By Goldman trader Paolo Schiavone

Key Events - Global Week Ahead: Fed and ECB, Lunar New Year, 20% S&P Earnings

- Monday : China industrial profits and PMI, Germany IFO , US new home sales, Lagarde speak in Budapest, Bessent confirmation. 3rd Feb first QRA.

- Tuesday : US consumer confidence, durable goods, Informal dinner Lagarde and Von der Leyen. GM, Starbucks results.

- Wednesday : Fed, Brazil and Canada rate decision, Spain GDP, Tesla, Microsoft, Meta, ASML earnings, Reeves speech in Oxfordshire, BOJ minutes

- Thursday : ECB, Apple, CAT, Visa, UPS Deutsche Bank, Shell earnings, US Q4 GDP; RBA Jones speaks, BOJ Himino speaks.

- Friday : France CPI, Germany CPI, unemployment, US personal income, PCE inflation, employment cost index, Samsung earnings, Bowman remarks.

Trading markets

- The plethora of events suggest x-asset vol is likely to be back next week. It’s Fed vs Mag7 earnings

- Very opportunity-rich environment if you’re quick on the trigger. But also, plenty of bad volatility (in as, not fundamentally driven, hard to forecast).

- So, you need to be nimble, size at half-75% of normal. Strong convictions weakly held. Weak convictions expressed in a risk efficient, premium down format.

Framework: Technical, Flows, Positioning. Valuation, Sentiment.

- Technical 30% : Top of the channel for US Equities/ Europe Breaking out / Oil and Copper at support / Momentum in bonds sell off seem to have calmed.

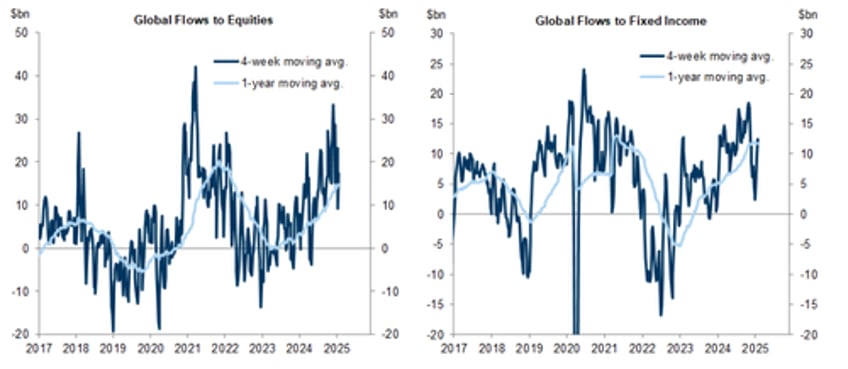

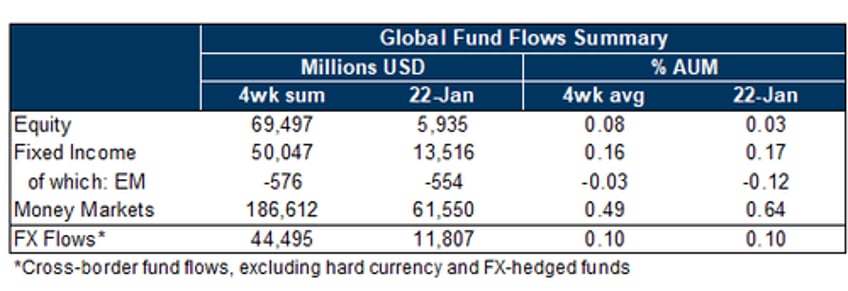

- Flows 30% : Global equity funds slowed (+$6bn vs +$13bn last week). Fixed income stronger demand (+$14bn vs +$11bn last week). EM negative flows. FX , USD demand.

- Positioning 20% : Cleaner in Equities/ FI/ FX. Tariffs, strong earnings, healthy thematic, supportive macro have left clients with limited convictions.

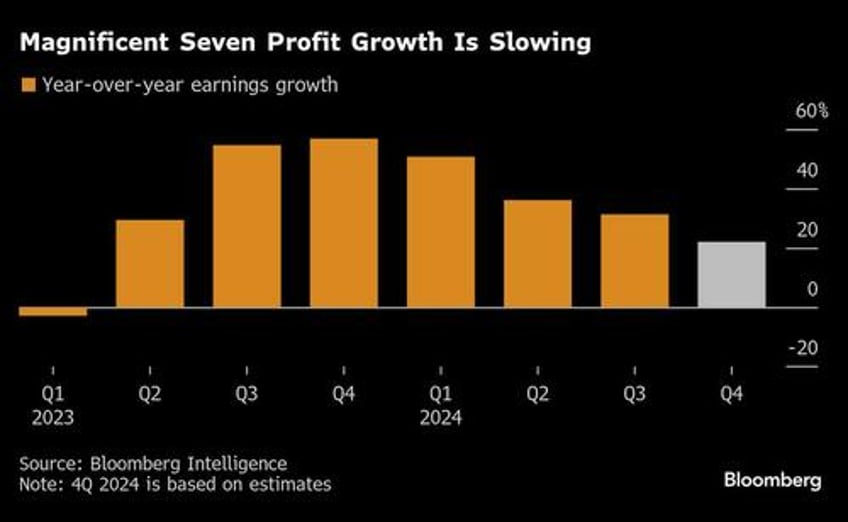

- Valuation 10% : Low Equity Risk premia / Neutral for bonds. Would say not very high for the Mag7 given the reset in EPS expectations. Bonds

