Back in September, the otherwise sleepy and mostly boring report that is the Fed's Beige Book report (which nobody otherwise reads due to its sheer size and dismal signal-to-noise ratio) got a sudden boost of notoriety and popularity when none other than Jerome Powell explained after the Fed's 50bps rate cut, that he had been closely following the Beige Book which had emerged as a driving force behind the Fed's unexpected "jumbo" 50bps rate cut. And unlike others, we actually do read the Beige Book, which is why two weeks before the FOMC rate cut we titled our analysis of the latest report as follows: "Ugly Beige Book Reveals Economic Activity "Flat Or Declining", Consumer Spending Slowing In Most Districts." So one can see why Powell panicked and why two rate cuts followed in September and November, just days after the election.

Fast forward to today when moments ago the Fed published its latest, December, Beige Book which suggested that a reversal of the sluggish, "flat or declining" conditions observed in September and November is underway, and which together with a strong jobs report on Friday may be sufficient to enable the Fed to pause rate cuts for the foreseeable future, especially now that Donald Trump is in the White House.

According to the Fed's latest report, economic activity "rose slightly in most Districts", a clear improvement from the descriptions used in the previous months, and that "three regions exhibited modest or moderate growth that offset flat or slightly declining activity in two others." Employment levels were flat or up only slightly across districts and prices rose only at a modest pace across Federal Reserve districts.

Reading further, we find yet another indication of the Trump effect, namely that although growth in economic activity was generally small (thank Biden), expectations for growth rose moderately across most geographies and sectors (thanks Trump) and "business contacts expressed optimism that demand will rise in coming months."

Elsewhere, we find that consumer spending was "generally stable" although many consumer-oriented businesses across Districts noted further increases in price sensitivity among consumers, as well as several reports of increased sensitivity to quality. Among the negative aspects, spending on home furnishings was down, which contacts attributed to limited household mobility, while demand for mortgages was low overall, though reports on recent changes in home loan demand were mixed due to volatility in rates. Commercial real estate lending was similarly subdued. Still, contacts generally reported financing remained available.

Turning to capital spending and purchases of raw materials, these were flat or declining in most Districts while sales of farm equipment were a notable headwind to overall investment activity, and several contacts expressed concerns about the future prices of equipment given ongoing weakness in the farm economy.

Energy activity in the oil and gas sector was flat but demand for electricity generation continued to grow at a robust rate. The rise in electricity demand was driven by rapid expansions in data centers and was reportedly planned to be met by investments in renewable generation capacity in coming years.

Some more details from the Beige Book, starting with Labor Markets:

- Employment levels were flat or up only slightly across Districts.

- Hiring activity was subdued as worker turnover remained low and few firms reported increasing their headcount.

- The level of layoffs was also reportedly low. Contacts indicated they expected employment to remain steady or rise slightly over the next year, but many were cautious in their optimism about any pickup in hiring activity.

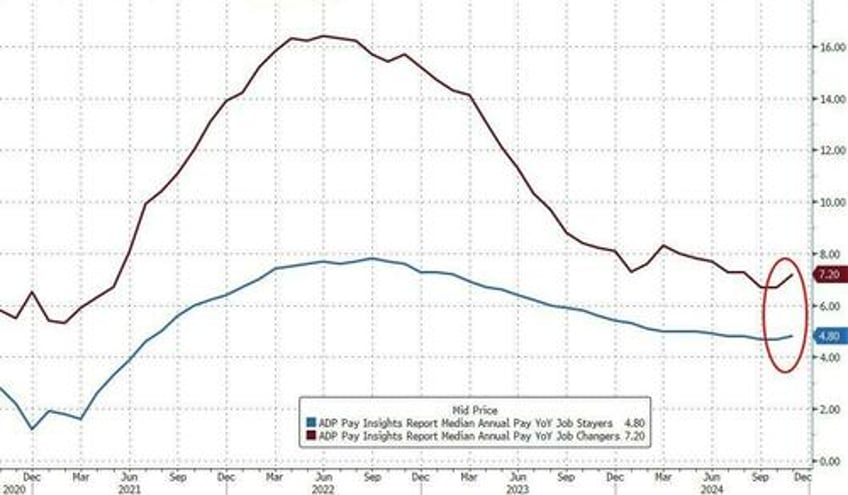

- Wage growth softened to a modest pace across most Districts, as did expectations for wage growth in coming months.

- Job growth and wage growth for entry-level positions and skilled trades were an exception, rising robustly and expected to grow further through next year.

While Friday's jobs report will have more to say about this, today's ADP report which indicated a sharp bounce in wage growth suggests that the Fed is now working on stale wage data.

Turning to prices:

- Prices rose only at a modest pace across Federal Reserve Districts.

- Both consumer-oriented and business-oriented contacts reported greater difficulty passing costs on to customers.

- Input prices were said to be rising faster than selling prices for most businesses, resulting in declining profit margins.

- Although input prices rose generally, contacts in several Districts noted declines in certain raw materials and non-labor costs.

- In contrast, rising insurance prices were again reported widely as significant costs pressures for many businesses.

- Contacts indicated they expect the current pace of price growth to persist, but businesses in several Districts indicated tariffs pose a significant upside risk to inflation.

Here are the main highlights by Fed District

- Boston: Economic activity was down a bit on balance. Prices increased at a slight pace. Employment held steady despite a slowdown in hiring demand. Consumers held back on restaurant spending. Warm, dry weather crimped demand for selected goods. Commercial real estate contacts perceived stabilization in the office sector. Expectations were mixed, marked by uncertainty among many contacts.

