The cost estimate of Biden’s Inflation Reduction Act coupled with EPA mandates, just jumped by $466 billion.

The Committee for a Responsible Federal Budget and the latest Congressional Budget Office outlook conclude IRA Energy Provisions Cost Could Double With New Emissions Rule

Last April, the Environmental Protection Agency (EPA) proposed a new rule for stricter vehicle emissions standards starting in model year (MY) 2027. If finalized, this rule would increase federal deficits both by increasing the number of electric vehicle tax credits awarded and reducing the collection of gas tax revenue.

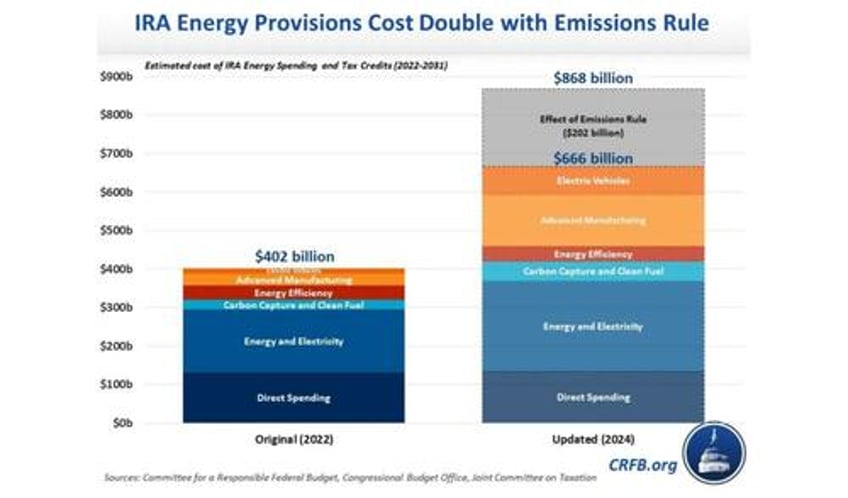

At the time of passage, CBO and the Joint Committee on Taxation (JCT) estimated the IRA’s energy and climate spending and tax breaks would cost about $400 billion through Fiscal Year (FY) 2031 and would be more than fully offset by other parts of the law.

Since then, the combination of higher inflation, greater demand for credits, and looser-than-expected regulations significantly boosted the cost of those credits. Last June, we estimated the cost of the IRA energy provisions had grown by two-thirds, to $660 billion through 2031. Assuming the new vehicle emissions rule proposed by the EPA is finalized, we now estimate the cost of the provisions will more than double to $870 billion through 2031, or $1.1 trillion through 2033.

CBO’s latest baseline also revised the original costs for “clean vehicle tax credits and gasoline excise taxes” upward by about $159 billion through 2031, from only $14 billion in the original score to $173 billion in their latest baseline. This revision is over $100 billion higher than in prior estimates, suggesting the remaining increase is due mainly to the new emissions rule. Because CBO applies a 50-percent weight to the effects of the proposed rule, we believe the rule itself would cost about $200 billion through 2031 once in effect.

Importantly, these estimates do not provide enough information to “re-score” the Inflation Reduction Act itself, which also includes various policies to raise revenue and reduce prescription drug costs. Nonetheless, the IRA tax credits themselves are expected to cost substantially more than originally believed, suggesting ample room to pare them back.

