By Peter Tchir of Academy Securities

The Game of "Chicken" in Today’s World

I’ve been thinking a lot about the game of “chicken” lately. The “game” where two people drive at each other, effectively “daring” each other to swerve out of the way or not.

Maybe this fixation was triggered by all the 40th anniversary of “Footloose” messages I saw on social media. Since I cannot dance to save my life (I have absolutely no rhythm), I just remember the game of chicken played with farm equipment.

But the reality is that the game of chicken can apply to so many things: geopolitically, politically, and even in markets as of late. Certainly every time someone mentions “drawing lines in the sand,” which is happening a lot, I think of the game of chicken. We will attempt to look at a few things through the “chicken” lens:

Russia and Ukraine.

The Middle East.

Fighting the Magnificent 7.

The Chinese stock market.

But first, let’s think about the game of chicken a little bit more.

The Game Theory of “Chicken”

Chicken is a great way to start thinking in terms of game theory. The game itself seems quite simple:

Only 2 actors.

Only 1 choice each actor can make.

An obvious and immediate consequence of those actions.

It is so simple (yet far more interesting) from a game theory perspective.

The analysis begins with this simple board:

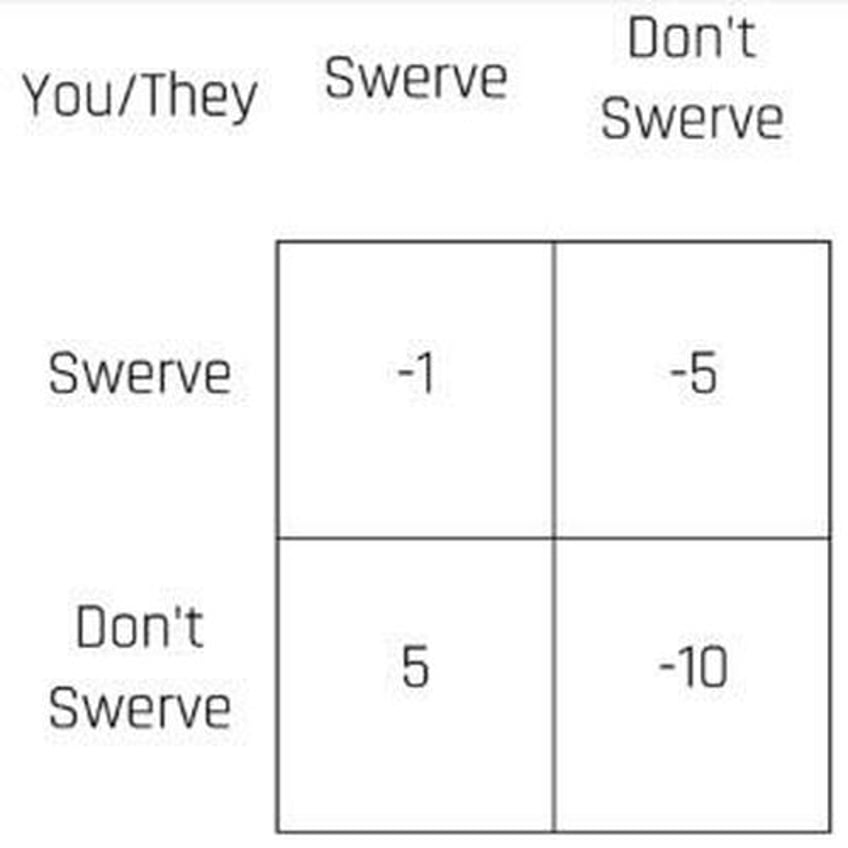

There are 4 possible outcomes. The first obvious step is to assign some “values” to these outcomes. Let’s use a scale of -10 to 10, with -10 being extremely bad and 10 being extremely good.

The “easiest” square to fill in seems to be the one in which neither side swerves. That ends in flames and death. So, let’s call it -10.

Both swerving is not really a win. You avoid flames and death, but you could have won, since the other side swerved. Let’s call this a -1. It is mildly annoying that you didn’t win, but no real consequences.

