan’s NFLX EPS revisions were only 1-2% last night), a tense geopolitical backdrop (overnight headlines) and elevated positioning are testing conviction into a busy week of earnings … some debate if this all ‘helps’ the set-up into FAAMG prints or if the market is just read to ‘take a breather’ and sell any good news..."

The MAG7 basket broke below its 50DMA this week - the first time since October, when The Fed 'pivoted' and save the world. The market cap of the MAG7 is now down over $1 Trillion from its highs a week ago...

Source: Bloomberg

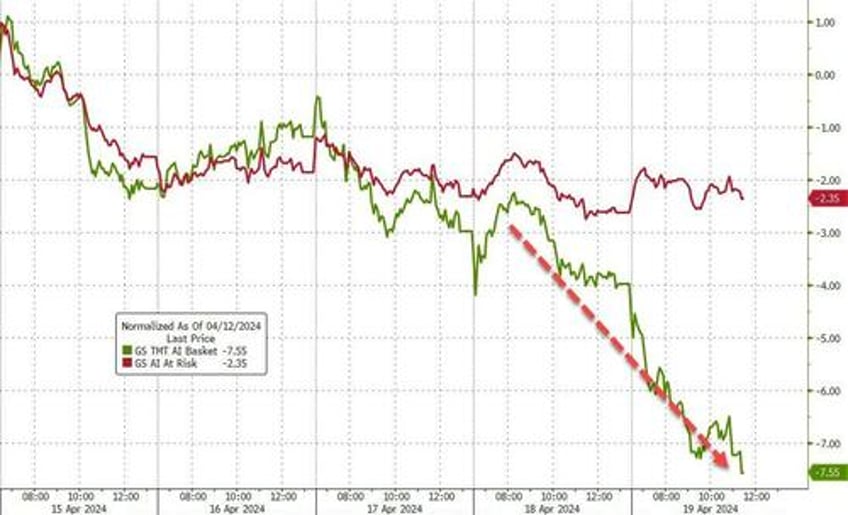

AI Leaders crashed relative to firms 'at risk from AI', plunging to their lowest in two months...

Source: Bloomberg

Of note is that the AI Leaders are perfectly back to their prior peak in 2021 (which was driven by chip demand for crypto mining and COVID disruptions), breaking down to the 100DMA and through the medium-term uptrend...

Source: Bloomberg

Semis were slaughtered this week...

Source: Bloomberg

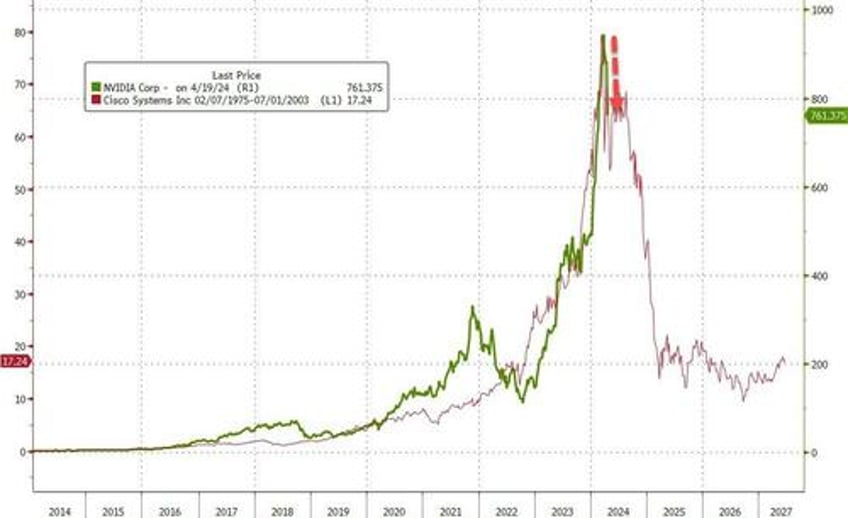

NVDA plunged 10% today, now in bear market (down over 22% from its highs) and the CSCO analog doesn't look so crazy anymore...

Source: Bloomberg

Interestingly, amid all this carnage, banks had a decent week with WFC and MS outperforming (JPM still lagging from its drop on last Friday's earnings)...

Source: Bloomberg

The Russell 2000, Nasdaq, and Dow are all back below their 100DMA, and the S&P 500 is pushing down towards its 100DMA (having blow thru the CTA 'sell' thresholds)...

