All eyes are going to be on Tesla after the bell today, with the company slated to report earnings and update its shareholders on numerous new developments as the stock continues slumping to start 2024.

First, what the street expects from Q4. According to Bloomberg forecasts, Tesla is anticipated to announce a revenue of $25.87 billion, marking a 6.4% increase from the previous year. Analysts are looking for EPS of $0.73, amounting to an adjusted net income of $2.61 billion, a 36.4% decrease from the same period last year.

As Bloomberg noted yesterday, the company's margins are going to be an obvious focus as Tesla continues to slash prices in order to help move volume:

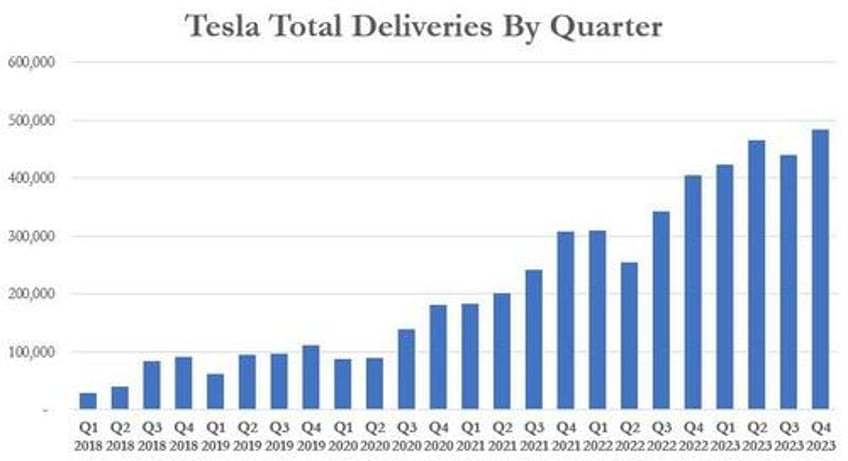

For Q4, Tesla announced it had "produced approximately 495,000 vehicles and delivered over 484,000 vehicles", putting up numbers in line with adjusted estimates for the quarter. Production beat estimates of about 482,336, per Bloomberg's estimates.

The company noted that its full year vehicle delivery number was up 38% to 1.81 million, slightly less than recently revised expectations for the year. Nonetheless, total deliveries mark a record quarter for the EV manufacturer. The company manufactured approximately 1.85 million vehicles for the period.

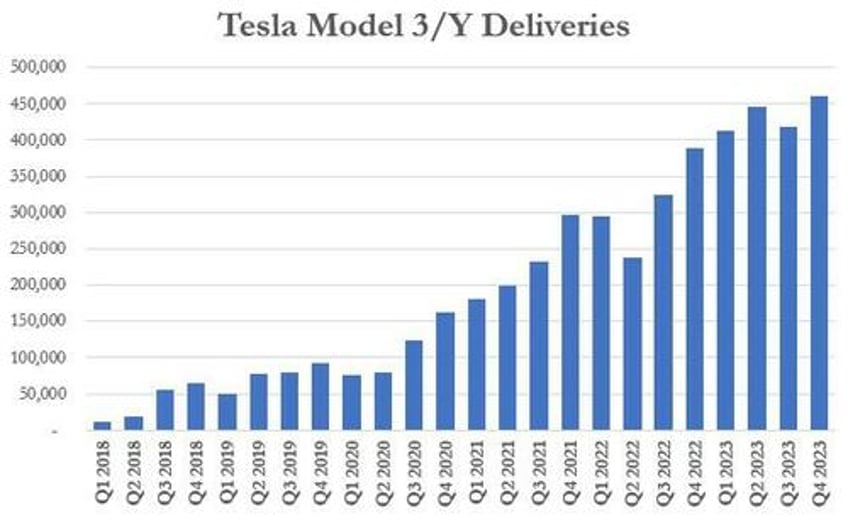

The company delivered 461,538 Model 3/Ys and 22,969 in "other models", which includes Model S, Model X and the new Cybertruck.

