As noted earlier, with all eyes on Tesla when the company reports Q4 earnings and updates its shareholders on numerous new developments as the stock continues slumping to start 2024, here is what the street expects from Q4.

Tesla is anticipated to announce a revenue of $25.87 billion, marking a 6.4% increase from the previous year. Analysts are looking for EPS of $0.73, amounting to an adjusted net income of $2.61 billion, a 36.4% decrease from the same period last year. As Bloomberg noted yesterday, the company's margins are going to be an obvious focus as Tesla continues to slash prices in order to help move volume.

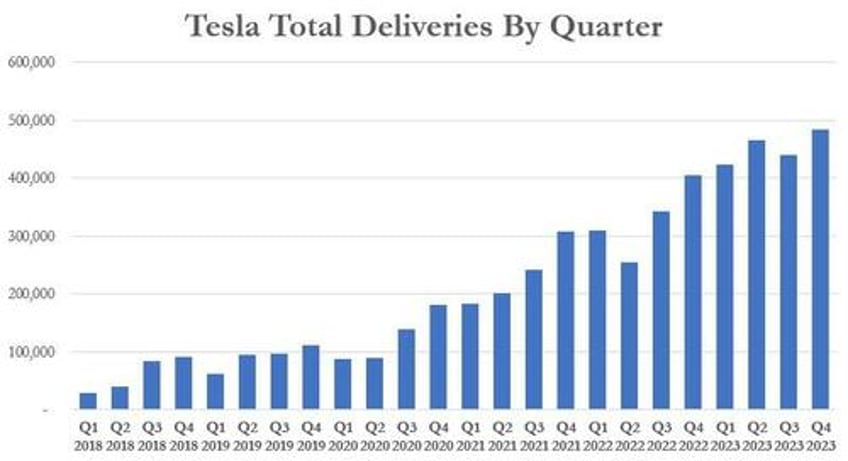

For Q4, Tesla announced it had "produced approximately 495,000 vehicles and delivered over 484,000 vehicles", putting up numbers in line with adjusted estimates for the quarter. Production beat estimates of about 482,336, per Bloomberg's estimates.

The company noted that its full year vehicle delivery number was up 38% to 1.81 million, slightly less than recently revised expectations for the year. Nonetheless, total deliveries mark a record quarter for the EV manufacturer. The company manufactured approximately 1.85 million vehicles for the period.

Some more thoughts ahead of earnings:

