With new home sales plummeting (playing catch-down to reality) and existing home sales bouncing very modestly off record lows (SAAR), pending home sales were expected to rise modestly MoM in November (+0.9%). However, Pending Home Sales missed expectations, unchanged in November (from an upwardly revised October decline of -1.2% MoM).

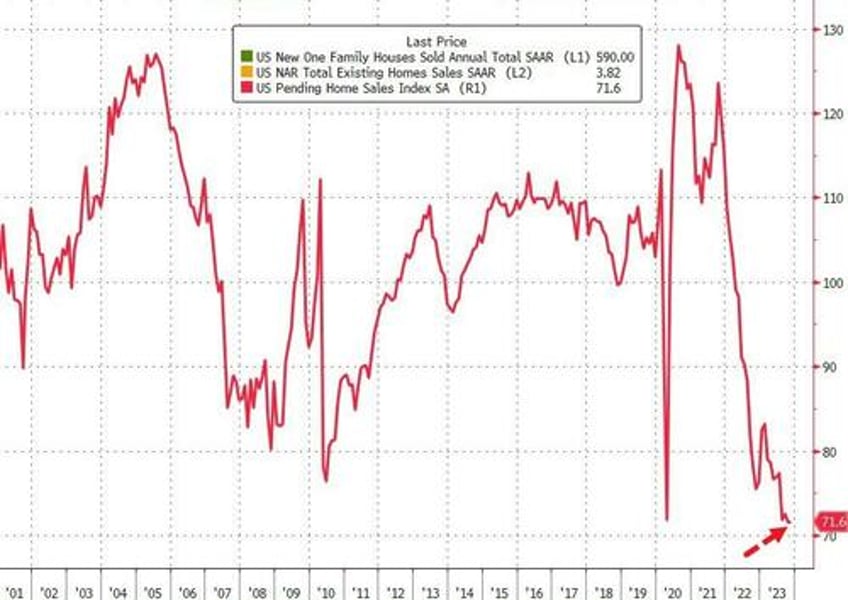

That left Pending Home Sales Index still down over 5% YoY...

Source: Bloomberg

That leaves the Pending Home Sales Index at a new record low...

Source: Bloomberg

The index of contract signings for existing homes declined in the South, the biggest US housing market, to the lowest level on record.

Pending sales climbed in the other three regions.

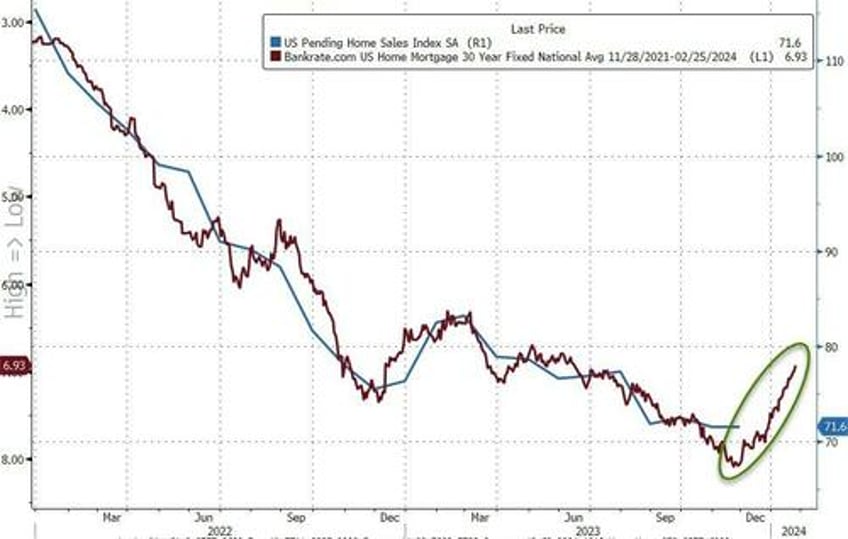

The trend in pending home sales appears to tracking mortgage rates (with about a one-month lag), suggesting things may be about to pick up more solidly in the next few months...

Source: Bloomberg

“Although declining mortgage rates did not induce more homebuyers to submit formal contracts in November, it has sparked a surge in interest, as evidenced by a higher number of lockbox openings,” Lawrence Yun, NAR’s chief economist, said in a statement.

“With mortgage rates falling further in December – leading to savings of around $300 per month from the recent cyclical peak in rates – home sales will improve in 2024,” Yun said.

Optimism - from a realtor - whoever would have thought!?