- New York: On balance, regional economic activity expanded slightly, led by strong growth in the manufacturing sector. Employment in the region grew slightly, and wage growth remained moderate. Commercial real estate markets steadied after a period of weakness, with a pickup in demand in the New York City office market. Selling price increases remained modest.

- Philadelphia: Business activity edged up in the current Beige Book period after falling slightly last period. Consumer spending was flat overall, but the broader nonmanufacturing sector edged up, and manufacturers reported modest growth. Employment, wages, and prices all rose modestly, but inflation expectations edged higher over concerns about potential tariffs. On average, firms expect moderate economic growth over the next six months.

- Cleveland: District business activity grew modestly in recent weeks, and contacts expected activity to increase further in the months ahead. Demand for business services remained robust, and nonresidential construction activity increased modestly. Employment levels grew slightly. Overall, contacts indicated that wages, nonlabor input costs, and prices increased modestly.

- Richmond: The regional economy grew slightly in recent weeks. Some negative impacts from Hurricane Helene and the port worker strike were reported by businesses in affected regions and segments of the economy. Employment was little changed this cycle, while wages grew moderately and price levels were little changed, leading to reports of profit margin compression for businesses.

- Atlanta: Economic activity in the Sixth District grew. Employment was steady and wages grew slowly. Input costs and prices were little changed. Retail sales improved slightly. Tourism declined modestly. Demand for housing deteriorated. Transportation activity grew slightly. Loan growth was modest. Manufacturing fell, and energy activity grew modestly.

- Chicago: Economic activity increased slightly. Consumer and business spending rose modestly; employment was up slightly; construction and real estate activity was flat; nonbusiness contacts saw little change in activity; and manufacturing activity decreased modestly. Prices were up modestly, wages rose moderately, and financial conditions loosened slightly. Prospects for 2024 farm income were unchanged.

- St. Louis: Economic activity across the Eighth District has slightly increased since our previous report. Prices increased moderately, with greater pushback against those price increases. Consumer spending has slightly declined across the income distribution. Contacts expected slight growth in employment, particularly coming from industrial production. The outlook has modestly improved; however, contacts noted that uncertainty about future policies was slowing investment, and businesses were increasing inventories in anticipation of potential import tariffs.

- Minneapolis: District economic activity increased slightly. Employment grew, but labor demand softened, and turnover was down. Wage growth was moderate, and prices increased slightly. Consumer spending was flat, but tourism increased. Energy, commercial construction, and residential real estate also saw growth while manufacturing and homebuilding decreased.

- Kansas City: Economic growth was modest and balanced across sectors. Expectations for demand growth were strong and supported plans to increase hiring and capital expenditures. Most contacts indicated they do not plan to raise wages substantially over the next year. Yet, the outlook for consumer spending remained strong, even as customers became more sensitive to prices and quality.

- Dallas: Economic activity rose moderately over the reporting period. Growth continued in nonfinancial services and resumed in manufacturing and retail. Employment increased, and wage growth ticked up. Outlooks improved, with widespread increases in demand expectations. Interest rate cuts have had an overall positive but mild effect, and contacts were mostly bullish on prospective business conditions under the incoming administration, though some noted worry about potential trade and immigration policy changes.

- San Francisco: Economic activity was stable. Employment levels were generally unchanged, and wages and prices increased slightly. Retail sales and activity in services sectors changed little. Activity in manufacturing, residential real estate, and financial services increased somewhat, while conditions in commercial real estate were stable. Conditions in agriculture softened slightly

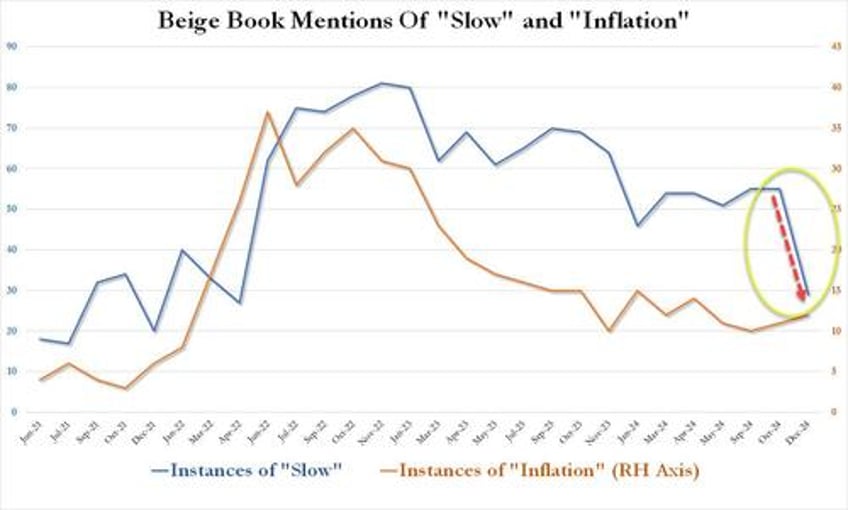

And in keeping with the argument that the Dec Beige Book was much more hawkish than many expected, a quick semantic analysis finds that mentions of "slow" collapsed from 55 in October and an average of 56 in the past year to just 29, the lowest since the covid surge. Meanwhile, "inflation" remained sticky with 12 mentions, up 1 from last month and the highest since April

Bottom line: if the September Beige Book is what ultimately tipped the scales for the Fed to cut 50bps, then the December Beige Book is the first solid hint that a Fed pause may take place as soon as this month (which is perfectly understandable since Trump is now in the White House and the Fed will do everything in its power to make his life miserable).