If you want to understand the direction of debt, rates, the USD, inflation, risk asset markets, gold and the US endgame, it might be better not to listen to the experts.

In fact, Johny Cash is a far better source…

Five Feet High & Rising

In a classic 1959 tune by Johny Cash, the singer asks: “How high’s the water mama?”

This question is then answered by a riff which chants, “she said it’s two feet high and risin.’”

And with each subsequent refrain, the water level goes to three feet, four feet and then five feet, “high and risin’.”

In short: An obvious flood.

And when it comes to debt in the land of the world reserve currency, Johny Cash may have something to teach Jerome Powell and the other DC children drowning the US (and its debt-soaked Dollar) into a slow but steady debt flood.

Boring?

I’ve often said that good journalism, like honest economics, is boring.

One has to understand “hard” indicators like bond yields (which move inversely to bond price) and the high-school level basics of supply and demand forces.

But as I’ve also said countless times, and will say countless times more: The bond market is THE thing, because bonds are all about DEBT.

If you understand bonds, and in particular, the Fed’s hidden (real) mandate to save Uncle Sam’s sovereign IOU’s from sinking in price, then you will be able to easily foresee (rather than date predict) the future of risk assets, gold, BTC, the USD and yes, inflation.

The complex truly is that simple.

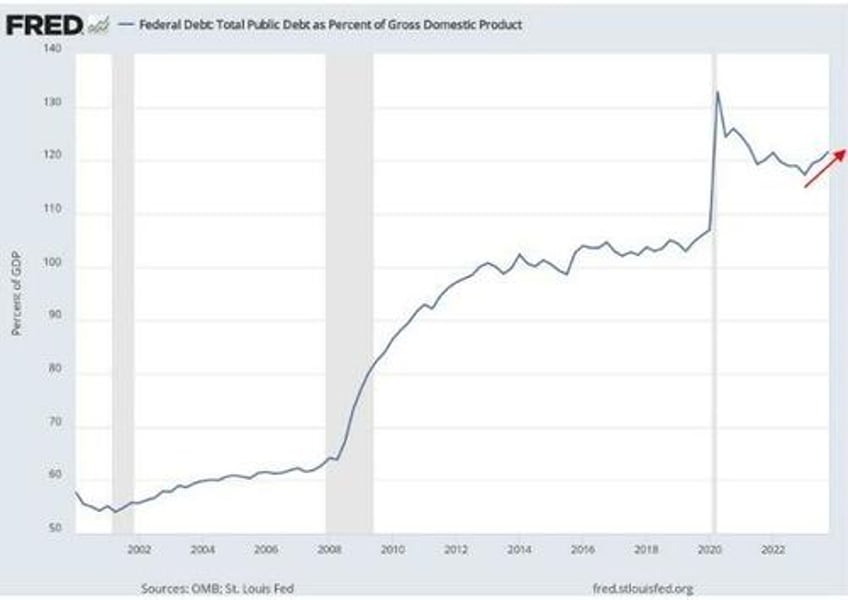

How High’s the Debt Mama? 120% and Risin’

And if you turn to Johny Cash and ask “How high’s the debt level mama?” well… the blunt answer informs just about everything you need to know.

So, let’s keep it simple.

Simple, Not Boring

Debt is WHERE it all begins, and it tells you exactly HOW the American song ends.

And just how high is the water (debt) mama?

Ten years ago, US public debt was $17T “and risin’.”

Today it’s $34.5T “and risin’.”

America’s debt to GDP is 120%, its deficit to GDP is around 6%, and every 100 days we add another $1T in borrowing to our shameless bar tab of debt addiction masquerading as capitalism.

Even our own Congressional Budget Office will confess that unless we issue more debt (and print more debased money to monetize it), our Medicare and social security piggy bank will be empty by 2030.

Meanwhile, the USA is staring down the barrel of $212T in unfunded liabilities yet only $190T in assets.

In other words, and based on objective math, America literally has the balance sheet of a banana republic.

No Crisis?

Apologists (i.e., truth and math-challenged politicos), however, will tell you there is no crisis, even as the water levels rise past our closed eyes.

The clever ones will remind us that America’s USD comprises 85% of FX transactions, the vast bulk (80%) of international trade settlements, and is in constant “milk-shake” demand from the Eurodollar, derivative and SWIFT payment systems.

In other words, the Dollar is gonna be just fine.

