By Michael Every of Rabobank

Powell/Power, Nasdaq/Nasrallah

US payrolls were slightly weaker than expected across the board. 150K jobs were added vs. 180K forecast, with downwards revisions to previous months, the household survey dropping, unemployment rising a tick to 3.9%, and average earnings undershooting at 0.2% m-o-m. These data still show a tight labor market, have seen slowdowns before only to pick up again, and are out of line with the strong JOLTS job openings, low weekly jobless claims, the huge pay deals struck by the UAW union, and ISM services prices paid at 58.6 and new orders 55.5 vs. 51.8 prior. Nonetheless, global bond yields plummeted as if we had seen a negative payrolls print. The US 10-year fell to around 4.50%, the dollar dipped, commodities were up, and the S&P +0.9%, +3.9% in the last three days, the Nasdaq +1.2% and +4.8%: who needs a 10-year Treasury when you can make the same return in less than a week?

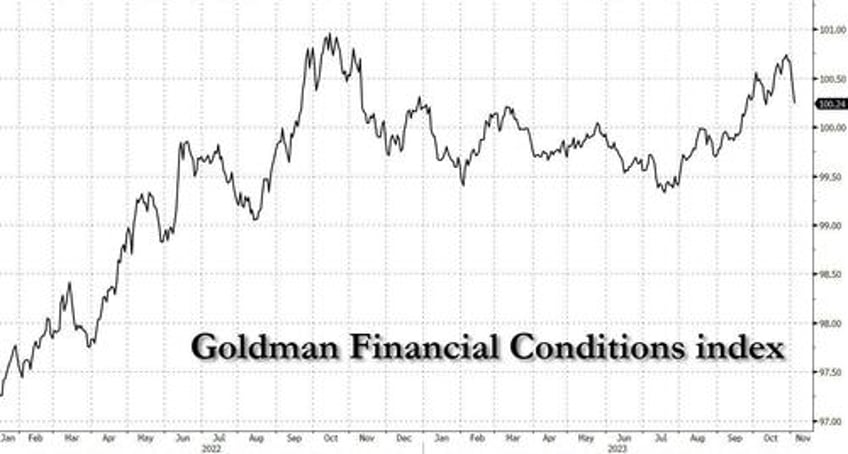

As such, the market undid much of the tightening of financial conditions which the Fed says is tightening policy for it. Keep that up and the Fed will still have to do more; and it is nowhere near doing the 100bps of rate cuts being priced in for 2024, just as they were for 2023.

Meanwhile, 30 minutes after payrolls, while we were still deep in the theology of the Bureau of Labor Statistics’ payrolls “birth/deaths” model, eyes turned to a speech from a secret bunker also wrapped in theology and deaths given by Hassan Nasrallah, leader of terrorists Hezbollah (listed as such even by the Arab League years ago). Kuwaiti media had reported prior that Iran had given him the green light to start a second front against northern Israel, the second of three dominoes (Israel > Gaza; Hezbollah > Israel; Israel/US > Iran and/or Iran > Saudi) which could trigger a regional escalation and a 2022-style energy-price spike.

Yet Nasrallah blinked. He claimed: Hamas’s 10/7 attack on Israel, while great, had nothing to do with him or Iran; he had already started a second front (with escalating ballistics exchanges seeing nearly 60 Hezbollah fighters dead); excoriated Arab governments for not doing more; wants to see tens of thousands of Israelis internally displaced away from their borders; called to attack US targets; and laid down a red line for full escalation – the Israeli elimination of Hamas. Yet that remains Israel’s --and the US and Germany’s-- policy goal, so it still seems when we escalate, not if. Moreover, Israel says it will target Hezbollah after Hamas, and it can never accept permanently depopulating its current internal buffer-zones (one town in which, Kiryat Shmona, was just slammed by Hezbollah rockets).

In short, just because things looked better on Friday than feared doesn’t mean all ends well.

