Tyson Foods, the second-largest producer of animal protein globally, plunged the most in one year after cautioning that heightened inflation is severely impacting its working poor customers, leading them to reduce their purchases of ready-to-eat products from its brands. This ominous warning comes one week after McDonald's and Starbucks warned that low-income consumers are starting to crack.

During an earnings call on Monday, Melanie Boulden, who oversees Tyson's Prepared Foods business, was asked by BofA's Peter Galbo about "commentary around quick-service, casual dining and non-commercial."

Boulden responded:

"So, Peter, in both retail and foodservice, as you know, the consumer is under pressure, especially the lower-income households. And in retail, we're seeing roughly 20% cumulative inflation over the last three years."

"Now the inflation impact coupled with historically low savings rates has created a more cautious, price-sensitive consumer. And we're also seeing a cautious consumer prioritize essential staples over discretionary categories."

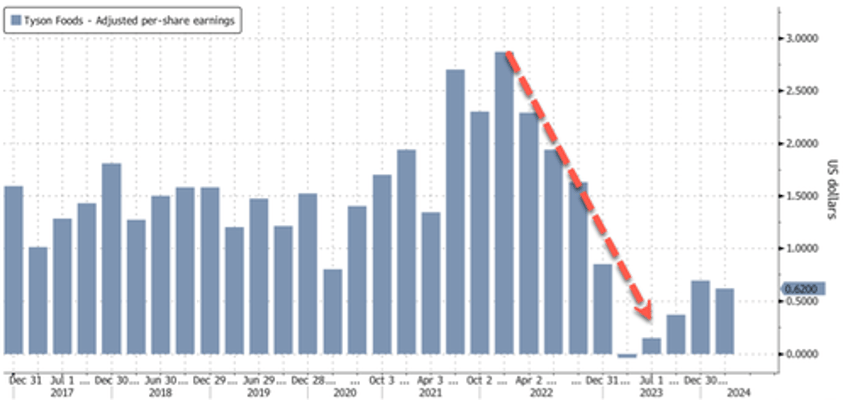

Boulden's comments raise serious questions about the company's ability to boost profitability after sliding in recent quarters.

As for the rest of the year, Chief Financial Officer John Tyson warned investors, "uncertainties remain around consumer strength and behavior."

Tyson added, "When we factor in these variables with Pork and Prepared Foods seasonality, there are reasons to believe that Q3 could be weaker than Q4."

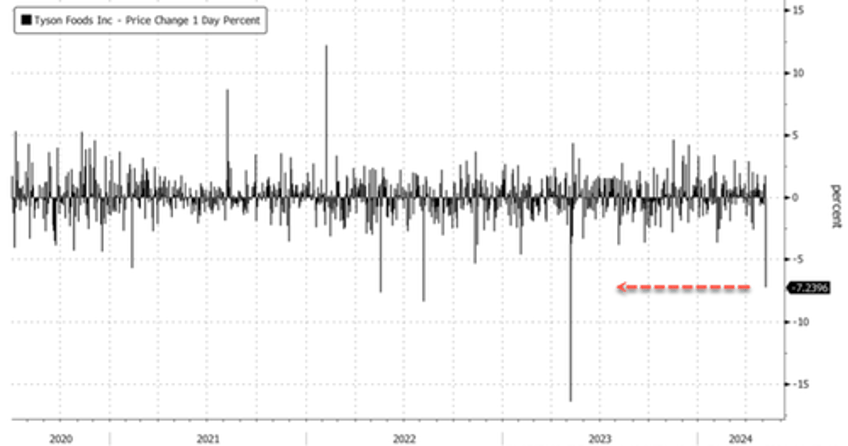

The gloomier outlook weighed on shares in New York on Monday, sliding more than 8%. If intraday losses hold, it will be the worst day since May 8, 2023.

Last week, McDonald's and Starbucks both warned about faltering consumer demand.

Notably, working-poor consumers are pulling back spending in a period of stagflation (read here & here).