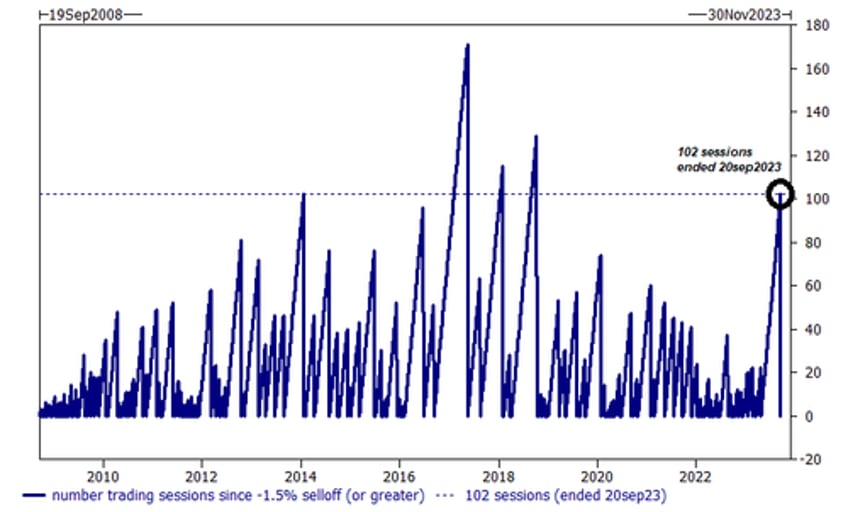

One week ago, Goldman derivatives guru Brian Garrett pointed out that it had been nearly 100 sessions since the market had suffered a 1.5% selloff, the longest such stretch since the VIXtermination ETN crash of Feb 2018 that sent the VIX from record lows to the 40s in the span of a few seconds. Alas, that streak - the 4th longest in recent history - is now over, thanks to Powell's unexpectedly hawkish post-FOMC presser which saw the S&P dump 1.6% on Thursday, and also drop on 5 of the past 6 sessions (assuming we close red today).

To be sure, hedge funds have noticed the recent downward in risk, and in his follow-up report note published overnight (available to pro subs) Garrett writes that according to the latest Goldman Prime Brokerage data there has been a sharp reversal in bullish sentiment toward US Equities, with net exposures “falling sharply from year to date highs"...