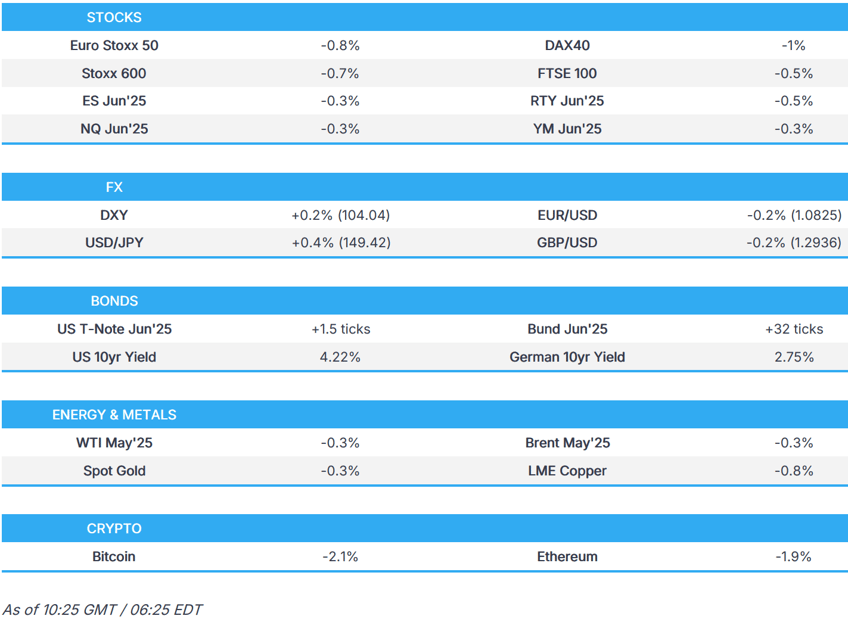

- European indices hold a negative bias, airliners on the backfoot with Heathrow closed; US futures are also lower.

- USD is broadly firmer vs. peers with macro newsflow on the light side, but ahead of Trump-Hegseth meeting at 15:00GMT.

- Gilts underperform on more unfavourable developments for Reeves, Bunds bid.

- TTF ignites on Sudzha damage, base metals dented by the risk tone.

- Looking ahead, Canadian Retail Sales, EZ Consumer Confidence, CBR Policy Announcement, DBRS Credit Review on France, Quad Witching, Speakers including Fed’s Williams & Waller.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- EU's von der Leyen said the impact of postponed countermeasures to US tariffs will not change.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.7%) opened lower despite a mixed session in APAC trade. The pressure accelerated throughout the morning, but has since stabilised a touch in recent trade; as it stands, indices reside just off worst levels.

- European sectors hold a strong negative bias, with only a couple of industries managing to stay afloat. Utilities take the top spot, joined closely by Telecoms. Travel & Leisure is the underperformer today; the sector has been hit after the UK’s Heathrow Airport announced a complete shutdown due a power outage, caused by a fire. Airliners are broadly lower; IAG (-3%) / Lufthansa (-1.5%). On this, insurance names move a little lower; Allianz (-0.8%), Swiss Re (-0.8%).

- US equity futures (ES -0.3%, NQ -0.3%, RTY -0.5%) are entirely in the red, with clear underperformance in the RTY, extending on the pressure seen on Thursday. There is no clear driver for the losses today, but comes in tandem with the downbeat mood in Europe and ahead of the looming April 2nd reciprocal tariffs.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is slightly firmer and trading within a 103.74-104.15 range in what has been a quiet session thus far - the US data docket remains light for the remainder of the. Focus however, will be on Fed speak from Williams, Waller and Goolsbee; the former will see the release of an accompanying text release and a Q&A thereafter. Elsewhere, US President Trump is to speak with Hegseth at 15:00GMT.

- EUR is a little lower and trades towards the bottom end of a 1.0820-35 range, continuing the losses seen this week. Aside from EZ Consumer Confidence, the docket remains light with no ECB speakers scheduled - though some focus will be on DBRS, who will review France's credit rating today.

- USD/JPY has edged higher and reclaimed the 149.00 handle despite the cautiousness in the region and with the pair also unfazed by the mostly firmer-than-expected Japanese inflation data.

- GBP is on the backfoot vs. the USD in an extension of yesterday's downside. Despite yesterday's mildly hawkish skew to the BoE announcement in which external member Mann reverted back to the unchanged camp, the pound has fallen victim to the broadly firmer USD. This morning's public sector net borrowing data showed a further deterioration in the nation's finances.

