As previewed earlier, today's TSLA print is likely to be ugly: the company was the only Mag7 member expected to report negative earnings growth as a result of continued anemic sales, even though unlike Q1, in Q2 Tesla sold more than 33,000 cars than they produced which cleared out some inventory that had been a real overhang. So once again, a key metric for Wall Street this quarter is gross margin, or how much of a profit hit Musk took to clear out the inventory. That said, in a note last week, Ben Kallo of Robert W. Baird wrote that “we think gross margin likely benefits from higher mix to the energy segment as well as higher regulatory credits.”

The other big thing markets want clarity on is the great Robotaxi unveil: last month, we learned that it was delayed from Aug. 8, so Musk will likely announce a new date. To be sure, investors will be counting on the Robotaxi, which Musk has also called a “Cybercab,” to drive the company’s next wave of growth. So, as Bloomberg asks, "are we going to just get a new date, or actually hear more about this vehicles capabilities, regulatory approvals and business model?"

Turning to the company's existing products, one can argue that Tesla’s existing car lineup is old, while Cybertruck sales are off to a slow start as interest rates remain sky high. So what is Tesla’s sales outlook for 2024? Tesla sold about 1.8 million vehicles globally in 2023. So far this year, they have sold about 831,000. Tesla will surely need to pick up the pace in the back half of the year and deliver a million units just in order to keep sales flat.

Finally, while TSLA's quarter’s earnings call isn’t expected to be very exciting, there are still some important topics that Musk and the team might touch on:

- Cheaper Tesla models. On the previous earnings call, Musk mentioned that Tesla was still committed to more affordable models and accelerating their launch. But few details were provided. Do these models – which Musk promised by early 2025 at the latest – exist?

- NACS integration. After laying off the entire supercharging team, Tesla appeared to hire back some of them. That team had been responsible for integrating other companies’ electric vehicles with the ability to access the Tesla Super Charging Network. Only Rivian and Ford have access to date — what about everyone else?

- Autonomy and Robotaxi. Will Musk be able to keep investors happy with Tesla’s Robotaxi unveiling moved to October?

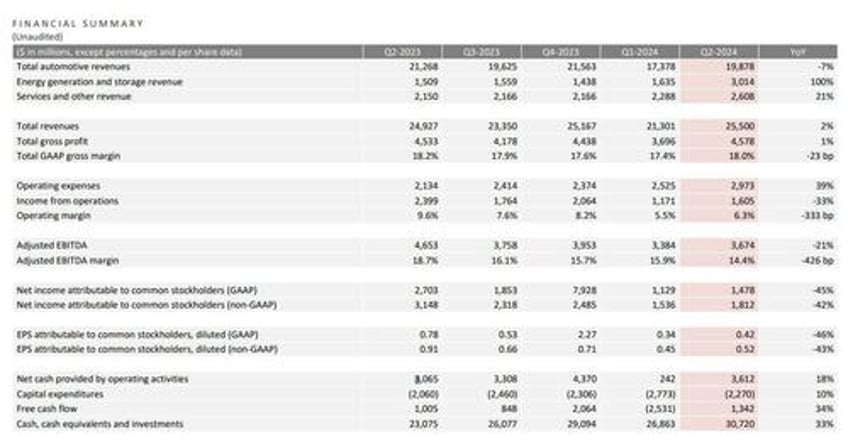

With all that in mind, here is the hot mess the company reported for the second quarter, which reveal that the margin pain taken to clear out all those excess cars was all too real:

- Q2 Revenue $25.5BN, up 2% YoY, and beating estimates of $24.63BN. That's the good news...

- Q2 Adj EPS 52c, down 43% YoY, and missing estimates of 60c

- Q2 Operating income $1.61BN, down 33% YoY and missing estimates of $1.81BN

- Q2 Automotive Gross Margin Ex-Regulatory Credits 14.6%, missing estimates

- Q2 Free Cash Flow $1.34BN, +34% YoY but missing estimates of 1.92BN

In short: a hot mess as summarized below:

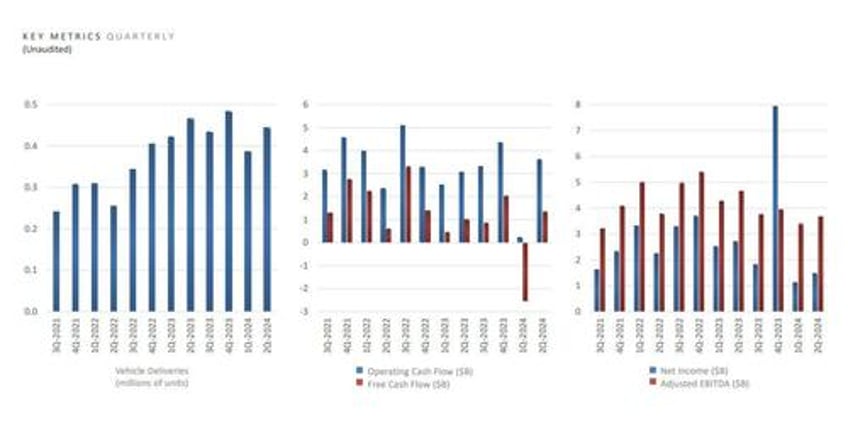

Charted, the results are not pretty but certainly an improvement from last quarter.

No amount of charts however will deflect attention from the ongoing double-digit drop in profits - and the fact that this was the fourth straight quarter that Tesla has missed profit expectations - and margin decline, which the company explained as follows:

Our operating income decreased YoY to $1.6B in Q2, resulting in a 6.3% operating margin. YoY, operating income was primarily impacted by the following items:

- reduced S3XY vehicle ASP as noted above

- restructuring charges

- increase in operating expenses largely driven by AI projects

- decline in S3XY vehicle deliveries

+ higher regulatory credit revenue

+ growth in Energy Generation and Storage gross profit

+ lower cost per vehicle, including lower raw material costs, freight and duties

+ lower cost of production ramp of 4680 cells and other related charges

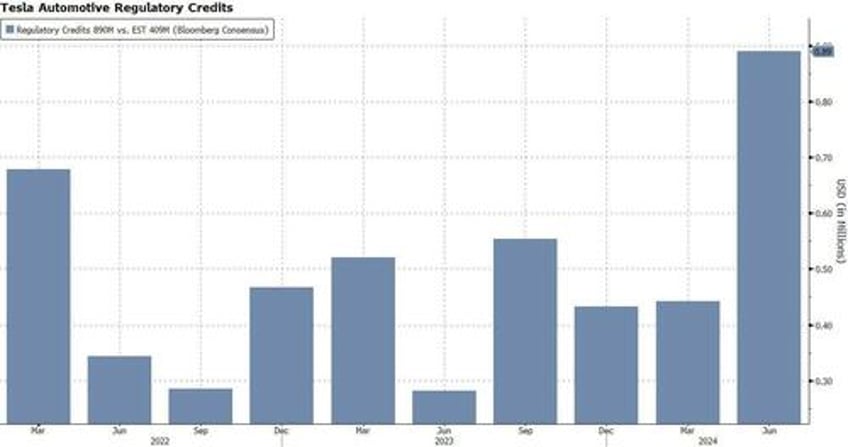

What's worse, it was once again the sale of regulatory credits that saved the day: $890 million this quarter, more than double from $442 million last quarter.

“We recognized record regulatory credit revenues in Q2 as other OEMs are still behind on meeting emissions requirements,” says Tesla in the shareholder deck.

That's the bad news. The good news is that this was the first quarter in a year that revenues beat estimates, and the outlook got a boost as TSLA now expects a "sequential increase in production in Q3" as it "continued to add to our vehicle lineup globally, including the introduction of new Model 3 and Model Y trims and additional paint options for the S3XY lineup."

Some more highlights from the letter:

- Tesla Still Sees ‘Notably Lower’ Volume Growth Rate for 2024, as its teams "work on the launch of the next generation vehicle and other products. In 2024, the growth rates of energy storage deployments and revenue in our Energy Generation and Storage business should outpace the Automotive business."

- Tesla's "purpose-built Robotaxi product will continue to pursue a revolutionary “unboxed” manufacturing strategy"

- Here, the company notes that the timing of Robotaxi deployment depends on technological advancement and regulatory approval, and TSLA is "working vigorously on this opportunity given the outsized potential value."

- Focus remains "on company-wide cost reduction, including reducing COGS per vehicle, growing traditional hardware business and accelerating development of our AIenabled products and services."