Goldman's trading desk warns, it could get worse: "CTA supply is building – our team’s work shows this group sold $25B globally this week ($9B in SPX) with next week expected to bring another $27B globally (and $10B SPX) in a flat tape scenario. Reminder the medium term threshold (aka most important) level is 4886 – less than 100 handles away from spot."

Next week brings 43% of SPX set to report earnings highlighted by META/MSFT/GOOGL (aka $6.1T of mkt cap) reporting on Thurs night...on the macro front, key reports include 1Q GDP on Thurs & March PCE on Fri.

VIX soared this week to six-month highs, and credit markets also - finally - started to crack...

Source: Bloomberg

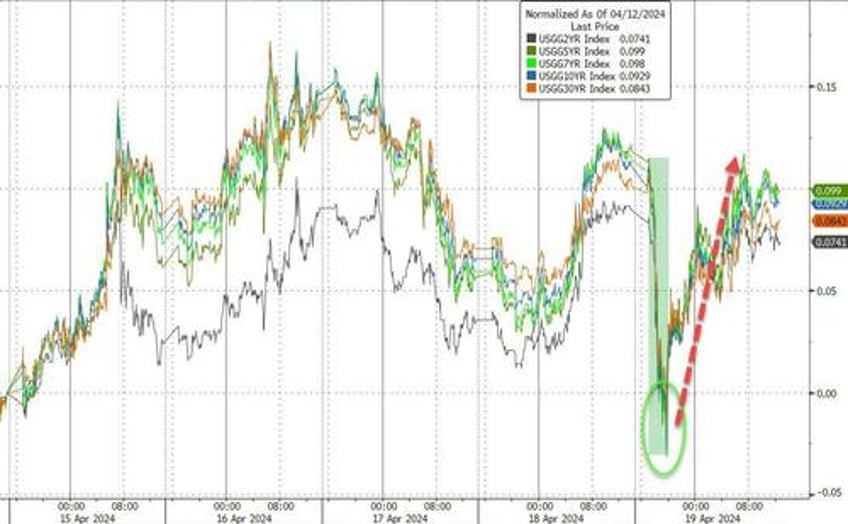

Treasury yields ended the week higher, but not before plunging overnight on a flight-to-quality bid as Israeli missiles hit Iran, taking yields lower on the week. By the close of the week, the belly slightly underperformed but yields were all up by around 8-10bps....

Source: Bloomberg

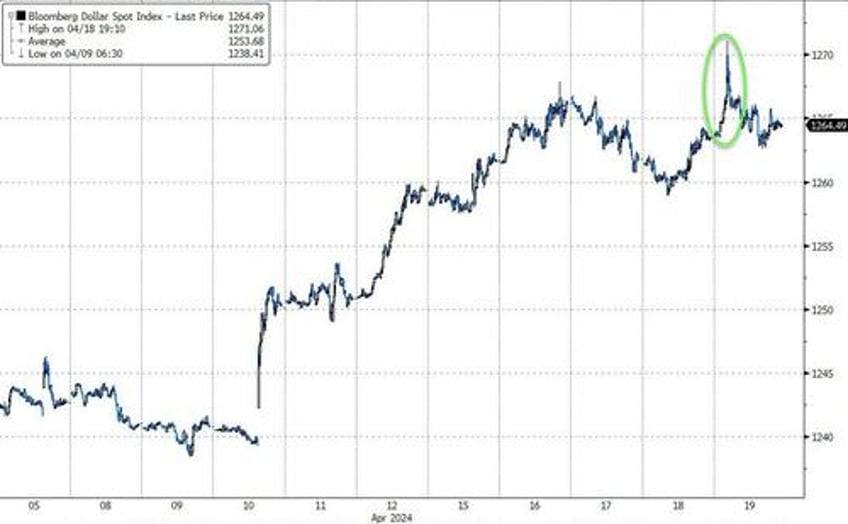

The dollar rallied for the second straight week, hitting its highest since early Nov 2023 last night on the mid-east attacks before sliding back...

Source: Bloomberg

Heading into today's 'halving' - likely to occur within the next few hours - Bitcoin was down, puking once again overnight on geopolitical chaos like it did last weekend, only to see buying come right back (after testing below $60,000 for the first time since early March)...