Hmmm…

Facts vs. “Just Fine”

As warned from day-1 of the myopic (and suicidal) sanctions against Putin in which the US weaponized the world reserve currency, those days of a “just fine” USD simply ended.

Not all at once, but slow and steady, like a flood’s water line…

In just 2 years, we’ve seen undeniable signs of de-dollarization from the BRICS+ nations and an extraordinarily telling shift in the petrodollar dynamics (20% of 2023 global oil sold outside the USD), which would have been otherwise unimaginable in the pre-sanction era.

But, if you remain convinced that America and its reserve currency have magical immunity from the de-dollarization’s slow drip greenback demise, let’s get back to the oh-so boring but oh-so honest cries of the US Treasury market.

Why?

Again. Because the bond market is everything.

As important, the bond market has everything to do with debt, and current US debt is drowning the nation and diluting the USD, one slow trillion at a time.

Sound sensational?

Pounding A Fact-Based Fist

For years, I have pounded my fist reminding readers and viewers that debt destroys nations and currencies. Every time, and without exception.

And for years I have pounded my fist saying the Powell’s “war on inflation” was a ruse, as every debt-soaked nation needs to debase its currency to inflate away debt.

And from day-1 of Powell’s claim (lie) that inflation was “transitory,” I’ve been calling his bluff.

For years, I’ve argued that the Fed would simply lie about inflation (i.e., grossly under-report it) in order to make it appear statistically lower than what we actually knew/felt it to be.

Even Larry Summers, who is the classic arsonist (from his repeal of Glass-Steagall to deregulating the derivatives markets) now playing at fireman, has publicly stated that the actual US CPI scale, using pre-1983 housing methods, peaked last year at 18%, not the official 3.7% range…

If we then tack on a US debt/GDP ratio that is 30% higher today than in 2009, we mathematically see that despite Powell’s repressive “higher-for-longer” rate polices, we’ve made zero dent in our debt—instead, we’ve increased it.

In other words, our war against inflation is a loss; and our debts have increased.

And in the last couple of years, I’ve been pounding my fist that Powell would pivot from rising rates, to pausing rate cuts to eventually cutting rates followed in turn by outright money printing (or rather mouse-clicking Dollars) to “pay” Uncle Sam’s debt at the expense of our currency via what Luke Gromen calls “super QE.”

And all modesty aside, I think I/we have been right…

Right or Wrong?

Already, and as of last week, Powell has openly projected rate cuts in 2024, and they are likely to come by or near September.

We’ll see.

For now, just the promise (words) of rate cuts have been enough to send Pavlovian (Fed-dependent) markets to all-time-highs despite a real economy already under water.

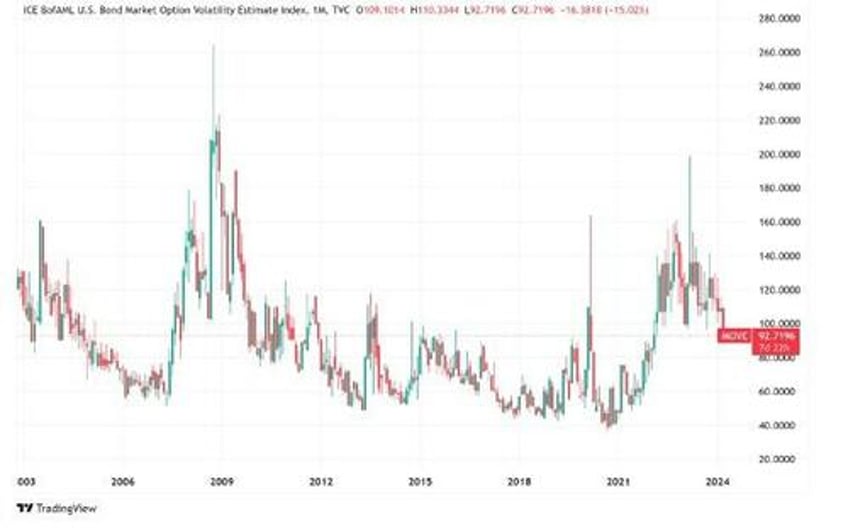

And the subsequent decline in the Market Option Volatility Estimate (“MOVE” Index) was a neon-flashing sign that the market is getting ready for a new flood of dollar-diluting liquidity…

Where’s the QE, Matt?

But what about my forewarned QE?

