By Howard Wang of Convoy Investments

The US economy is as bipolar as I've ever seen it, with some parts cold and other parts running hot. Below I provide a summary of my current views on the economy, then some select charts from our economic dashboard with additional commentary.

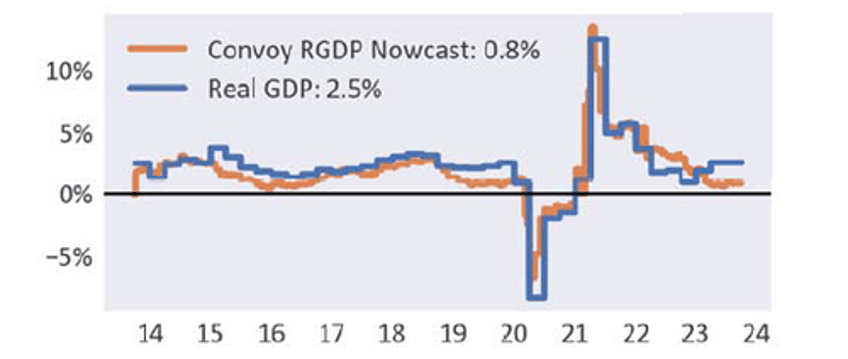

At a high level, I believe the US economy is slowing down and is at around 0.8% real GDP growth. It's not quite at recession levels yet, but it's close. Q2 GDP numbers were recently revised substantially downward as new data came in. The rest of the world is in a worse position than the US, and it will also affect US growth.

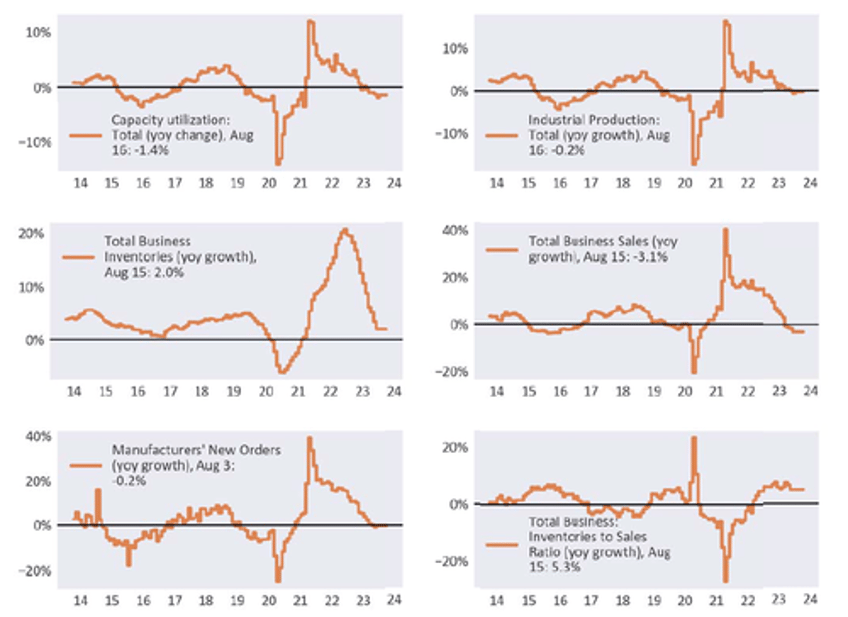

Capacity utilization, industrial production, business inventories, total business sales, and manufacturing new orders all paint the same picture – a drop in 2020 due to Covid, followed by a spike as the economy reopened in 2021 fueled by money printing. Now, we are back to near zero growth as liquidity is being drained out of the system.

