Shares of Taiwan Semiconductor Manufacturing (TSMC) trading in New York climbed as much as 7.5% in premarket trading after the chipmaker, the leading supplier for Apple and Nvidia, issued 2025 sales and capital expenditure forecasts that topped Bloomberg Consensus estimates.

TSMC projected revenue of $25 billion to $25.8 billion in the first quarter, exceeding the Bloomberg Consensus estimate of $24.3 billion estimate. Management expects capital expenditure between $38 billion and $42 billion for the year, far surpassing the $35.2 billion estimate.

TSMC's Year Forecast

- Sees capital expenditure $38 billion to $42 billion, estimate $35.15 billion (Bloomberg Consensus)

TSMC's First Quarter Forecast

Sees sales $25 billion to $25.8 billion, estimate $24.43 billion

Sees gross margin 57% to 59%, estimate 56.9% * Sees operating margin 46.5% to 48.5%, estimate 46.4%

The world's biggest chipmaker also reported fourth-quarter sales that beat estimates despite TSMC's largest customer, Apple, having a rather uninspiring AI iPhone launch over the fall into winter months for the West and China.

TSMC's Fourth Quarter Earnings:

Net income NT$374.7 billion, +57% y/y, estimate NT$369.84 billion

Gross margin 59% vs. 57.8% q/q, estimate 58.5%

Operating profit NT$425.71 billion, +64% y/y, estimate NT$411.42 billion

Operating margin 49% vs. 47.5% q/q, estimate 48.1%

Sales NT$868.46 billion, +39% y/y, estimate NT$855.34 billion

TSMC's 2024 Results:

Sales NT$2.89 trillion, +34% y/y, estimate NT$2.88 trillion

R&D expenses NT$204.18 billion, +12% y/y, estimate NT$205.98 billion

For more color on TSMC's solid fourth-quarter results and its forecast, which underscores continued optimism about the AI spending cycle that propelled TSMC and Nvidia to new highs, Goldman's Nelson Armbrust shared the following with clients this morning:

Stock + 5%, TSMC guides above for Q1 & FY capex above = positive Semicap (see Asian names reaction Tokyo Electron + 3.7% and Advantest +1.5%) On capex its guiding - 2025 to US$38-42bn, inline with GS estimate of US$40bn but better than cons of US$35.1bn. For Europe would expect positive for asm, asml, besi (they raised the advanced packaging guide); and vacn. The continued driver is Fits with the theme of Alex note overnight – for 2025 he prefers semicaps given strong AI demand (TSMC on call saying AI will remain strong and other areas will see a mild recovery); is selective on Analog/CommTech; and cuts Nokia to Sell (now sell on both Nokia & Ericsson). (TY Sean Johnstone)

William Chan from our Asia team finds it interesting that the cost of TSMC puts is at 8 month lows and that the local Taiwan line's implied vol is trading at 15 vols discount vs US ADR line (chart 1 & 2). For investors who want to protect their TSMC long holdings for potential de-gross sell-off risk in Q1, I think spending a few % premium to buy insurance makes sense here, especially given the stock gained 81% last year and back in July the stock sold-off 20%+ in two weeks when the AI momentum cooled off.

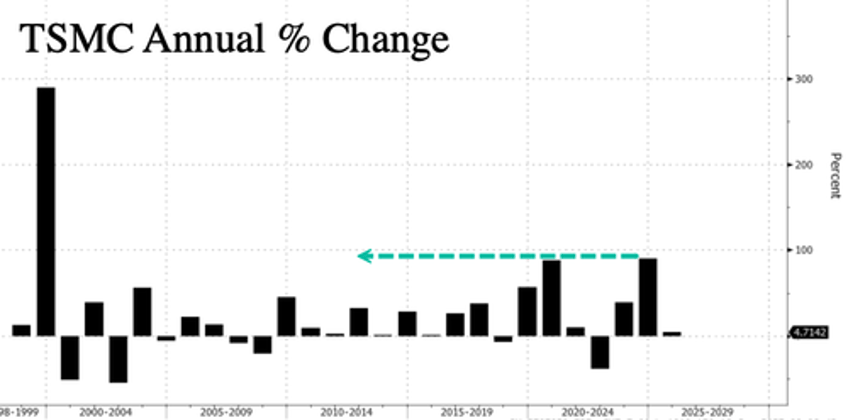

In 2024, TSMC shares in New York jumped nearly 90%, the largest annual percentage gain since the Dot Com frenzy of 1999.

Bloomberg Intelligence analyst Charles Shum summed up in a note about the 2025 revenue outlook: "For the driver, besides the ongoing robust AI chip demand, there will be support from new smartphone chips and AI PCs, possibly more outsourcing orders from Intel, and WiFi 7 chips."

As previously noted, the whole AI smartphone launch with iPhones has been a dud.