Source: Bloomberg

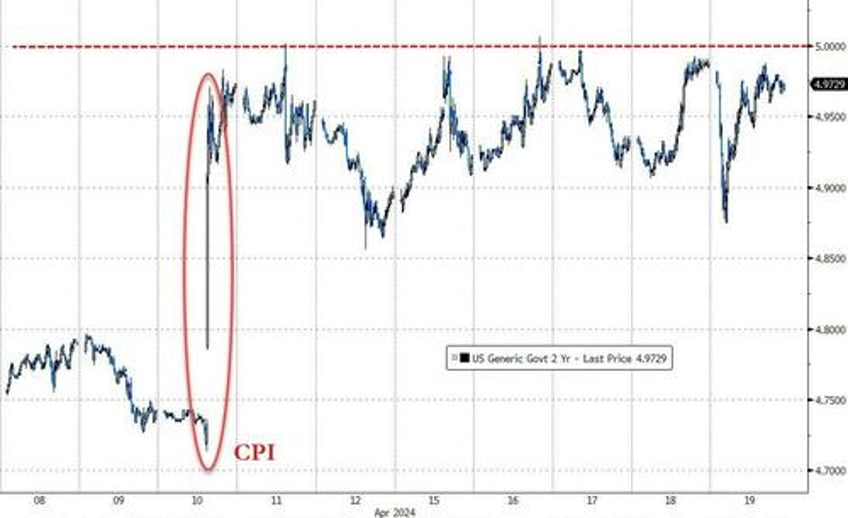

5.00% remains a key level for the 2Y Yield...

Source: Bloomberg

Despite two major attacks in the Middle East, oil prices ended lower for the second week in a row (well WW3 hasn't started yet). Some knock-on effects from an evaporation of hope for demand-sponsoring rate-cuts also weighed on sentiment as WTI

Source: Bloomberg

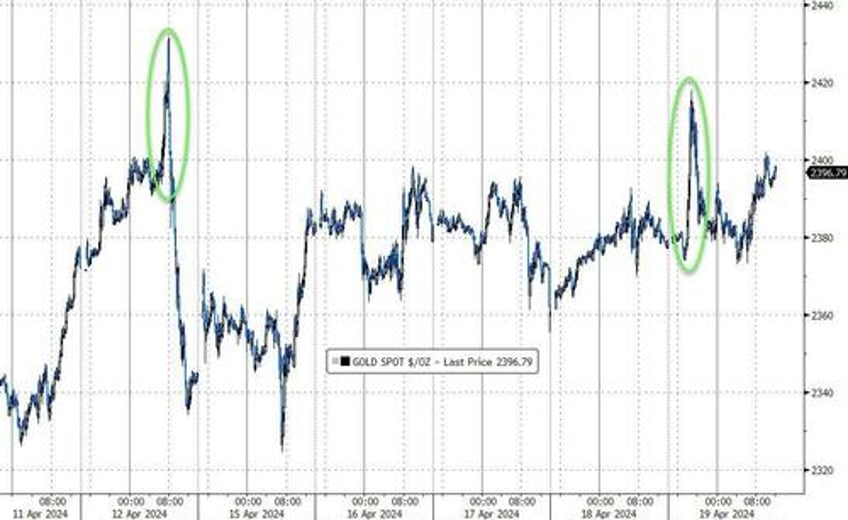

Spot Gold prices spiked overnight on the Israel attack, pulled back, then rallied up to $2400 once again to close at the highs...

Source: Bloomberg

Gold closed the week at a new record high...

