By Ven Ram, Bloomberg Markets Live reporter and strategist

German bonds and the euro have found the going tough so far in the second half of the year, and today’s meeting of the European Central Bank is unlikely to alter their trajectory meaningfully.

Decision & Language:

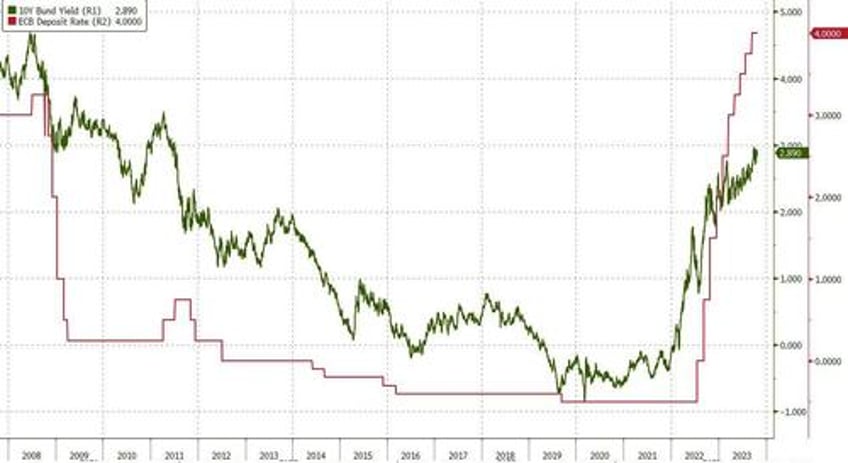

There is no need to hold your breath on the decision per se, given that the ECB signaled last month that it was moving to the sidelines after raising its benchmark to 4%. Financial conditions have since tightened, with 10-year bund yields rising and Italy’s yield spread over Germany widening.

Even so, the ECB will likely be cautiously hawkish given the potential for tensions in the Middle East to spur oil prices higher and stoke inflation. Any protracted conflict will, of course, be a drag on the euro-area economy, presenting the ECB with an unwelcome double whammy of elevated inflation and anemic growth.

Unlike last month, there will be no macroeconomic projections this time around. Traders will, therefore, focus on the language accompanying the decision, especially around this part:

“Based on its current assessment, the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target. The Governing Council’s future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary.”

I expect the ECB to stick to that language, and a hawkish about-turn would be unwarranted at this stage, while a dovish turn would be confounding and premature.

Even though traders aren’t pricing further tightening from the ECB in this cycle, there is no clear prescription for bunds to rally yet. The prospect of the geopolitical risk and correlations with Treasuries suggest that any such attempt to re-start a rally after today’s meeting will be little more than an in-the-moment reaction to headlines from President Christine Lagarde’s press conference

Beyond today’s meeting, EUR/USD fortunes will be at the mercy of what happens on the dollar side of the equation. With the US economy still proving to be pretty resilient, the euro is likely to end the year on a whimper.