In fact, premature de-escalation carries its own risks of larger, longer-term problems. In central banking, we agree if wage growth fails to fall and CPI refuses to drop back to 2%, a rates pause will see ‘term premia’ rise and inflation expectations rise. That’s the 1970’s policy error. In geopolitics, dovish world leaders and Western street protests calling for a ceasefire think of the loss of civilian life, that defeating Hamas may lead Iran to trigger a wider regional war, and that whoever replaces Hamas could be even worse. However, others think allowing Hamas to recover via a ceasefire, even if the US forces Iran to back down regionally, will see Tehran and Hamas claim a geopolitical ‘win’, with a deleterious effect on US, Saudi, and UAE efforts to expand the Abraham Accords peace treaty to Israel under a US defence guarantee. In many eyes that would start the clock ticking to an even larger war - and recall Iran is close to obtaining a nuclear weapon.

This is to say that despite last week’s risk-on move on the belief that hawks have had their day, not all the hawks have, and risks continue to build that we cannot mitigate with dovish policy. Moreover, whatever we do, ‘sticking the landing’ is far harder than markets took it to be on Friday.

In the economy, if deflation now looms, things will still get very nasty, very fast given what it implies for employment and fiscal deficits; but if inflation lingers on that’s also the case, as we already see around us. In geopolitics, if regional war looms now, things will get very nasty, very fast, and so will inflation – Larry Fink and Jamie Dimon are both warning it would cause global recession, and that the present geopolitical moment looks as perilous as 1938; but if regional war is delayed, it could end up being even larger and nastier next time.

Just as we didn’t deal with our real economic problems post-2008, we are nowhere near dealing with our real geopolitical problems now. Both are now going to be vastly more expensive that if we had done so years earlier. It goes without saying that markets, global trade, and the global financial architecture will shift around as either of the above outcomes happen: how can they not?

Look at the long-read from Bloomberg today, ‘The Price of Money Is Going Up, and It’s Not Only Because of the Fed’, looking at longer-run data backing a rising neutral level of rates, whatever the Fed says. As Bas van Geffen noted in our latest Monthly Outlook, echoing a regular meme here, expect “rate hikes and acronyms”. Or look at ‘The Dollar’s Dominance is Shakier Than Ever’ by a former economic advisor to the Trump White House, which talks about intra-BRICS11 FX trade settlement (or de facto bilateral barter). Or read ‘Would an inflation tax help tame price pressures? As groupthink grips Threadneedle Street the need for novel policies is greater than ever’, which has some backing a tax on UK pay hikes above 3%: yes, that’s out of the box thinking, but why not tax asset prices too?!

Given the awful pictures we are already seeing from the Middle East (and not only there), and the awful implications of what follows, many analysts are avoiding the topic entirely, as they did Ukraine; some are trying, but failing to join all the dots; some are shrugging and saying it’s a moral-equivalent mess (including former President Obama, who publicly asked what he could have done better. “How about not empowering Iran?” is the regional chorus); and some expert views are becoming plain offensive.

A junior Israeli minister said “Nuke Gaza” (for which he was immediately suspended; and Israel’s Arab Islamist party Ra’am, present in the last government, called on one of its MPs to resign for saying not all the crimes Hamas committed on 10/7 are visible on the bodycam showreel of horrors now compiled). There is talk of huge policy shifts to the right in the West over the ability to protest and in regards to free speech, as well as policing and immigration. And on the left, former Eurodollar insiders, who already embraced Russian, Iranian, and Chinese news as more trustworthy than anything Western, are now retweeting antisemitic tropes as if this is the pathway to a global, progressive post-US financial system backed by allies like ‘Her-bollah’ and ‘Hama-X’.

In short, caveat emptor on analysis of this complex, confounding, conflated, and centrifugal issue.

My own simple take is that Friday epitomised our ‘new, new normal’ where geopolitics matters first, even if markets wrongly thought it flagged a return to the old ‘new normal’ where rate cuts are all that count.

Everyone should be able to see that power matters like Powell, and Nasrallah like the Nasdaq. Unless you are hiding in a bunker.