What could the difference of a couple of quarters make to the overall year’s scorecard?

Well, a ton, if you are sitting in the currency markets.

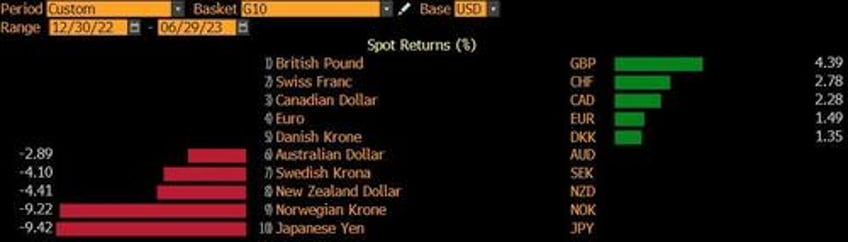

Only a handful of currencies had managed to eke out a gain against the dollar in the first half:

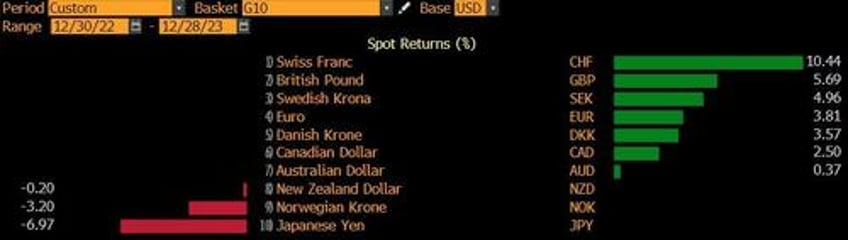

But the recent months have been a different story, with just about everything rallying against the dollar - skewing the narrative for the whole of 2023.

While the yen is still in losses for the year, it has clawed its way back impressively and may do better in 2024:

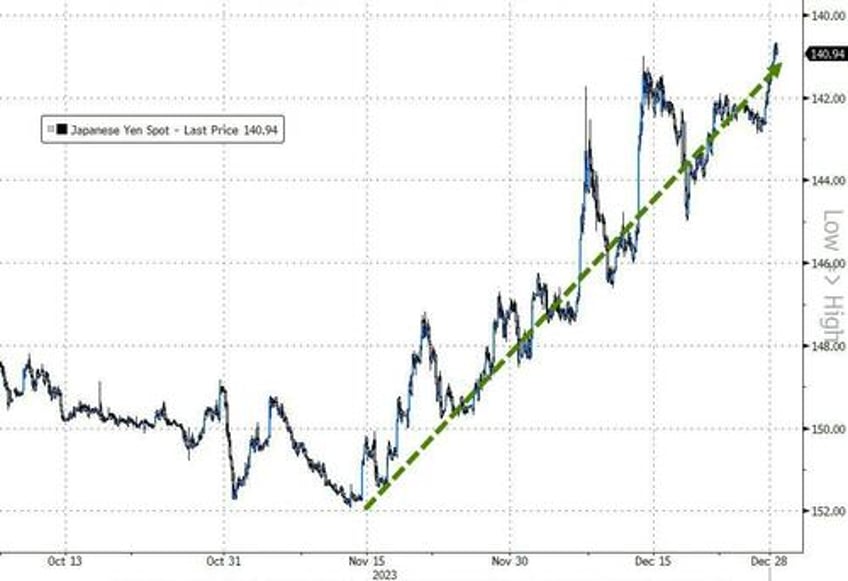

The yen is running up and away yet again, a familiar sight for much of this quarter. It may strengthen more next year, though the bulk of the gains will likely come after March.

Governor Kazuo Ueda indicated Wednesday that the Bank of Japan may not have to wait for wage negotiations from small and medium firms, implying that it could have sufficient data to act on by April.

Talk of an exit from negative rates sooner than then appears to be premature, meaning long yen positions will have to cool their heels and be at the mercy of what happens on the dollar side of the equation to justify running a negative carry.

Most of the yen’s 6% surge this quarter has come on the back of real and nominal yields state-side having crumbled about 75 basis points or more.

While that dynamic is set to continue into 2024, there has been a degree of overexuberance when it comes to the slump in yields.

That may lead to a mild correction in the first quarter, which would also argue for a tempering of enthusiasm regarding the yen.

The yen’s gains may pick up momentum beyond then, with the BOJ expected to exit negative rates and the dynamic of lower nominal and real rates in the US continuing apace.

If the BOJ delivers, the yen will rally to 130 per dollar by my calculations.

The broad dollar, meanwhile, isn’t likely to fare half as well as it did this year as interest-rate differentials narrow in favor of its G-10 peers.

Although we note that the euro looks rich relative to the dollar relative to rate-differentials...

Just as it did in June/July 2023 (only to reverse all that expectation in the next three months in favor of the dollar).