As DB's Henry Allen writes, February was another very strong month for risk assets, with many major world equity indices hitting fresh record highs. That included the S&P 500, which surpassed the 5,000 mark for the first time, as well as the Nikkei, which surpassed its previous record from 1989. In part, that was because of continued excitement around AI, and the Magnificent 7 posted their best performance in 9 months. However, with inflation still above target and surprising on the upside in the US, investors pushed out the timing of future rate cuts, and sovereign bonds lost further ground. In addition, US regional banks continued to struggle, as investor concerns persisted about commercial real estate. As for cryptocurrencies and bitcoin which soared almost 50% in February after the launch of bitcoin ETFs, well, don't get Elizabeth Warren started.

Month in Review - The high-level macro overview

February had several ongoing stories that were relevant for markets.

1. The first was that global data was still robust for the most part, and hopes for a soft landing continued. For instance, the US jobs report for January showed nonfarm payrolls up by +353k, along with positive revisions to the previous two months. Moreover, the ISM manufacturing print hit a 15-month high. But even as growth remained strong, there were further upside surprises on inflation, which raised fears that the path back to target was unlikely to be a smooth one, and raised questions as to whether the economy would face a “no landing”. In particular, the US core CPI print for January came in at a monthly +0.4%, which pushed the 3-month annualised rate for core CPI up to +4.0%.

With inflation above target and growth remaining strong, that led investors to push out the timing of future rate cuts once again. At the Fed, futures moved from pricing 146bps of cuts by the December meeting, to 85bps, a reduction of 61bps over February. In addition, they pushed out the likely timing of the first rate cut to the June meeting. As a result, sovereign bond yields rose further, and US Treasuries (-1.4%) posted their worst monthly performance since September. Similarly in the Euro Area, investors reduced the expected cuts by December from 160bps to 91bps, and Euro sovereign bonds fell -1.2%. Lastly in Japan, expectations grew that the BoJ might end the negative interest rate policy as early as April, and yields on 2yr JGBs were up +9.7bps to 0.17%, marking their highest level since 2011.

2. The second important story was the ongoing excitement around AI, which led to a fresh outperformance from the Magnificent 7. They were up +12.1% in total return terms, which was their best monthly performance since May 2023, and Nvidia surged by a further +28.6%, which followed their strong earnings release towards the end of the month. That helped to power the overall S&P 500 (+5.3%) to a 4th consecutive monthly advance, although the rally continued to be a narrow one, with the equal-weighted S&P 500 up by a smaller +4.2% in February.

3. Third, the concerns about commercial real estate continued, particularly at the start of February. That came after New York Community Bancorp reported a loss on January 31 as they raised their expected loan losses on commercial real estate. This raised fears that the full consequences from higher interest rates are still yet to materialise, particularly give the amount of debt that needs refinancing over 2024 and 2025. For markets, it meant that US regional banks lost further ground, with the KBW Regional Banking Index down another -2.8%, bringing its YTD decline to -9.5%. New York Community Bancorp led those declines, with a -25.2% return in February, taking its YTD decline to -52.7%.

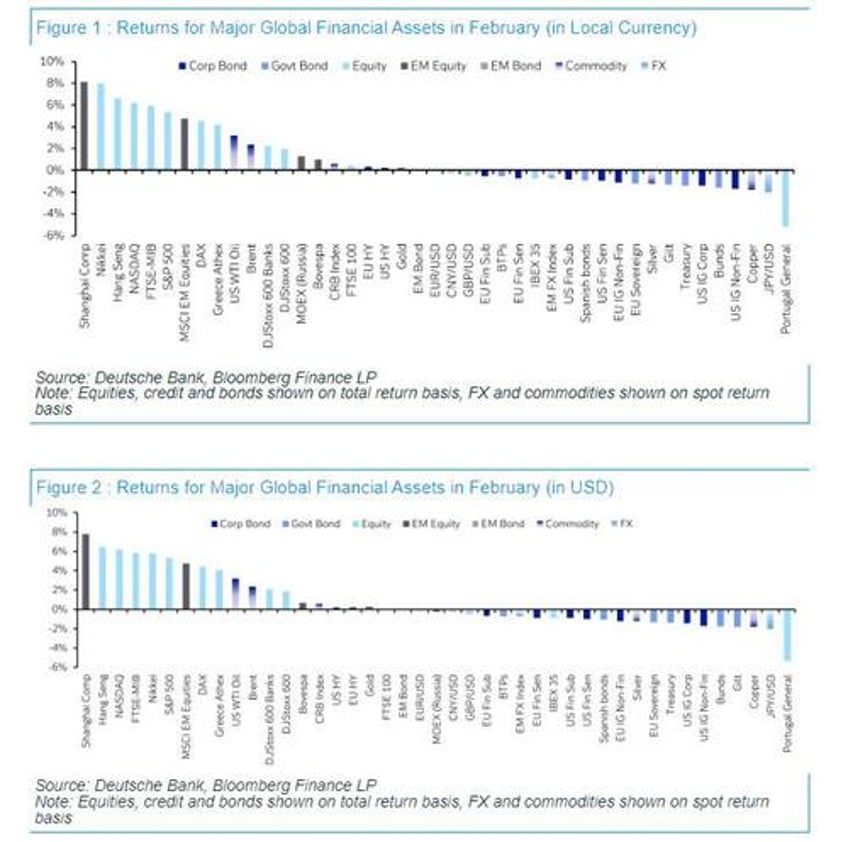

Which assets saw the biggest gains in February?