Source: Bloomberg

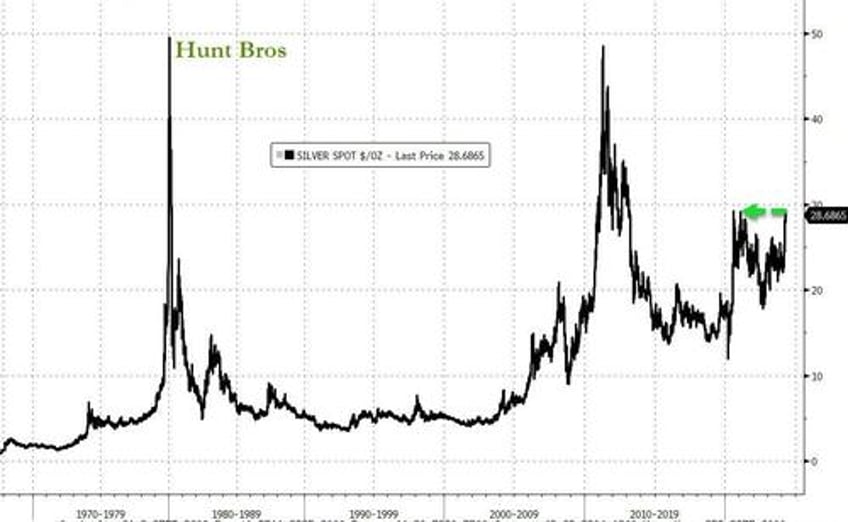

Silver soared 3% on the week to new cycle highs (its highest since Feb 2021)...

Source: Bloomberg

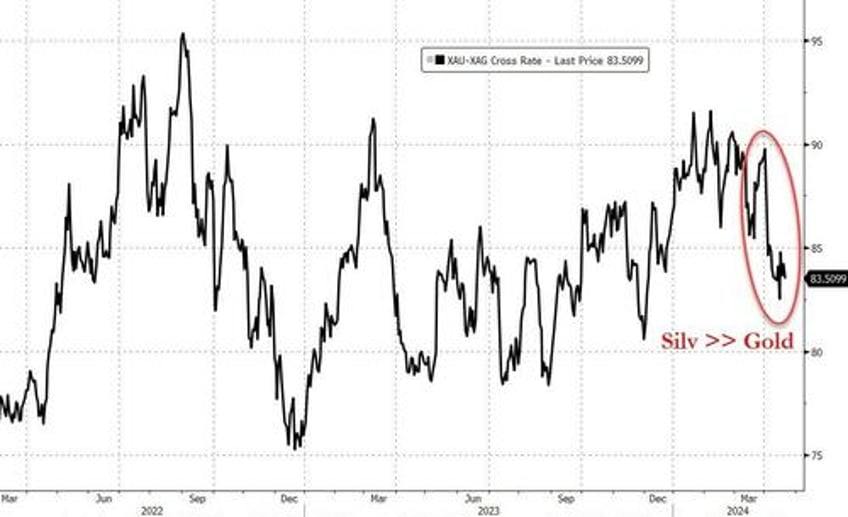

Silver has been broadly speaking outperforming gold in recent weeks after peaking at a gold-to-silver ratio of around 92x in January, it is ow down to 83 (still well above the 65x average since 1980... implying silver remains 'cheap' to gold)...

Source: Bloomberg

...and then there's Cocoa...

Source: Bloomberg

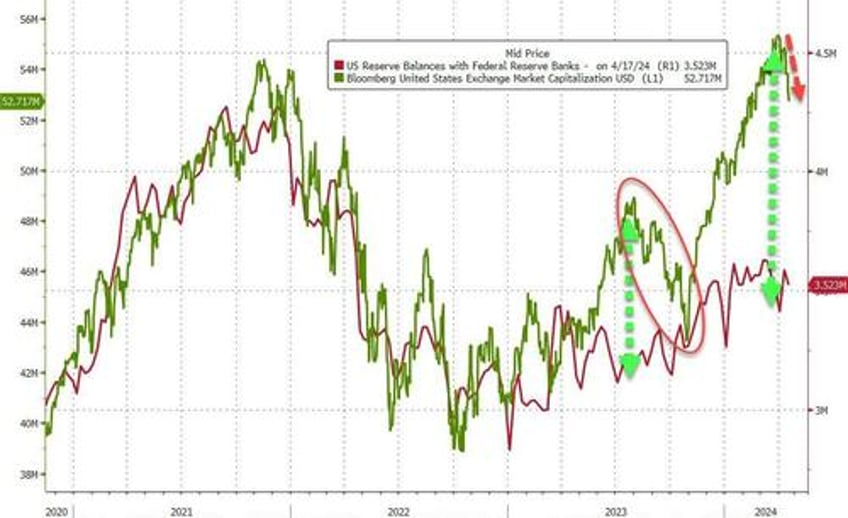

And finally, are bank reserves at The Fed still the driving force for reality?

Source: Bloomberg

We saw the reality check from Aug-Oct last year; are we about to get another?