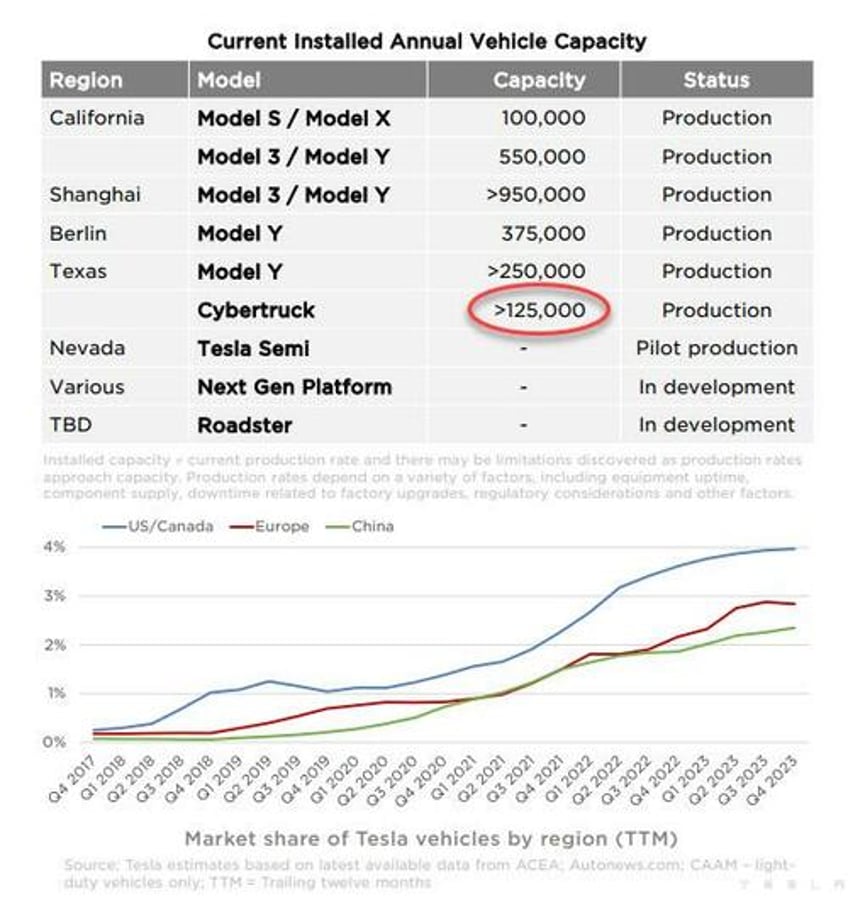

- Investors are also going to be watching for where the automaker will set the bar for production and delivery goals for 2024. Analysts had predicted the company would deliver 1.82 million vehicles in 2023, up 37% from the year prior. Estimates were for about 473,000 vehicles delivered in the fourth quarter.

- Daiwa Capital Markets analyst Jairam Nathan revised Tesla's 2024 delivery forecast down to 2.04 million from 2.14 million, anticipating a 4% drop in average revenue per vehicle compared to 2023.

- The street is also looking for more granularity with Cybertruck deliveries, which were not broken out from its Q4 delivery total. There are likely be questions about how quickly the ramp up in production in the new model is moving

- Back in November 2023, HSBC lowered their price target on the name to $146, citing skepticism about the Cybertruck: “We see considerable potential in Tesla’s prospects and ideas, but we think the timeline is likely to be longer than the market and valuation is reflecting. Hence the Reduce rating,” the note said.

- "Timing of delivery is our primary concern: we think questioning Tesla’s credibility is problematic. Its ambitions may be grand (20m units by 2030), but it has a track record of generally doing what it promises."

- Last night there were also (timely, if we do say so ourselves) reports of Tesla considering a new $25,000 mass market vehicle for potential launch in 2025. Reuters noted that the company has told suppliers it wants to start production of a new mass market vehicle code named "Redwood" in mid-2025. The report also notes that Tesla plans on making an "inexpensive robotaxi" based on the same vehicle architecture.

- Given the delays the company has experienced with the Cybertruck, investors on social media are skeptical of the timeframe for the proposed new vehicle idea.

- Within the last 3 weeks, the company has cut prices globally again and has seen demand from rental car firm Hertz evaporate.

Separately, Musk, who for months has inisted that Tesla is an AI and robotics company, recently posted that he is “uncomfortable growing Tesla to be a leader in AI & robotics without having ~25% voting control.” This has been seen as an effort to pressure the Tesla board -- of which Musk is one of eight -- to come up with a new compensation package to keep him around. Musk runs several other companies and Tesla is highly dependent on him. Tesla does not have a COO, and Musk is one of just four named executive officers. This will likely be addressed on the call: Is the board readying a new compensation package? Interest on is clearly high: One of the most popular question on Say, the investor communications platform, for this quarter is the following: “Should retail shareholders be concerned that Elon has stated he is uncomfortable expanding AI and robotics at Tesla if he doesn’t have 25% of voting?”

Also, as noted above, Reuters reported some new details on the next-generation Tesla. While there have been similar reports before, the story did offer some more concrete information: Specifically, a targeted production date of June 2025. Suppliers are also being told that the model -- codenamed ‘Redwood’ -- will aim for 10,000 vehicles produced each week. At an annual rate, that would be around 520,000 units -- pretty massive for just the US market alone. While it will be hard to say much more until there is confirmation, along with more details on pricing, size and launch, the Model 3 sits at around $39,000, so there is plenty of room for Tesla to place this next-gen model at a lower starting cost and not impede on the 3.