Investors are also going to be watching for where the automaker will set the bar for production and delivery goals for 2024. Analysts had predicted the company would deliver 1.82 million vehicles in 2023, up 37% from the year prior. Estimates were for about 473,000 vehicles delivered in the fourth quarter.

Daiwa Capital Markets analyst Jairam Nathan revised Tesla's 2024 delivery forecast down to 2.04 million from 2.14 million, anticipating a 4% drop in average revenue per vehicle compared to 2023.

Today the street will also be looking for more granularity with Cybertruck deliveries, which were not broken out from its Q4 delivery total. There are likely be questions about how quickly the ramp up in production in the new model is moving.

Back in November 2023, HSBC lowered their price target on the name to $146, citing skepticism about the Cybertruck: “We see considerable potential in Tesla’s prospects and ideas, but we think the timeline is likely to be longer than the market and valuation is reflecting. Hence the Reduce rating,” the note said.

"Timing of delivery is our primary concern: we think questioning Tesla’s credibility is problematic. Its ambitions may be grand (20m units by 2030), but it has a track record of generally doing what it promises."

Last night there were also (timely, if we do say so ourselves) reports of Tesla considering a new $25,000 mass market vehicle for potential launch in 2025. Reuters noted that the company has told suppliers it wants to start production of a new mass market vehicle code named "Redwood" in mid-2025. The report also notes that Tesla plans on making an "inexpensive robotaxi" based on the same vehicle architecture.

Given the delays the company has experienced with the Cybertruck, investors on social media are skeptical of the timeframe for the proposed new vehicle idea.

Within the last 3 weeks, the company has cut prices globally again and has seen demand from rental car firm Hertz evaporate.

Multiple sources, citing Tesla's website, reported earlier this month that Tesla had reduced prices for two variants of its Model Y in Germany by 5,000 euros ($5,439). The Performance version of the Model Y is now available to German buyers at EUR55,990, and the Long Range version is priced at EUR49,990. Additionally, Tesla has decreased the price of the basic Model Y model by EUR1,900, bringing it to EUR42,990.

Daiwa Capital Markets analyst Kelvin Lau said in a note that the price cuts are hurting sentiment in the industry and that lackluster sales in China to start 2024 helped fuel the sell off.

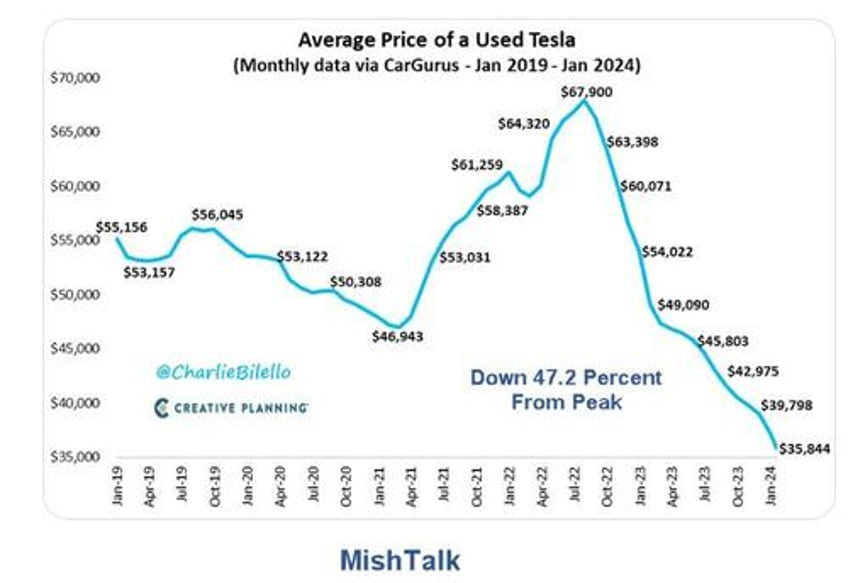

About two weeks ago we also noted that Hertz began dumping 20,000 EVs on the used car market last month and will be a seller through 2024. The sales are expected to record a non-cash charge in the fourth quarter of $245 million related to incremental net depreciation expense.

