The size of the Federal Reserve pivot, i.e. the interest-rate cuts expected by the market, is likely to continue falling as inflation starts to decline at a slower rate.

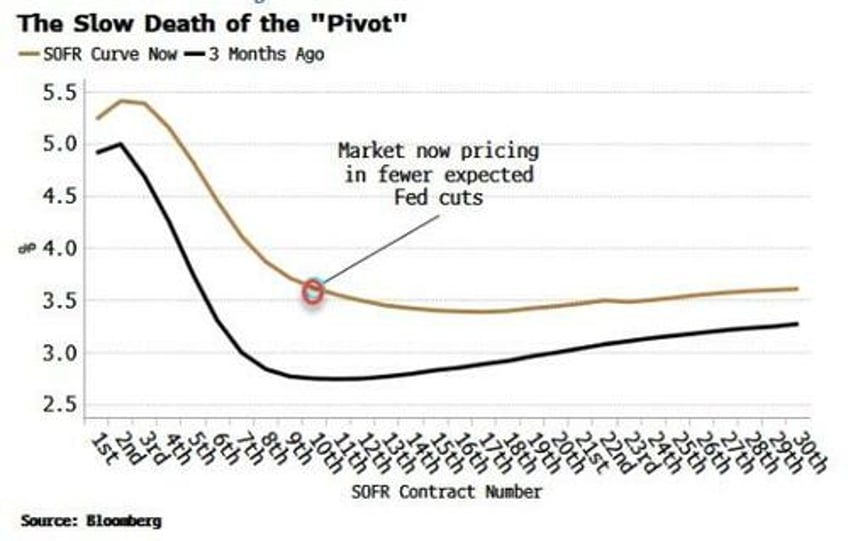

The outcome of today’s FOMC is close to a foregone conclusion. After the expected 25-bps rate hike there is only 10 bps of rate rises left priced in by markets. But it is in the later parts of the SOFR rates curve - where the pivot is - that we’re likely to see more of the price action.

In the chart below of the SOFR curve, we can see the rate cuts priced in by the market have been falling.

Last meeting the Fed passed on hiking rates, but amped up the hawkish message. While it is clear what the Fed will do with rates this meeting, it is less certain what happens at subsequent meetings as the FOMC becomes less convergent in its views.

The hawks, e.g. Fed Governor Christopher Waller, want to make sure inflation is fully snuffed out, while the doves, such as the Chicago Fed’s Austan Goolsbee, are more concerned about the slowing economy, and are less comfortable about a rise in unemployment to bring price-growth down.

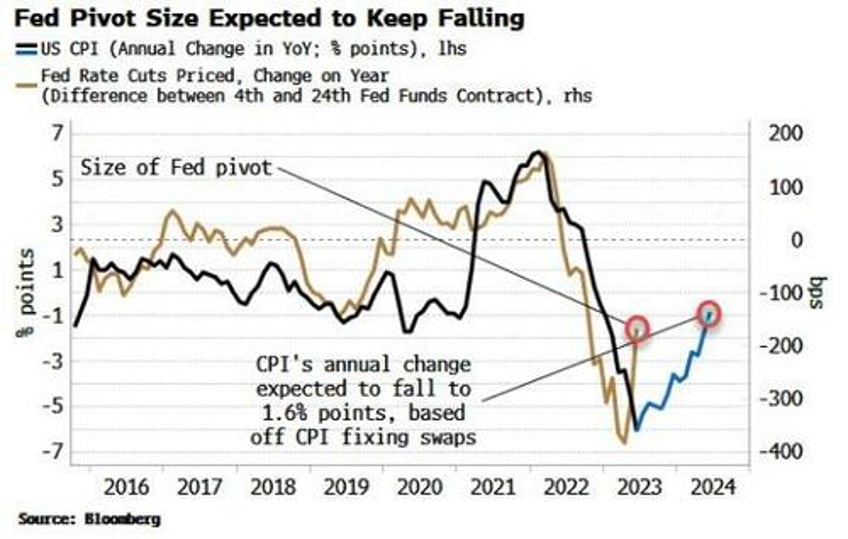

Nonetheless, the outlook for inflation suggests that the magnitude of the pivot has more to fall, i.e. the latter part of the short-term rates curve will keep steepening.

Inflation has been slowing, but it’s the change in inflation that matters more for the market. At the moment inflation is falling rapidly at an annual rate of over 6 percentage points a year. But fixing swaps for CPI expect this to slow to about 1.6 ppts in a year’s time.

The chart below shows this is consistent with latter part of the rates curve (fed funds in this case, but SOFR too) to continue steepening.

The main risk for a re-flattening of this curve at today’s Fed meeting would be an indication they have several more rate hikes to go. This is unlikely until there is a clear sign of a re-acceleration in inflation.