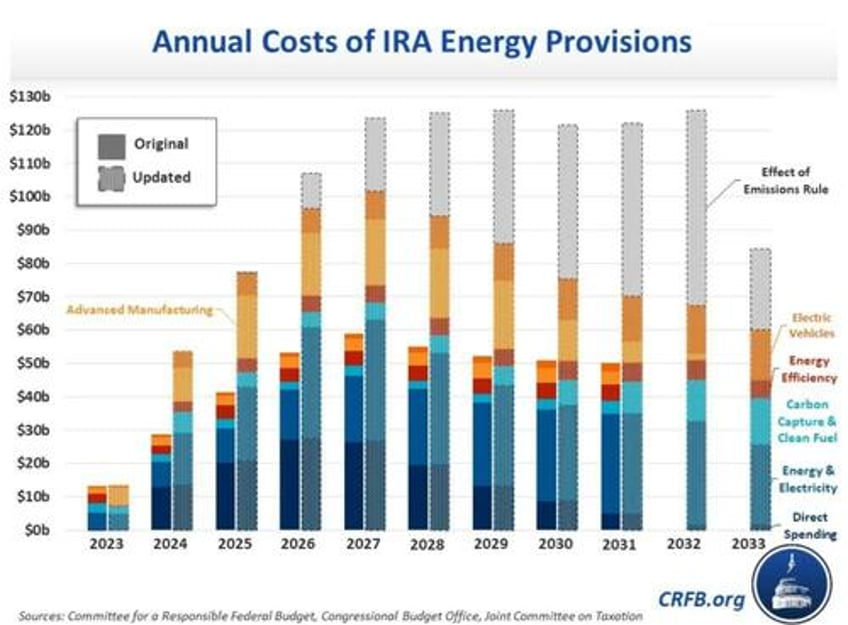

CBO Budget Outlook

The new emission rule will cost about $280 billion through 2033, including $200 billion through 2031, if finalized in its current form.

With the emission rule in place, energy-related provisions from the Inflation Reduction Act (IRA) will cost almost $870 billion through 2031, more than double the original $400 billion estimate.

Of the total increase, about two-fifths would be the result of the emission rule and the rest is due to a mixture of laxer-than-expected regulations on new credits, higher-than-expected demand for green technologies, and other economic and technical changes.

Annual Costs of IRA Energy Provisions

Anyone surprised by this wasn’t thinking and likely still isn’t.

The Shocking Truth About Biden’s Proposed Energy Fuel Standards

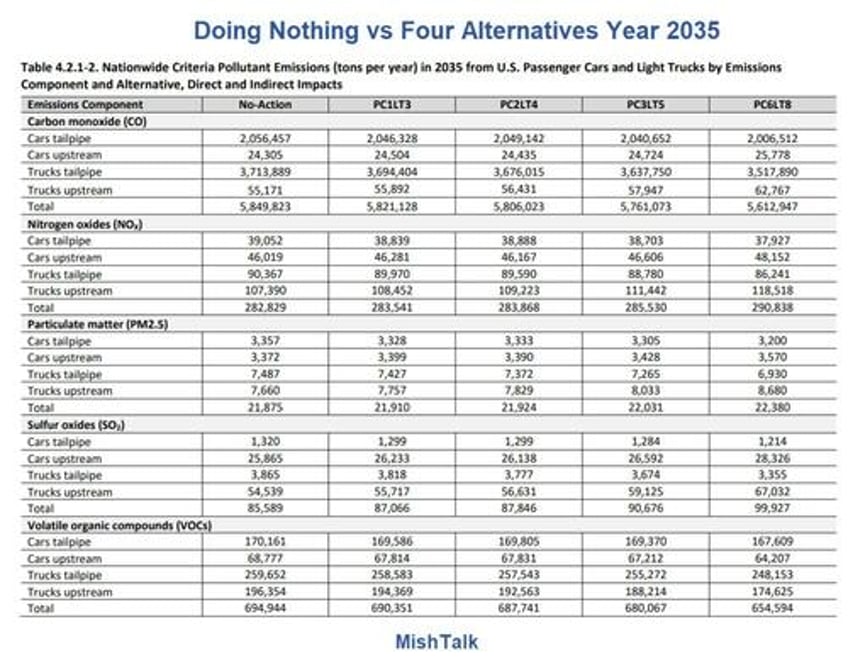

The National Highway Traffic Safety Administration NHTSA did an impact assessment of 4 fuel standard proposals and compared them to the cost of doing nothing. Guess what.

Following roughly 150 pages of fearmongering discussion of things like gasoline spills, 27 references to cancer, and the hypothetical benefits of proposed actions, we arrive at this amusing table.

Doing Nothing vs Four Alternatives Year 2035

Passenger car emission image from NSTA Draft Environmental Impact Statement

For discussion and more tables, please see my August 26, 2023 report on The Shocking Truth About Biden’s Proposed Energy Fuel Standards

Here is the NHTSA’s bottom line: “Net benefits for passenger cars remain negative across alternatives” vs doing nothing at all.

Costs are always much greater than expected, and in this case we are already starting from a negative benefit.

And so, here we are.

The Inflation Reduction Act that Biden told us would pay for itself, not only delivers negative benefits “across all time frames” in reducing emissions, it is now expected to cost $466 Billion more over 10 years.