Bond yields are primarily driven by macroeconomic factors such as inflation and economic growth.

Given their impact on inflation and the economy, the U.S. dollar and oil prices are frequently well correlated with bond yields.

Therefore, bond traders often take their cue from the dollar and oil markets.

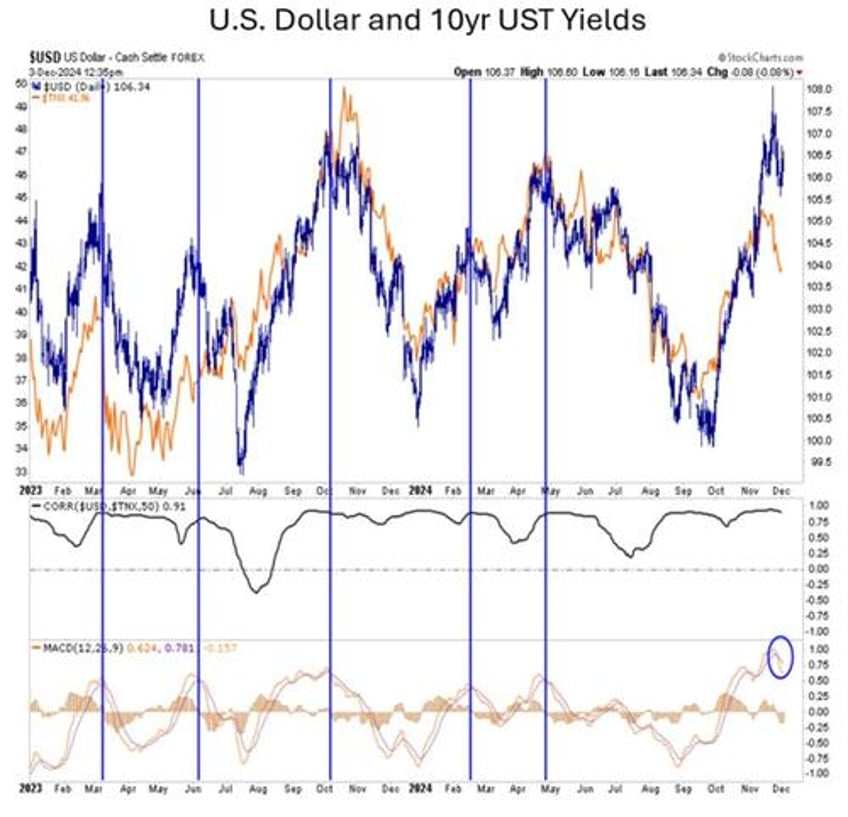

The dollar (blue), as graphed below, has been on a tear since early October.

As is typical, bond yields (orange) closely followed the dollar higher.

The graph below the dollar/yield shows the correlation between .75 and 1.00 over the period.

The dollar is now at the upper end of a two-year range, and its MACD sends a strong sell signal. The blue vertical lines show the prior periods when similar sell signals were triggered.

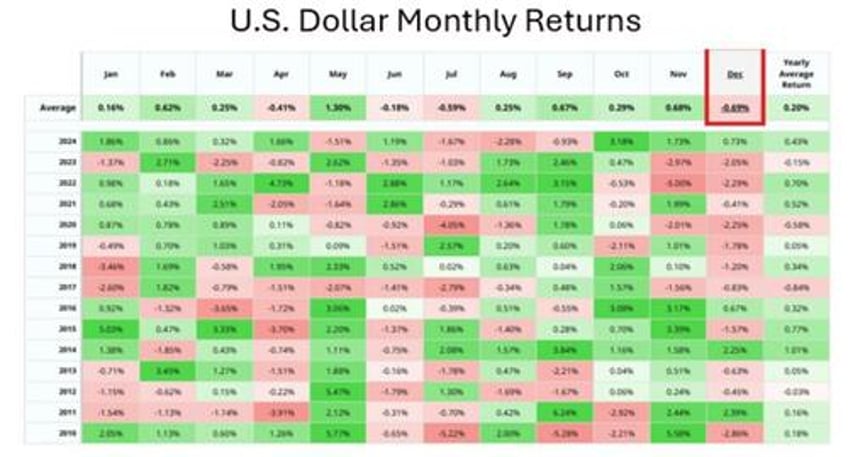

The technical sell signal for the dollar, thus a buy signal for bond prices (lower yields), aligns with the table below, which shows that the dollar has traded down in the last seven December’s.

Moreover, since 2010, December has been the worst month for the dollar.

The final graph below highlights the strong correlation between crude oil and bond yields.

In this case, crude oil trades at the lower end of its two-year range. However, bond yields have yet to “catch down” to oil prices.

Assuming the correlation holds up, which is not necessarily a given, bond yields could revisit September’s lows.