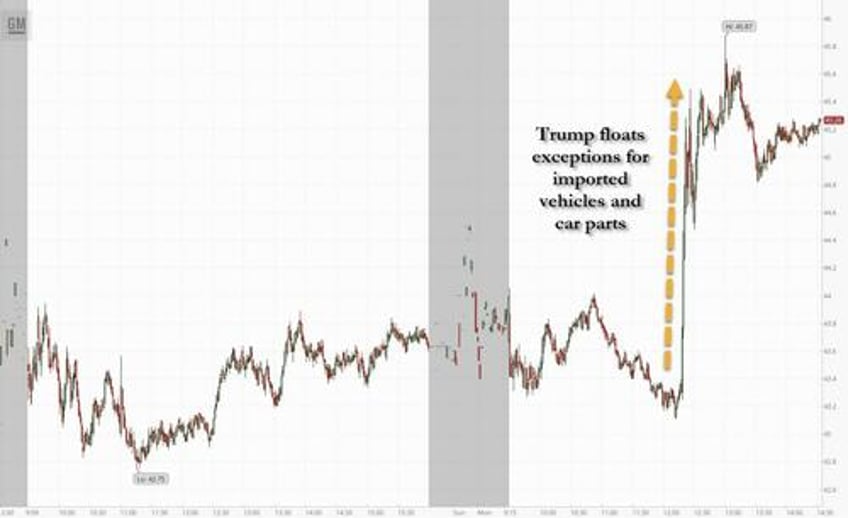

Auto stocks popped Monday after President Trump said he wants to “help some of the car companies” affected by the new 25% tariffs, acknowledging they “need a little bit of time” to shift production to the U.S.

Automakers like GM surged higher on the news. Ford, GM, and Stellantis jumped 3–6%, Rivian rose 4.9%, and Tesla held flat. Japanese and EV makers like Toyota, Honda, and Lucid saw gains of 1.5–2%.

“I’m looking for something to help some of the car companies, where they’re switching to parts that were made in Canada, Mexico and other places... But they need a little bit of time,” Trump said during a meeting with El Salvador’s president, according to CNBC.

A senior industry executive called Trump’s remarks “some recognition that this is getting tough for the industry.” Despite recent tariff relief for tech firms like Apple, the auto levies remain.

Carmakers are adapting in different ways. Ford and Stellantis launched employee pricing deals, Jaguar Land Rover halted U.S. shipments, and Hyundai pledged no price hikes for two months.

GM is boosting U.S. production, reversing downtime at its Tennessee plant. “The previously announced downtime for the week of May 12th is being rescinded,” plant management told workers. A GM spokesperson confirmed the move.

Meanwhile Deutsche Bank released a note on Monday stating that as Q1 2025 earnings approach, automakers still face significant uncertainty from new tariffs. They expect strong early-year demand as consumers buy ahead of price hikes, followed by a slowdown in the second half as tariffs bite—pushing 2025 U.S. auto sales to 15.4 million, down from 16.0 million in 2024.

Ford and GM could see gross costs rise by over $10 billion, while Tesla and Rivian face smaller impacts due to their supply chains, the note said. These estimates assume a 25% tariff on imported vehicles and parts starting May 3, with exemptions for USMCA-compliant content.

Deutsche said it believes automakers will share the cost burden with dealers and consumers and use various cost-offsetting strategies. Still, Ford and GM may see a $4–7 billion EBIT hit annually.

"In such a context, we think Rivian may have the cleanest set-up given its relatively small exposure to the tariffs and prospects for a strong R2 product cycle (naturally subject to execution risk though)," analysts wrote.

"We continue to view Tesla favorably longer term as an embodied AI secular winner but acknowledge it faces many cross currents for the next quarter or two.

For Ford and GM, we believe both will deliver solid 1Q results compared to expectations but will withdraw full-year guidance as they implement tariff mitigation strategies. As such, we reluctantly downgrade GM to Hold from Buy given structural uncertainty around US industrial/tariff policy. While the stock already trades at a low multiple, we worry it may be an impaired asset for several years."