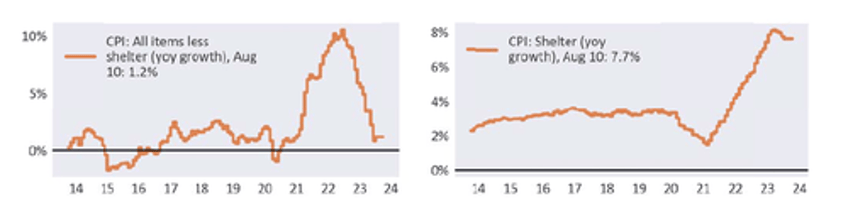

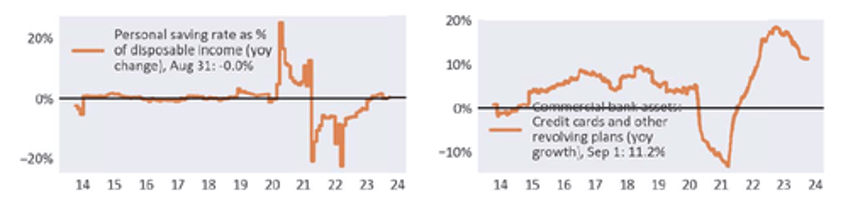

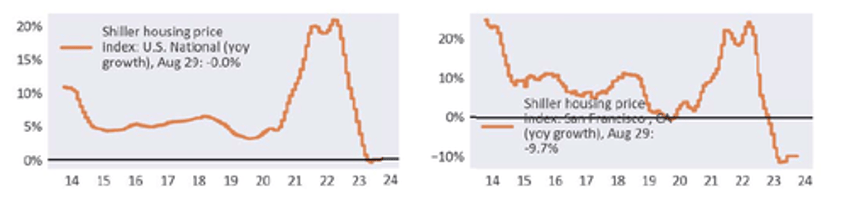

Inflation is also slowing down. Headline inflation is at 3.3%, and core inflation is at 4.7%. Commodities inflation has been negative for some time, with wage growth and housing costs as the main drivers of sticky inflation. For example, CPI ex-shelter is close to zero. Wage growth is slowly moderating as the job market continues to slow, while housing prices have remained stubbornly high. However, year-over-year growth (which is what matters for inflation) is already at zero. That said, shelter CPI still has some room to grow because it increased a lot less than housing prices did. So, I expect inflation to slow but remain above the 2% target for some time.

While the job market remains tight due to the mass retirement of Baby Boomers post-Covid, job opening numbers are falling by -23% year-over-year. This should reduce the imbalance between labor supply and demand, continuing to moderate wage growth.

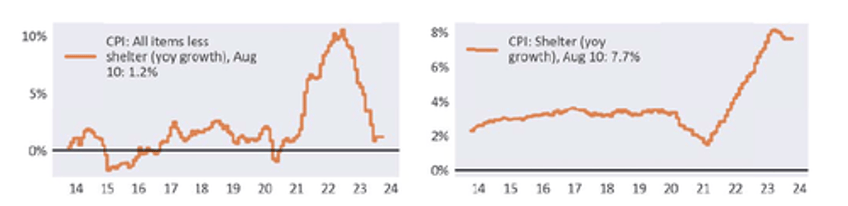

Producer price indices are negative year-over-year, as are import costs, due to the dollar's strength and the lag in global growth. The US is importing a lot of deflation.

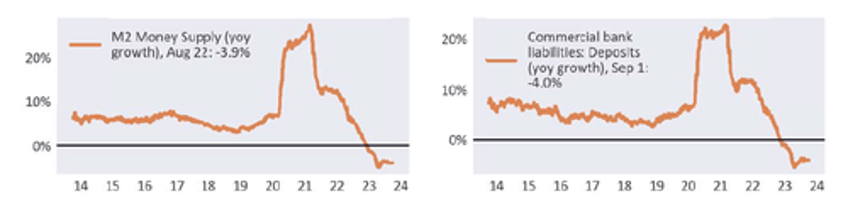

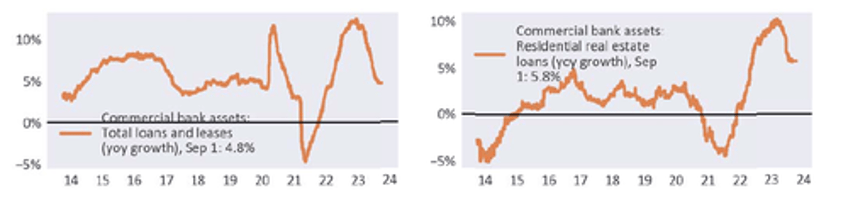

Money supply is shrinking rapidly. More importantly for the economy, bank loans are finally dropping as banks feel the squeeze from rising rates and a shrinking deposit base. This is slowly choking the life out of the economy.