- Antipodeans are both struggling for direction after recent losses and with price action contained amid a quiet calendar and the mixed risk sentiment.

- PBoC set USD/CNY mid-point at 7.1760 vs exp. 7.2423 (Prev. 7.1754).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are slightly firmer, in-fitting with action in Bunds as the risk tone remains under pressure this morning. US specifics a little light thus far though the docket ahead is packed. Firstly, POTUS is due to give remarks from the Oval Office at 15:00GMT alongside his Defence Secretary. Given Hegseth’s inclusion the remarks may be focussed on Iran, with rhetoric from the Supreme Leader this morning punchy. As it stands, USTs are at the upper-end of a 111-00 to 111-09 band, with yields softer across the curve which itself is incrementally steeper.

- Bunds are firmer and at the top-end of a 128.15-128.58 band. Strength this morning comes from the downbeat risk tone which broadly speaking appears to be a continuation of the recent narrative of taking risk off the table into the April 2nd tariff announcement. German Bundesrat has passed the debt reform bill and EUR 500bln fund, as expected.

- Gilts gapped higher by a handful of ticks given the lead from EGBs but then succumbed to the morning’s borrowing data and slumped to a 91.73 trough. However, as the risk tone deteriorated, the benchmark lifted off worst and briefly got back to within reach of the 92.00 mark in a 91.73-92.12 band; though, ultimately, Gilts remain under notable pressure. PSNB showed a larger-than-expected borrowing figure alongside a downward revision to the prior which has taken borrowing for the 11-months of the current FY to the GBP 132bln mark, exceeding the GBP 127.5bln forecast by the OBR for the entire FY period.

- Click for a detailed summary

COMMODITIES

- Crude is incrementally lower, after spending the majority of the European morning around the unchanged mark; WTI'May now trades towards the lower end of a USD 67.80-68.65/bbl range. Energy-specific newsflow has been light today, whilst punchy rhetoric from Iran's Supreme Leader Khamenei failed to lift prices.

- Natural gas prices have been boosted today after Kyiv Post reported "Putin’s forces shelled the Sudzha gas metering station in Russia’s Kursk region with artillery in order to blame Ukraine — the General Staff of the Ukrainian Armed Forces". In response to this attack, Russia's Kremlin said Ukrainian President Zelensky cannot be trusted.

- Precious metals are on the backfoot, with spot gold pulling back from best levels in overnight trade; into the European session, price action has been fairly contained and currently sits towards the mid-point of a USD 3,021.73-3,047.51/oz range.

- Base metals are entirely in the red given the downbeat risk tone and poor Chinese performance overnight. 3M LME Copper currently trades towards the lower end of a USD 9,842.2-10,001.8/t.

- China is to add cobalt and copper to its state metal reserves.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK GfK Consumer Confidence (Mar) -19.0 vs. Exp. -21.0 (Prev. -20.0)

- UK PSNB Ex Banks GBP (Feb) 10.71B GB vs. Exp. 6.6B GB (Prev. -15.442B GB, Rev. -13.321B GB); PSNB, GBP (Feb) 10.71B GB (Prev. -15.442B GB, Rev. -13.321B GB); PSNCR, GBP (Feb) 6.357B GB (Prev. -22.484B GB, Rev. -22.402B GB)

- French Business Climate Manufacturing (Mar) 96.0 vs. Exp. 97.0 (Prev. 97.0)

NOTABLE EUROPEAN HEADLINES

- London's Heathrow Airport said it is experiencing a significant power outage due to a fire at an electrical substation supplying the airport and will be closed until 23:59 GMT today, while it stated significant disruption is expected over the coming days and passengers should not travel to the airport under any circumstances until it reopens.

- Denmark is reportedly open to joint European projects and funding if required, via FT citing sources

- UK says it is pausing the publication of Service Producer Price Index and Producer Price Index; planning to recommence publication in the summer and will keep users informed of progress; CPI unaffected.

- German Bundesrat has passed the debt reform bill and EUR 500bln fund, according to the vote tally cited by Reuters

NOTABLE US HEADLINES

- US President Trump posted "Egg prices are WAY DOWN from the Biden inspired prices if just a few weeks ago. “Groceries” and Gasoline are down, also. Now, if the Fed would do the right thing and lower interest rates, that would be great!!!"

- US President Trump posted "Unlawful Nationwide Injunctions by Radical Left Judges could very well lead to the destruction of our Country!... STOP NATIONWIDE INJUNCTIONS NOW, BEFORE IT IS TOO LATE".

