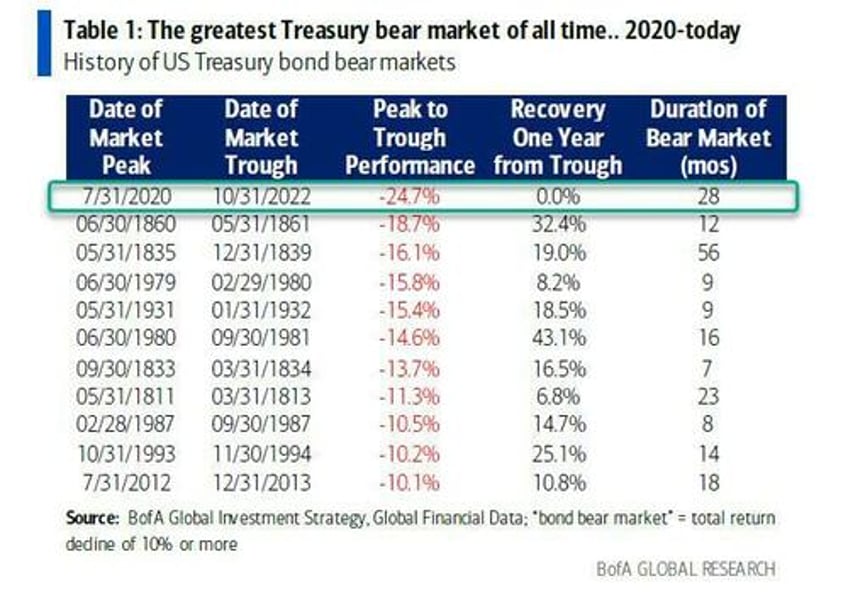

There was a remarkable chart in the latest Flow Show note from BofA resident bear Michael Hartnett: after peaking in July 2020 and in the subsequent 28 months drawing down by a record 25%, this is now the single greatest bond bear market of all time!

Considering that BofA's historical data goes back 236 years all the way to the founding of the republic, this is a jarring statistic, and a poignant reminder of the magnitude of the pain rippling through the financial world in the aftermath of an inflation shock and interest-rate surge that few saw coming... a shock which Deutsche Bank last week quantified as a $70 trillion Mark to Market hit to duration portfolios (while some may claim it's not a loss unless you actually sell the bond, the truth is that any bond which is pledged as collateral in the repo markets or elsewhere is valued daily, and the cumulative haircut assuming all eligible duration was pledged is, drumroll, $70 trillion).

Worse, the historical bond bear market also underscores the growing angst in some corners of Wall Street about the increasingly shaky state of US government finances. As a reference, it took the US government just 18 days to add more than $500 billion dollars in debt after rising above $33 trillion for the first time: a run-rate of $1 trillion in new debt in under 2 months. Also, it took the US until March 1975 to accumulate its first $500 billion. It just did the same in 18 days.

And just 18 days later we are at $33.513 trillion. That's $28.5 billion in new debt per day, and on pace to add another trillion in 1.5 months. https://t.co/tOrhqmldNj

— zerohedge (@zerohedge) October 6, 2023

As Bloomberg Markets Live reporter Ye Xie writes, massive deficits as far as the eye can see seemed fine when the Federal Reserve had interest rates pinned at zero and was monetizing tens of billions of dollars’ worth of Treasuries every week. Free money can mask a lot of problems.

But at today’s 5% rate, though, the math gets tricky. The government’s tab, and, as a result, the supply of bonds it needs to sell, adds up so fast that it can overwhelm what was long considered to be insatiable demand for the world’s safest investment.

"There’s just way too much debt," says Ed Yardeni, founder of Yardeni Research. And so, Xie goes on, the price on the 10-year Treasury bond is tumbling, driving its yield up to the highest level in 16 years. Investors, in other words, are demanding a discount to buy the debt, a dynamic that’s magnified by the Fed’s sudden exit from the market. Quantitative easing, as the Fed’s bond-purchase program was known, became untenable once policymakers deemed inflation was Enemy No. 1; it just pumped too much cash into an already overheated economy. Central banks in Brazil, China, Japan, Saudi Arabia and elsewhere have also halted their US bond purchases. In some cases, they’ve taken to outright selling.

The vacuum created by the central banks’ departure is once again empowering the traditional forces in finance: banks, hedge funds, insurers. Yardeni refers to this group as the bond vigilantes, a term he coined first back in the 1980s. Right now, he says, they’re back to doing their thing, pushing bond prices down and yields up, and sending a warning to Washington to rein in the deficit and inflation.

This isn’t about the US defaulting on its debts. The periodic histrionics surrounding the debt ceiling and government funding deadlines are, for now at least, just that. The real concern is that by pursuing a fiscal policy that drives up yields so much, Washington is putting the squeeze on companies and consumers across America. Push yields too high, too fast and something in the economy will break, something both JPMorgan and Goldman agree on (see "Goldman, JPMorgan Pull The Alarm: As Yields Soar "Risks Are Growing Of A Sharp, Impulsive, Negative Feedback Loop... There Will Be A Financial Accident".)

Last March, it happened with SVB, and while nothing was fixed the problem of massive mark to markets bond losses was masked courtesy of the Fed's BTFP facility which has hit new record highs every weeks since its inception (the facility is supposed to terminate next March; instead it will be greatly expanded). Yardeni frets it will happen again now, and potentially drag the economy into a painful recession in the process.

“We’re getting pretty close to the level where something could break,” he says. A key level for him: 5% on the 10-year bond. Surpass that, he says, and the odds of a recession really pick up. The yield got as high as 4.89% last week. Just two months earlier, it was hovering around 4%. During the pandemic, it was as low as 0.3%.

