Nasdaq 100 futures and the Philadelphia SE Semiconductor index stabilized ahead of the US cash session after better-than-expected earnings and strong forecasts from Taiwan Semiconductor Manufacturing Co. (TSMC), the world's largest contract chipmaker. This stabilization follows a significant rotation out of tech and chip stocks on Wednesday after Bloomberg reported that the Biden administration is considering tighter restrictions on exports of semiconductor technology to China.

TSMC, whose top clients include Nvidia and Apple, reported that second-quarter revenue for its most advanced chips increased by 28% from the previous quarter.

Here's a snapshot of second-quarter earnings results (courtesy of Bloomberg):

Net income NT$247.8 billion, +36% y/y, estimate NT$235 billion

Gross margin 53.2% vs. 53.1% q/q, estimate 52.6%

Operating profit NT$286.56 billion, +42% y/y, estimate NT$274 billion

Operating margin 42.5% vs. 42% q/q, estimate 41.5%

Sales NT$673.51 billion, +40% y/y, estimate NT$658.14 billion

For the third quarter or current quarter, TSMC forecasts revenue of as much as $23.2 billion, above the average analysts tracked by Bloomberg. It also narrowed its third-quarter estimate for capital spending to the high-end range of between $30 billion and $32 billion from a previously stated level of $28 billion.

Third quarter earnings forecast:

Sees sales $22.4 billion to $23.2 billion

Sees gross margin 53.5% to 55.5%, estimate 52.5%

Sees operating margin 42.5% to 44.5%, estimate 42.1%

"Our business in the second quarter was supported by strong demand for our industry-leading 3-nanometer and 5-nanometer technologies, partially offset by continued smartphone seasonality," CFO Wendell Huang wrote in a statement.

Huang said, "Moving into the third quarter of 2024, we expect our business to be supported by strong smartphone and AI-related demand for our leading-edge process technologies."

TSMC noted that second-quarter shipments of 3-nanometer chips accounted for about 15% of total wafer revenue, 5-nanometer chips accounted for 35%, and 7-nanometer chips made up 17%. The most advanced AI chips are below 7-nanometer, and those chips accounted for 67% of TSMC's total wafer revenue.

Needham analyst Charles Shi told clients that TSMC's boost in revenue growth outlook for the year from a "low—to mid-20s" percentage to a "mid-20s" percentage suggests higher prices are inbound.

The upward revisions highlight TSMC's view that AI spending will continue, which was enough to attract dip buyers into chip and tech stocks in early premarket trading following Wednesday's selloff.

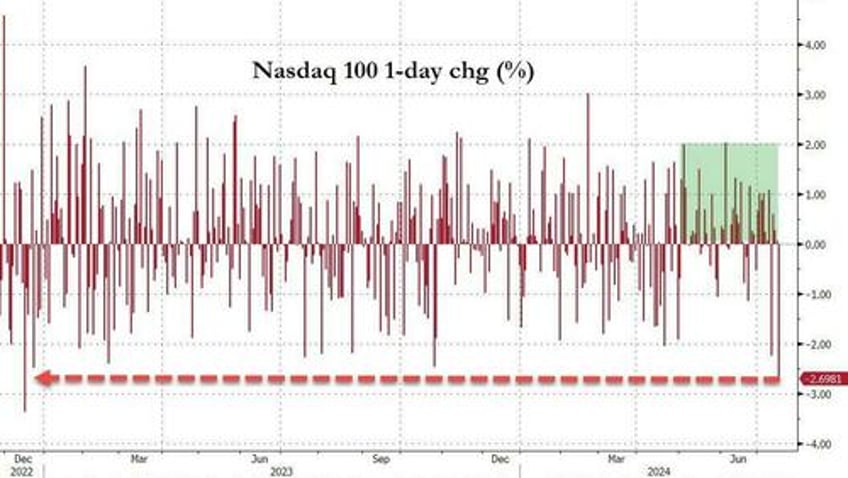

On Wednesday, the Philadelphia SE Semiconductor index had its worst day in four years.

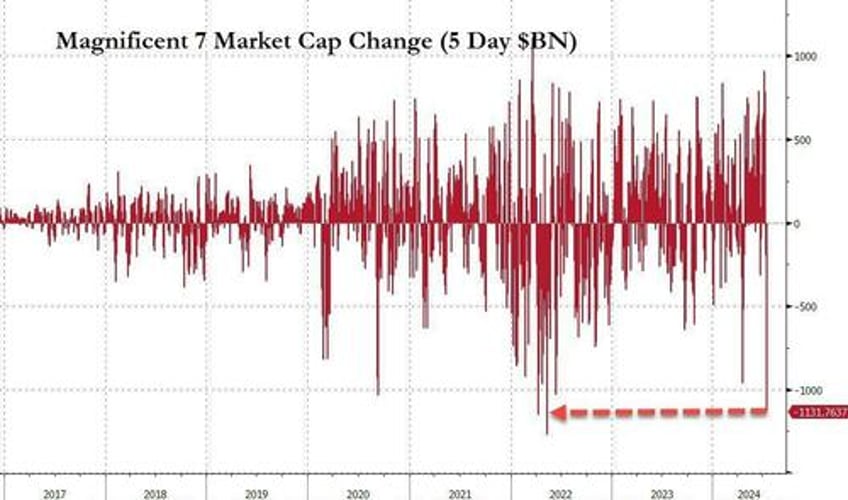

As for Mag7 stocks...

And Nadaq.

Around 0800 ET, shares of Nvidia were up 2%, AMD 1.75%, TSMC 1.3%, Intel 1.3%, and Broadcom 1%. The iShares Semiconductor ETF (SOXX) was up about 1% in premarket trading.

Earlier this week, Goldman Sachs strategists Ryan Hammond and David Kostin noted, "The AI trade is under increasing scrutiny."

In a note penned to pro-subs this week, we pointed out that a 'great rotation' out of tech appears to have started. The note is titled "Did The AI Bubble Just Burst, And What Happens Next."