So with all that in mind, this is what Tesla reported moments ago for the 4th quarter:

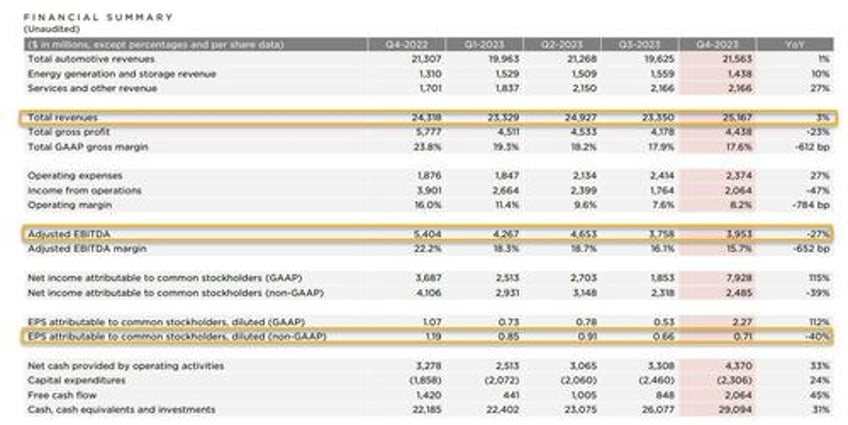

- Adjusted EPS 71c, down 40% YoY and missing estimates of 73c (unadjusted EPS of $2.27)

- Revenue $25.17 billion, up 3% from $24.318 billion and missing estimate $25.87 billion

- + growth in vehicle deliveries

- + growth in other parts of the business

- + positive FX impact of $0.1B

- - reduced vehicle average selling price (ASP) YoY (excl. FX impact), including unfavorable impact of mix

- - lower FSD revenue recognition YoY due to FSD Beta wide release in North America in Q4`22

- Gross margin 17.6%, missing estimates 18.1%

- Capital expenditure $2.31 billion, in line with estimates $2.32 billion

- Free cash flow $2.06 billion, beating estimates $1.45 billion

In other words, a top and bottom line miss, with the exception of free cash flow which came in modestly stronger.

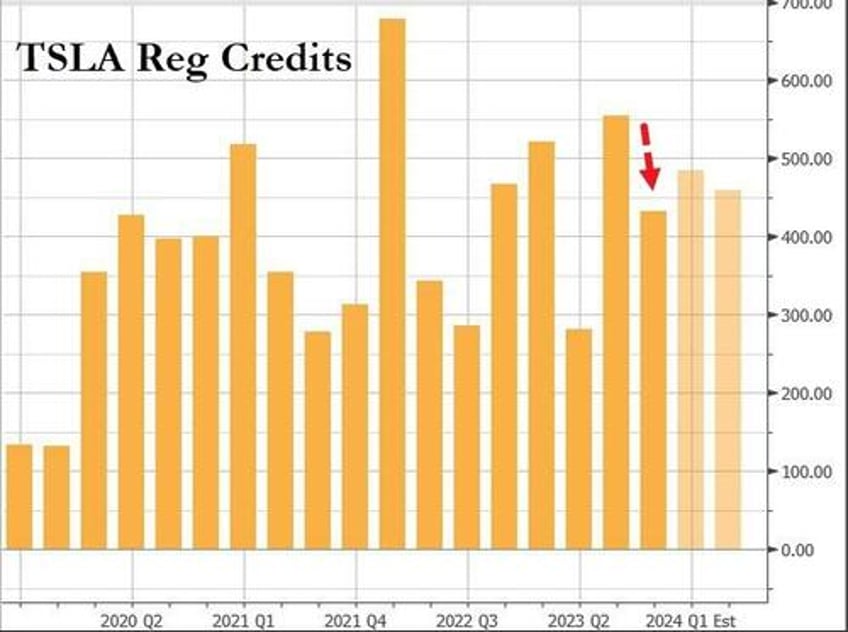

As regular readers know, Tesla’s profit is often boosted by revenue from regulatory credits. In Q4, income from the sale of regulatory credits -- used by other automakers to offset greenhouse gas emissions -- was $433 million, down from the $554 million last quarter.

Additionally, Tesla said that in 2023, it delivered over 1.2 million Model Ys, "making it the best-selling vehicle, of any kind, globally." Here Musk notes that "for a long time, many doubted the viability of EVs. Today, the best-selling vehicle on the planet is an EV." Typically, Tesla lists Model 3 and Model Y deliveries together. But in their deck, Tesla broke this statistic out.