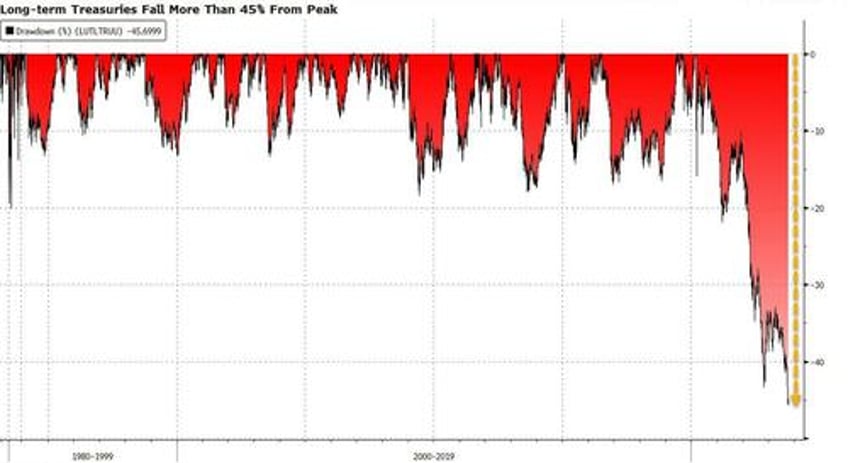

Meanwhile, Xie points to the latest Hartnett notes and reminds readers that the superlatives quantifying the bond rout are endless. One comparison being made is to the wipeout in stocks during the dot-com bust (in both cases, the losses reached 50%).

Another startling reference is that at one point last quarter the spike in yields was the biggest since the increase that proceeded the 1987 stock market crash. The pain has started to spill into stocks this time, too, albeit to a far lesser extent. Corporate bonds have also slid while the dollar has rallied against most other currencies. Even oil, which had largely been impervious to broader economic forces throughout the summer, got sucked into the bond market vortex last week, posting losses that broke a months-long rally.

What makes this moment all the more shocking to Wall Street veterans is that it disrupted years of Fed-orchestrated stability in the bond market. That comatose state, in which benchmark yields hovered around 2% day after day, year after year, had become known as the new normal. The US—and much of the rest of the world—had entered an era of low growth and low inflation in the aftermath of the 2008 financial crisis, so rock-bottom rates made sense.

Few on Wall Street saw much that might change that, not even when the pandemic unleashed a torrent of government spending. Now that change is here at such a radical pace, many of finance’s best and brightest are suddenly citing all sorts of economic forces that could keep yields high for years: global warming, the transition to green energy, deglobalization, demographic shifts and, of course, the ever-growing supply of government bonds. “We are in a world with a permanently higher cost of capital, and that does have consequences,” says Torsten Slok, chief economist at Apollo Global Management.

The years from 2008 to 2020 were abnormal, even if at some point they came to feel normal, Slok says. The Bank of America strategists dug up another historical nugget to underscore the point: Global interest rates during this period were the lowest in 5,000 years. “The new world that we live in,” Slok says, “is really the normal world that we were in.”

It’s a world in which Yardeni’s vigilantes, the bond traders, have a much bigger voice, the Fed has a smaller one, and consumers, corporate executives and Washington lawmakers have to confront a harsh reality: America’s free-money experiment is over.

And while it is certainly admirable that central banks are, at least superficially, seeking a return to the old normal, the problem is that if the Fed truly hopes to put the QE years behind it, it better be prepared to also wipe away about 80% of the stock market gains since 2009.

Of course, this will never happen, as the alternative would be the biggest depression in global history, one which promptly mutates into social unrest and civil and global war. Which is why it is amusing to watch the Fed play chicken on two front: inflation on one, and the threat of unprecedented capital markets collapse on the other.

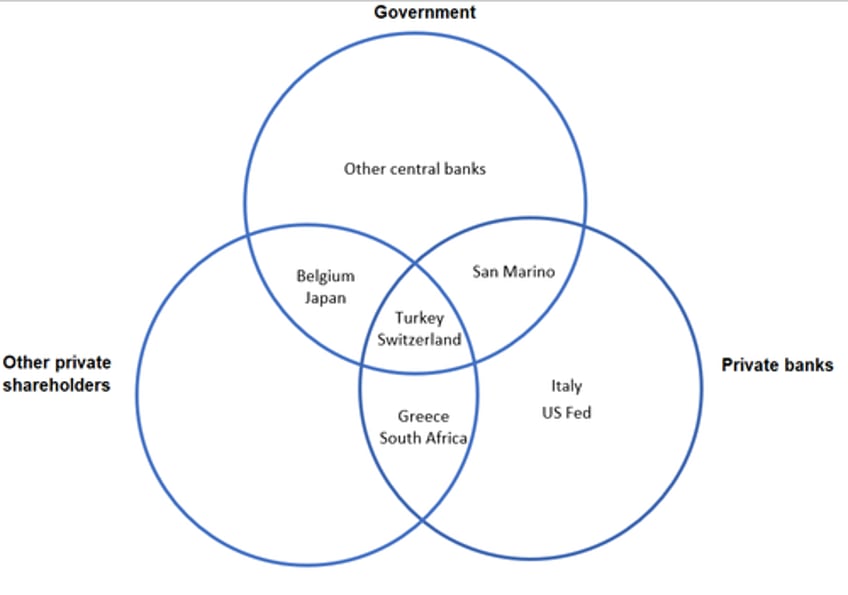

Amusing, because in the end everyone knows which alternative the Fed - an unaccountable, private entity owned by America's private banks and financial interests...

Classification of central banks by ownership

... will choose, and it's also why we are fully certain that within a few years the new inflation target in the US will be 3%, if not much higher.