- US President Trump and Defense Secretary Hegseth are to deliver remarks from the Oval Office today at 11:00EDT/15:00GMT, according to the White House.

- White House has commenced a review of Federal Agency plans for a 2nd round of mass layoffs, according to Reuters sources.

GEOPOLITICS

MIDDLE EAST

- Hamas says it is still studying the US proposal and the other proposed ideas in order to reach a deal that ensures hostage releases, the end of the war, and Israeli withdrawal.

- Iran's Supreme Leader Khamenei says the "US need to know if they mess around with Iran, it will receive a hard slap"; "has no proxies in the region, those groups act independently".

- Israel's cabinet voted to fire the head of Shin Bet Ronen Bar, according to AP.

- US National Security Adviser Waltz said Israel has every right to defend its people from Hamas terrorists and the ceasefire would have been extended if Hamas released all remaining hostages, but they chose war instead.

RUSSIA-UKRAINE

- Russia's Kremlin says Russian President Putin's order not to strike Ukrainian energy infrastructure remains in force; attack on Russian Gas transit station in Sudzha shows Ukrainian President Zelensky cannot be trusted.

- Kyiv Post reports "Putin’s forces shelled the Sudzha gas metering station in Russia’s Kursk region with artillery in order to blame Ukraine — the General Staff of the Ukrainian Armed Forces".

- Explosions were reported in the sky of Ukraine's capital and air defences were working to counter a large-scale attack with drones, while it was also reported that Russian drones hit civilian targets in Odesa on Thursday night.

- US reportedly seeks to reopen terms of a Ukraine minerals deal, according to FT.

- Germany, Italy, Poland, UK, and Canada leaders are to meet in Paris next week to discuss Ukraine, while French President Macron said the European meeting next week is to discuss ways to accelerate immediate military support for Ukraine and will discuss plans to strengthen the Ukrainian army if an agreement is reached with Russia.

- EU's Costa said he believes EU member states will increase pledges of support to Ukraine.

- Russia's presidential security adviser Shoigu arrived in North Korea and is to meet with North Korea's leader.

- Russian Investigative Committee opens a case over explosion at Sudzha gas metering station in Russia's Kursk region organised by Ukraine; station significantly damaged in a blast.

CRYPTO

- Bitcoin is a little lower and trades just above USD 84k whilst Ethereum attempts to reclaim USD 2k.

APAC TRADE

- APAC stocks ultimately traded mixed following the choppy performance stateside in the aftermath of the Super Thursday deluge of central bank announcements and ahead of quad witching.

- ASX 200 was just about kept afloat by notable outperformance in Consumer Staples as shares of Coles and Woolworths rallied after a report by the competition regulator which noted the supermarket retailers along with discount rival Aldi, were among the most profitable supermarket businesses in the world.

- Nikkei 225 initially traded higher on favourable currency moves but then reversed course after hitting resistance ahead of the 38,000 level and as the mostly firmer-than-expected Japanese inflation data supported the case for the BoJ to continue policy normalisation in the future.

- Hang Seng and Shanghai Comp were pressured despite the lack of fresh catalysts and as earnings results trickled in, while trade uncertainty continued to cloud over risk sentiment and NYT recently reported that Elon Musk is set to get access to a top-secret US plan for a potential war with China although President Trump later refuted this.

NOTABLE ASIA-PAC HEADLINES

- Elon Musk was initially reported to get access to a top-secret US plan for a potential war with China, according to the New York Times. However, President Trump later refuted the report which he said was fake news.

- Japan's Rengo says second round data shows avg. wage hike of 5.4% for Fiscal 2025 vs 5.46% in the first-round data.

- Meituan (3690 HK) FY24 (CNH) Net Income 35.8bln (exp. 37.8bln), Revenue 337.6bln (exp. 337bln); Q4: Adj. Net Income 9.85bln (exp. 9.91bln), Revenue 88.5bln (exp. 87.9bln).

- Nio Inc (NIO) Q4 (CNY): EPS -3.17 (exp. -2.4) Revenue 19.7bln (exp. 20.07bln); sees Q1 total revenue 12.367-12.859bln

DATA RECAP

- Japanese National CPI YY (Feb) 3.7% vs Exp. 3.5% (Prev. 4.0%)

- Japanese National CPI Ex. Fresh Food YY (Feb) 3.0% vs Exp. 2.9% (Prev. 3.2%)

- Japanese National CPI Ex. Fresh Food & Energy YY (Feb) 2.6% vs Exp. 2.6% (Prev. 2.5%)