What about that ultimate moment when Powell admits full defeat in his so-called “war” on inflation (while quietly seeking inflation) and openly does what many off us (nod again to Luke Gromen et al) already know he will do, that is: Debase the currency to “save” a rigged-to-fail (i.e., debt-based) USA?

Clearly, it seems, I/we have been wrong about that QE, no?

Well…Not so fast.

Coming Through the Back Door

In fact, Powell, along with his former Fed colleague-turned-mind-numbing Treasury Secretary, Janet Yellen, have been doing un-noticed back-door QE at staggering levels too complex (or obvious) for the mental midgets in our so-called main stream media to even notice.

Shocker? Hardly…

Facts Are Stubborn Things

The fact is that five times in the last four years, DC has been doing QE by just another name (what I call “backdoor QE”) to avoid the embarrassment of direct QE.

Notwithstanding the “not-QE” (which really was QE) in 2019 when the Fed bailed out a cash-dry repo market (which, by design, no one understood), the DC magicians have been doing trillions worth of QE-like liquidity measures without having to call it, well QE…

That is, the Fed and Treasury Dept. have been pulling liquidity out of the drying Treasury General Account, the now retired “BTFP” measures, and the intentionally confusing reverse repo markets.

More recently (and equally as well intentionally confusing to the masses), the Fed is quietly on the verge of allowing the Fed banks to use unlimited leverage to buy unlimited amounts of USTs off the Fed’s balance sheet via the removal of what the fancy lads call “Supplementary Reserve Ratios.”

This latest trick, by the way, is just off-balance sheet QE, and yet another symptom of the big banks becoming branch offices of the Fed, as our already centralized America becomes even more grotesquely, well…centralized, which is a classic symptom of a desperate and debt-soaked regime.

But just in case none of the foregoing tricks of backdoor QE have convinced you of what basically amounts to just QE, we can get our clearest signals from—you guessed it: THE BOND MARKET.