But revenue and EPS aside, perhaps the most important metric -- automotive gross margin excluding regulatory credits -- came out to 17.2% for the quarter, well above the expectation of 15%; a slight improvement over last quarter’s 16.3%, which was the lowest in over four years. In other words, the company has found a sweet spot where it is grabbing market share from other EV OEMs but not at a huge margin loss to its own operations.

Some more details: in Q4, Tesla's operating income decreased YoY to $2.1B in Q4, resulting in an 8.2% operating margin. YoY, operating income was primarily impacted by the following items:

- - reduced vehicle ASP due to pricing and mix

- - increase in operating expenses partly driven by AI and other R&D projects

- - lower FSD revenue recognition YoY due to FSD Beta wide release in North America in Q4`22

- - cost of Cybertruck production ramp

- + lower cost per vehicle, including lower raw material costs, logistics costs and IRA credit benefit

- + growth in vehicle deliveries

- + gross profit growth in Energy Generation and Storage

While it did not impact Operating Income, Tesla recorded a one-time non-cash tax benefit of $5.9B in Q4 for the release of valuation allowance on certain deferred tax assets.

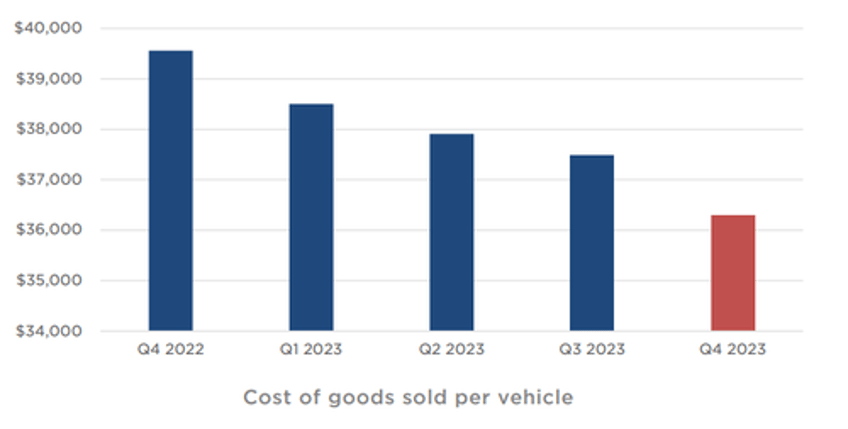

One final point on profits: Tesla said that "cost of goods sold per vehicle declined sequentially in Q4" and "Our team remains focused on growing our output, investing in our future growth and finding additional cost efficiencies in 2024. Tesla also noted that it has reached the “natural limit of cost down of our existing electric vehicle line up" to wit:

Cost of goods sold per vehicle declined sequentially to slightly above $36,000. Even as we approach the natural limit of cost down of our existing vehicle lineup, our team continues to focus on further cost reductions across all points of production, from raw materials to final delivery.

Bloomberg here asks if given the amount of price cuts that they’ve engaged in over the past year, does this mean that future reductions in cost for the Model 3 and Model Y will be limited? "It makes sense for the residual value of those vehicles and others to introduce newer, more affordable models as opposed to continuing to reduce the price of the existing lineup."

While the results were mixed, what Wall Street has immediately focused on was a warning in the outlook section of the earnings presentation, in which Tesla notes that it is "currently between two major growth waves: the first one began with the global expansion of the Model 3/Y platform and the next one we believe will be initiated by the global expansion of the next-generation vehicle platform" and delivers the following punchline :"In 2024, our vehicle volume growth rate may be notably lower than the growth rate achieved in 2023" which is where the Bloomberg soundbite cuts off, but what is missing is the following important conclusion to the sentence... "as our teams work on the launch of the next-generation vehicle at Gigafactory Texas."

In other words, Tesla confirms the earlier Reuters report that it is currently working on a next generation platform, i.e. Gen 3, at the Austin factory.

Additionally, in 2024, Tesla says that "the growth rate of deployments and revenue in our Energy Storage business should outpace the Automotive business." Which is good news for a business which many take as a call option on the core automotive operation; that said, it was a disappointing quarter for solar deployments: at just 41 megawatts, it was less than 25% of what US leader Sunrun typically does each period. Still, while the company’s energy storage deployments dipped in the fourth quarter compared to the prior one, total installations for 2023 were more than double 2022. And the unit’s profits nearly quadrupled.

