Tequila inventories in Mexico have surged past half a billion liters, approaching the country's annual production levels, as demand slows in key markets like the US. The oversupply crisis has translated into the second bust cycle for agave prices since the Dot Com crash 25 years ago.

Mexico's Tequila Regulatory Council shared data with Financial Times that showed the industry had 525 million liters of tequila in inventory, either aging in barrels or about to be bottled, by the end of 2023. Of the 599 million liters of tequila produced in 2023, about one-sixth remained in inventory.

"Much more new spirit is being distilled than is being sold, and inventories are starting to accumulate," Bernstein analyst Trevor Stirling wrote in a note. He said rising inventory levels were due to sliding demand and new distillery capacity coming online.

Stirling warned: "The tequila industry is set for a very turbulent 2025."

Tequila Regulatory Council president Ramón González said, "There is oversupply at the moment of several times what the industry needs, and probably some of these plantations won't be sold looking at the industry numbers."

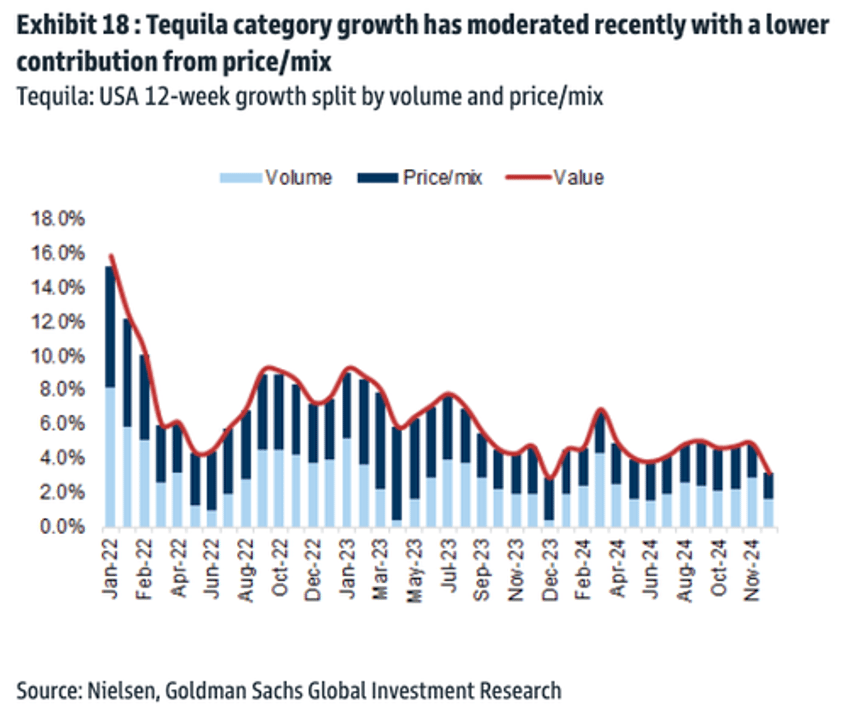

The oversupply conditions come as demand has been sliding for the past 18 months. The Covid pandemic boom in spirits has mostly faded due to cash-strapped consumers no longer being able to afford premium spirits.

On Tuesday, Goldman's Olivier Nicolaï pointed out to clients that oversupply conditions will likely boost promotional activity at the liquor store.

Demand slides...

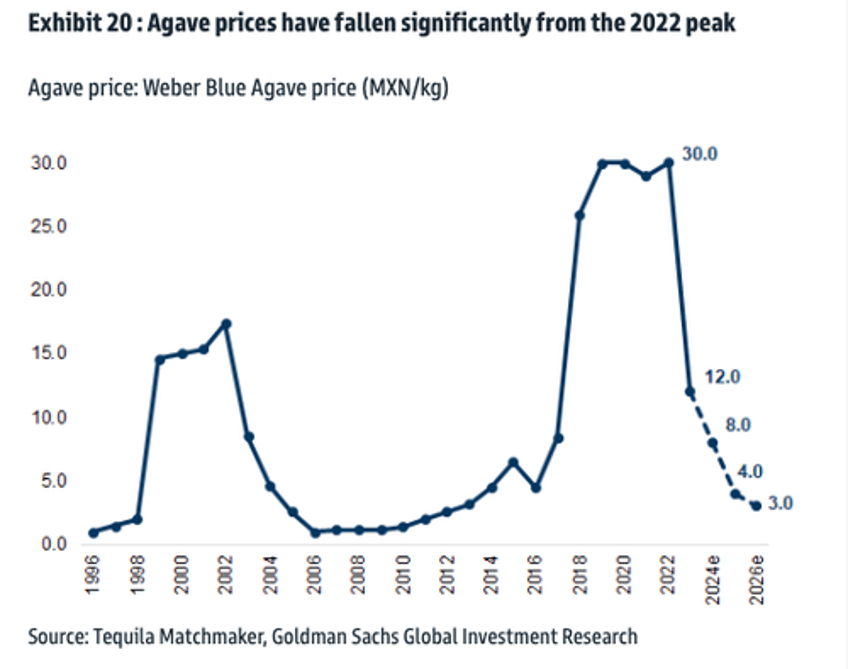

Nicolaï said the price of agave had crashed 73% from its 2022 peak - a similar plunge seen 25 years ago during the Dot Com bust.

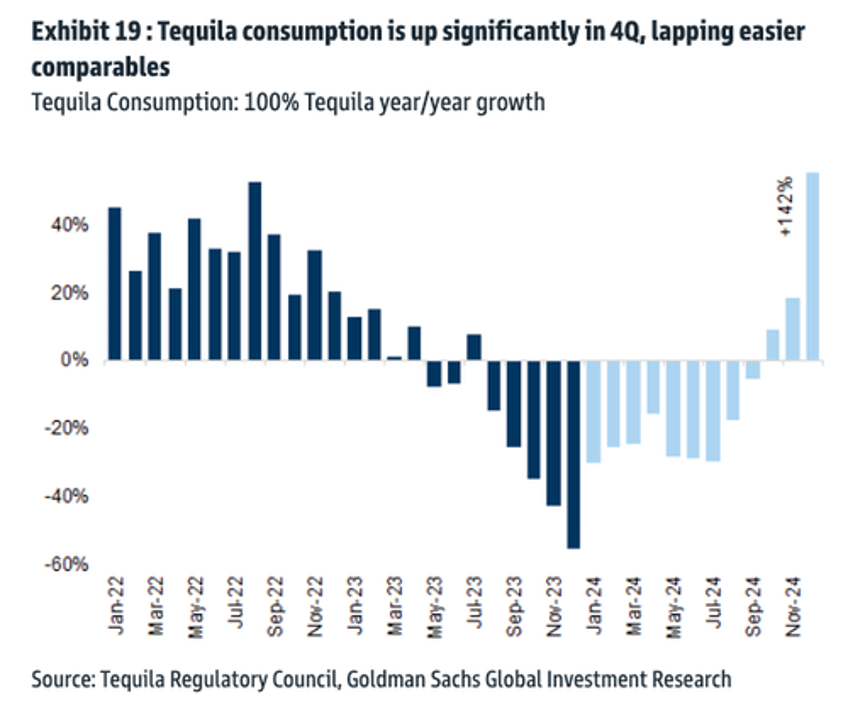

The good news is that tequila consumption jumped before and after the US presidential election following a multi-year slump.

The Bernstein and Goldman analysts both expect top tequila brands, such as Patrón and Casamigos, will ramp up promotions to counter weaker demand. This is great news for consumers.