By Joe DeLaura, Senior Energy Strategist at Rabobank

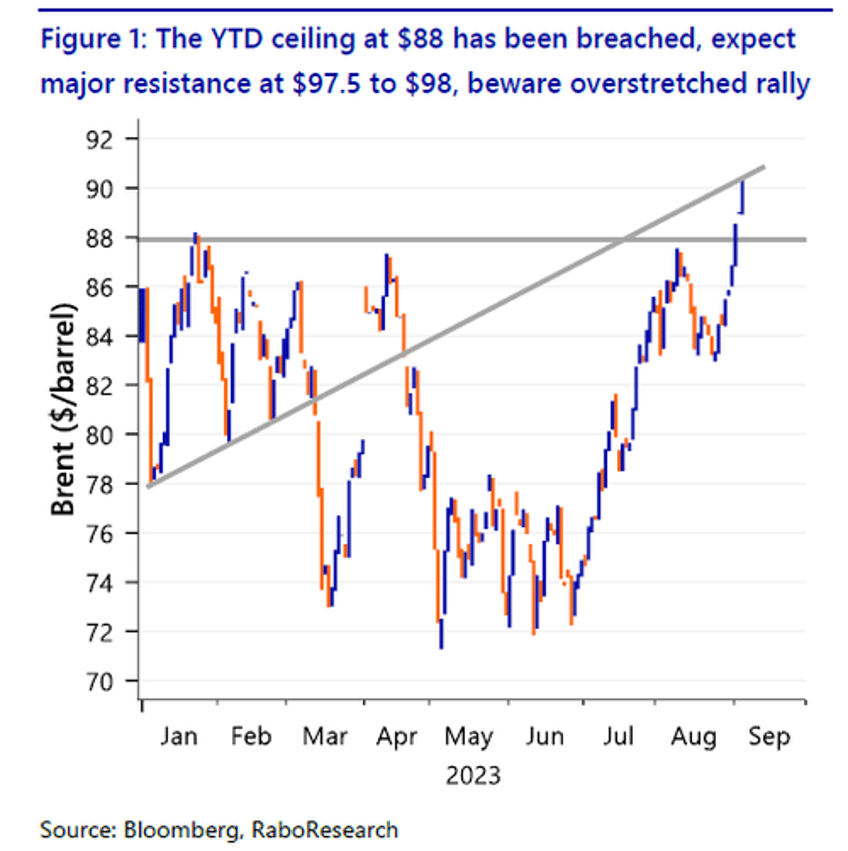

A surprise Saudi Arabian announcement at 9:00 AM ET, September 5, pushed Brent crude up over $90 for the first time since November and set a new high for the year. The extension of the current voluntary 1m barrel-per-day cut through December will continue to prop up a fundamentally strong market. Saudia Arabia will keep their output at about 9 million barrels a day, while a separate announcement by Russia also extended their export cuts of 300,000 bpd for the same duration.

In contrast rig counts are falling in the US while production is ticking up strangely, mainly due to drilled-but incomplete wells being finished off. Front spreads are strongly backwardated as refineries run crude at high capacity to try and rebuild depleted downstream products inventories. It’s the perfect bull market from a real, physical world perspective.

The major bearish case comes from worsening economic data from China and other large economies. China is shifting into a slower growth path. The post-Covid rebound was spearheaded by travel, pushing up jet fuel demand, but domestically, it is running out of steam. A deepening property slump and fading luxury goods buying underlie the weakness. The world’s primary producer of base metals and many vital industrial components in an era of rising interests does not bode well. Rising rates depress infrastructure spending and discourage capital investments. But this becomes a circular problem! If drilling and exploration for new oil and gas fields decreases and no solar, wind, or lithium-ion battery factories and semiconductor plants are built, then where will the new supply come from?

Rising energy prices will beget further increases! You cannot solve an upstream supply crisis by destroying demand. You have to either shift demand elsewhere (renewables) or find more supply! But shifting demand elsewhere without corresponding infrastructure does nothing to solve the real problem.

We project that renewable fuels and electricity generation will affect demand in the around 2028 and the early 2030s, respectively. But it is not a lightswitch – a downshift means there is still usage of gas and oil until that point and even beyond. Yet we are not seeing the kind of production and supply growth to keep a lid on prices until that magical point is reached.

Our current political and economic systems seem content to wait for a wizard to solve everything while they pull the ineffectual rates levers. “Someone else will solve the problem, we cannot act directly anymore,” sums up the statements coming from every Western government lately.

Hedge accordingly.