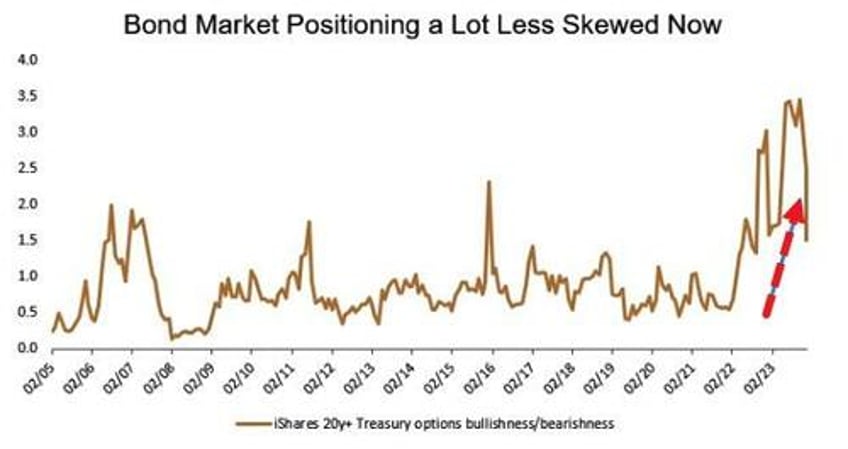

The recent correction in the bond markets is being reflected in options positioning, with sentiment toward Treasuries showing a remarkable pullback from the exuberance we saw toward the go-go days of November and December.

As the chart shows, market positioning is a lot less lopsided now, especially given that fund managers are likely to hold onto or build on their conviction about the merits of duration this late in the cycle.

Even so, theta decay is probably a bigger risk than other Greeks, and last week’s jobs data that showed an acceleration in average hourly earnings growth of 4.1% in December - inconsistent with its 2% overall inflation target - would suggest that the urgency for the Fed to cut rates isn’t so high.

The Treasury 10-year maturity is fairly valued at 3.98% on my model, and at 4.03% as I write this, the incentive for a further increase in yields is limited.

The December reading of the inflation metrics is expected to bring “a touch higher” narrative in the on-month number, though core is expected to remain flat at 0.3%.

Barring shock readings higher, long-dated Treasuries will bob around current levels for now.