- Sentiment 10%: AAII stretched, GS Neutral. Despite one of the largest USD weekly drawdowns in years still constructive in Equities, Short oil, Neutral bonds.

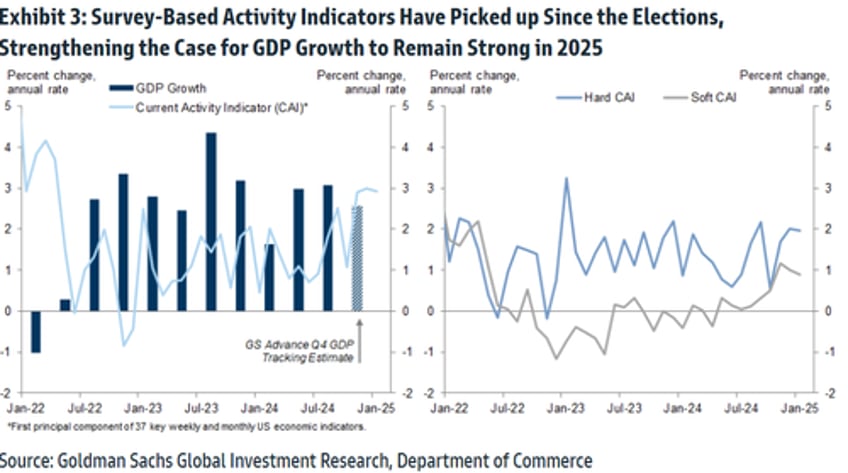

Fed view: We are pricing, 7 for March ,14 for May 25 for June. We view “market pricing as a probabilistic statement about possible Fed paths in coming years is too hawkish”

Interesting Trades:

- Fed- Dovish vs pricing- Rec SFRM5Z5

- Rec BOC meeting on Wed- 25 or more than 0

- Deepseek- low quality dip on Nasdaq. Buy dips in NQH5

- Earnings: ASML short MSFT long/ Meta long

- Earnings: Oracle/ Microsoft/ Amazon vs NVDA

- Long Copper into Chinese seasonality and Lunar new year destocking.

Weekend News flow:

- Trump ridicules Denmark and insists US will take Greenland – FT

- Meta's chief AI scientist says DeepSeek's success shows that "open source models better vs proprietary ones"

- President Trump said he wants to "clean out" the Gaza Strip and urged Jordan and Egypt

- German Election Taboos Broken as Merz and Musk Flirt With AfD

- Baltic Sea data cable damaged in latest case of potential sabotage

- Reeves seeks to unlock billions from UK pension schemes for investment- FT

Charts:

Chart 1 GS Flow of funds last week:

Chart 2: Mag Seven: EPS expectations slowing- buying opportunity on a lower bar ( BBG)