If you don’t swerve and the opponent swerves, you “won.” But what did you win? Some satisfaction, but I think it is obvious that you didn’t win as much as you lose if you really lose. So, let’s say you call a win a 5.

Similarly, if you swerve and your opponent doesn’t, you have “lost” pride more than anything. To make this a bit symmetric, to start, let’s assign a -5 to this outcome.

After this initial “analysis,” here is how “you” are thinking about the game.

You can see that it is asymmetric, at least with the values we’ve assigned.

Swerving limits how bad the outcome could be (worst case of -5 versus -10). If your opponent was equally likely to swerve or not swerve, your “expected” outcome of swerving is slightly worse than not swerving, as it is -3 vs -2.5.

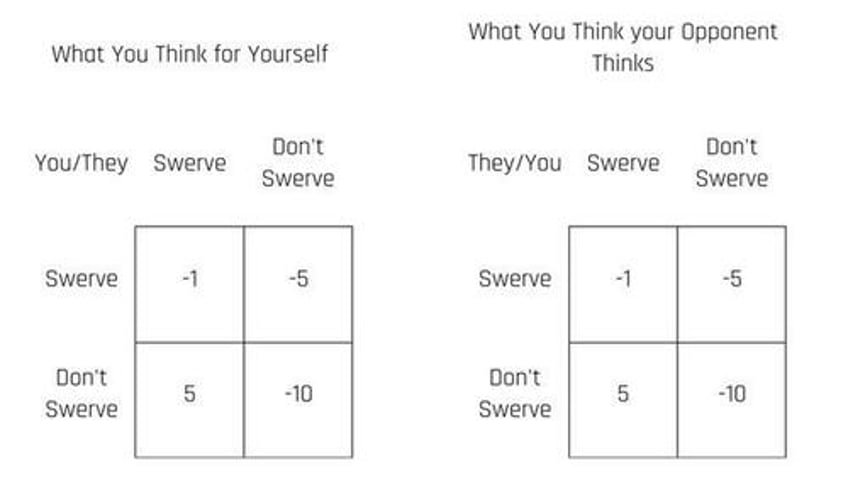

Aside from telling us that this is a stupid game to get involved in (the expected values are negative no matter what decision you make), we “know” our opponent is not random and is likely engaging in a similar decision process. For starters, let’s assume that their outcome function is the same as ours (this is called “mirroring” in the intelligence world, and is often a mistake).

Two things come out of this step:

Are you really sure about the values you have assigned to the outcomes? Maybe on a cursory initial thought, they made sense, but are they true?

Not just for yourself, but for your opponent as well.

If your tendency is to reduce the tail risk (the -10 outcome), then you would tend to swerve. However, if you think your opponent thinks like you do, they may also have that tendency, allowing you to possibly “win” by not swerving.

The already simple game has become more complex.

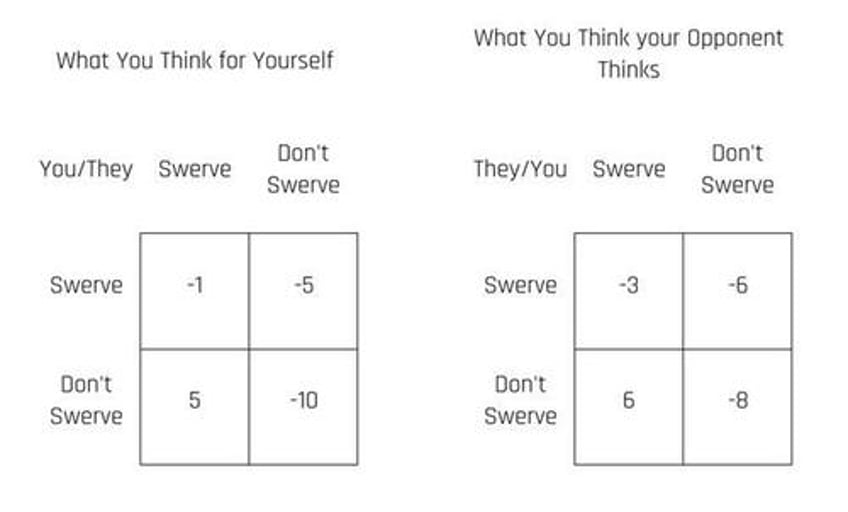

There is no reason to believe that your opponent’s reaction function is the same as yours.