In other words, Tesla is saying that they it deliver less than the 1.8 million cars they delivered in 2023:

As for the Cybertruck - which became the best-selling EV pickup in the U.S. in Q2 - the company reported that "production more than tripled sequentially and remains on track to achieve profitability by end of year." Oh, and the Semi got an honorable mention: discussing the car which was unveiled in November 2017, Tesla said that "preparation of Semi factory continues and is on track to begin production by end of 2025."

While the disappointing results would likely have been enough to hammer the stock - even more - after hours, TSLA is only modestly lower thanks perhaps to these three paragraphs in the company's "product outlook" section, which reaffirm what everyone has been hoping for: cheaper cars are coming some time in H1 2025.

Plans for new vehicles, including more affordable models, remain on track for start of production in the first half of 2025. These vehicles will utilize aspects of the next generation platform as well as aspects of our current platforms and will be able to be produced on the same manufacturing lines as our current vehicle line-up.

This approach will result in achieving less cost reduction than previously expected but enables us to prudently grow our vehicle volumes in a more capex efficient manner during uncertain times. This should help us fully utilize our current expected maximum capacity of close to three million vehicles, enabling more than 50% growth over 2023 production before investing in new manufacturing lines.

Our purpose-built Robotaxi product will continue to pursue a revolutionary “unboxed” manufacturing strategy.

Here, Tesla again notes that it will release more “affordable models” by the first half of 2025; then again, in the last earnings call, Elon Musk made it seem like it would be early 2025, so perhaps the timeline was once again pushed back a bit. Offering a clearer product pipeline like other automakers in the US - such as Rivian or GM - might help ease concerns that the company is ignoring the core EV business.

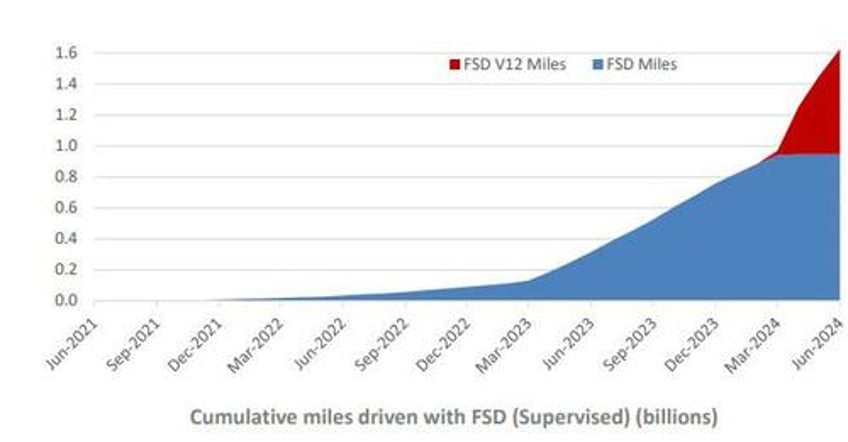

Understandably, Tesla dedicated a section of the report to its AI efforts, as follows:

Artificial Intelligence Software and Hardware

In Q2, we focused on reducing interventions with FSD (Supervised), while improving driving comfort. Notably, we rolled out a version of FSD (Supervised) that primarily relies on eye tracking software to monitor driver attentiveness. We also increased the robustness of our next gen FSD (Supervised) model with substantially more parameters. Looking ahead to future autonomous driving and robotaxi service, we continued progress on software and hardware development. Optimus is performing its first task handling batteries in one of our facilities. The south extension of Gigafactory Texas is nearing completion and will house our largest cluster of H100s yet

Elsewhere, Tesla deployed a staggering amount of energy storage during the quarter -- 9.4 gigawatt hours -- and revenue for that part of the business doubled from the second quarter of 2023. The company previously predicted storage would grow faster than car sales. As Bloomberg notes, that turned out to be quite an understatement.

Even though it is no longer a pressing issue, Tesla noted that its quarter-end cash was $30.7B, with the sequential increase of $3.9B a "result of positive free cash flow of $1.3B, driven by an inventory decrease of $1.8B and partially offset by AI infrastructure capex of $0.6B in Q2."

With the stock soaring in the past month, if sliding modestly in the the past week, TSLA shares dipped as much as 4% after hours before recovering some of their losses to last trade around $237.

The full Tesla earnings presentation can be found here.