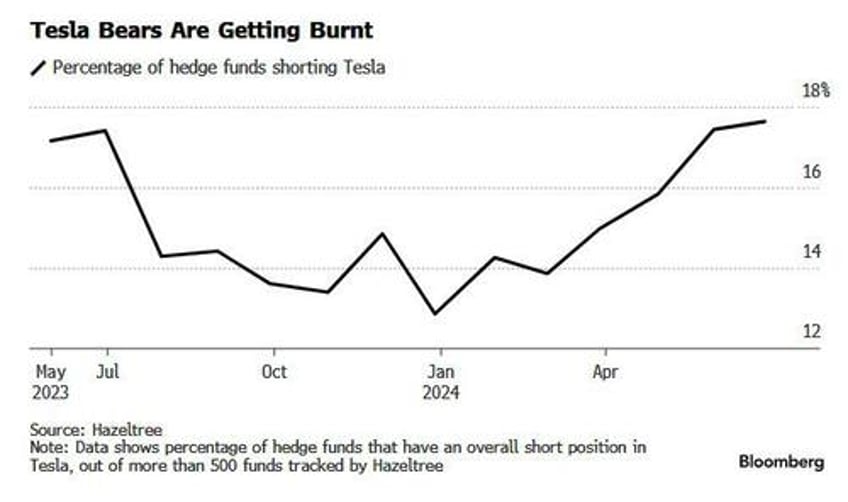

One month ago, when momentum-chasing market pundits and other fair-weather experts were quick to throw Tesla out of the Mag7 and forecast that the stock would keep on sinking indefinitely even as the AI bubble took the Big 5 - MSFT, NVDA, AAPL, GOOGL and META - into the stratosphere, we observed that "TSLA remains one of the most shorted names in the hedge fund space and is one of the biggest mutual fund underweights"

TSLA remains one of the most shorted names in the hedge fund space and is one of the biggest mutual fund underweights pic.twitter.com/fr3Rxju9Wq

— zerohedge (@zerohedge) June 4, 2024

The implication, of course, was that a face-ripping short squeeze was imminent - and sure enough, just three weeks later we have seen the biggest meltup in TSLA history, the stock surging nearly 50% in just over a week.

We were once again about a month ahead of the curve, and now Bloomberg has caught up, writing that hedge funds had piled into short bets against Tesla right before the electric vehicle maker unveiled a set of numbers that triggered a hefty share-price rally.

Bloomberg notes that about 18% of the 500-plus hedge funds tracked by data provider Hazeltree, had a short position on Tesla at the end of June, the highest percentage in more than a year. That compares with just under 15% at the end of March. Of course, anyone who tracked our Twitter feed or had access to our premium subscription, was well aware of this and the imminent squeeze that would soon follow.

The next part is obvious: having ignored the inevitable meltup, Bloomberg now scrambles to catch up and writes that the massive pile up of short bets "now threaten to saddle the hedge funds behind them with losses." Which is also wrong: the losses have already been booked and most funds were forced to close their shorts in the recent panic meltup. In fact, if anything, now that the squeeze is common knowledge thanks to Bloomberg pointing out what our readers know a month ago, it's time to close the long and go short again, even if the fundamentals suggest that there is more potential upside.

Tesla is likely to see its profit margins improve, helped by lower production and raw material costs, according to Morningstar Inc.’s Seth Goldstein, one of the top three analysts covering the stock in a Bloomberg ranking that tracks price recommendations.

The company will likely “return to profit growth” next year, he said in a note to clients. But how Tesla handles the market’s intensifying focus on affordable EVs will be key, he added.

Not only that, but with the stock price surging 50% in just a few days, one can make the argument that most if not all good news for the foreseeable future was promptly priced in. Meanwhile, there is a growing sense of uncertainty around how to treat the wider EV market, amid a sea of conflicting dynamics. The industry benefits from generous tax credits. Yet it’s also contending with significant hurdles in the form of tariff wars and even identity politics, with some consumers rejecting EVs as a form of “woke” transport.

In the US, Donald Trump has said that if he becomes president again after November’s election, he’ll undo existing laws supporting battery-powered vehicles, calling them “crazy.” That said, Trump is a “huge fan” of Tesla’s Cybertruck, according to Elon Musk, who recently told staff to brace for major job cuts, with sales roles among those affected. And the Cybertruck, Tesla’s first new consumer model in years, has been slow to ramp up.

For that reason, some hedge fund managers have decided the stock is off bounds altogether. Tesla is “very difficult for us to position,” said Fabio Pecce, chief investment officer at Ambienta where he oversees $700 million, including managing the Ambienta x Alpha hedge fund.

Basically, it’s not clear whether investors are dealing with “a top company with a great management team” or whether it’s “a challenged franchise with deficient corporate governance,” he said.

However, “if Trump wins, it is truly going to be very positive” for Tesla, though “obviously not amazing for EVs and renewables in general,” he said. That’s because Trump is expected to impose “massive tariffs towards the Chinese players,” which would be “beneficial” to Tesla, Pecce said; this is also wrong since there is virtually no Chinese EV penetration in the US, and if anything it would force even more dumping of Chinese EVs in Europe which is also a huge market for Tesla.

While TSLA managedto go green for the year last week after a painful slump which nearly wiped out half the stock value since 2023, other EV companies have fared worse: the Bloomberg Electric Vehicles Price Return Index, whose members include BYD, Tesla and Rivian, is down about 22% so far in 2024. At the same time, the metals and minerals needed to produce batteries are at the mercy of wildly volatile commodities markets, with speculators regularly trying to make a quick buck on shifts in supply and demand. Price volatility means some battery manufacturers are having to adjust to a market in which their profit margins have been getting badly squeezed.

Against that backdrop, more traditional automakers are finding themselves under pressure from shareholders to slow down their capital expenditure on EVs, with recent examples including Porsche. Polestar Automotive, a high-end EV manufacturer, has lost almost 95% of its value since being spun out of Volvo Car AB two years ago. Fisker, another luxury EV maker, saw its value wiped out starting last year and has since filed for a second Chapter 11 bankruptcy protection.

Soren Aandahl, founder and CIO of Texas-based Blue Orca Capital, said “valuations in the EV space are so beat up” that he’s now avoiding shorting the sector. It’s no longer an obvious contrarian bet, because those tend to do best if investors enter “when things are a little bit higher,” he said. But at this point, “a lot of the air’s already come out of the balloon” and we certainly agree: the time to go long TSLA was a month ago. Now much of the immediate good news has been priced in.

But Eirik Hogner, deputy portfolio manager at $2.7 billion hedge fund Clean Energy Transition, suggests there may be more pain to come for the wider EV industry. There are still “way too many” startups that remain “sub-scale” and with gross margins that are simply “too low,” he said. As a result, the supply-demand dynamic of the EV market “is still very negative.”

“Ultimately, I think you need to see more bankruptcies” before the market starts to look healthier, Hogner said.