That concept of “mirroring” is problematic. Let’s assume, for the moment, that you went back and reviewed your valuations and are comfortable with them (easier said than done). Then your decision will ultimately be influenced by what you really believe your opponent believes.

What if flames and death isn’t viewed as a -10 by your opponent? What if they have some reason to view that as “only” a -8? What if “bravado” or something is an important feature of your opponent, and they place greater weight on “winning” and view the outcomes where they swerve with greater disdain?

In this scenario, your opponent seems far less likely to swerve. Their “downside” is only the difference between -8 and -6. Their “expected” outcome (assuming you were 50/50 on what to do) is -4.5 if they swerve, versus -1 if they don’t swerve. You, in your analysis, probably have to start assuming the opponent is unlikely to swerve, skewing your expected outcome calculations much more in the direction of swerving (because you believe your opponent is less likely to swerve).

Winning The Game of “Chicken”

We could play with a variety of scenarios, but one theory in the game of chicken is that if you can demonstrate an inability to “swerve” you “should” win.

The example that my professor used was you make a big show of dropping a concrete block on the accelerator, tying the steering wheel into position, and then sticking your hands and feet out of the window – clearly demonstrating that you cannot swerve. The opponent, if they believe you won’t panic at the last moment, has to assume you won’t swerve. In which case, unless they have dramatically different outcome values, they should swerve.

But enough about the game theory of chicken and let’s get back to the 4 things that we came to discuss.

Russia and Ukraine

As we enter the third year of this war, the U.S. is debating what level of support to provide Ukraine.

From a “game of chicken” perspective, I think that Ukraine has already lost. Assuming that we get through this year’s process, it would seem logical for Putin to decide that next year might be the year funding doesn’t get approved. Yes, something decisive could happen during the U.S. elections, but November is a long way away right now. Putin’s logical conclusion would be to drag this out, and hope that next year, funding fails.

If the U.S. wanted Ukraine to “win” this war, it should approve a massive 5-year spending plan, that cannot be easily undone after the election. That would change Putin’s calculus. He doesn’t get the “free option” of thinking that the U.S. might tire of its spending.

For now, I expect this war to drag on.

As the U.S. election nears, both Zelensky and Putin will have to play their own games of chicken with the election results.

If it looks like a Trump/Biden rematch will be close at the polls in November, both Russia and Ukraine may gravitate towards a truce of some sort. The Ukrainians face existential risks if the outcome will ensure that funding will dry up. The Russians, as the “bad actors” in the area, can always go back to war if they like the outcome of the election, but since they are also tiring of this war that they seem incapable of winning, some sort of deal should make sense to them as well.

Status quo for now, with all parties keeping a close eye on the U.S. election.

The Magnificent 7

If I had a dollar for every time NVDA was mentioned this week, I’d have a LOT of $$$$$$s!

We went into this week having written A Retrospective of All-Time Highs on February 11th and A Market “Only a Mother” Could Love on February 19th. After the NVDA earnings came out, we published NVDA Crushes It, Nasdaq 100 Still Lower Than Friday early on Thursday.

The title of that latest report didn’t age well as stocks not only gapped higher on the open but continued their relentless push higher. On the other hand, for all the hype, all the excitement, and all the jubilation, I’m not sure who holds the winning hand right now – the bulls or the bears?

Given the excitement and hype, no one can be blamed for realizing that even with all the hoopla, the Nasdaq 100 was only higher than where it had been back on February 9th for a brief window and that didn’t occur until Friday!

Yes, if you have been fighting the market and the so-called Mag 7 for a year, it has been an epic failure. If you got in more recently and covered any shorts at all after the 3% to 5% pullback ahead of the now fabled earnings, you are probably sitting in pretty good shape!

But that isn’t the game of chicken I came to talk about.