"The company expects to reinvest a portion of the proceeds from the sale of EVs into the purchase of internal combustion engine vehicles to meet customer demand," Hertz said, adding, "The company expects this action to better balance supply against expected demand of EVs."

As of last October, Scherr said EVs were about 11% of Hertz's total fleet, with Tesla accounting for 80%. This has likely not helped the tumbling price of used Teslas, which we noted has fallen for 18 straight months.

On Monday, analyst Adam Jonas of Morgan Stanley wrote: "Tesla has already announced price cuts in China and Europe that matched or exceeded our prior expectations of price reductions for the full year 2024. The German Tesla price cuts came merely days after Tesla announced production cuts at Giga Berlin related to Red Sea shipping issues."

He continued: "Fewer vehicles are eligible for IRA incentives given foreign content/local sourcing rules. Our teams anticipate further weakening/dilution of consumer EV incentives globally as governments re-assess budgets."

Investors may also be looking for more clarity on Musk's recent comments on X about his ownership stake. Last week Musk wrote: "I am uncomfortable growing Tesla to be a leader in AI & robotics without having ~25% voting control. Enough to be influential, but not so much that I can’t be overturned. Unless that is the case, I would prefer to build products outside of Tesla."

The company's relationship with China will likely also be in focus. This morning it also broke that China was expanding its ban of Tesla vehicles from military bases to "other government affiliated venues".

In late December we wrote that the EV-maker was launching a new mega factory project in Shanghai that would be designed to manufacture 10,000 megapacks per year.

The packs are designed for large-scale energy storage and efficient renewable energy distribution, and will be available for global sales.10,000 Megapack units annually equates to about 40GWh of energy storage capacity.

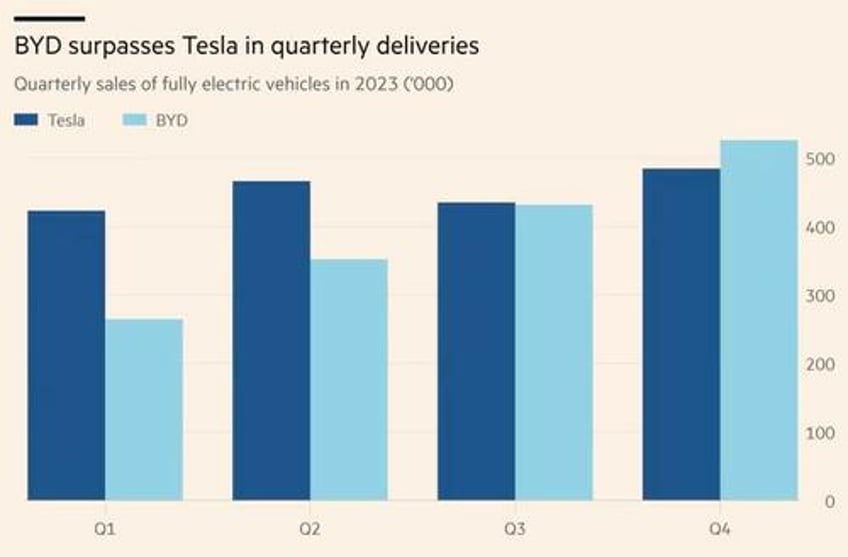

And as we noted earlier this month, despite price cuts, competition globally and in China is ramping up: BYD has surpassed Tesla in full electric vehicle deliveries for the first time ever in Q1 2024.

We wrote back in September that BYD and Tesla were the two companies neck and neck leading the EV industry. We noted then that for the first half of 2023, BYD alone sold almost 1.2 million plug-in electric vehicles (incl. plug-in hybrids), roughly double the combined total of BMW, Volkswagen and Mercedes.

We'll know more after market close today...