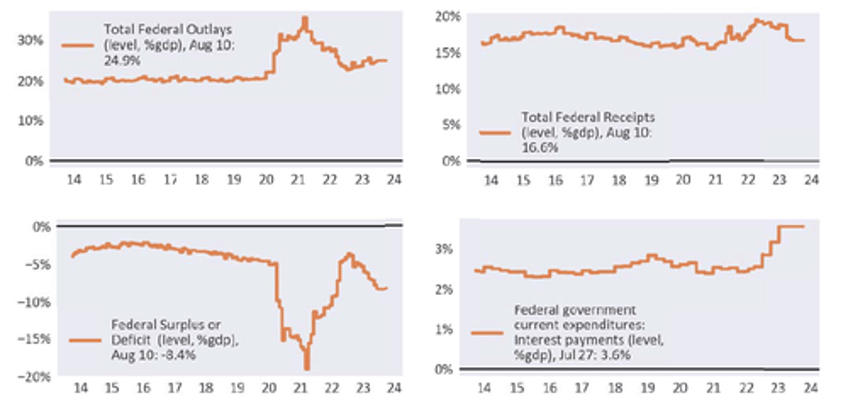

While the federal government's deficits spiked this year, I believe it is mostly temporary as we are feeling the lagged effects of the 2022 market drop on government tax receipts – there is a very tight correlation between stock market returns and federal tax receipts. So this year's market bounce will mean a recovery for the federal budget as well. While our budget faces long-term questions, I don't think we'll have an acute funding issue in the short term. While some people attributed the recent 10-year Treasury yield rise to default risks, the fact that the dollar also rallied at the same time suggests it was more due to growth expectations, not default risks.

Some charts on the points above, with some brief commentary. I combine all the relevant economic indicators into a "nowcast" to provide my real time estimate on US economic growth, which I plot below relative to actual real GDP growth. My nowcast suggests we are now growing at a modest 0.8% year-over-year rate. Not recession territory yet but certainly slowing down.

Below I show some key economic activity indicators. Capacity utilization, industrial production, total business inventory/sales/orders are all at zero or negative growth after a few blockbuster years. Inventory to sales ratio is now also growing.

As M2 money supply contracts, commercial banks are losing their deposit base, leading to failures for some of the more aggressively positioned regional banks.

More importantly, it means they are also finally tightening up their lending standards. I wrote a paper about why Fed Fund Rates going up weren't actually slowing down the economy because most checking accounts had zero rates so bank loans were still growing very fast in the early part of this year. But this is finally beginning to slow down as banks (get squeezed in the middle. This is why I believe inflation is coming down and growth is finally cooling.

On the prices front, CPI is coming down, particularly CPI ex-shelter, which is already below the 2% target. Shelter prices will take some additional time to adjust as 1) housing prices went up far higher and faster than shelter CPI, so there is an additional gap to still work out of the system 2) most of the mortgages in the US are fixed, which means those who locked in a low rate during Covid don't want to sell, which artificially limits supply, keeping prices elevated. I believe CPI will remain above the 2% target for some time to come.

From the producers side, goods and commodities prices are negative year-over-year, services prices are at about 2%, both bodes well for inflation management.

At the same time, the dollar continues to rise and the rest of the world is slowing down, this means cheaper imports, i.e. importing deflation.

On the jobs front, payroll continues to grow at a modest 2% pace, but the number of job openings are dropping rapidly. This is closing the gap between labor supply and demand, which should continue to moderate wage growth, which is still elevated, but dropping.

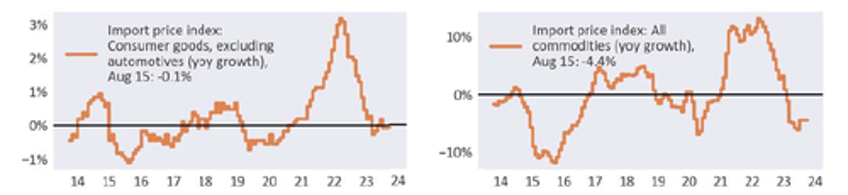

From a household balance sheet point of view, US households finally spent down their excess savings from Covid, and now savings rates are flat year over year. The recent spending has largely been powered by credit card debt, which is still piling up fast, but the rate of growth is slowing as interest rates continue to rise and household balance sheet deteriorates.

On housing prices, year-over-year growth is now zero on average across the country, but prices have remained stubbornly high. Shelter will remain a key driver of CPI for some time to come. Certain pockets that saw bigger price bubbles during Covid are experiencing steeper drops (e.g. San Francisco, Texas, Las Vegas).

From federal balance sheet point of view, the recent rise in deficit has been driven more by low federal receipts, which suffered from a 2022 market drop, than outlays, which have stabilized after the Covid handouts ended. In the short-term, I expect deficits to stabilize as federal receipts catch back up to the market recovery this year. I don't expect this to be a major driver cause of concern for the bond markets in the short-term. Long-term is of course more of an open question, which I've gone into details in other commentaries.

Overall, I see an economy that is inevitably slowing - it is just a matter of time. Just like it took time for the money printing to flow through to inflation in 2021/2022, it will take some time for the tightening to flow through to a cooling down of inflation. Inflation will likely remain higher than 2% for a long time due to fixed mortgage rates in the US keeping housing prices high. The Fed will likely need some patience in fixing the long-term problems created by near zero 10-year rates and mass helicoptering of money.