When I look at QQQ (a Nasdaq 100 ETF with a transparent portfolio), you see that MSFT is 8.8% of that index. AAPL 8.2%. NVDA 5.6%. META and Broadcom and the two classes of Alphabet are also around 5%.

So, the game of “chicken” that I think is being played out is among active managers who are underweight those stocks relative to the index that gets so much attention (and, more importantly, the allocations).

Some managers are restricted to 5% or less in their portfolio by their own rules. But even managers who don’t have rules may find it “uncomfortable” owning so much of a stock (especially ones that have performed extremely well, outstripped the market, and have some metrics that seem to push the boundaries on some “traditional” rule of thumb valuation metrics).

How many managers have some of these stocks as their largest positions, but are still underweight relative to the indices?

That is the game of chicken that is being played out in real time. In many ways, whether we see a “capitulation” into market weight on these names, or not, will determine the next move. I find it difficult to believe, even after Thursday, that many who are underweight will change their minds now.

I’m staying bearish the market here. I will “buy the dips” but by that I mean cover some shorts, only to reload higher, but I am a fully committed U.S. equity bear here. While there is no obvious catalyst to a big move lower, I’m not sure what the catalyst higher is as we move away from the last vestiges of post-NVDA earnings trading.

On Friday, I did overhear someone on Bloomberg point out that large rallies into new highs (like we had on Thursday/Friday) have been a precursor to large downward moves in the past. I don’t have the details on that report, but I’d like to see it, as it fits my needs well!

Dancing With Myself

Since I cannot keep a beat, but enjoy dancing, I find that I have to dance to the 5 songs that seem to be at the beat I dance to. Ironically, or weirdly, or just strange, is that one of those songs is “Dancing with Myself” by Billy Idol. Anyways, felt compelled to share how I would try to “win the game of chicken” on the dance floor!

Don’t Fight the CCP

We all know that you Don’t Fight the Fed! It probably should be the first three chapters of any credible finance textbook right now. But, many seem comfortable fighting the Chinese Communist Party.

That just seems weird to me. While I don’t think China is investible longer-term (from either the asset management side of things or the corporate side of things), I think that it is tradable. Over time I don’t think the CCP will be good to foreign investors, but right now, I want to be overweight Chinese equities (overweight or max long, as my “normal” weighting to China is 0.0%).

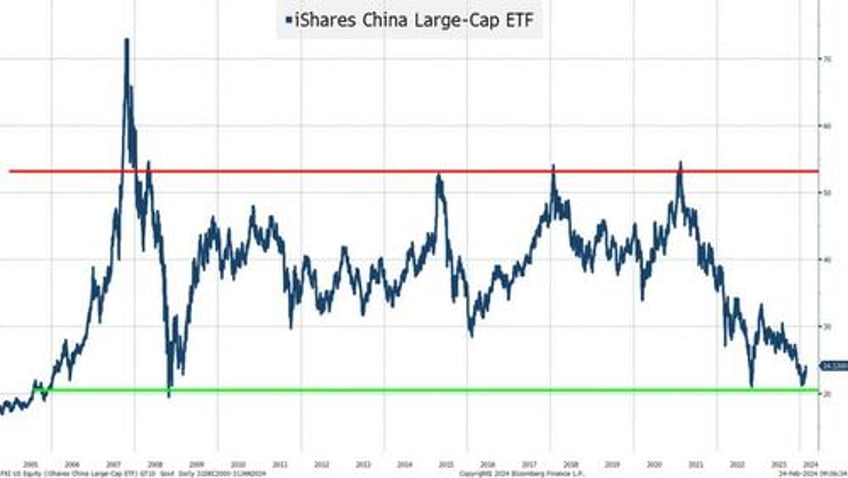

Chinese stocks (based on FXI, an ETF that is easily accessible) are at levels that required a “crisis” to achieve in the past (post-GFC and post-COVID). While I don’t like the demographics in China, I do not think they will reclaim their role as an “industrial hub” of America and Western Europe, and while I don’t think they will treat foreign investors well, I think there are several reasons to own some Chinese shares right now.