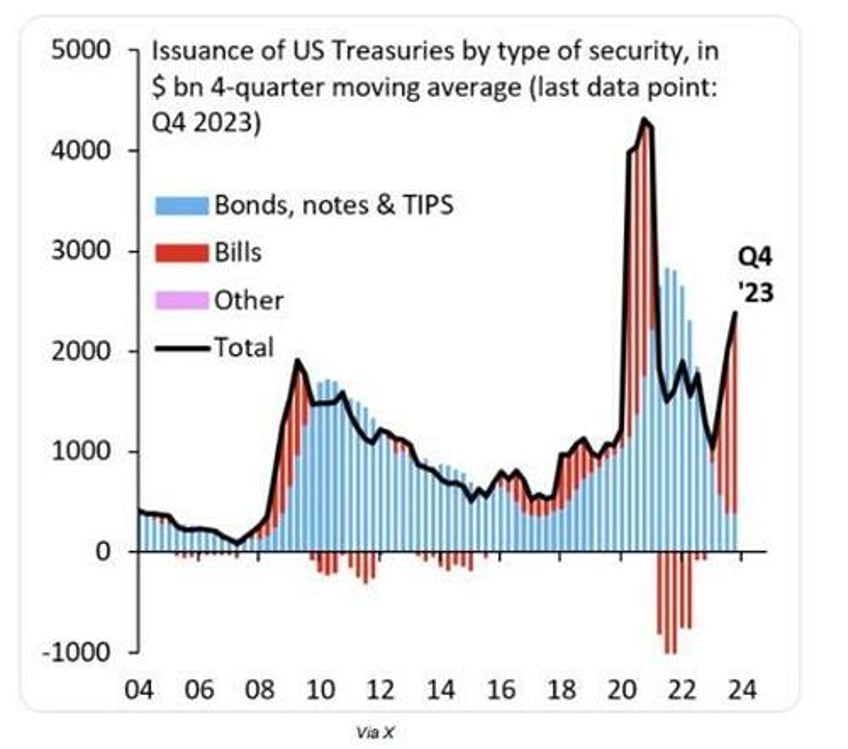

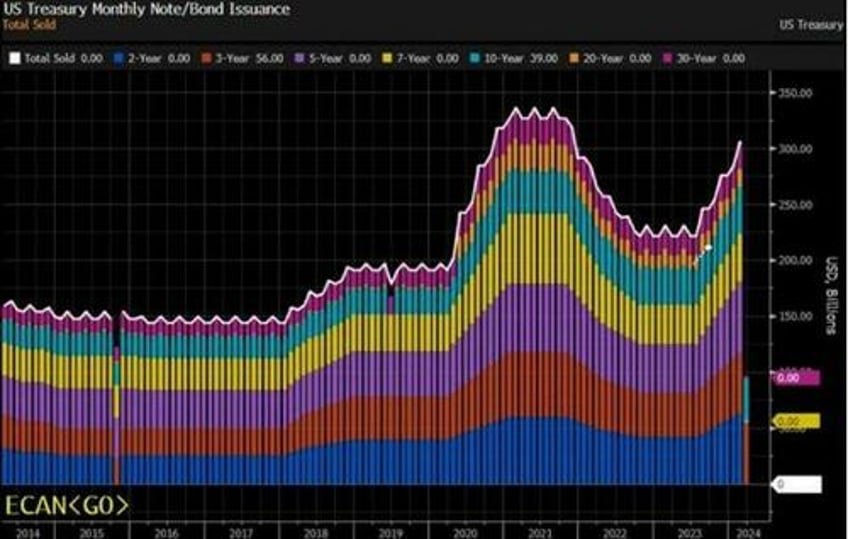

That is, one of the most obvious examples of “backdoor QE” is the Treasury Department’s open yet ignored trick of issuing most of its recent debt from the short duration end of the yield curve.

What The T-Bills Are Saying

By issuing more short-term IOUs in the form of T-Bills, this takes the supply-push inflation pressure off the openly unloved 10Y USTs, whose price declines (and subsequent as well as fatally unpayable yield/rate spikes) not only crushed regional banks, but Uncle Sam’s wallet as well.

OK. Yield curves and duration implications may sound, well… boring, but stick with me because this really, really matters.

The extreme levels of T-Bill issuance (as opposed to 10Y IOUs) has immense implications and is a flashing neon sign that the US is not heading into an economic crisis, but is in fact, ALREADY in a crisis.

Today, T-Bill issuance is at a two-decade high, and comprises greater than 85% of all US Treasury issuance.

This short-end issuance is far more like QE, i.e. simple money printing—which, we remind you, is highly inflationary/reflationary.

Hard to believe? See for yourself:

The last time we saw such QE-like desperation from the T-Bill side of the yield curve was during the Great Financial Crisis and the COVID crisis.

No Crisis? Huh?

But according to our so-called “leaders,” we are not at all in a crisis today. As they keep reminding us, we are at “full employment” (eh-hmmm) and nominal GDP is growing at 6%.

Then again, nominal GDP “growing” on the back of over $23T in UST issuance (bonds, notes and bills) is simply debt-driven “growth,” and debt-driven growth is not growth, it’s just debt.

In short, and as Luke Gromen concluded far better than I: “You know the debt crisis is real when the US resorts to short-term debt issuance.”

Summing Up

Whenever one is dealing with truth-challenged profiles like the Fed, Treasury Dept or White House, it is far better/simpler to watch what they do rather than what they say, as the difference is approximately 180 degrees…

All of the evidence above (from debt levels, de-dollarization trends, petrodollar shifts, backdoor QE measures and T-Bill over-issuance) screams of an open and obvious debt crisis which ALWAYS indicates a consequent currency crisis.

Always.

And as I have said for years, including a public discussion with Brent Johnson, the US can’t afford a strong USD because its debt levels require a weaker, inflated USD, regardless of its “relative”/DXY “strength.”

The string cite of evidence above (and beyond just rate cuts) is simply a cleverly veiled way of the Fed and Treasury telling us they want (need) a much weaker USD to save their necks at the expense of the dollar in your portfolio, checking account or wallet.

Gold, of course, is sniffing this out.

So are the stock markets and BTC.

So are the global central banks, who are stacking gold and dumping USTs at record levels.

The COMEX and London exchanges are also sniffing this out, as physical gold and silver is going from churn motions to actual physical delivery at record levels.

Meanwhile, even the BIS has made gold a Tier-1 asset.

Just saying…

The empirical (rather than “sensational”) evidence of an unloved UST and distrusted (debased and weaponized) USD is there for all who have eyes to see and ears to hear.

Gold has hit all-time-highs (and will go much, much higher) simply because the USD is going much, much lower.

But, of course, no one in DC will say the quiet part out loud.