- Equities: Excitement about AI and strong growth data helped global equities advance for a 4th consecutive month, with the S&P 500 (+5.3%) and the STOXX 600 (+2.0%) both rising. Asian indices saw the largest gains, with the Nikkei up +8.0%, and the Shanghai Comp (+8.1%) had its best monthly performance since November 2022.

- US Dollar : As investors pushed out the timing of future rate cuts, the dollar index rose for a second consecutive month, rising +0.9%. Moreover, the dollar strengthened against every G10 currency apart from the Swedish Krona.

- Oil : Despite the losses for other commodities, oil prices rose for a second consecutive month, with Brent crude up +2.3%, and WTI up +3.2%.

- Cryptocurrencies : It was a very strong month for cryptocurrencies, with Bitcoin (+44.7%) seeing its best monthly performance since December 2020, ending the month at $61,431.

Which assets saw the biggest losses in February?

- Sovereign Bonds : As investors pushed out the timing of rate cuts, sovereign bonds saw further losses. That included US Treasuries (-1.4%), Euro sovereigns (-1.2%) and gilts (-1.3%)

- Japanese Yen : The Japanese Yen weakened a further -2.0% against the US Dollar in February, leaving it as the worst-performing G10 currency on a YTD basis, having now weakened -6.0% since the start of the year.

- Commodities (except oil) : Several commodities saw significant declines in February. European natural gas was down -17.8%, marking a fourth consecutive monthly decline. Copper (-1.8%) also lost ground after three monthly gains, whilst agricultural goods including wheat (-3.0%), corn (-7.3%) and soybeans (-7.7%) fell back as well.

Finally, here are the charts summarizing major asset performance in February in local currency and USD...

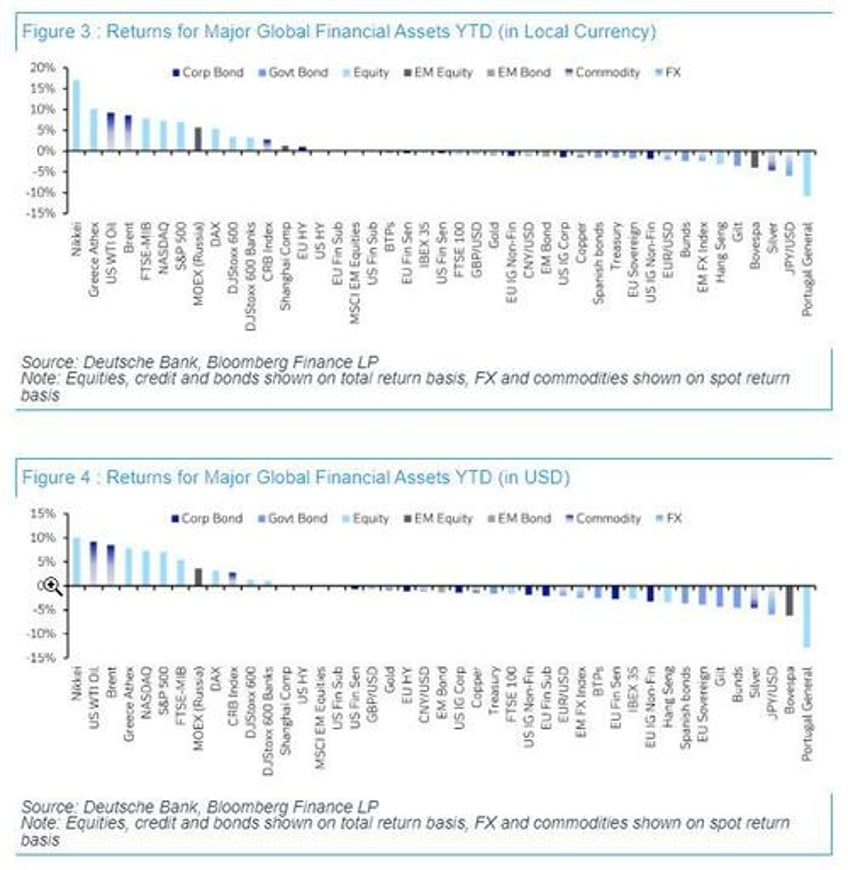

... and YTD.