By Michael Every of Rabobank

The Fed Chair’s dovish Jackson Hole speech was analysed pithily by our Fed watcher Philip Marey: “Regarding the Fed’s initial diagnosis that inflation was “transitory”, Powell tried to hide behind other economists who were also wrong: “The good ship Transitory was a crowded one, with most mainstream analysts and advanced-economy central bankers on board.” This is the classic sharing the-blame defence of failing economists, but totally inappropriate for the world’s leading central bank with the largest staff of economic researchers in the world, holding PhDs from America’s most prestigious universities. Even a modest Dutch bank could see that the Fed was going to be blindsided by inflation.

Powell has already concluded that the Fed has brought down inflation while preserving labor market strength. This may be a bit premature, given the unemployment rate is rising so fast that the Sahm rule has already been triggered, and the lagged effects of restrictive monetary policy could still materialize in the coming months. Instead, Powell was patting himself on the back. He concluded his speech with, “The limits of our knowledge --so clearly evident during the pandemic-- demand humility and a questioning spirit focused on learning lessons from the past and applying them flexibly to our current challenges.” Humility? This speech reflected hubris, not humility.”

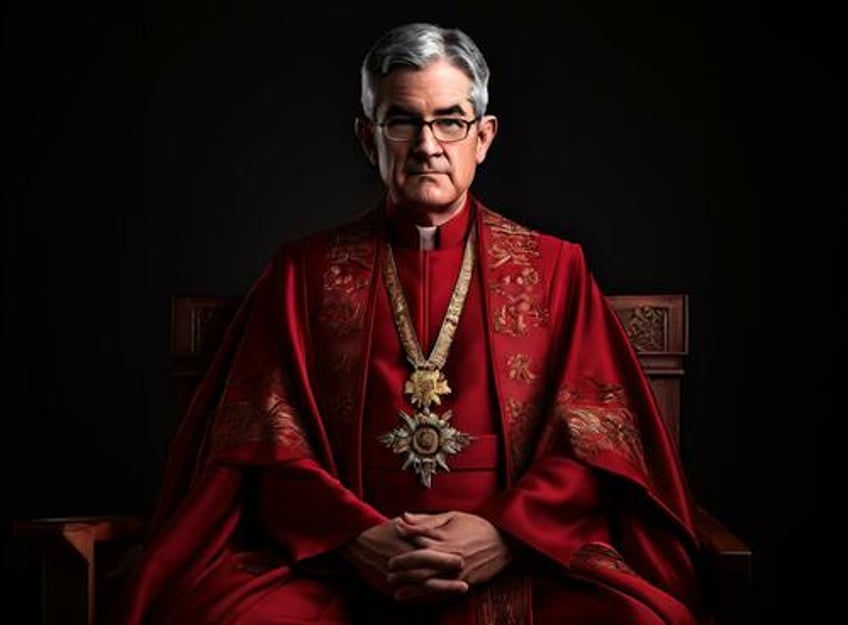

Indeed, the Fed Chair pivot to “do-everything-we-can” rate cuts, ostensibly with inflation beaten, and as a friend-of-labor --‘The Powell of the Powerless’-- and markets swallowing it, makes me think of a political essay with a similar name. In 1978, just before the Fed got serious on rates under Volcker after years of crash and Burns, then Czechoslovak dissident Havel wrote ‘The Power of the Powerless’, showing how to resist an all-pervasive “post-totalitarian” system. In 2024, with a light edit on my end, Havel’s text is also a tongue-in-cheek critique of the assumption that the all-pervasive Fed won’t be resisted ahead:

“Our system is not limited in a local, geographical sense; rather, it holds sway over a huge power bloc controlled by one of the two superpowers… It commands [a] precise, logically structured, generally comprehensible and, in essence, extremely flexible ideology that, in its elaborateness and completeness, is almost a secularized religion… In an era when metaphysical and existential certainties are in a state of crisis, when people are being uprooted and alienated and are losing their sense of what this world means, this ideology inevitably has a certain hypnotic charm… [Its] mechanisms for wielding power are for the most part not established firmly, and there is considerable room for accident and for the arbitrary and unregulated application of power…

A portfolio manager places in his email the slogan: RATE CUTS! Why does he do it? What is he trying to communicate to the world? Is he genuinely enthusiastic about the idea of lower rates? Is his enthusiasm so great that he feels an irrepressible impulse to acquaint the public with his ideals? Has he really given more than a moment’s thought to how such rate cuts might occur and what they would mean?...He put RATE CUTS! into emails simply because it has been done that way for years, because everyone does it, and because that is the way it has to be. If he were to refuse, there could be trouble. He could be reproached for not having the proper decoration in his email; someone might even accuse him of disloyalty. He does it because these things must be done if one is to get along in life. It is one of the thousands of details that guarantee him a relatively tranquil life “in harmony with society,” as they say…

The slogan is really a sign, and as such it contains a subliminal but very definite message. Verbally, it might be expressed this way: “I, XY, live here and I know what I must do. I behave in the manner expected of me. I can be depended upon and am beyond reproach. I am obedient and therefore I have the right to be left in peace.” This message, of course, has an addressee: it is directed above, to his superior, and at the same time it is a shield…”

Of course, individual incentives for groupthink in markets are clear; “Stay alive ‘til 25” is a mantra for many praying for rate cuts; and the belief 2021-24 was a “long transitory” inflation aberration before a return to ZIRP and QE still holds sway with many. Yet that doesn’t mean the Fed’s ideology isn’t projecting an ideological ‘reality’ inconsistent with the facts: inflation is beaten… when over target, especially in services; the labour market was strong; now it’s suddenly cooling… yet the Fed can forecast the economy; and it cares about labour… after being prepared to see rising joblessness to cap inflation, worrying about high wage growth, and surely knowing mass low-wage, illegal immigration was underway for years.