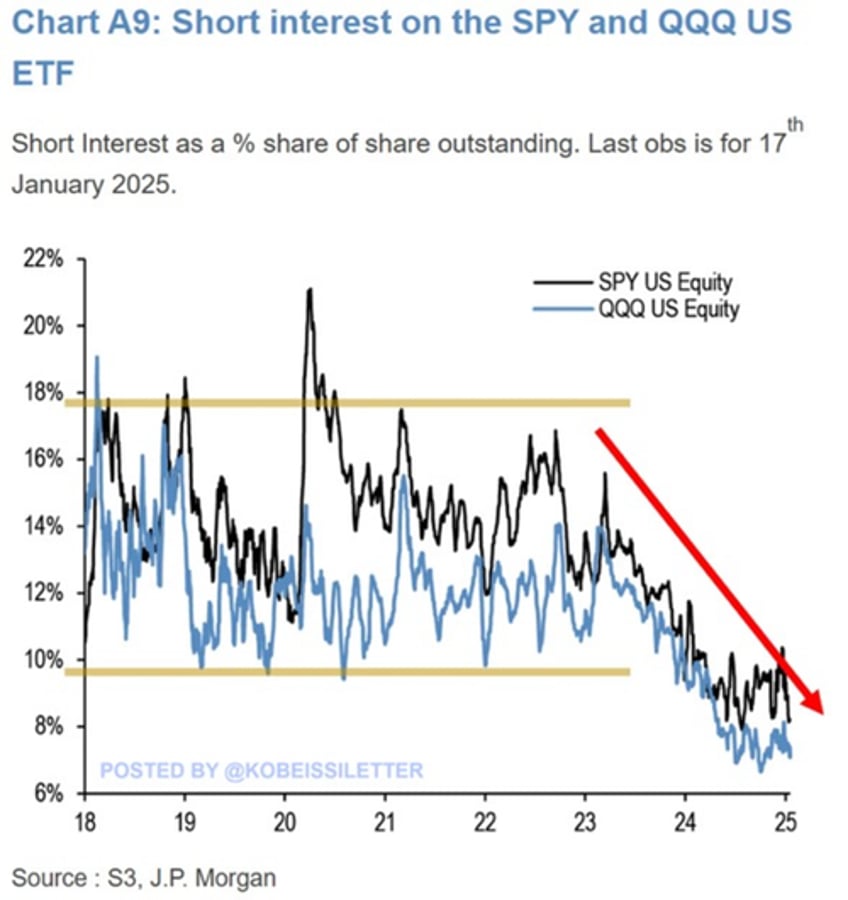

Chart 3: SPX short and USD shorts capitulation was at full speed.

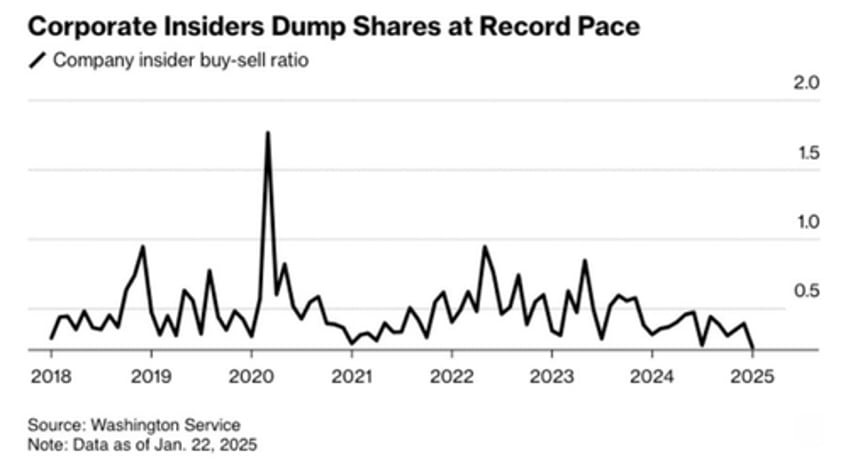

Chart 4: Corporate Insiders are dumping shares at the fastest pace in history (data going back to 1988)

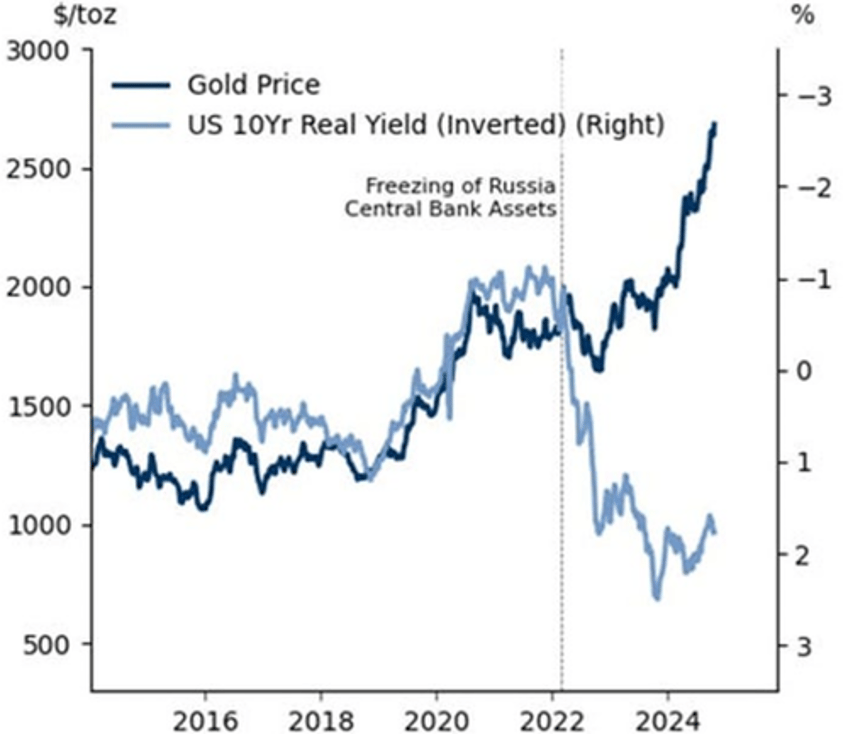

Chart 5: Gold continues to be one of the highest conviction/ trend trades out of the gates in 2025. (Goldman)

More in the full Goldman note available to pro subs.