All fiat currencies are no more than floating abstractions of value. Society has put its faith in fiat currency issued by governments. These government-issued currencies are not backed by a physical commodity, such as gold or silver, but rather by the promises from the government that issued it. A difficult question investors today face is determining which assets will appreciate most thus rising in value and which form to hold their wealth.

The value of fiat money is derived from supply and demand and the stability of the government that issues it. Over the years many promises have been made that simply cannot or will not be honored. History and many real-life examples exist that indicate that promises are easier to make than keep.

It is very possible in the near future we may see a strong bifurcation of the financial system. The Hard Asset Inflation / Paper Asset Deflation Theory laid out below is based on the idea that as wealthy individuals begin to realize the fragility of the current financial system they will shift their investment preferences to items of substance.

This repositioning of wealth in assets could occur rather rapidly during a period of inflation. If such a revamping of how the wealthy invest takes place it could drastically add to any inflationary trends. In short, some investments would fall like a stone while others soar. Imagine real estate doubling in value while pensions are cut and stocks falter. This dovetails with my theory the Fed should be ecstatic so many people have been willing to invest in intangible assets because it has helped to minimize inflation.

While real estate is normally valued by the amount of income it can generate, this could change. Other factors exist such as replacement cost. The way things are taxed also plays a big part in this game. Another problem with many hard assets is they often require constant protection from the threat of theft. Regardless, the biggest factor we face is that it can be difficult to get out of the paper promise arena and into real assets. Reality places at risk all those pensions, stock holdings, and dollar signs held in banks and stored on computer files in some cloud.

This issue of perceived value is put under a microscope and comes front and center with the realization many of the promises that have been made cannot be fulfilled. This all flows into what we buy and where we buy it matters. For years much of the wealth people earn has been flowing into paper assets and promises. There is a strong possibility this is not only about to stop but reverse as people realize the fragility of our current system.

When it comes to inflation, it appears the lag effect has begun to catch up to the figures we see. The easy inflation comparisons due to the base effect are coming to an end, now begins the battle of forces that determine the "price of everything." This is best seen in the service sector which is beginning to impact the Producer Price Index (PPI). This index is a measure of inflation at the wholesale level. It measures the average change over time in the prices domestic producers receive for their output.

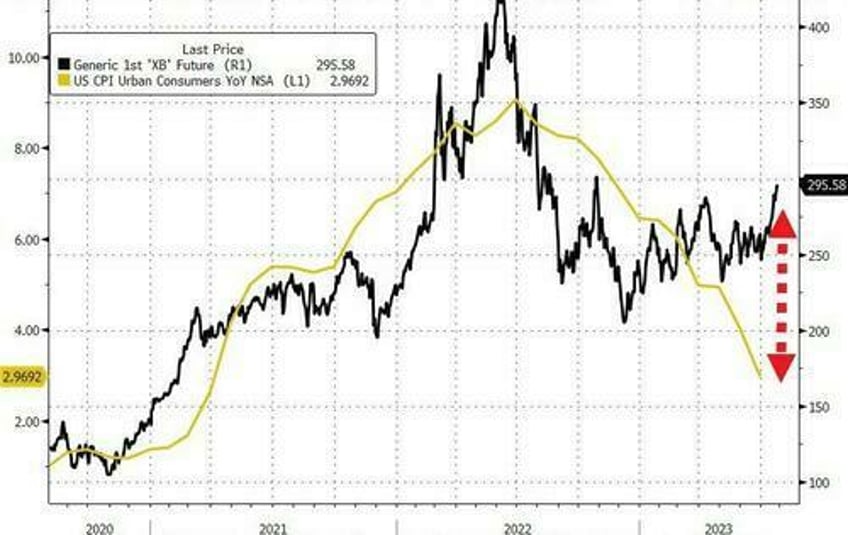

One of the best indicators of where inflation is going is the cost of gasoline and energy in general. The chart below indicates we are likely to see inflation kick back up over the next few months.

Many trends tend to go on for years. Still, nothing goes on forever, the overriding issue is what happens when and if there is a "tipping point." Central banks have been able to set interest rates for a long time but logic dictates they are not in a position of ultimate power. The markets have the potential to take the power of setting interest rates away from the Fed and central banks, this would change everything. The central banks are powerful but the markets hold the ultimate power of what happens.

It is important to consider the duration of a recession can be more important than its depth. How the Fed fights a recession also matters. We can expect the government to go into a super spend cycle but how the Fed accommodates this is also a factor in how things play out. It could be argued that consumers are choking on durable goods after the last wave of spending.

Considering the Fed is in a full-court press to halt inflation many people will miss the validity of this theory. It is important to remember inflation is uneven and supply and demand matter. Many people are praying and hoping for a return to ZERP and easy money. This is what they expect when they talk about Powell being forced to pivot. Some of us more focused on the long-term investment environment believe higher interest rates and inflation are here to stay even if prices occasionally drop before popping higher.

The MMT, Modern Monetary Theory or, More Money Today has already brought a lot of pent-up demand forward. It has also created a great deal of debt. Our tendency to view things as continuing as they have creates a recency bias that can blind us to future changes. It is normally infinite supply assets and those tied to scarce assets like energy that stay with the real rate or outpace true inflation. This means that while any country printing its own money may not default on its bonds in technical terms it can nominally through currency devaluation. This a real wealth killer.