Havel notes a post-totalitarian system “has a natural tendency to disengage itself from reality… Because the regime is captive to its own lies, it must falsify everything. It falsifies the past. It falsifies the present, and it falsifies the future. It falsifies statistics… It pretends to fear nothing. It pretends to pretend nothing. Individuals need not believe all these mystifications, but they must behave as though they did, or they must at least tolerate them in silence, or get along well with those who work with them. For this reason, however, they must live within a lie. They need not accept the lie. It is enough for them to have accepted their life with it and in it. For by this very fact, individuals confirm the system, fulfil the system, make the system, are the system.”

In 1978, Havel’s power of the powerless was a Czechoslovak greengrocer not putting an official sign saying, “Workers of the world, unite!” in their state-run shop window. In 2024’s Western free(ish) society and free(ish) markets “there are always certain correctives that effectively prevent ideology from abandoning reality altogether.” Here’s some samizdat for those wanting to dissent:

- August payrolls are key: a weak number may see markets price a 50bp September Fed move, but would also prompt concern about corporate earnings. Yet what if we get a stronger print?

- Powell didn’t address China’s deflation and mercantilism, which help make US inflation look “transitory.” Yet were Beijing to switch to stimulus alongside Fed rate cuts, as pressure is lifted off CNY (chatter now of a $1trn inflow to China if so), global commodity prices would leap.

- High Fed rates and a strong dollar capped commodity prices too, but WTI oil rose 2.5% Friday and another 3.0% Monday – coincidence, warning, or both?

- Massive new liquidity flowing into the global system means asset price inflation: hooray - but that will create political problems as the powerless and assetless get restless.

- Then there’s (geo)politics. If Trump wins, tariffs, tax cuts, and a smaller US labor force follow, and inflation rises; Western voters seem discontent with high immigration, without which wage growth rises; the Houthis blowing up an oil tanker underline Suez isn’t coming back as a global trade conduit; Israel and Hezbollah came closer to war before the latter blinked; Libya stopped oil exports; Russia saw more refinery damage; Canada put 100% tariffs on Chinese EVs and steel; China is considering tariffs on EU autos; and its controls on and stock-piling of rare earth minerals are pushing up the prices of key inputs for vital silicon chips.

- On the downside, the IFO warned the German economy risks slipping into “crisis” ahead of September regional elections that could make it look ungovernable; France has no government, and President Macron won’t allow a left-wing one; and the new UK Prime Minister is singing “Things can only get worse before they get better”, while media say violent offenders are being let off prison sentences if they say “sorry”, while anti-immigration rioters can all find cells.

- Central banks who’d cut dovishly before Powell (i.e., the BOC, RBNZ, ECB) were already seeing their currencies rise the dollar rather than sink: are they happy about more exchange-rate deflation pressures, or worried about loss of exports if global growth slows?

If the Fed cuts, then has to hike again, the current decade, like the one fifty years before it and the one forty years before that, risks marking the failure of not just the Fed’s reputation, but our global system and its “because markets” ideology. In the 1970s, we moved past high inflation via much more debt, much more globalisation, and inflation targeting. Today, that trinity looks impossible to return to. So, what next? Nobody at the Fed, and few in markets, are willing to talk about these huge downside risks, just the apparent downside for rates ahead. Havel had a few things to say about that, as I just showed.

Yet if the Fed has to cut again more than expected, things also look ugly. A recent Kansas City Fed paper explains central banks and governments can coordinate on a ‘safe debt’ regime that insures bondholders or a ‘risky debt’ regime that insures taxpayers; monetary dominance (QE) = safe debt, fiscal dominance (and no QE) = risky debt. Tellingly, it then concludes “high-frequency evidence shows the risky debt regime is a better fit for the recent US Treasury market experience as well as the experience of other advanced economies. Large unfunded spending shocks trigger large adjustments in the valuation of the government debt portfolio, even in a well-functioning bond market.” There’s a major Fed warning about fiscal spending at a time when austerity seems impossible or improbable. Of course, the above was against a backdrop of high rates and QT as well as huge fiscal deficits, and if we were to go back to ZIRP and QE then logically we would also be back to ‘safe debt’ again (and taxpayers, shmaxpayers).

However, we wouldn’t be in a safe currency regime. Or, as a result, a safe global trade regime. Or, logically, a safe inflation regime. So, if the global system sees another major crisis, the go-to answer of ZIRP and QE just creates massive new problems, not a replay of 2008-2020.

In short, the key danger for markets is that while all they want to hear is ‘finally, Fed rate cuts!’, the FOMC Chair may yet show himself to be “The Powell of the Powerless”, in that he can’t do what he and they want.

Then the Velvet Revolution, or the Velvet Divorce, may really start.