As you all know, or anyone who has been reading the T-Report for the past year knows, I am all about the transition from “Made in China” to “Made by China.” Chinese brands will attempt to sell more and more of their products globally – with Emerging Market countries (where China has a trade deficit) as the focal point. I view it more as a threat to our companies, but it should help their companies. But that isn’t the main driver of things right now. I think it is quite simple:

- China, and especially the CCP, needs to keep the middle class at least somewhat happy. We saw how quickly some protests over COVID turned China’s COVID policy around. The CCP wants to retain power, and while “suppression” is one of their tools, so is “appeasement.”

- I think that the “mistake” many are making is that we are “mirroring” (to China) what we are used to in response to financial market and economic weakness domestically. The reality is that most of the time, the Fed is the only game in town. While D.C. acted relatively quickly and aggressively in response to COVID, the central bank has usually done the heavy lifting here. So far, the Bank of China has not been as aggressive as we would have expected if they were serious about getting the market to bounce. But I think that is where we are making a mistake. I expect China and the CCP to have a multi-pronged approach. They will attack the problem from many angles.

- One pertinent point is that “normally” I laugh at efforts to restrict short selling. Yeah, you have to run for the hills briefly, but you know it will just take out the short base (which will become a dip buyer) and markets will find ways to short the things anyways (either through proxies, or some other vehicle or mechanism) and things will get worse again. I do not think that with respect to China’s efforts to restrict selling and short selling. “Where there is a will, there is a way” applies to China here.

So, in this game of chicken, I’m staying long Chinese stocks.

I couldn’t resist and I cherry picked the start date of Feb 2nd. For the month of February, FXI has done well versus the Nasdaq 100, but all we hear about is being bullish big tech/Mag 7 and bearish China. I think that is a lot like what we saw start in early November. Back then, the “laggards” had started to outperform, but it was ignored for several weeks until the trend was well in place, and only then did people jump on the bandwagon.

Nasdaq versus FXI seems like a losing game of chicken, but I highly suspect that positioning and news flow is on my side.

The Middle East

There are so many horrific “games of chicken” being played in the Middle East that I don’t know where to begin. So I won’t. I will focus on the one that I think is most important for financial markets.

That is Iran versus the U.S. Many see the two countries sitting across a chess board and moving pieces around. I see two drivers all geared up. So far away, that they look like specks on the horizon to each other. But they are travelling on a collision course and are gaining speed.

The biggest risk for markets is that the U.S. feels compelled to stop Iranian oil shipments. There are far worse things going on for people in the region, but the one thing that I think would move markets dramatically would be if the U.S. feels that they need to stop the Iranian flow of oil. That may be a relatively high hurdle (Russia still sells oil, after all), but would be the one that would send shockwaves through the market.

It is also the one game of chicken where I am incredibly fearful that we are not playing chicken properly!

- I don’t think we understand the other side’s outcome table very well. I am incredibly concerned that we are “mirroring” our own values when we think about their decisions. That would potentially be a big mistake.

- More importantly, and this is the first time we’ve discussed this, I think that we think how they think about us is wrong. That is incredibly confusing, but I think it is correct. We are trying to portray an image of power. Don’t cross this line or we will do this! And so far, we have done this. I think that the U.S. believes it has been successful in establishing fear. That the escalate to de-escalate strategy is working (see Escalation and Expansion). I am concerned that they think if they prod that line a few more times, we will “swerve.” That we don’t really have the stomach to not swerve. We are trying to convince them that we place a much higher value on not swerving than they believe we really have. I think that may be correct.

This is a game of chicken with real life consequences, and it is far from over.

Bottom Line

Maybe Goldilocks is here, but I think that the bears are quite comfortable right now too. Lots of head-to-head battles, figuratively and literally.

From a positioning standpoint:

- 10-year to trade into the 4.4% to 4.6% range.

- Start thinking about 2 cuts this year, rather than 4. The dot plot could surprise.

- Be very cautious on risk here. Equities and the big winners in particular.

- Still undecided on CRE and the banking space.

- Credit will hold in better than other asset classes but will be pushed around by equity risk and if I’m right, expect a widening in credit spreads.

In any case, it will be curious what phrase takes over the airwaves this week, though I suspect it will still be AI.