Some other highlights from the outlook:

- Cash: We have sufficient liquidity to fund our product roadmap, long-term capacity expansion plans and other expenses.

- Furthermore, we will manage the business such that we maintain a strong balance sheet during this uncertain period.

- Profit: While we continue to execute on innovations to reduce the cost of manufacturing and operations, over time, we expect our hardware-related profits to be accompanied by an acceleration of AI, software and fleet-based profits.

- Product: Cybertruck production and deliveries will ramp throughout this year. In addition, we continue to make progress on our next generation platform.

Taking a 30,000 foot approach, a key question of growth for 2024 is where there is much room for Tesla’s EV sales to grow? As BBG notes, "the Model Y hitting 1.2 million is a remarkable achievement. Given that high volume of sales, how much higher could it hit in 2024? The Model 3 has held its own, with a new refresh coming to the US just this month (and this could help stimulate some sales in the first half of this year). Tesla has been rumored to launch a refresh of the Y in the second half of this year. Meanwhile, the sales of X, S and Cybertruck are already minimal compared to the 3 and the Y. If the next-gen vehicle isn’t a story until the back half of 2025, there only appear to be two models that can offer some growth -- unless the Cybertruck ramp which the automaker downplayed ends up moving more quickly than they anticipate."

And speaking of the cybertruck, the company revealed that it currently has capacity to make more than 125,000 vehicles in the Austin facility.

That said, Tesla noted in the investor deck that its ramp time will be longer than for their other models “given its manufacturing complexity" to wit:

Before Tesla purchased the Fremont factory, the record output of the previous owner was nearly 430,000 vehicles made in a single year. In 2023, the Tesla Fremont factory produced nearly 560,000 vehicles thanks to our ~20,000 Fremont based employees. At Gigafactory Texas, we began production of the Cybertruck and delivered the first units to customers. We expect the ramp of Cybertruck to be longer than other models given its manufacturing complexity.

Turning to Autopilot, Tesla said that it started rolling out V12 of FSD Beta6: “Trained on data from a fleet of over a million vehicles, this system uses AI to influence vehicle controls (steering wheel, pedals, indicators, etc.) instead of hard-coding every driving behavior. V12 marks a new era in the path to full autonomy.” Here, the company has a commanding head start on the competition and combined with its AI, should break away from the competition once the final version of FSD is launched.

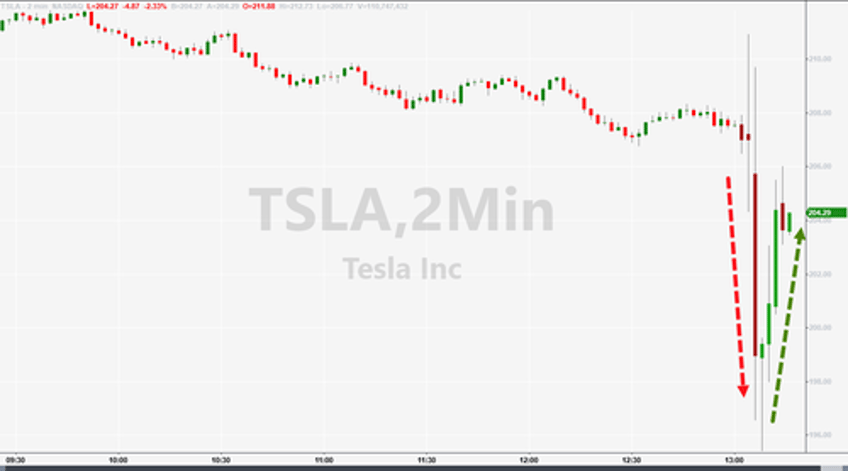

Bottom line, a mixed quarter yet not too bad despite the top and bottom line miss, as operating margin beat and increased, as the ASP decline was offset by growth in vehicle deliveries and a lower COGS. And TSLA stock is reflecting this after hours, first tipping below $200 and sliding as much as 5%, only to rebound and trade modestly below the day's closing price. Considering options straddles were bracing for a more-than 6% swing in Tesla shares in either direction, the current 2.7% drop would be seen as a shrug by the market.

Full Q4 slideshow below (pdf link)