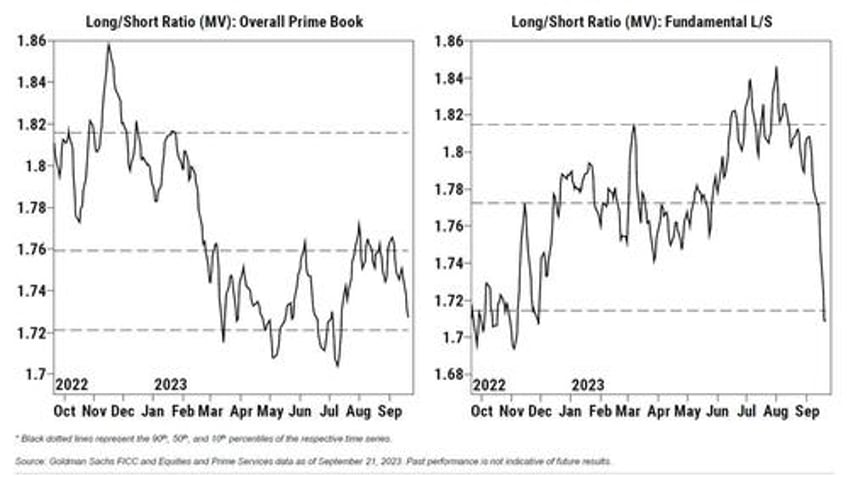

Over the past few weeks, we warned that as a result of the unprecedented surge in hedge fund short positioning in (increasingly illiquid) US stocks, which pushed the Long/Short ratio among fundamental hedge funds to the lowest level this year...

... a short squeeze was imminent. The first such warned took place two weeks ago in "Surge In Short Selling Has Goldman Prime Predicting Imminent Painful Squeeze", which was then followed over the weekend by "Sellers Exhausted, HF Short Covering Begins." Citing Goldman's trading desk, we noted that the spark behind last Friday's meltup was the start of a short squeeze as "hedge funds drove the narrative":