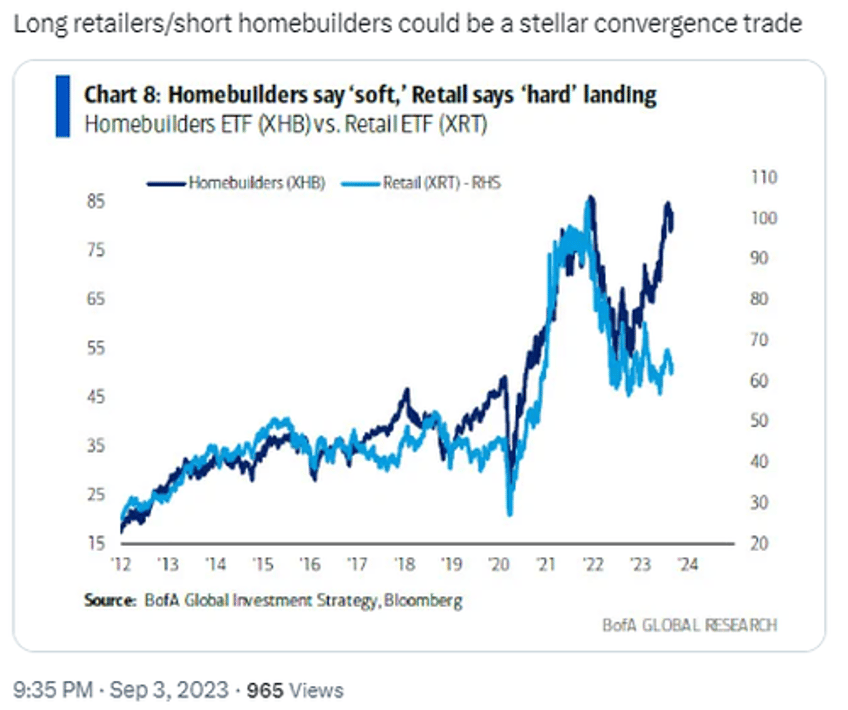

Over the weekend, when looking at the latest market dislocations, we told readers in our private twitter feed (which is open to subscribers) that long retailers (XRT)/short homebuilders (XHB) could be a "stellar convergence trade"...

... and no sooner did we tell readers that homebuilder luck may have run out now that 30Y mortgage rates are back to generational highs, than we saw the XHB tumble 4%, double the slide in the XRT, and a solid start to bets that the outperformance of homebuilders vs retailers is now over.

We were therefore not surprised to read in Goldman's EOD wrap late last night, that the bank's trading desk was "peppered with questions on weakness, notably within homebuilders with the group -6% on the day (2 sigma move lower)."

According to Goldman, the biggest catalyst for the hit to homebuilders, was the sharp resumption of Friday's rate steepening (the US 10Y jumped +9bps to 4.27%, and flirting with YTD highs) which drove broader pockets of heavy weakness on long duration assets (R2K sold off -210bps). Goldman thinks this was a product of

- 1) heavy IG corp supply

- 2) crude rallying +1.3% on the back of Saudi 1M b/d production cut extension through December

- 3) positioning as longs are unwound by HFs (similar to Friday, our rates desk saw steepening flows from levered accounts).

Goldman's traders add that in addition to the aforementioned points on rising yields and crude, there was also a mixed (negative) "competitor note which highlighted that channel feedback across a range of building product categories/suppliers continues to highlight solid new construction momentum BUT with underwhelming remodel activity."

And then there was offside positioning, which however is not as short as it once was as most got stopped out after better than expected earnings. Bottom line: "pressure on homebuilders is 90% rates/oil trade."

The move in homebuilders was also discussed by Goldman trader Rich Privorotsky this morning, when he said that while the Tuesday drop was an outlier, it was also "odd how much they rallied into Labor day. I find homebuilders to be the poster boy of soft landing. Strong labor markets and higher for longer rates is ironically creating the perfect set of conditions that is a.) severely restricting existing home supply (can't move if your new mortgages is 2-3x your old one) and b.) the lack of recession means demand is good enough to sustain a need for new homes/household formation."

However, echoing our caution (and in part, trade reco), Privorotsky notes that "the trade is very convex on the downside, if the economy slows enough rates will come down (mobility returns to housing market)…peculiarly lower prices could create more supply."

It's then that the XHB short - which is effectively a bet on a hardish landing/recession - will really pay off.

More in the full notes available to pro subs.